Previous Session Recap

Trading volume at PSX floor increased by 66.07 million shares or 51.05% on DoD basis, whereas, the benchmark KSE100 Index opened at 38504.71, posted a day high of 38620.66 and a day low of 37736.73 during last trading session. The session suspended at 38525.11 with net change of 43.41 and net trading volume of 107.74 million shares. Daily trading volume of KSE100 listed companies increased by 50.58 million shares or 88.48% on DoD basis.

Foreign Investors remained in net selling position of 15.06 million shares and net value of Foreign Inflow dropped by 8.79 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 5.04 and 10.05 million shares. While on the other side Local Individuals remained in net selling of 14.99 million shares but Local Companies, Banks, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 16.12, 6.29, 0.28, 0.65, 4.19 and 2.84 million shares respectively.

Analytical Review

Asian shares were treading water in early trade on Wednesday as crude oil futures steadied after a selloff, while a widely expected interest rate hike from the Federal Reserve underpinned the dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was a few ticks higher in early trade. Japan's Nikkei stock index .N225 edged down slightly, shrugging off data that showed Japanese core machinery orders rose a more-than-expected 5 percent in October in a sign of resilient capital spending. On Wall Street on Tuesday, the Dow Jones Industrial Average .DJI and the S&P 500 .SPX both notched record closing highs, though the Nasdaq Composite .IXIC shed 0.19 percent. The dollar index, which tracks the greenback against a basket of six major rival currencies, edged down 0.1 percent to 94.048 .DXY but remained not far from three-week highs touched on Tuesday.

The World Bank will stop financing oil and gas exploration and extraction from 2019, it announced Tuesday at a climate summit seeking to boost the global economy's shift to clean energy. "The World Bank Group will no longer finance upstream oil and gas , after 2019," it said in a statement in Paris, where world leaders sought to unlock more money for the shift away from Earth-warming fossil fuels. The move, it said, was meant to help countries meet the greenhouse gas-curbing pledges they had made in support of the 2015 Paris Agreement to limit global warming. "In exceptional circumstances, consideration will be given to financing upstream gas in the poorest countries where there is a clear benefit in terms of energy access for the poor and the project fits within the countries' Paris Agreement commitments," the statement said. The bank also announced it was "on track to meet its target of 28 percent of its lending going to climate action by 2020."

Pakistani and Russian experts are in process of holding negotiations on Build-Operate-Own-Transfer (BOOT) agreement to lay an 1100 kilometer gas pipeline from Lahore to Lahore (North-South) for which the two countries had signed an intergovernmental accord two years ago. The project, costing around $2 billion, is facing delay due to some international sanctions on Russian company RT-Global Resources. “The actual construction on the pipeline will start after finalisation of the contractual arrangement. Currently, the parties are negotiating the BOOT agreement. Pakistan has already communicated that any structure/arrangement needs to be sanctions free,” official sources told APP. Answering a question, they also informed that the matter of US sanctions on the company was discussed with the Russian authorities, while the proposed solution by the Russian side was under evaluation by the energy and law ministries.

Engro Elengy Terminal Private Limited (EETPL) has signed an LNG Supply Agreement (LSA) with Sui Southern Gas Company (SSGC) for provision of additional 200 mmsfcd gas. The agreement was signed by Jehangir Piracha, CEO EETPL , and Amin Rajput, acting MD SSGC , in presence of Minister of State for Petroleum Jam Kamal Khan amongst other dignitaries at the Petroleum Division – Ministry of Energy. “Importing natural gas is a more economically viable source of energy since it is not only cheaper but also more efficient fuel for power generation. Today’s signing is testament to our resolve to meet the rising demand of gas in the country and fuel economic growth and help alleviate the energy crisis,” said Jehangir Piracha, CEO of EETPL .

The 17 percent return to the gas utility companies in Pakistan is more than double the rate of return enjoyed by the gas companies in America. This was stated by Energy Regulatory Partnership-Pakistan USAID, chief of party J. Michael Biddison, recommending the return rate should be based on efficiency and performance. “Fix return of 17 percent, on assets of the gas utilities companies, is too high as the companies in the US are getting less than half of this returns,” said Mr. Biddison in a presentation to the Consultative Sessions on Gas sector Reforms. Oil and Gas Regulatory Authority, in collaboration with the World Bank and Ministry of Energy, has concluded the consultative sessions on Gas Sector Reforms with reference to Third Party Access Rules, Network Code and Tariff regime.

