Previous Session Recap

Trading volume at PSX floor increased by 18.80 million shares or 11.64% on DoD basis, whereas the benchmark KSE100 index opened at 39,714.46, posted a day high of 40,637.79 and a day low of 39,714.46 points during last trading session while session suspended at 40,531.13 points with net change of 816.67 points and net trading volume of 126.56 million shares. Daily trading volume of KSE100 listed companies also increased by 10.61 million shares or 9.15% on DoD basis.

Foreign Investors remained in net selling positions of 13.75 million shares and value of Foreign Inflow dropped by 4.92 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.004, 11.59 and 2.15 million shares respectively. While on the other side Local Individuals, Companies, Mutual Fund and Brokers remained in net long positions of 6.32, 4.02, 7.65 and 0.02 million shares but Banks, NBFCs and Insurance Companies remained in net selling positions of 2.22, 0.04 and 2.18 million shares respectively.

Analytical Review

Jump in new coronavirus cases stymies stock rally

Asian stock markets wobbled on Thursday while safe-havens such as the yen, gold and bonds rose as the number of new coronavirus cases and deaths in the outbreak’s epicenter jumped. China’s Hubei province, where the virus is believed to have originated, reported 242 new deaths, double the previous day’s toll, and confirmed 14,840 new cases on Feb. 12. The rise in the number of cases, which came as officials adopted a new methodology for counting infections, is a sevenfold increase from a day earlier. It was not immediately clear how the new methods affected the results, nor why the death toll rose so sharply, but it seemed to dash hopes that the virus’ spread might be slowing. E-mini S&P 500 futures turned from positive to fall 0.3% ESc1. Dow Jones futures fell by the same margin YMc1, suggesting a pause in Wall Street’s strong rally.

IMF asks govt to focus on human development

The International Monetary Fund (IMF) has asked Pakistan to reduce import tariffs, ensure General Sales Tax harmonisation, enter into free-trade agreements and take ownership of underfunded Sustainable Development Goals (SDGs). At a joint meeting of the Senate and National Assembly standing committees on finance, a visiting staff mission of the IMF briefed the parliamentarians on Pakistan’s trade growth, SDGs financing and GST harmonisation. Informed sources said the IMF team put SDGs costing at Rs6.196 trillion until 2030 and wanted creation of additional fiscal space. This came amid media reports that Pakistani authorities and the IMF mission had completed the second review of the $6bn bailout programme and agreed not to bring a mini-budget or increase taxes during the current fiscal year despite a massive revenue shortfall. However, a finance ministry official said talks would continue on Thursday.

Government to help scale innovative business ideas: PM Imran

While acknowledging the role startups are playing in the country’s economic growth and financial inclusion, Prime Minister Imran Khan said on Wednesday that his government will facilitate talented entrepreneurs in transforming their innovative ideas into sustainable businesses. Addressing a ceremony at the National Incubation Centre (NIC) for startups under its Ignite programme, the premier gave his own example when urging youth not to be afraid of criticism. He told youth not to take failures to heart saying: “When you critically analyse your mistakes and then retry, it only makes you stronger.” Such incubation centres across the country will facilitate and provide support required to succeed including mentorship and networking by leading entrepreneurs, top professionals, investors and meet-ups.

State Bank raises freelance payment limit to $25,000

The State Bank of Pakistan on Wednesday increased the payments limit for freelance services in information and communication technology by five times. In a circular issued on Wednesday, the bank said the decision has been made to broaden the scope of business-to-customer transactions through home remittance channel. As a result, the payment limit against freelance services in the said area has been enhanced to $25,000 per individual a month from $5,000 previously. This increase in limit will facilitate freelancers to route greater value of funds through a more economical and efficient channel of home remittances and help in receiving foreign exchange flows through formal banking, said the SBP.

