Previous Session Recap

Trading volume at PSX floor increased by 43.90 million shares or 21.29% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,957.10, posted a day high of 43,115.52 and a day low of 42,798.88 during last trading session. The session suspended at 42,842.18 with net change of -81.77 and net trading volume of 137.71 million shares. Daily trading volume of KSE100 listed companies increased by 30.31 million shares or 28.23% on DoD basis.

Foreign Investors remained in net selling position of 10.17 million shares and net value of Foreign Inflow dropped by 5.98 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.11 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 9.16 and 1.12 million shares. While on the other side Local Individuals, Companies, Banks and Mutual Fund remained in net buying positions of 8.50, 0.09, 1.41 and 3.08 million shares but NBFCs, Brokers and Insurance Companies remained in net selling positions of 0.97, 1.06 and 1.79 million shares respectively.

Analytical Review

Asia shares, euro under water as Turkish lira sinks

Asia share markets skidded and the euro hit one-year lows on Monday as a renewed rout in the Turkish lira drove demand for safe harbors, including the U.S. dollar, Swiss franc and yen. Japan’s Nikkei lost 1.3 percent and MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.1 percent as bourses across the region turned red. EMini futures for the S&P 500 were off 0.33 percent, while 10-year Treasury yields dipped further to 2.85 percent. China’s blue chip index shed 1.2 percent, while Hong Kong stocks lost 1.4 percent as the local dollar fell to the limits of its trading band.

Bank deposits see decline of 0.12pc

ACCORDING to the weekly statement of position of all scheduled banks for the week ended July 27, 2018, deposits and other accounts of all scheduled banks stood at Rs12,551.434 billion after a 0.12 per cent decrease over the preceding week’s figure of Rs12,566.667bn. Compared with last year’s corresponding figure of Rs11,701.701bn, the current week’s figure was higher by 7.20pc. Deposits and other accounts of all commercial banks stood at Rs12,484.235bn against preceding week’s deposits of Rs12,500.068bn, showing a fall of 0.12pc. Deposits and other accounts of specialised banks stood at Rs67.199bn, larger by 0.90pc against previous week’s figure of Rs66.599bn.

CPEC repayment plan under preparation

ISLAMABAD: Ahead of the new government, bureaucrats are busy in working out details for a bailout package especially for repayments of instalments of operational projects under the China-Pakistan Economic Corridor in 2018-19. The blueprint mostly identifies a string of measures to cater to supply-side arrangements of foreign exchange in a period of five years — 2018-2023. The issue gained importance nationally and internationally after Washington’s recent warning to the International Monetary Fund in discussing the bailout package with Pakistan on the plea that there is “no rationale to bail out Chinese bondholder or China itself”.

Week Rupee lifts cement rates in retail market

After witnessing a drop of almost 15 percent during last fiscal year, the cement prices have started reverting to previous level in north region amidst 20 percent Rupee depreciation, as different companies have increased prices by Rs5-10 on average. However, the prices in South region remained stable on higher side at Rs580-600/bag. Industry sources said that hike in coal prices, rupee depreciation o f about 20 percent and strong demand due to heavy construction work in Punjab was the major factors which led to the hike in cement prices to reach Rs535-565/bag. Industry stakeholders said that additional duties in federal budgets on cement are also one of the reasons behind this hike in rates. In retail market of Lahore, different brands of cement bags are available in the range of Rs535 to Rs565 per 50kg bag against their previous rates of Rs525 to Rs5560, showing a jump of Rs5-10 per 50kg bag on average.

820km Optic Fiber Cable project in GB to facilitate tourism

The fiber optic network project in Gilgit-Baltistan (GB) under China-Pakistan Economic Corridor (CPEC) is being carried out at a fast pace and would facilitate trade, tourism and Information Technology (IT) awareness in region. The coast of 820km of Optic Fiber Cable from Khunjerab to Rawalpindi is US $ 44 million and expenditure incurred so far is $28.30million. Sources at Planning and Development Division Sunday said the project completion time is December 2018 but it may be completed ahead of schedule. Giving details, the sources said main alignment of CPEC optical fiber is Rawalpindi, Mansehra, Naran, Babusar top, Chillas, Gilgit, Karimabad, and Khunjerab. The project while establishing alternate international connectivity of Pakistan and China with rest of the world will particularly play a key role in provision of 3G and 4G services in Gilgit-Baltistan at parity with services now available in other parts of the country.

