Previous Session Recap

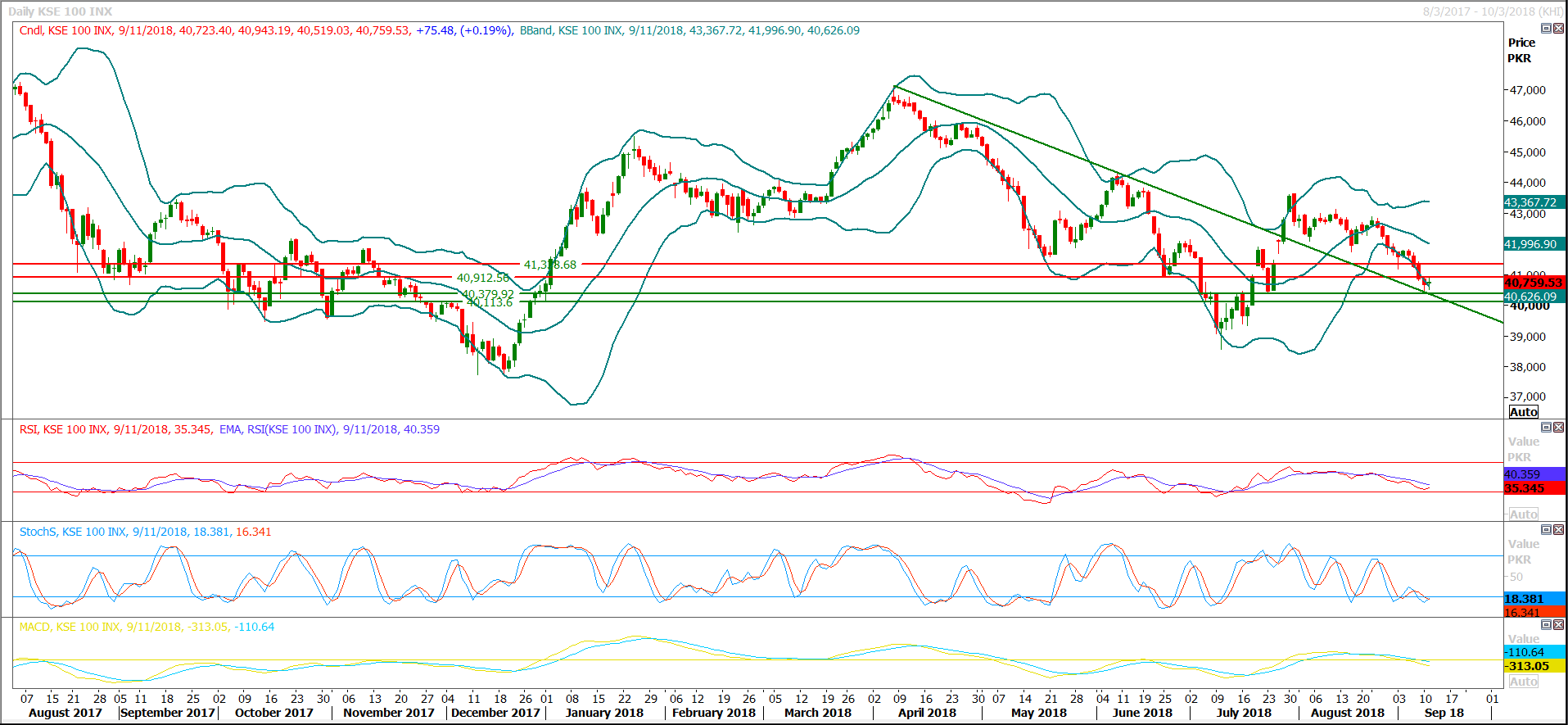

Trading volume at PSX floor dropped by 26.96 million shares or 19.32% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,723.40, posted a day high of 40,943.19 and a day low of 40,519.03 during last trading session. The session suspended at 40,759.53 with net change of 75.48 and net trading volume of 77.72 million shares. Daily trading volume of KSE100 listed companies dropped by 17.45 million shares or 22.45% on DoD basis.

Foreign Investors remain in net selling positions of 2.56 million shares but net value of Foreign Inflow dropped by 2.50 million US Dollars. Categorically Foreign Individuals remained in net buying positions of 0.01 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 2.34 and 0.23 million shares. While on the other side Local Individuals, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 7.18, 1.88, 2.11 and 8.15 million shares respectively but Local Companies, NBFCs and Brokers remained in net selling positions of 11.44, 1.34 and 3.84 million shares.

Analytical Review

Asia stocks wobble near 14-month lows on simmering trade worries

Asian stocks were pinned near 14-month lows on Wednesday, as investor confidence was chilled by the latest round of verbal threats in an intensifying U.S.-China trade conflict. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.05 percent, hovering near its lowest levels plumbed since July 2017 on Monday. Tokyo's Nikkei .N225 fell 0.25 percent and Australian stocks gave up 0.3 percent, while South Korea's KOSPI .KS11 managed to eke out a modest 0.15 percent gain.

Necessary changes in Finance Act 2018 soon: Asad

Finance Minister Asad Umar on Tuesday said that the government would soon introduce necessary changes in the Finance Act 2018 to make it more relevant to the current economic state of the country. He made these remarks in a meeting with delegation of Overseas Investors Chamber of Commerce and Industry (OICCI), led by Irfan Wahab khan, president of OICCI. The delegation greeted the finance minister on taking charge of his new responsibilities. The minister welcomed the delegation and acknowledged the importance of the corporate sector in the development of Pakistan.