Germans, Italians investors keen to invest in Allama Iqbal Industrial City

Keen interest has been evinced by the German and Italian investors and manufacturers to pump colossal investment in Allama Iqbal Industrial City, a prioritized Special Economic Zone of Faisalabad Industrial Estate Development and Management Company (FIEDMC) under CPEC. This was disclosed by FIEDMC Chairman Mian Kashif Ashfaq on Wednesday while talking to different delegations of Germans and Italians investors during ongoing tour to Europe. Mian Kashif further said there was a vast scope of enhancing Pak-German bilateral trade relations whereas German investors were also taking keen interest to invest in various sectors in Pakistan especially in FIEDMC. He said that investors and manufacturers’ delegation from Germany would soon visit Pakistan to explore business opportunities in Pakistani market and FIEDMC would provide them all required assistance in this regard.

Asian stock markets wobbled on Thursday while safe-havens such as the yen, gold and bonds rose as the number of new coronavirus cases and deaths in the outbreak’s epicenter jumped. China’s Hubei province, where the virus is believed to have originated, reported 242 new deaths, double the previous day’s toll, and confirmed 14,840 new cases on Feb. 12. The rise in the number of cases, which came as officials adopted a new methodology for counting infections, is a sevenfold increase from a day earlier. It was not immediately clear how the new methods affected the results, nor why the death toll rose so sharply, but it seemed to dash hopes that the virus’ spread might be slowing. E-mini S&P 500 futures turned from positive to fall 0.3% ESc1. Dow Jones futures fell by the same margin YMc1, suggesting a pause in Wall Street’s strong rally.

The International Monetary Fund (IMF) has asked Pakistan to reduce import tariffs, ensure General Sales Tax harmonisation, enter into free-trade agreements and take ownership of underfunded Sustainable Development Goals (SDGs). At a joint meeting of the Senate and National Assembly standing committees on finance, a visiting staff mission of the IMF briefed the parliamentarians on Pakistan’s trade growth, SDGs financing and GST harmonisation. Informed sources said the IMF team put SDGs costing at Rs6.196 trillion until 2030 and wanted creation of additional fiscal space. This came amid media reports that Pakistani authorities and the IMF mission had completed the second review of the $6bn bailout programme and agreed not to bring a mini-budget or increase taxes during the current fiscal year despite a massive revenue shortfall. However, a finance ministry official said talks would continue on Thursday.

While acknowledging the role startups are playing in the country’s economic growth and financial inclusion, Prime Minister Imran Khan said on Wednesday that his government will facilitate talented entrepreneurs in transforming their innovative ideas into sustainable businesses. Addressing a ceremony at the National Incubation Centre (NIC) for startups under its Ignite programme, the premier gave his own example when urging youth not to be afraid of criticism. He told youth not to take failures to heart saying: “When you critically analyse your mistakes and then retry, it only makes you stronger.” Such incubation centres across the country will facilitate and provide support required to succeed including mentorship and networking by leading entrepreneurs, top professionals, investors and meet-ups.

The State Bank of Pakistan on Wednesday increased the payments limit for freelance services in information and communication technology by five times. In a circular issued on Wednesday, the bank said the decision has been made to broaden the scope of business-to-customer transactions through home remittance channel. As a result, the payment limit against freelance services in the said area has been enhanced to $25,000 per individual a month from $5,000 previously. This increase in limit will facilitate freelancers to route greater value of funds through a more economical and efficient channel of home remittances and help in receiving foreign exchange flows through formal banking, said the SBP.

Keen interest has been evinced by the German and Italian investors and manufacturers to pump colossal investment in Allama Iqbal Industrial City, a prioritized Special Economic Zone of Faisalabad Industrial Estate Development and Management Company (FIEDMC) under CPEC. This was disclosed by FIEDMC Chairman Mian Kashif Ashfaq on Wednesday while talking to different delegations of Germans and Italians investors during ongoing tour to Europe. Mian Kashif further said there was a vast scope of enhancing Pak-German bilateral trade relations whereas German investors were also taking keen interest to invest in various sectors in Pakistan especially in FIEDMC. He said that investors and manufacturers’ delegation from Germany would soon visit Pakistan to explore business opportunities in Pakistani market and FIEDMC would provide them all required assistance in this regard.

Market is expected to remain volatile during current trading session.

