Previous Session Recap

The Bench Mark KSE100 Index Opened at 4471.94, posted day low of 44741.98 and day high of 45489.59 during last tradign session while session suspended at 45387.23 with net change of 645.25 points and net trading volume of 195.26 million shares. Daily trading volume of KSE100 listed companies increased by 59.33 million shares or 43.65% on DOD bases.

Foreign Investors remain in net buying of 0.45 million shares but net value of Foreign Inflow dropped by 9.43 million US Dollars during last trading session. Categorically Foreign Individuals and Overseas Pakistanis remain in net selling of 10002 and 99745 shares but Foreign corporates remain in net buying of 0.56 million shares. While on the other side Local Individuals and Companies remain in net selling of 2.05 and 4.28 million shares but Local Banks, Mutual Funds and Brokers remain in net buying of 3.14, 3.4 and 3.93 million shares respectively.

Analytical Review

Asian shares and the dollar were on tenterhooks on Tuesday as investors awaited the looming outcome of the Federal Reserve rates review, with all eyes on how the Fed steers monetary policy in the wake of Republican Donald Trump surprise election win last month. Crude oil prices also pulled back after their surge to 18-month highs, while a raft of China data had little impact across asset markets. Chinese data showed factory output and retail sales grew faster than expected in November, while fixed-asset investment was in-line with forecasts, adding to growing signs of stabilization in the world second-biggest economy. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged down 0.1 percent, while Japanese Nikkei stock index .N225 was off early lows but still down 0.2 percent by midday as the dollar came off overnight highs against the yen. The market has already priced in a rate hike and some are ready to take profits after confirming the result, said Masashi Oda, general manager of strategic investment department at Sumitomo Mitsui Trust Asset Management.

Sui Southern Gas Company (SSGC) on Sunday closed Compressed Natural Gas (CNG) stations across the province as a sudden gas shortage hit the system of the gas utility. According to a SSGC spokesman, the decision to shut CNG stations across the province was taken after a gas shortage hit the system of SSGC.

The government collected custom duty of Rs 3.159 billion from high speed diesel (HSD) during the first quarter (July-September) of the current fiscal year, showing highest collection of import duty from the POL product during this period, official documents reveal. A copy of official document available with Business Recorder revealed that collection of Rs 3.159 billion custom duty from HSD was followed by Rs 2.896 billion custom duty from furnace oil and Rs 1.114 billion collection of custom duty from motor spirit.

Hydropower generation and water sector projects are being put on a strategic path to rope in shy private investors. The new draft policy paradigm, now in its initial phase, also supports net hydropower profit payments to all regional and provincial stakeholders, where these natural resources are located. The private sector that has so far been reluctant to invest in long-gestation projects — having burnt its fingers in the past —would now be offered comfort through collaboration with the government, or its entities (such as Wapda)..

According to the weekly statement of position of all scheduled banks for the week ended Nov 25, deposits and other accounts of all scheduled banks stood at Rs10471.74bn after a 0.41pc increase over the preceding weekly figure of Rs10428.84bn. Compared with last year corresponding figure of Rs9162.46bn, the current weekly figure was higher by 14.28pc. Deposits and other accounts of all commercial banks stood at Rs10405.64bn against preceding week deposits of Rs10363.57bn, showing a rise of 0.40pc. Deposits and other accounts of specialised banks stood at Rs66.09bn, higher by 1.28pc against previous week figure of Rs65.27bn. Total assets of all scheduled banks stood at Rs14091.27bn, higher by 0.85pc over preceding weekly figure of Rs13972.82bn. Current weekly figure is higher by7.90pc compared to last year corresponding figure of Rs13058.61bn.

SEARL along with Oil & Gas Sector, Cement Sector and Banking Sector can lead market in positive direction.

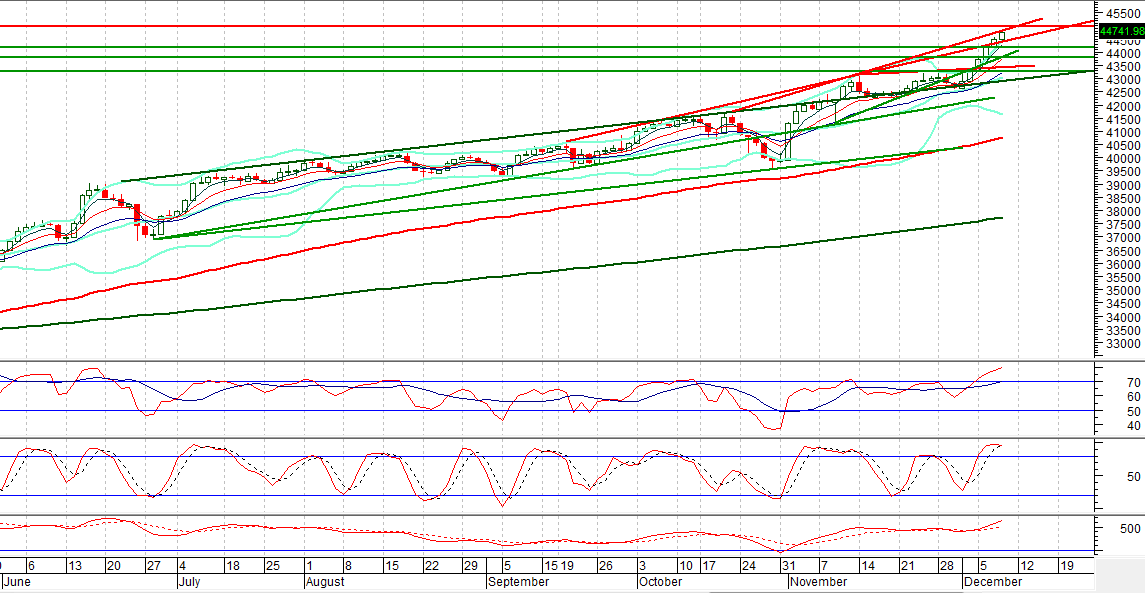

Technical Analysis

The Bench Mark KSE100 Index have penetrated its cap of a trend line on Intraday chart on its double top. Daily Stochastic and MAORSI also have reached required level for a pullback. On daily chart Stochastic is trying to create a crossover which can be an end for current bullish rally. For current trading session, market has a gap till 45852 points. Trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.