Auto sales fall 6pc in Aug

Pakistan auto sales fell by 20 percent YoY in Aug 2018, showing signs of much anticipated demand contraction in the auto sector. This is the first time that auto sales have declined in first 2M of a fiscal year since FY15 (excluding Taxi scheme). Reasons for sales slowdown in Aug 2018 included, 1) lower number of working days due to Eid-ul-Adha, 2) deteriorating macroeconomic environment, 3) 3-4 price hikes in ongoing calendar year and 4) impact of law requiring car purchasers to be filers. It is expected this slowdown will continue in coming months as rising interest rates and PKR depreciation take their toll on auto sector, with former due to likely decline in consumer financing and latter due to further price hikes.

Pakistan must invest in entire value chain of textile sector

The significance of textile sector in Pakistan’s economy can hardly be debated. Punjab Board of Investment & Trade (PBIT) convened a roundtable, bringing together notable textile sector stakeholders including prominent members from APTMA. Participants at the roundtable emphasized that the industry needs to see credible commitment and follow-up from federal and provincial governments, and reassured that they are willing to make further investments if they receive the right governmental support, including simplification of cumbersome processes and procedures through effective one-window facilitation.

Trade deficit shrinks to $6.167 billion

Trade deficit shrank 1.25 percent year-on-year to $6.167 billion in the first two months of the current fiscal year of 2018/19 as growth in exports outpaced rise in imports, official data showed on Tuesday. Exports increased 5.05 percent year-on-year to $3.663 billion in the July-August period, while imports were marginally up 1.01 percent to $9.830 billion during the period.

Asian stocks were pinned near 14-month lows on Wednesday, as investor confidence was chilled by the latest round of verbal threats in an intensifying U.S.-China trade conflict. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.05 percent, hovering near its lowest levels plumbed since July 2017 on Monday. Tokyo's Nikkei .N225 fell 0.25 percent and Australian stocks gave up 0.3 percent, while South Korea's KOSPI .KS11 managed to eke out a modest 0.15 percent gain.

Finance Minister Asad Umar on Tuesday said that the government would soon introduce necessary changes in the Finance Act 2018 to make it more relevant to the current economic state of the country. He made these remarks in a meeting with delegation of Overseas Investors Chamber of Commerce and Industry (OICCI), led by Irfan Wahab khan, president of OICCI. The delegation greeted the finance minister on taking charge of his new responsibilities. The minister welcomed the delegation and acknowledged the importance of the corporate sector in the development of Pakistan.

Pakistan auto sales fell by 20 percent YoY in Aug 2018, showing signs of much anticipated demand contraction in the auto sector. This is the first time that auto sales have declined in first 2M of a fiscal year since FY15 (excluding Taxi scheme). Reasons for sales slowdown in Aug 2018 included, 1) lower number of working days due to Eid-ul-Adha, 2) deteriorating macroeconomic environment, 3) 3-4 price hikes in ongoing calendar year and 4) impact of law requiring car purchasers to be filers. It is expected this slowdown will continue in coming months as rising interest rates and PKR depreciation take their toll on auto sector, with former due to likely decline in consumer financing and latter due to further price hikes.

The significance of textile sector in Pakistan’s economy can hardly be debated. Punjab Board of Investment & Trade (PBIT) convened a roundtable, bringing together notable textile sector stakeholders including prominent members from APTMA. Participants at the roundtable emphasized that the industry needs to see credible commitment and follow-up from federal and provincial governments, and reassured that they are willing to make further investments if they receive the right governmental support, including simplification of cumbersome processes and procedures through effective one-window facilitation.

Trade deficit shrank 1.25 percent year-on-year to $6.167 billion in the first two months of the current fiscal year of 2018/19 as growth in exports outpaced rise in imports, official data showed on Tuesday. Exports increased 5.05 percent year-on-year to $3.663 billion in the July-August period, while imports were marginally up 1.01 percent to $9.830 billion during the period.

ATRL, DGKC, ISL and SNGP would try to lead positive sentiment during current trading session.

Technical Analysis

The Benchmark KSE100 Index is getting support from a descending trend line along with a strong horizontal supportive region at its 61.8% correction of its last bullish rally since last two consecutive trading sessions. Now chances of reversal are increasing because momentum indicators on hourly chart have generated bullish crossovers and if index would succeed in closing above 40,930 points during current trading session then daily momentum indicators would also change their direction towards bullish sentiment. If index would succeed in penetrating above 40,930 points then chances of a morning star would become evident on daily chart which would lead index towards 41,200 and 41,340 points. For current trading session index have supportive regions ahead at 40,380 and 40,110 points while resistant regions are standing at 40,930 and 41,340 points. It’s recommended to start buying on dip with strict stop loss of 40,110 points.

ATRL, PAEL, DGKC, ISL and SNGP would try to lead index in positive direction because all these scripts are trying to bounce back after completing their corrections and daily momentum have changed its direction in all these scripts from bearish to bullish.

ATRL, PAEL, DGKC, ISL and SNGP would try to lead index in positive direction because all these scripts are trying to bounce back after completing their corrections and daily momentum have changed its direction in all these scripts from bearish to bullish.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.