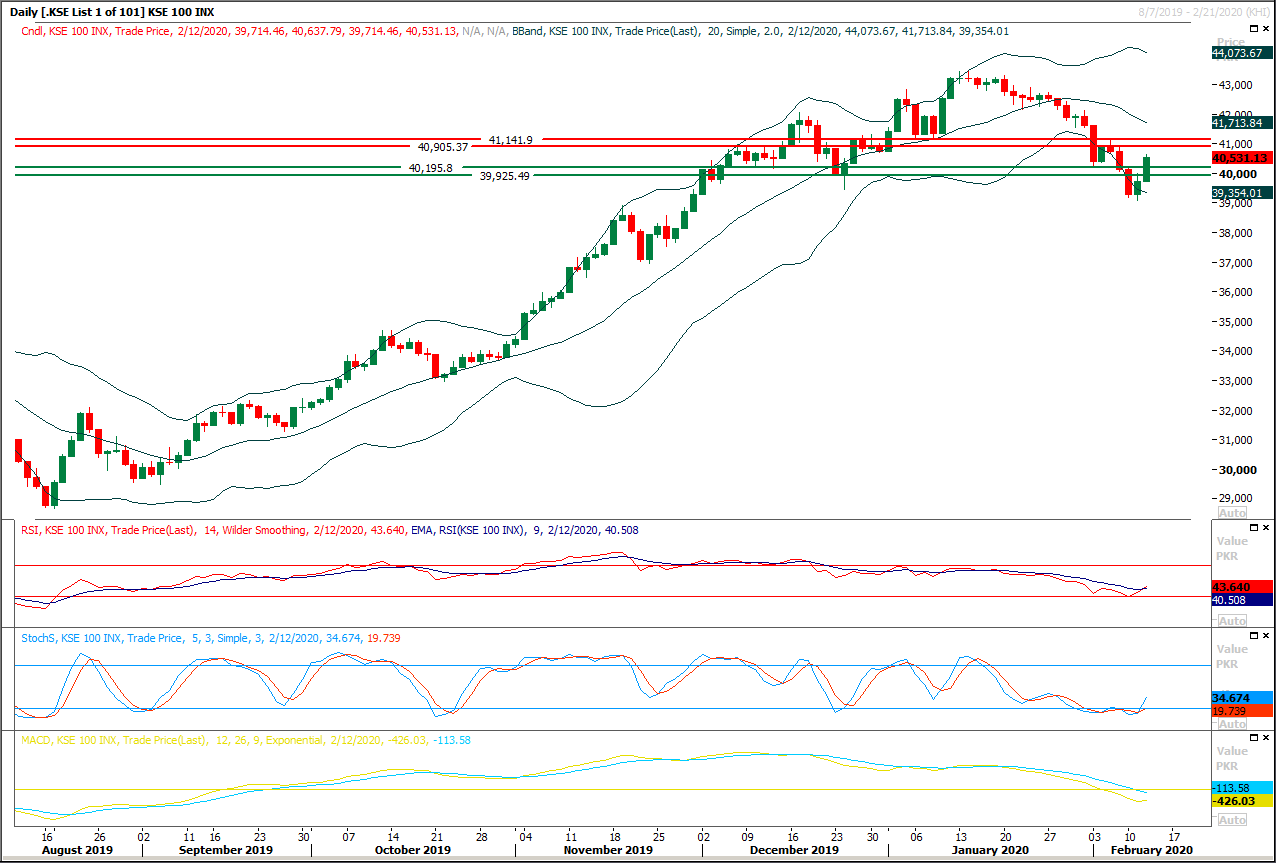

Technical Analysis

The Benchmark KSE100 index have continued its bullish trend during last trading session and succeed in closing above its initial resistant region of 40,500 points but it still remain under uncertainty and could face rejection from 40,900 points or 41,200 points on intraday or daily chart. It's recommended to stay cautious because some fresh volumes would be needed to close index above 41,000 points. It's recommended to swing trades until index succeed in closing above 41,200 points. In case of rejection from its resistant regions index would try to target 40,200 and 39,880 points and breakout below that region would call for a new bearish trend which may lead index towards new monthly low.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.