Previous Session Recap

Trading volume at PSX floor increased by 21.62 million shares or 17.43% on DOD basis whereas the Benchmark KSE100 index opened at 38,733.10, posted a day high of 38,851.96 and day low of 38.130.07 during last trading session while session suspended at 38,307.44 points with net change of -544.52 points and net trading volume of 107.03 million shares. Daily trading volume of KSE100 listed companies increased by 22.61 million shares or 26.78% on DOD basis.

Foreign Investors remained in net selling positions of 11.05 million shares and net value of Foreign Inflow dropped by 3.39 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 11.85 million shares but Overseas Pakistanis investors remained in net buying positions of 0.80 million shares. While on the other side Local Individuals, Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 6.88, 0.86, 0.26, 1.42 and 6.86 million shares respectively but Banks and Mutual Fund remained in net selling positions of 0.70 and 4.61 million shares.

Analytical Review

Asian shares, sterling up on pause in Brexit, trade fears

Asian shares and the pound moved higher on Thursday as investors breathed a sigh of relief after British Prime Minister Theresa May survived a no-confidence vote, and as China appeared to be taking more steps to meet U.S. demands to open its markets. Sterling rallied from a 20-month low after the vote, and was holding onto gains early in the Asian trading day, trading at $1.2629.

'Hope is very much in the air': Asad Umar on Pakistan's economy

Finance Minister Asad Umar on Wednesday asserted that surveys held following the completion of PTI government's first 100 days in power showed that "a very clear majority of Pakistanis think the country is moving in the right direction and heading towards a better place than where it was before". "Hope is very much in the air," the finance minister mentioned while being interviewed by Stephen Sackur on BBC News programme Hard Talk.

Power sector woes cost Pak economy $18b: WB

Pakistan’s power sector suffers due to inefficiencies that cost the economy $18 billion or 6.5 percent of GDP in fiscal year 2015, said a new World Bank report. Costs are far greater than previous estimates based on fiscal costs alone and reforms could save Pakistan’s economy $8.4 billion in business losses and could increase total household incomes by at least $4.5 billion a year, said World Bank Senior Economist Fan Zhang while launching the World Bank report "In the Dark: How Much Do Power Sector Distortions Cost South Asia," here today.

ECC approves budget estimates of NTC

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved the budget estimates of the National Telecommunication Corporation (NTC).The ECC, which was chaired by Finance Minister Asad Umar, has cleared proposal of Ministry of Information Technology (IT) regarding approval of budget estimates of National Telecommunication Corporation (NTC) by the federal cabinet. The ECC however, observed that NTC being an autonomous and self earning body should be empowered like other public sector corporations to formulate and approve its own budget. The Committee directed that necessary authorization may be granted so that in future the budget is considered and approved by the NTC Board.

PGP gives RLNG to system at lowest tariff

Pakistan Gas Port Limited is operating at 105 percent of its capacity through its LNG Import and Regasification Terminal at Port Qasim. It is dispatching 650 mmscfd of regasified LNG to the Sui pipeline system at one of the lowest tariffs in the country. Under a 15-year Agreement, Pakistan LNG Terminals Limited has contracted out the processing of 600 mmscfd of imported LNG to the PGP Terminal. The private-sector owned-and-operated terminal is operating beyond its contracted capacity with PLTL and is supplying critical energy at a time when SSGC has stopped gas supply to CNG sector and captive power plants owing to reduced gas supply.

Asian shares and the pound moved higher on Thursday as investors breathed a sigh of relief after British Prime Minister Theresa May survived a no-confidence vote, and as China appeared to be taking more steps to meet U.S. demands to open its markets. Sterling rallied from a 20-month low after the vote, and was holding onto gains early in the Asian trading day, trading at $1.2629.

Finance Minister Asad Umar on Wednesday asserted that surveys held following the completion of PTI government's first 100 days in power showed that "a very clear majority of Pakistanis think the country is moving in the right direction and heading towards a better place than where it was before". "Hope is very much in the air," the finance minister mentioned while being interviewed by Stephen Sackur on BBC News programme Hard Talk.

Pakistan’s power sector suffers due to inefficiencies that cost the economy $18 billion or 6.5 percent of GDP in fiscal year 2015, said a new World Bank report. Costs are far greater than previous estimates based on fiscal costs alone and reforms could save Pakistan’s economy $8.4 billion in business losses and could increase total household incomes by at least $4.5 billion a year, said World Bank Senior Economist Fan Zhang while launching the World Bank report "In the Dark: How Much Do Power Sector Distortions Cost South Asia," here today.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved the budget estimates of the National Telecommunication Corporation (NTC).The ECC, which was chaired by Finance Minister Asad Umar, has cleared proposal of Ministry of Information Technology (IT) regarding approval of budget estimates of National Telecommunication Corporation (NTC) by the federal cabinet. The ECC however, observed that NTC being an autonomous and self earning body should be empowered like other public sector corporations to formulate and approve its own budget. The Committee directed that necessary authorization may be granted so that in future the budget is considered and approved by the NTC Board.

