Previous Session Recap

Trading volume at PSX floor dropped by 45.84 million shares or 32.56%,DoD basis, whereas, the benchamark KSE100 Index opened at 41401.02, posted a day high of 41552.05 and a day low of 41062.47 during the last trading session. The session suspended at 41126.83 with a net change of -274.19(-0.67%) points and a net trading volume of 50.38 million shares. Daily trading volume of KSE100 listed companies dropped by 27.86 million shares, 35.61% on DoD basis.

Foreign Investors remained in a net buying position of 1.43 million shares but net value of Foreign Inflow dropped by 0.23 million US Dollars. Categorically, Foreign Corporate Investors remained in a net selling position of 0.74 million shares but Overseas Pakistanis remained in a net buying position of 2.16 million shares. While on the other side Local Individuals, Banks and Brokers remained in net buying position of 1.4, 0.27 and 3.43 million shares respectively but Local Companies and Mutual Funds remained in net selling position of 5.48 and 2.61 million shares.

Analytical Review

Asian shares hit a 10-year peak on Tuesday with investors breathing a sigh of relief as North Korean fears eased slightly and the worst-case scenario from Hurricane Irma looked to have been avoided. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.2 percent to its highest level since late 2007. Japan's Nikkei .N225 added 1.0 percent. On Wall Street on Monday, U.S. S&P 500 Index .SPX surged over 1 percent to a record high close of 2,488 while MSCI's broadest gauge of the world's stock markets .MIWD00000PUS covering 47 markets also hit a new record high, having made its biggest gains in about two months. Insurers were among the biggest winners, with the MSCI World’s insurer index .MIWO0ISGUS rising 1.5 percent on Monday, as insured property losses from Hurricane Irma’s are expected to be smaller than initially forecast.

Islamic banks beat their conventional banking counterparts by mobilising deposits at a higher pace in April-June. The State Bank of Pakistan (SBP) issued on Monday the Islamic Banking Bulletin for April-June, which reveals that deposits of the Islamic banking industry increased by Rs156 billion or 10 per cent quarter-on-quarter to Rs1,720bn. Deposits of the overall banking industry grew 6.5pc over the same period. The share of Islamic banks’ deposits in overall banking industry’s deposits increased to 13.7pc at the end of June from 13.2pc a quarter ago.

The World Bank’s International Finance Corporation (IFC) aims to raise an extra $1 billion within a year as part of a planned $5bn infrastructure investment fund, an official said, with China’s Belt and Road programme offering more opportunities. IFC this year raised $1.1 billion from Allianz and Eastspring Investments, the Asian asset management business of Prudential, IFC Chief Investment Officer for infrastructure and natural resources Ram Mahidhara said. The fund-raising plans are part of IFC’s so-called Managed Co-Lending Portfolio Programme (MCPP) that seeks to raise a little over $5bn from investors by 2021, a large part of which is expected to be deployed for Belt and Road related projects.

The Federal Board of Revenue (FBR) would brief the Senate Committee on Finance, Revenue and Economic Affairs on the issue faced by importers on the import of solar power generator systems during its upcoming meeting scheduled on September 13. The board representatives would also brief the senate body about the details of the exemptions provided by FBR to the solar system, according to notification issued by the Senate Secretariat. The senate body, during its discussion on the issue in its last meeting, had decided to call the Alternate Energy Development Board (AEDB) and Engineering Development Board (EDB) to attend the next meeting to clarify the issues related to duty on solar power generator imports. The issue came up for discussion after some stakeholders had requested the committee that their container was not being cleared by Customs authorities as they seek No Objection Certificate (NOC) from EDB.

The Asian Infrastructure Investment Bank (AIIB) Monday expressed willingness to finance some projects presented to the bank by Pakistan. "The projects presented by Pakistan for future financing include a number of very important projects and the bank would like to finance some of them based on further discussion with the relevant officials,” said Vice President, D J Pandian, who was leading a three-member delegation that called on Finance Minister Senator Mohammad Ishaq Dar here on Monday. AIIB Vice President stated that Pakistan had been an active member of the Bank and was also selected to be the recipient of the first financing by AIIB. He said that the visit of AIIB Board of Directors (BOD) to Pakistan would also give both the sides an opportunity to discuss various matters in greater detail. On the occasion, the minister said that the government looked forward to the visit of the BOD, according to press statement issued by the ministry.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

