Previous Session Recap

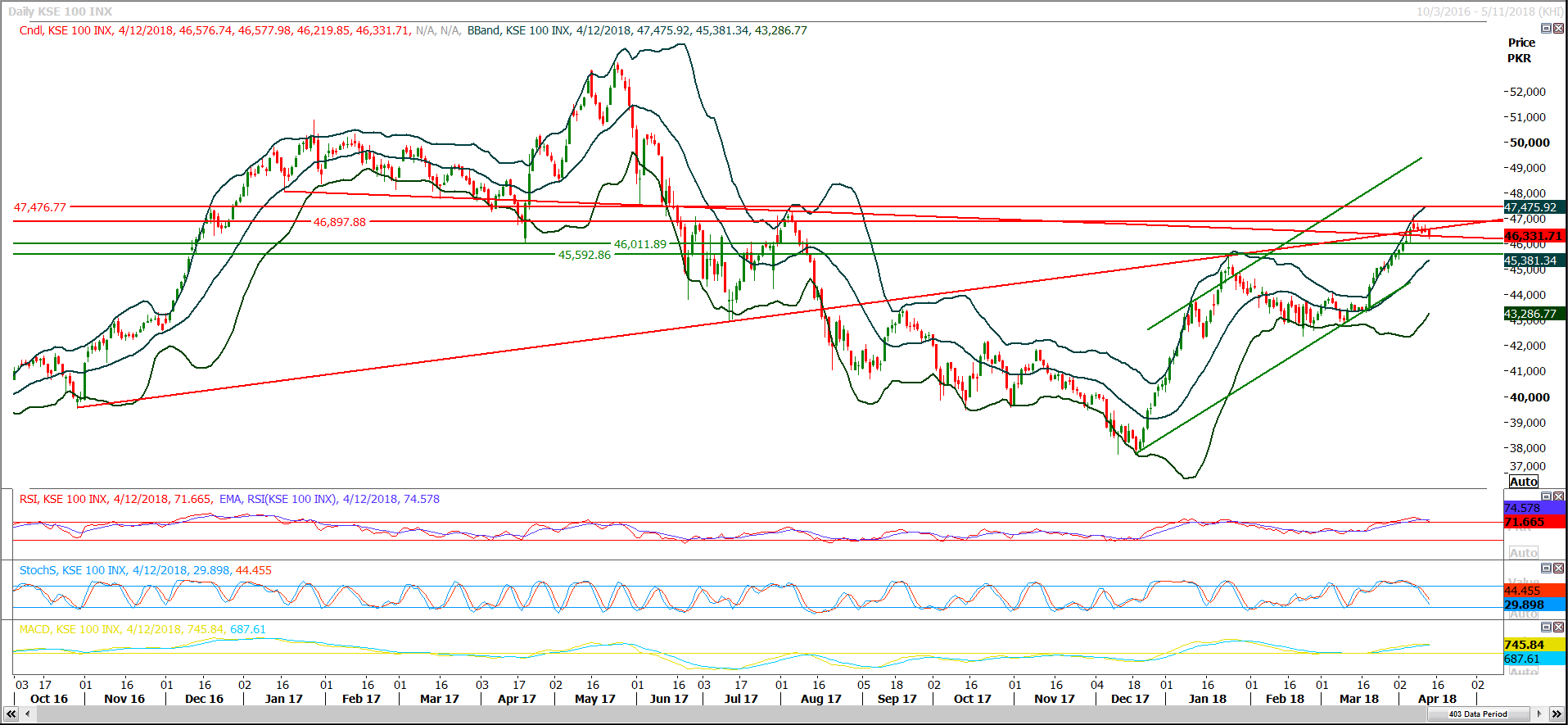

Trading volume at PSX floor increased by 48.52 million shares or 17.06% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 46,576.74, posted a day high of 46,577.98 and a day low of 46,219.85 during last trading session. The session suspended at 46,331.71 with net change of -154.79 and net trading volume of 153.29 million shares. Daily trading volume of KSE100 listed companies increased by 46.95 million shares or 44.14% on DoD basis.

Foreign Investors remained in net buying position of 8.72 million shares and net value of Foreign Inflow increased by 6.35 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis remained in net buying positions of 0.13, 5.94 and 2.65 million shares respectively. While on the other side Local Individuals, Banks, Mutual Funds and Insurance Companies remained in net buying positions of 6.81, 1.23, 0.67 and 10.79 million shares but Local Companies, NBFCs and Brokers remained in net selling positions of 14.03, 0.04 and 2.97 million shares respectively.