ENGRO, PSO, ATRL, TRG and DGKC may lead the market in positive direction

Technical Analysis

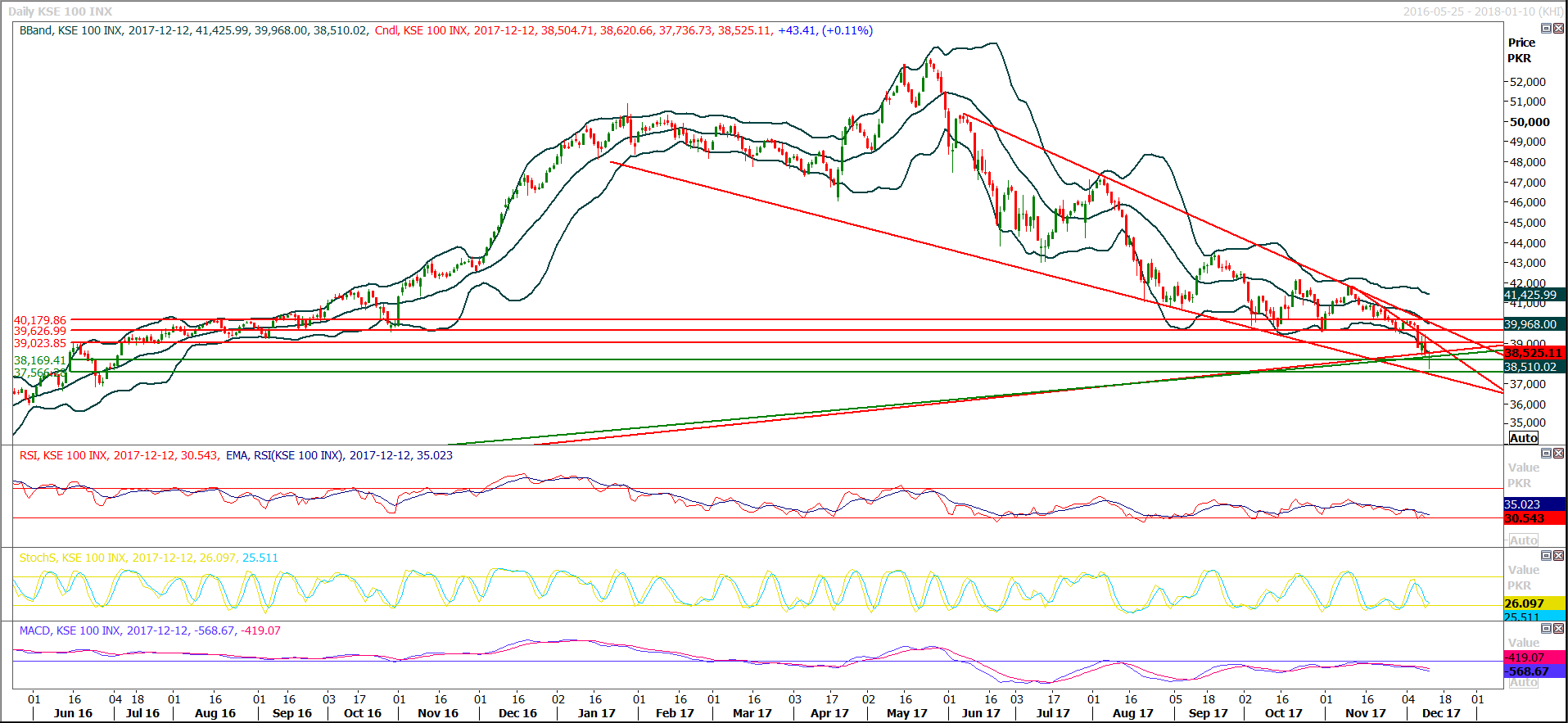

The Benchmark KSE100 Index have bounced back after expanding its 61.8% correction on hourly chart and closed again at its 50% correction of yesterday's bearish rally. For current trading session a gap opening above 38787 is required for a clear rally towards 39500 because 38787 would react as a resistance for current trading session. If index would become able to open with a gap above 38787 then next targets would be 39023 and 39500 points for current trading session. Current trading session's closing above 39000 would turn one more stone for start of a bullish rally as a morning star would be created on daily chart. Its recommended to practice cautious while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.