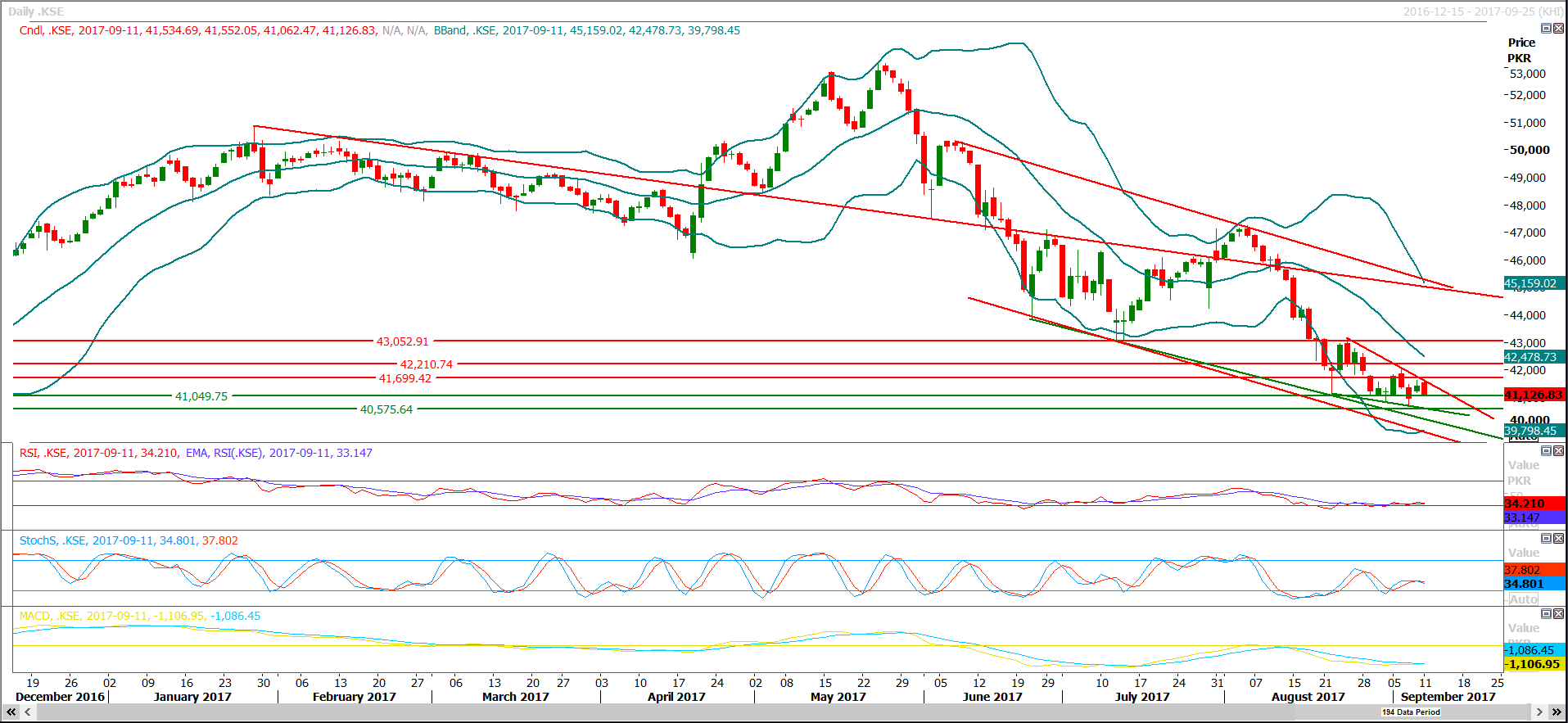

The Benchmark KSE100 Index have fulfilled its Gap, occurred on Friday's opening and right now it is getting support from a horizontal supportive region at 41049. It is capped by a resistant trend line at 41460. Hourly Stochastic and MAORSI is ready for a pullback on the bullish side which indicates that an intraday spike could be witnessed but daily indicators are not supporting bullish sentiment which means selling on strength would be beneficial as index would face resistances around 41700 and 42200. Oil and Gas Sector is stuck in the middle of nowhere which could drag index for further 1500 points on breakout of either side so trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.