Previous Session Recap

The Bench Mark KSE100 Index Opened at 49360.99, posted a day high of 46456.39 and a day low of 49048.95 during last trading session whereas session suspended at 49191.75 with a net change of -200.69 points and net trading volume of 78.12 million shares. Daily trading volume of KSE100 listed companies dropped by 18.4 million shares or 19.06% on DoD basis. Uncertainty over Panama case judgement and SECP crackdown on in-house badla financing continued to haunt investors this week, taking KSE-100 index down by 0.9 percent/432pts WoW to close at 49,192. One positive development, however, during the week there was a release of 90 percent PSX sale proceeds to the brokerage houses, leading to improved liquidity. Overall activity remained lower than last week as both average traded volume and value registered a decline of 21 percent WoW (to 238 million shares/day) and 20 percent WoW (to $109 million/day), respectively.

Foreign Investors have turned back to buying again during last trading session and the remain in net buying position of 2.47 million shares and net value of Foreign Inflow increased by 3.24 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani investors remain in net buying position of 1.79 and 0.68 million shares respectively but Foreign Individuals remain in net selling position of 500 shares. While on the other hand Local Individuals, and Mutual Funds remain in net selling position of 6.23 and 1.36 million shares but Local Companies, Banks, NBFCs adn Brokers remain in net buying position of 0.79, 0.9, 0.075 and 2.1 million shares respectively.

Analytical Review

Asian shares rose on Monday, taking their cue from gains on Wall Street after strong U.S. job data, though the mood was cautious as oil prices plunged to 3 1/2-month lows on fresh worries of oversupply. A confluence of major events this week including an expected interest rate hike by the U.S. Federal Reserve, a potentially divisive election in the Netherlands and a Group of 20 (G20) finance ministers meeting kept many investors on edge. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.6 percent, led by gains in tech-heavy South Korean shares .KS11 and Taiwanese shares .TWII. Japanese Nikkei .N225 edged 0.2 percent higher, with exporters shares buoyed by a weaker yen. Global stocks rose on Friday, with the MSCI index of 46 markets .MIWD00000PUS gaining 0.5 percent, snapping six straight days of losses after the robust U.S. jobs report. Strong U.S. jobs data all but sealed the chance of a rate increase by the Federal Reserve on Wednesday.

Around 400m cubic feet of natural gas is going to waste every day, accounting for almost 14-15pc of total supplies to the country’s integrated transmission and distribution network. This much of gas is sufficient to run up to 2,400megawatt of power plants at an average fuel cost of just Rs5 per unit (kwh) compared to Rs12 or so of furnace oil-based generation, or Rs8 per unit on imported liquefied natural gas. If diverted to the fertiliser sector, this quantity of gas is enough to operate about four plants of the size of Engro Fertiliser — that earns around Rs20bn profit per year. Almost the same amount of gas is currently being imported at the expense of foreign exchange losses on furnace oil imports.

Deposits and other accounts of all scheduled banks stood at Rs10,730.19bn after a 0.47pc increase over the preceding week figure of Rs10,679.88bn, according to the weekly statement of position for the week ended Feb 24. Compared with last year corresponding figure of Rs9,385.55bn, the current week figure was higher by 14.32pc. Deposits and other accounts of all commercial banks stood at Rs10,659.14bn against preceding week deposits of Rs10,609.30bn, showing a rise of 0.47pc. Deposits and other accounts of specialised banks stood at Rs71.05bn, higher by 0.67pc against previous week’s figure of Rs70.57bn. Total assets of all scheduled banks stood at Rs14,825.96bn, higher by 0.007pc over preceding week figure of Rs14,824.87bn. Current week figure is higher by 9.68pc compared to last year corresponding figure of Rs13,517.39bn.

THE cotton production target has been missed yet again this year by around 25pc. The actual production so far stands at 10.5m bales against the original estimate of 14.1m bales. Cotton watchers think that the final figure may reach 10.6m bales by the end of this month as some farmers are still persisting with the crop. The current output, however, has improved by 800,000 bales when compared with the last year’s arrival figure of early March at 9.7m bales. The season ended with 10m bales and the gap between target and production was then 30pc.