Analytical Review

Stocks bounce as Trump changes tack on Syria, earnings hopes

Global stocks recovered to three-week highs on Friday as anticipated strong earnings season took center stage after U.S. President Donald Trump backtracked on his suggestion of an imminent missile attack on Syria. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up 0.1 percent while Japan's Nikkei .N225 gained 0.8 percent. MSCI’s broadest gauge of the world’s stock markets .MIWD00000PUS also edged up 0.1 percent after hitting a three-week high on Thursday. In New York, the S&P 500 .SPX gained 0.83 percent, led by a 1.83 percent gain in financials .SPSY after strong quarterly results from BlackRock Inc (BLK.N) boosted optimism for corporate earnings.

ECC reallocates Rs15b to LPG-air mix projects

The Economic Coordination Committee (ECC) of the Cabinet on Thursday approved reallocation of an amount of Rs14.8 billion from RLNG-II pipeline project to LPG-air mix projects for their expeditious completion. The ECC chaired by Prime Minister Shahid Khaqan Abbasi has approved a proposal for allowing Sui Southern Gas Company Limited to reallocate an amount of Rs14.8 billion from RLNG-II pipeline project to LPG air mix projects for their expeditious completion and to ensure uninterrupted supply of gas to household, industry etc. The ECC directed SSGCL to expand setting up of air mix plants in every district of the country. The ECC approved a proposal for grant of 4-years extension in Kandra Development and Production Lease. The decision was taken after taking into account various impediments which have hindered the production of recoverable reserves from Kandra gas field and setting up of 120 MW power plant by M/s Kandra Power Company Ltd (a subsidiary of M/s Pakistan Exploration (Pvt.) Ltd.).

Moody's optimistic about amnesty scheme success

Pakistan's tax amnesty scheme would increase the government's revenue base and alleviate fiscal pressure from its low revenue generation capacity and increasing capital expenditures for the China Pakistan Economic Corridor (CPEC). Capital inflows resulting from the repatriation of liquid foreign assets also would ease balance-of-payment pressure in the past few months of the current fiscal year, which ends in June 2018, Moody's, the international credit rating agency has said. Last Thursday, Prime Minister Shahid Khaqan Abbasi announced a new one-off tax-amnesty scheme to incentivize the declaration of undeclared local and foreign assets and the repatriation of assets held offshore. "The repatriation of foreign liquid assets would reduce Pakistan's external vulnerability risk, although the positive effect would only last through the end of June 2018, when the amnesty expires. Pakistan is facing external pressures, with higher imports largely from CPEC weighing on the current account and foreign reserves," the Moody's noted.

Cement prices start rising again in North

The cement prices, after witnessing a drop of almost 10 percent for the last 9 months, have started reverting to previous level in north region, as different companies have increased prices by Rs20 on average. However, the prices in South region remained stable at an average of Rs570/bag. Industry sources said that hike in coal prices, rupee depreciation o f about 9 percent and strong demand due to heavy construction work in Punjab were the major factors which led to the hike in cement prices to reach Rs540 per 50kg bag- the previous level of June 2017 when the budget of current fiscal year was announced and additional duties were imposed on cement. In retail market of Lahore, different brands of cement bags are available in the range of Rs25 to Rs40 per 50kg bag against their rates of last week of Rs505 to Rs525, showing a jump of Rs20 per 50kg bag on average during the last couple of weeks..

Power outages continue in 80pc areas of Lesco

The despite having surplus power supply from the national grid the Lahore Electric Supply Company has been carrying out electricity shutdown of two to four hours in urban areas while rural areas are facing electricity loadshedding of more than six hours. The suburbs of Okara, Kasur, Sheikhupura and Nankana Sahib, which are considered as high loss feeders, are facing more power shutdowns as compared to the urban areas. According to Lesco officials, there was no shortfall of power in Lesco's distribution system, as the company is being provided power more than its demand. They said that power allocation from the national grid for the company is around 3100MW while current demand is up to 3000MW but power outages of at least two to four hours have been reported in a number of areas. Consumers have refuted the claims of the federal government regarding loadshedding, stating that more than 60 percent of the feeders across the province were facing loadshedding.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Global stocks recovered to three-week highs on Friday as anticipated strong earnings season took center stage after U.S. President Donald Trump backtracked on his suggestion of an imminent missile attack on Syria. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up 0.1 percent while Japan's Nikkei .N225 gained 0.8 percent. MSCI’s broadest gauge of the world’s stock markets .MIWD00000PUS also edged up 0.1 percent after hitting a three-week high on Thursday. In New York, the S&P 500 .SPX gained 0.83 percent, led by a 1.83 percent gain in financials .SPSY after strong quarterly results from BlackRock Inc (BLK.N) boosted optimism for corporate earnings.

