Previous Session Recap

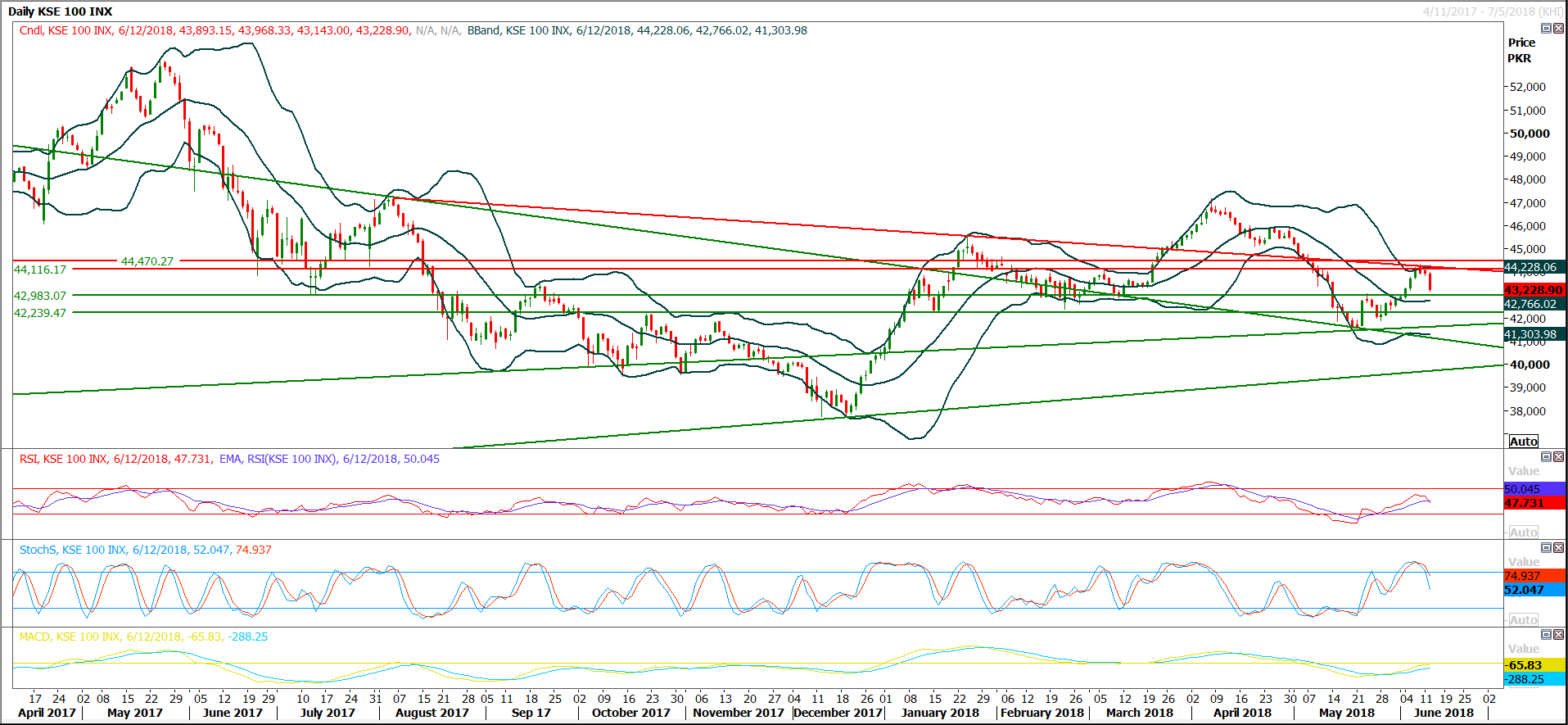

Trading volume at PSX floor dropped by 22.36 million shares or 13.96% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43,893.15, posted a day high of 43,955.50 and a day low of 43,150.91 during last trading session. The session suspended at 43,228.90 with net change of -702.26 and net trading volume of 86.90 million shares. Daily trading volume of KSE100 listed companies dropped by 17.55 million shares or 16.80% on DoD basis.