Asia share markets skidded and the euro hit one-year lows on Monday as a renewed rout in the Turkish lira drove demand for safe harbors, including the U.S. dollar, Swiss franc and yen. Japan’s Nikkei lost 1.3 percent and MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.1 percent as bourses across the region turned red. EMini futures for the S&P 500 were off 0.33 percent, while 10-year Treasury yields dipped further to 2.85 percent. China’s blue chip index shed 1.2 percent, while Hong Kong stocks lost 1.4 percent as the local dollar fell to the limits of its trading band.

ACCORDING to the weekly statement of position of all scheduled banks for the week ended July 27, 2018, deposits and other accounts of all scheduled banks stood at Rs12,551.434 billion after a 0.12 per cent decrease over the preceding week’s figure of Rs12,566.667bn. Compared with last year’s corresponding figure of Rs11,701.701bn, the current week’s figure was higher by 7.20pc. Deposits and other accounts of all commercial banks stood at Rs12,484.235bn against preceding week’s deposits of Rs12,500.068bn, showing a fall of 0.12pc. Deposits and other accounts of specialised banks stood at Rs67.199bn, larger by 0.90pc against previous week’s figure of Rs66.599bn.

ISLAMABAD: Ahead of the new government, bureaucrats are busy in working out details for a bailout package especially for repayments of instalments of operational projects under the China-Pakistan Economic Corridor in 2018-19. The blueprint mostly identifies a string of measures to cater to supply-side arrangements of foreign exchange in a period of five years — 2018-2023. The issue gained importance nationally and internationally after Washington’s recent warning to the International Monetary Fund in discussing the bailout package with Pakistan on the plea that there is “no rationale to bail out Chinese bondholder or China itself”.

After witnessing a drop of almost 15 percent during last fiscal year, the cement prices have started reverting to previous level in north region amidst 20 percent Rupee depreciation, as different companies have increased prices by Rs5-10 on average. However, the prices in South region remained stable on higher side at Rs580-600/bag. Industry sources said that hike in coal prices, rupee depreciation o f about 20 percent and strong demand due to heavy construction work in Punjab was the major factors which led to the hike in cement prices to reach Rs535-565/bag. Industry stakeholders said that additional duties in federal budgets on cement are also one of the reasons behind this hike in rates. In retail market of Lahore, different brands of cement bags are available in the range of Rs535 to Rs565 per 50kg bag against their previous rates of Rs525 to Rs5560, showing a jump of Rs5-10 per 50kg bag on average.

The fiber optic network project in Gilgit-Baltistan (GB) under China-Pakistan Economic Corridor (CPEC) is being carried out at a fast pace and would facilitate trade, tourism and Information Technology (IT) awareness in region. The coast of 820km of Optic Fiber Cable from Khunjerab to Rawalpindi is US $ 44 million and expenditure incurred so far is $28.30million. Sources at Planning and Development Division Sunday said the project completion time is December 2018 but it may be completed ahead of schedule. Giving details, the sources said main alignment of CPEC optical fiber is Rawalpindi, Mansehra, Naran, Babusar top, Chillas, Gilgit, Karimabad, and Khunjerab. The project while establishing alternate international connectivity of Pakistan and China with rest of the world will particularly play a key role in provision of 3G and 4G services in Gilgit-Baltistan at parity with services now available in other parts of the country.

ATRL, DGKC, MLCF and SSGC would try to lead index in negative direction.

