Previous Session Recap

The Benchmark KSE100 Index Opened at 49908.15, posted day high of 5093.38 and day low of 49845.85 during last trading session. The session suspended at 49925.08 with net change of 16.93 points and net trading volume of 137.31 million shares. Daily trading volume of KSE100 listed companies dropped by 108.54 million shares or 44.15% on DOD bases.

Foreign Investors remained in net selling position of 4.51 million shares but net value of Foreign Inflow increased by 4.3 million US Dollars. Categorically Foreign Individual and Corporate Investors remained in net selling position of 4802 shares and 4.95 million shares respectively but Overseas Pakistanis remained in net buying position of 0.45 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs and Mutual Funds remained in net buying position of 3.14, 1.17, 0.42, 1.18 and 3.62 million shares respectively but Brokers remain in net selling position of 5.64 million shares.

Analytical Review

The dollar rose against the yen on Monday on relief that U.S. President Donald Trump set aside tough campaign rhetoric over security and jobs in a smooth meeting with Japanese Prime Minister Shinzo Abe, with no mention of currency policy. Asian stocks ticked up, helped by renewed optimism over Trump tax reform plans, generally upbeat global economic data and Trump change of tack to agree to honor the one China policy. The global economy seems fairly sound now, compared to last year, as China is supporting its economy through fiscal measures. The downside risk in the U.S. economy is small due to Trump policies,Masayuki Kichikawa, chief macro strategist at Sumitomo Mitsui Asset Management. The dollar rose as much as 0.9 percent against the yen to 114.17 yen, extending its rebound from 111.59 yen touched last Tuesday, which was its lowest level in 10 weeks. A senior Japanese government spokesman said Abe and Trump did not discuss currency issues and that Trump did not request a bilateral trade deal.

The government raised just Rs39.39bn from the auction of Pakistan Investment Bonds of various tenors held last Thursday, smaller against the received amount of Rs137.89bn. It generated Rs28.98bn from three year PIBs at a cut off yield of 6.40pc, followed by five year PIBs with Rs10.40bn at 6.89pc, and 10 year PIBs Rs1.06m at 7.94pc. Three year PIBs attracted the highest amount of Rs82.44bn: 5 year PIBs Rs34.57bn, and 10 year PIBs Rs20.87bn. No bids were received for 20 year PIBs. Last Thursday, the State Bank of Pakistan, injected Rs183bn into the banking system through an Open Market Operation, against an offered amount of Rs214.50bn. The amount was accepted at 5.85pc and was for a one day contract.

The local currency market witnessed a firmer trend in rupee versus the dollar and euro last week. Activity remained dull in the market as traders stayed glued to the sidelines in the absence of fresh triggers after the dollar overseas traded near break-even levels, retreating from an early advance as investors continued to watch the political situation in Europe with caution. The local currency traded almost range-bound due to sluggish market sentiments.

More than 90 percent of the leather industry is unable to avail the Prime Minister incentive package of Rs180 billion announced recently for the export-oriented industries, as the Commerce Ministry has ignored all major finished leather products HS Codes in its notification. Industry sources said that the second biggest export-oriented industry of the country was still deprived of the PM export fund due to sheer negligence of the ministry, which failed to include the export-related HS Codes of finished and tanned leather in the related SRO 62(I)/2017 issued on Feb 2, 2017 despite detailed information provided by the industry.

Iran is ready to increase electricity supply to Pakistan from the existing over 100 megawatts to 3,000 megawatts, said Iranian Consul General Ahmad Mohammadi. According to Radio Tehran, he expressed these words while speaking at the Iranian Consulate General at an event held to mark the 38th anniversary of the Islamic Revolution. The consul general was of the view that Iran-Pakistan (IP) gas pipeline is the least expensive, most secure and profitable source of energy for Pakistan. It is a turning point for ties between the two countries and both are determined to complete it at the earliest, he said.

HBL, MCB, SNGP, SSGC and SHEL can lead market in positive direction. While, ASC can lead market in negative direction.

Technical Analysis

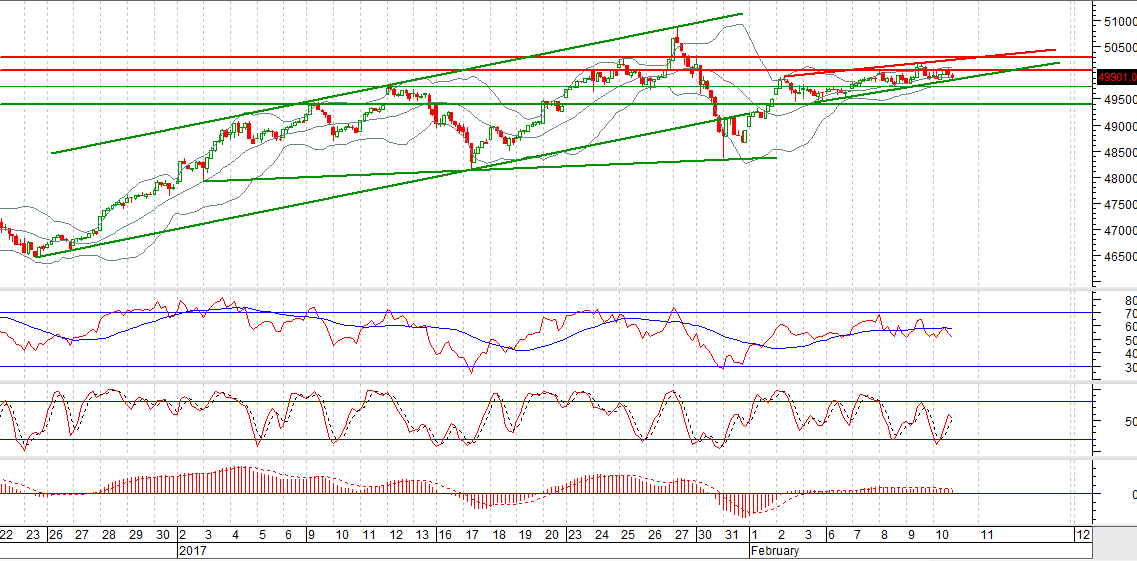

The Benchmark KSE100 Index is caged in an upward price wedge on hourly chart and it’s also capped by a resistant horizontal line at 61.8% correction level of its last bearish rally. Breakout of this wedge could push index for further 1000-1500 points on either side. On hourly and daily chart bullish momentum seems expiring but a gap opening above 49960 could pump some fresh breeze in index to move upward. To start a new bullish rally Index needs to close above 50255 and 50306, if index closes below 49700 then next supportive region would be 49426 and breakout of that region would call for a new bearish trend. A caution call is generated for current trading session so trading with strict stop loss is recommended until Index closes above 50306 or below 49426.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.