Foreign Investors remained in net selling position of 4.67 million shares and net value of Foreign Inflow dropped by 1.49 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.17 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 1.92 and 2.92 million shares. While on the other side Local Individuals, Local Companies, NBFCs, Mutual Fund and Brokers remained in net buying positions of 5.85, 4.88, 3.67, 0.19 and 1.51 million shares but Banks, Insurance Companies remained in net selling positions of 0.28, and 7.20 million shares respectively.

Analytical Review

Asian stocks step back as investors brace for Fed

Asian shares edged slightly lower on Wednesday as investors looked to the Federal Reserve policy decision and any clues it might give on future rate hikes, shifting focus away from the historic U.S.-North Korea summit in Singapore. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.15 percent in early trade, giving up the slim gains they made following Tuesday’s meeting between U.S. President Donald Trump and North Korean leader Kim Jong Un. Japan's Nikkei .N225 eked out gains of 0.10 percent. On Wall Street, the S&P 500 gained 0.17 percent, led by a continued rally in technology shares. The Nasdaq Composite .IXIC added 0.57 percent, to finish at record low of 7,703. “The agreement at the summit lacked details. There was no clear roadmap to denuclearization. So that wasn’t something that makes markets 100 percent risk-on,” said Shuji Shirota, head of macro economic strategy group at HSBC Securities in Japan.

Resolution of payments issue must for uninterrupted power supply

Minister for Energy Syed Ali Zafar has said that that the issue of payments by power sector against fuel/LNG supplies needs to be resolved so that uninterrupted electricity supply may be ensured in the country. He expressed these view during his first visit to the Petroleum Division. The minister held meetings with senior officials of the Division. A comprehensive briefing was made by Sikandar Sultan Raja, the secretary petroleum, about overall functioning of Petroleum Division, overall performance and operations as well as challenges and issues faced by petroleum sector. The briefing was also attended by additional secretary, joint secretaries and director generals along with chief executive officers of public sector entities in petroleum sector. The minister expressed his satisfaction over smooth functioning of the sector and advised the secretary petroleum to keep him abreast on all important matters.

Businessmen blast hike in fuel prices

The business community has severely criticised bulk increase in petroleum products prices and said that caretaker government has implemented a bad decision of Oil & Gas Regulatory Authority (OGRA), which must be withdrawn immediately. LCCI president Malik Tahir Javaid said that Oil & Gas Regulatory Authority (OGRA) is moving with closed eyes. “This body doesn’t care for economy, trade and industry and is continuously taking anti-businesses decisions,” he added. He said that government needs to care for economy that is in a bad position but it is a matter of concern that it has implemented the OGRA’s decision without taking stakeholders on board. Why doesn’t OGRA suggest government to reduce duties and taxes on petroleum products besides cutting non-development expenditures of the state, he questioned? On the other hand, Islamabad Chamber of Commerce and Industry called upon the caretaker government to withdraw its decision of making further hike in the prices of petroleum products as it would enhance the cost of production, increase inflation for the general public, affect exports and hit the growth of the economy.

Punjab PDWP okays irrigation sector scheme

The Punjab Provincial Development Working Party (PDWP) on Tuesday approved development scheme of irrigation sector with an estimated cost of 332,246.00 million rupees. The scheme was approved in the 74th meeting of PDWP of current fiscal year 2017-18, presided over by Chairman P&D Muhammad Jahanzeb Khan. The approved development scheme is: Implementation of National Flood Protection Plan-IV (NFPP-IV) (Umbrella PC-I) at the cost of Rs 332,246.00 million.

Land acquired for construction of oil refinery in Karak

Khyber Pakhtunkhwa (KP) government has acquired six hundred kanals land for the construction of an oil refinery in Karak district. The spokesman of the provincial government said that a memorandum of understanding has been signed with Frontier Works Organization for construction of the oil refinery, Radio Pakistan reported. It will be completed at a cost of about sixty-four billion rupees in four years, he said, adding that a similar MoU has also been signed with a Russian company for the construction of another oil refinery in the area. The company will spend thirty five billion rupees on the construction of the refinery, he said. Both the refineries will have the capacity to refine sixty thousand barrels oil per day. Karak, Kohat and Hangu have huge oil and gas reserves, he mentioned.