Technical Analysis

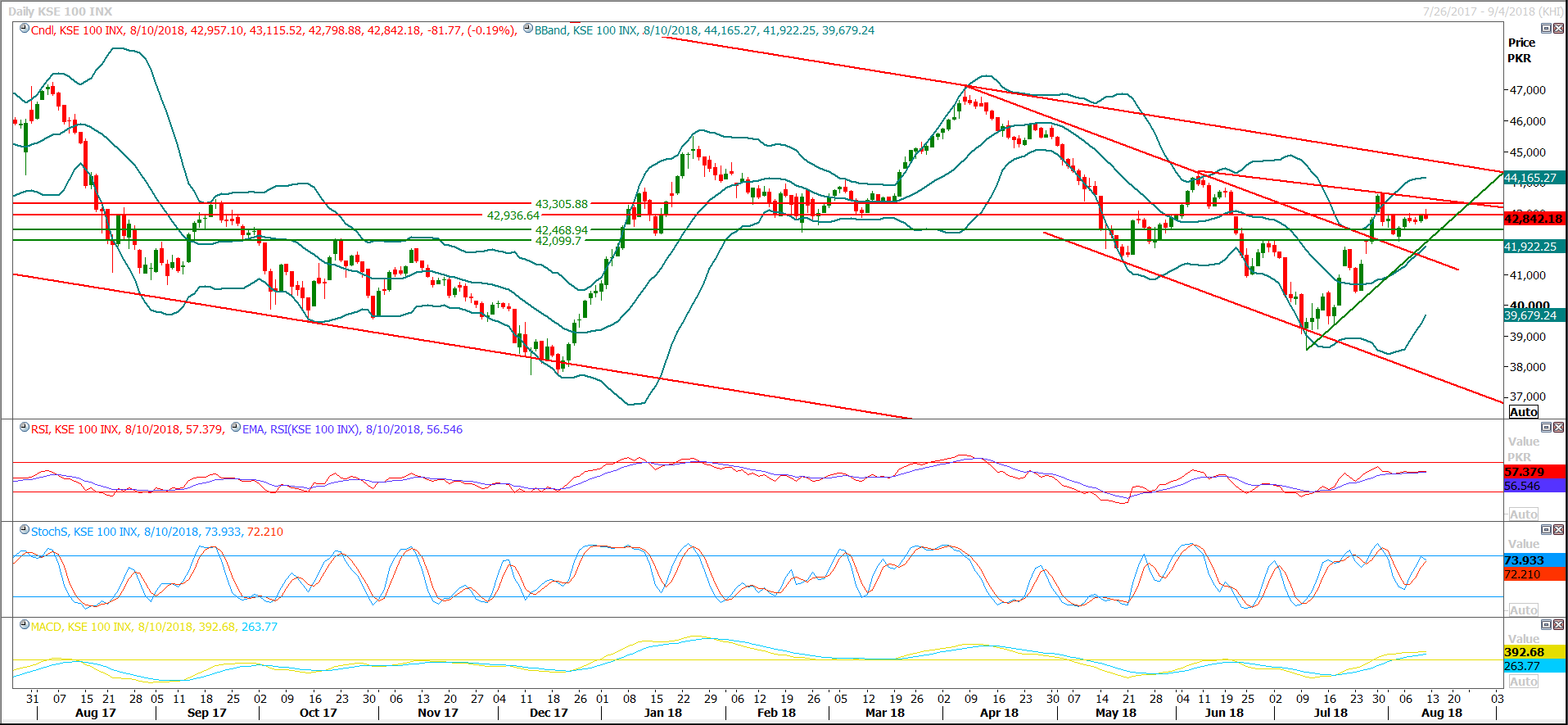

The Benchmark KSE100 Index have tried a lot to penetrate its retracement levels in upward direction during last week but have not succeeded in doing so, as of now its momentum have been changed to bearish direction and a pressure could be witnessed which may lead index for expansion of said corrections towards 42,089 and then 40,500 points in coming days. Daily Stochastic and MAORSI have generated bearish crossovers and index have started sliding from a triple top on daily chart therefore its recommended to initiate selling on strength with strict stop loss of 43,330 points. Initially 42,460 and 42,089 points would try to provide some ground and if index would slide below these levels on daily basis then a rally of further 1000-1500 points in bearish direction could be witnessed in this week.

DGKC, MLCF, FCCL have formatted a bearish dark cloud on daily chart and these scripts would witness further pressure during current trading session while PSO, SSGC and ISL would join them on bearish side as they have completed their corrections on daily and weekly chart.

DGKC, MLCF, FCCL have formatted a bearish dark cloud on daily chart and these scripts would witness further pressure during current trading session while PSO, SSGC and ISL would join them on bearish side as they have completed their corrections on daily and weekly chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.