The Economic Coordination Committee (ECC) of the Cabinet on Thursday approved reallocation of an amount of Rs14.8 billion from RLNG-II pipeline project to LPG-air mix projects for their expeditious completion. The ECC chaired by Prime Minister Shahid Khaqan Abbasi has approved a proposal for allowing Sui Southern Gas Company Limited to reallocate an amount of Rs14.8 billion from RLNG-II pipeline project to LPG air mix projects for their expeditious completion and to ensure uninterrupted supply of gas to household, industry etc. The ECC directed SSGCL to expand setting up of air mix plants in every district of the country. The ECC approved a proposal for grant of 4-years extension in Kandra Development and Production Lease. The decision was taken after taking into account various impediments which have hindered the production of recoverable reserves from Kandra gas field and setting up of 120 MW power plant by M/s Kandra Power Company Ltd (a subsidiary of M/s Pakistan Exploration (Pvt.) Ltd.).

Pakistan's tax amnesty scheme would increase the government's revenue base and alleviate fiscal pressure from its low revenue generation capacity and increasing capital expenditures for the China Pakistan Economic Corridor (CPEC). Capital inflows resulting from the repatriation of liquid foreign assets also would ease balance-of-payment pressure in the past few months of the current fiscal year, which ends in June 2018, Moody's, the international credit rating agency has said. Last Thursday, Prime Minister Shahid Khaqan Abbasi announced a new one-off tax-amnesty scheme to incentivize the declaration of undeclared local and foreign assets and the repatriation of assets held offshore. "The repatriation of foreign liquid assets would reduce Pakistan's external vulnerability risk, although the positive effect would only last through the end of June 2018, when the amnesty expires. Pakistan is facing external pressures, with higher imports largely from CPEC weighing on the current account and foreign reserves," the Moody's noted.

The cement prices, after witnessing a drop of almost 10 percent for the last 9 months, have started reverting to previous level in north region, as different companies have increased prices by Rs20 on average. However, the prices in South region remained stable at an average of Rs570/bag. Industry sources said that hike in coal prices, rupee depreciation o f about 9 percent and strong demand due to heavy construction work in Punjab were the major factors which led to the hike in cement prices to reach Rs540 per 50kg bag- the previous level of June 2017 when the budget of current fiscal year was announced and additional duties were imposed on cement. In retail market of Lahore, different brands of cement bags are available in the range of Rs25 to Rs40 per 50kg bag against their rates of last week of Rs505 to Rs525, showing a jump of Rs20 per 50kg bag on average during the last couple of weeks..

The despite having surplus power supply from the national grid the Lahore Electric Supply Company has been carrying out electricity shutdown of two to four hours in urban areas while rural areas are facing electricity loadshedding of more than six hours. The suburbs of Okara, Kasur, Sheikhupura and Nankana Sahib, which are considered as high loss feeders, are facing more power shutdowns as compared to the urban areas. According to Lesco officials, there was no shortfall of power in Lesco's distribution system, as the company is being provided power more than its demand. They said that power allocation from the national grid for the company is around 3100MW while current demand is up to 3000MW but power outages of at least two to four hours have been reported in a number of areas. Consumers have refuted the claims of the federal government regarding loadshedding, stating that more than 60 percent of the feeders across the province were facing loadshedding.

Technical Analysis

The Benchmark KSE100 Index had formatted a double top on weekly chart and current trading session is very crucial because confirmation of that double top have to be completed today. Index is trying to move downward but it’s being supported by a descending trend line during current week on daily chart. As of now it’s expected that index would try to open with a negative gap below that trend line but this bearish momentum would be strengthen if index would close below 46,000 points during current trading session. For current trading session index have supportive regions at 46,200 and 45,900 while resistant regions are standing at 46,600 and 46,890 points. If index would slide below 46,000 points today then a bearish harami pattern also would be generated on weekly chart which would add pressure on index along with weekly double top as index is bouncing back after completing its 61.8% correction on weekly chart. Its recommended to sell on strength with strict stop loss during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.