Asian shares edged slightly lower on Wednesday as investors looked to the Federal Reserve policy decision and any clues it might give on future rate hikes, shifting focus away from the historic U.S.-North Korea summit in Singapore. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.15 percent in early trade, giving up the slim gains they made following Tuesday’s meeting between U.S. President Donald Trump and North Korean leader Kim Jong Un. Japan's Nikkei .N225 eked out gains of 0.10 percent. On Wall Street, the S&P 500 gained 0.17 percent, led by a continued rally in technology shares. The Nasdaq Composite .IXIC added 0.57 percent, to finish at record low of 7,703. “The agreement at the summit lacked details. There was no clear roadmap to denuclearization. So that wasn’t something that makes markets 100 percent risk-on,” said Shuji Shirota, head of macro economic strategy group at HSBC Securities in Japan.

Minister for Energy Syed Ali Zafar has said that that the issue of payments by power sector against fuel/LNG supplies needs to be resolved so that uninterrupted electricity supply may be ensured in the country. He expressed these view during his first visit to the Petroleum Division. The minister held meetings with senior officials of the Division. A comprehensive briefing was made by Sikandar Sultan Raja, the secretary petroleum, about overall functioning of Petroleum Division, overall performance and operations as well as challenges and issues faced by petroleum sector. The briefing was also attended by additional secretary, joint secretaries and director generals along with chief executive officers of public sector entities in petroleum sector. The minister expressed his satisfaction over smooth functioning of the sector and advised the secretary petroleum to keep him abreast on all important matters.

The business community has severely criticised bulk increase in petroleum products prices and said that caretaker government has implemented a bad decision of Oil & Gas Regulatory Authority (OGRA), which must be withdrawn immediately. LCCI president Malik Tahir Javaid said that Oil & Gas Regulatory Authority (OGRA) is moving with closed eyes. “This body doesn’t care for economy, trade and industry and is continuously taking anti-businesses decisions,” he added. He said that government needs to care for economy that is in a bad position but it is a matter of concern that it has implemented the OGRA’s decision without taking stakeholders on board. Why doesn’t OGRA suggest government to reduce duties and taxes on petroleum products besides cutting non-development expenditures of the state, he questioned? On the other hand, Islamabad Chamber of Commerce and Industry called upon the caretaker government to withdraw its decision of making further hike in the prices of petroleum products as it would enhance the cost of production, increase inflation for the general public, affect exports and hit the growth of the economy.

The Punjab Provincial Development Working Party (PDWP) on Tuesday approved development scheme of irrigation sector with an estimated cost of 332,246.00 million rupees. The scheme was approved in the 74th meeting of PDWP of current fiscal year 2017-18, presided over by Chairman P&D Muhammad Jahanzeb Khan. The approved development scheme is: Implementation of National Flood Protection Plan-IV (NFPP-IV) (Umbrella PC-I) at the cost of Rs 332,246.00 million.

Khyber Pakhtunkhwa (KP) government has acquired six hundred kanals land for the construction of an oil refinery in Karak district. The spokesman of the provincial government said that a memorandum of understanding has been signed with Frontier Works Organization for construction of the oil refinery, Radio Pakistan reported. It will be completed at a cost of about sixty-four billion rupees in four years, he said, adding that a similar MoU has also been signed with a Russian company for the construction of another oil refinery in the area. The company will spend thirty five billion rupees on the construction of the refinery, he said. Both the refineries will have the capacity to refine sixty thousand barrels oil per day. Karak, Kohat and Hangu have huge oil and gas reserves, he mentioned.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index have bounced back after completing its 50% correction on daily chart and have succeeded in maintaining its major resistant region of 44,330 points which fall on crossover of a horizontal line with a descending trend line, as of now its heading towards its supportive regions of 42,900 and 42,630 points. Daily momentum indicators have confirmed start of a new bearish rally but it would be strengthen if index would succeed in closing below 42,900 points. On intraday basis a spike could be witnessed as hourly momentum indicators would try to normalize themselves but at day end it’s expected that index would remain under pressure. For current trading session it’s recommended to adopt swing trading strategy or selling on strength could be beneficial. If index would succeed in closing below 42,600 points in coming days then index would try to target 39,200 points after Eid holidays.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.