Previous Session Recap

Trading volume at PSX floor dropped by 54.66 million share or 29.67% on DoD basis, whereas, the benchmark KSE100 Index opened at 40639.75, posted a day high of 40776.7 and a day low of 40315.02 during last trading session. The session suspended at 40503.68 points with net change of -107.04 points and net trading volume of 52.75 million shares. Daily trading volume of KSE100 listed companies dropped by 69.04 million shares or 56.69% on DoD basis.

Foreign Investors remain in net buying of 7.76 million shares and net value of Foreign Inflow increased by 6.99 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remain in net buying of 7.29 and 0.56 million shares during last trading session. While on the other side Local Individuals and Mutual Funds remain in net selling of 4.6 and 8.14 million shares but Local Companies, Banks, Brokers and Insurance Companies remain in net buying of 0.74, 0.04, 1.36 and 1.21 million shares respectively.

Analytical Review

Asian equities advanced after U.S. stocks hit record highs, while the dollar maintained losses after minutes showed there remains a strong degree of caution at the Federal Reserve over the timing of future interest-rate increases. Japanese stocks extended gains, with the Nikkei 225 Stock Average trading at the highest level since 1996, following a fresh S&P 500 Index record. Equities also rose in South Korea, Australia and Hong Kong. Treasuries were steady after the release of the minutes from the Sept. 20 policy meeting. Investors still expect borrowing costs to rise this year, with market-implied odds of a U.S. rate hike by year-end remaining at about 75 percent, based on January 2018 fed fund futures. The euro remains on course for a strong week as the immediate threat of Spain’s breakup over Catalonia’s independence bid receded.

Retired Justice Javed Iqbal assumed the charge of chairman of the National Accountability Bureau (NAB) on Wednesday with a pledge to ensure across-the-board accountability by strictly following the law.“I cannot turn dreams of all people into reality, but people will definitely feel the difference in NAB within a couple of months,” Justice Iqbal, who also heads the Inquiry Commission on Miss¬ing Persons, told reporters after a meeting of the Human Rights Committee of the Senate at Parliament House. He said there were some bottlenecks in the prosecution of the Panama Papers case against the ousted Prime Minister Nawaz Sharif and his family, but vowed to remove all those bottlenecks.

Pakistan’s trade deficit widened nearly 30 per cent in the first quarter of the current fiscal year, the Pakistan Bureau of Statistics said on Wednesday. It rose to $9.09 billion between July and September from $7bn over the previous year. The trade deficit increased by 22pc year-on-year in September to $2.8bn.The rising trade deficit poses one of the most serious challenges for the government in the current fiscal year.

The Exchange Companies Association of Pakistan (ECAP) reported the dollar rate in the open market on Wednesday as Rs107.30-60 while the interbank rate the same day was Rs105.38-48.The higher open market rates encourage illegal transaction of remittances through the hundi and hawala system. Recently, National Bank President Saeed Ahmed said remittances were facing their biggest challenge from the illegal system of hundi as a large number of overseas Pakistanis were using it due to lack of proper information.“There are several reasons for the dollar appreciation, but the main problem is political uncertainty” said ECAP General Secretary Zafar Parach.

The cement manufacturers in north region of the country, which comprises Punjab and KP provinces, have reduced rates by Rs10-15 per 50kg bag to Rs480-495. This is third cut in prices during the last three months, leading to decline of rates in north by around 12 percent from the high of Rs560 per 50kg bag after budget announcement in May 2017. The industry sources said that prices in southern region, particularly in Karachi, remain up in the range of Rs570-600 per 50 kg bag, showing a difference of around Rs100/bag to north including Rs40/bag after adjustment of freight charges. A report of Topline stated that cement prices in Lahore, Islamabad, Faisalabad and Peshawar have declined to Rs495-530/bag. For instance, in Islamabad, Cherat Cement and Bestway Cement are available at Rs495 per bag and Fauji Cement at Rs515 per bag.

Today ATRL, HTL, NRL and SNGP may lead the market in the positive direction.