Pakistan Gas Port Limited is operating at 105 percent of its capacity through its LNG Import and Regasification Terminal at Port Qasim. It is dispatching 650 mmscfd of regasified LNG to the Sui pipeline system at one of the lowest tariffs in the country. Under a 15-year Agreement, Pakistan LNG Terminals Limited has contracted out the processing of 600 mmscfd of imported LNG to the PGP Terminal. The private-sector owned-and-operated terminal is operating beyond its contracted capacity with PLTL and is supplying critical energy at a time when SSGC has stopped gas supply to CNG sector and captive power plants owing to reduced gas supply.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

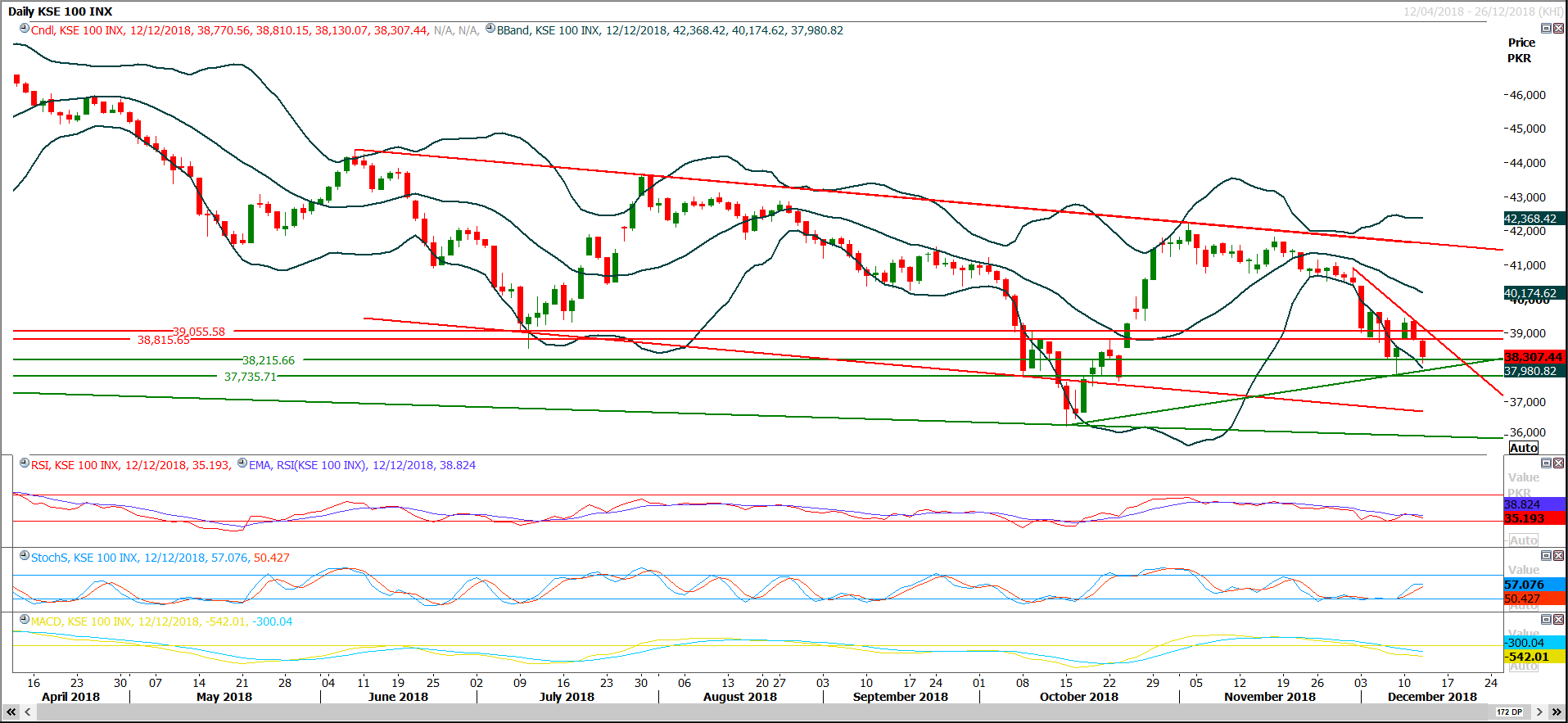

Technical Analysis

The Benchmark KSE100 index has supportive regions ahead at 37,940 and 37,730 points where it’s being supported by a rising trend line along with a horizontal supportive region respectively. Daily momentum indicators are ready to generate bearish crossovers but it’s expected that a pullback may would be witnessed before day end and index would try to recover before breakout of 37,730 points, therefore its recommended to adopt a swing trading strategy during current trading session and start short positions in first half and adopt a cut and reverse strategy in second half of the day. Index seems to remain bearish on short term basis but an intraday pullback would provide some good volumes in market leaders.

PAEL have a strong supportive region at 24.25 and it would try to bounce back towards 26.44 & 26.80 Rs in swing mode. ATRL would try to remain range bounce between 164 & 175 Rs. PSO have strong supportive region ahead at 224-222 Rs region and it would also try to bounce back from that region towards 234 Rs. While TRG would try to find ground between 24.27 till 23.89 Rs region and in case of bounce back it would try to target 25.50 & 26.54.

PAEL have a strong supportive region at 24.25 and it would try to bounce back towards 26.44 & 26.80 Rs in swing mode. ATRL would try to remain range bounce between 164 & 175 Rs. PSO have strong supportive region ahead at 224-222 Rs region and it would also try to bounce back from that region towards 234 Rs. While TRG would try to find ground between 24.27 till 23.89 Rs region and in case of bounce back it would try to target 25.50 & 26.54.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.