THE outlook for irrigation water availability for kharif season in Sindh looks grim as indicated by the reduced water flows. Sindh irrigation officials anticipate that if there is no rainfall in upper reaches, the shortage during peak kharif season will be severe. The water storage in Tarbela Dam, which feeds three barrages in the province, is fast depleting and, according to the March 5 information of Indus River System Authority, 0.3MAF water was available in the dam. A Sukkur barrage official also said around 2ft of water is being withdrawn daily from Tarbela, whose current level is 1,398ft against its dead level of 1380ft.

Today market is expected to remain volatile again, Traders are advised to exercise cautiously until market takes a clear direction, Take profit on higher levels and buy on dips.

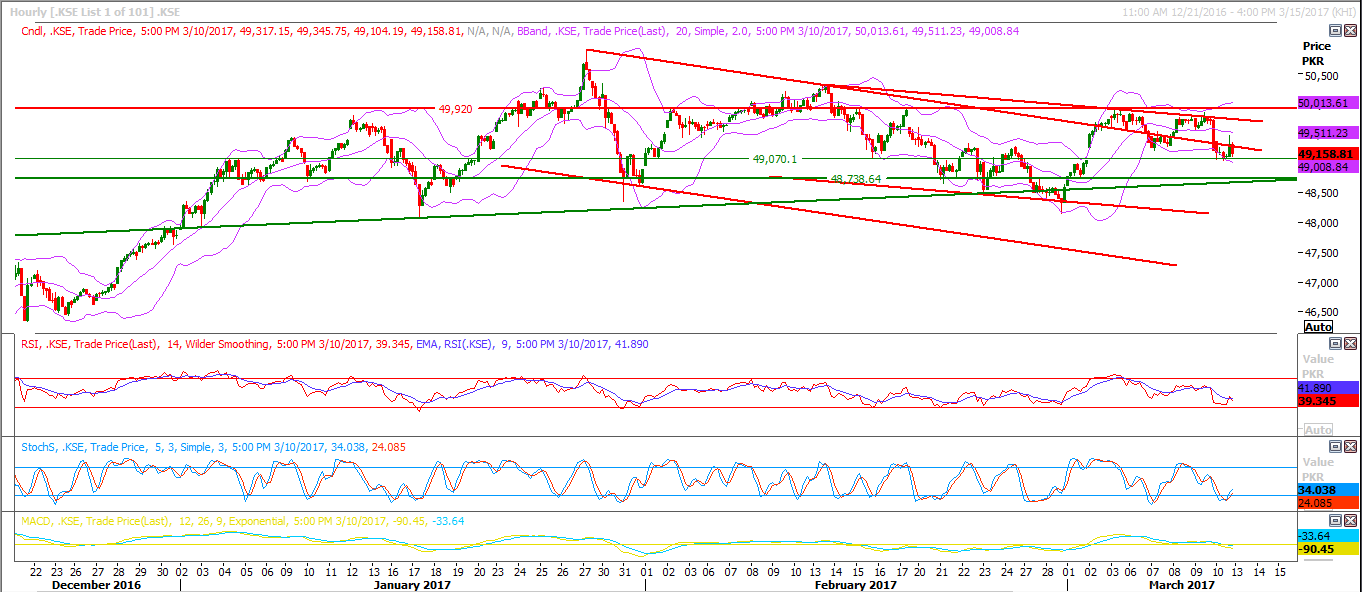

Technical Analysis

The Bench Mark KSE100 Index still not been able to close above its psychological barrier of 50000 points on weekly chart and it is caged in corrections on its hourly chart which are putting pressure on index, for current trading session index have supportive regions which are standing at 49036 and 48738 points while it can face a strong resistance from 49440. Market seems under pressure during current trading session so it is not recommended to initiate new long positions. Closing below 48680 will call for 47900.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.