Technical Analysis

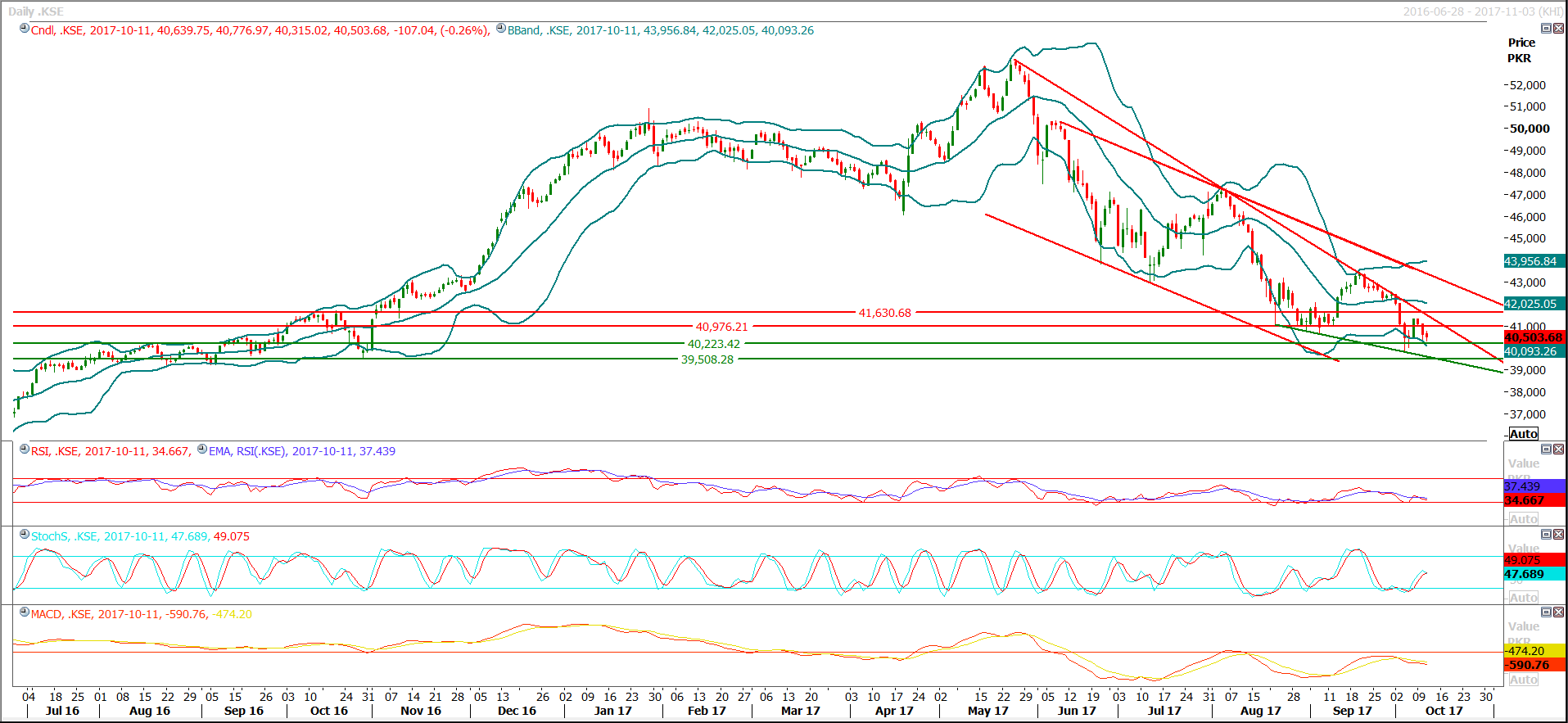

The Benchmark KSE100 Index has tried to format a double bottom on the daily chart but Stochastic and MAORSI are trying to generate a bearish crossover on daily chart while these have converted in to bearish mode on hourly chart, which indicates some sort of uncertainty and would try to add pressure on index. Right now index might move for a serious dip after breakout of 40220 towards 40000 and 39770. For the current trading session index has supports at 40220 and 39772 while resistant regions are standing at 40970 and 41200. For the current trading session a cautious trading strategy is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.