Previous Session Recap

Trading volume at PSX floor increased by 13.06 million shares or 6.00% on DoD basis, whereas the benchmark KSE100 index opened at 37,160.88, posted a day high of 37,255.13 and a day low of 35,895.77 points during last trading session while session suspended at 35,956.69 points with net change of -1716.56 points and net trading volume of 188.31 million shares. Daily trading volume of KSE100 listed companies also increased by 14.50 million shares or 8.34% on DoD basis.

Foreign Investors remained in net selling positions of 7.63 million shares but value of Foreign Inflow dropped by -3.47 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.008 and 7.78 million shares but Overseas Pakistani remained in net selling positions of 0.16 million shares respectively. While on the other side Local Individuals, Banks, Brokers and Insurance Companies remained in net long positions of 21.15, 5.86, 0.58 and 6.36 million shares but Local Companies, NBFCs and Mutual Fund remained in net selling positions of 18.58, 0.08 and 7.99 million shares respectively.

Analytical Review

Stocks crash as pandemic panic sweeps markets

Global stock markets crashed on Friday, ending a years-long bull run, with coronavirus panic selling hitting almost every asset class and leaving investors nowhere to hide. Half a trillion dollars in liquidity from the U.S. Federal Reserve and the promise of more were not enough to calm the fear that has wiped some $14 trillion from world stocks in a month. On Friday, Japanese stocks were in freefall and markets from Seoul to Jakarta punched through downlimit circuit breakers. The Nikkei .N225 dropped as far as 10% and is heading for its worst week since the 2008 financial crisis. Not one stock on the index is in positive territory.

PM chairs meeting on trade policy

Prime Minister Imran Khan on Thursday asked the Commerce Division for early finalisation of five-year Strategic Trade Policy Framework (STPF) and Textile Policy in consultation with stakeholders to make it more inclusive for boosting exports. The premier chaired a high-level meeting of STPF and Textile Policy 2020-25 in which the Commerce and Textile Division gave in-depth briefing over the broad contour of the proposed strategy and its objectives. The government economic team and former finance minister Shaukat Tareen also attended the briefing. The meeting discussed procedures in details and recommended modifications. “We will include all suggestions that for the policy document,” an official source privy to the meeting told Dawn.

Virus fears stir markets, but prices unchanged for now

Falling world prices of various commodities owing to the coronavirus has diluted the impact of rupee devaluation against the dollar on local prices of imported items. Market people said that in addition to the declining trend in world prices, local prices of imported pulses, spices, chemicals, tea, palm oil, plastic items etc have remained intact since dollar has been climbing up from Monday onwards, followed by low demand of these goods in the local market. From its closing value of Rs154.25 on Friday, the dollar has rose to Rs159.30, thus making imports costlier.

ECC approves wheat support price at Rs1,400

The government on Thursday announced that it would pass on the benefit of reduced international oil prices to consumers ‘in due course’ and as per mechanism already being followed by it. The announcement was made by Ministry of Finance after a meeting of the Economic Coordination Committee (ECC) of the Cabinet which also set up an inter-ministerial Monitoring Group for procurement of wheat at a minimum support price of Rs1,400 per 40kg. The ECC meeting was presided over by Finance Adviser Dr Abdul Hafeez Shaikh. The ECC discussed falling prices of oil in international market and its impact on the national economy and “announced the benefit of the reduced oil prices in the global market would be passed on the consumers in Pakistan in due course.”

FBR directed to release Rs15bn refunds to exporters

Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh has directed the Federal Board of Revenue (FBR) to release approximately Rs15 billion refunds to exporters in the next two days to resolve their liquidity issues. “We have received a directive from the adviser to release the refunds,” FBR Official Spokesperson Dr Hamid Ateeq confirmed to Dawn, adding the amount will be released in the next couple of days. The directive came from top when exporters met with top officials and Prime Minister Imran Khan and complained about their stuck refunds with the FBR. Normally, FBR blocks release of refunds to show higher revenue growth.

Global stock markets crashed on Friday, ending a years-long bull run, with coronavirus panic selling hitting almost every asset class and leaving investors nowhere to hide. Half a trillion dollars in liquidity from the U.S. Federal Reserve and the promise of more were not enough to calm the fear that has wiped some $14 trillion from world stocks in a month. On Friday, Japanese stocks were in freefall and markets from Seoul to Jakarta punched through downlimit circuit breakers. The Nikkei .N225 dropped as far as 10% and is heading for its worst week since the 2008 financial crisis. Not one stock on the index is in positive territory.

Prime Minister Imran Khan on Thursday asked the Commerce Division for early finalisation of five-year Strategic Trade Policy Framework (STPF) and Textile Policy in consultation with stakeholders to make it more inclusive for boosting exports. The premier chaired a high-level meeting of STPF and Textile Policy 2020-25 in which the Commerce and Textile Division gave in-depth briefing over the broad contour of the proposed strategy and its objectives. The government economic team and former finance minister Shaukat Tareen also attended the briefing. The meeting discussed procedures in details and recommended modifications. “We will include all suggestions that for the policy document,” an official source privy to the meeting told Dawn.

Falling world prices of various commodities owing to the coronavirus has diluted the impact of rupee devaluation against the dollar on local prices of imported items. Market people said that in addition to the declining trend in world prices, local prices of imported pulses, spices, chemicals, tea, palm oil, plastic items etc have remained intact since dollar has been climbing up from Monday onwards, followed by low demand of these goods in the local market. From its closing value of Rs154.25 on Friday, the dollar has rose to Rs159.30, thus making imports costlier.

The government on Thursday announced that it would pass on the benefit of reduced international oil prices to consumers ‘in due course’ and as per mechanism already being followed by it. The announcement was made by Ministry of Finance after a meeting of the Economic Coordination Committee (ECC) of the Cabinet which also set up an inter-ministerial Monitoring Group for procurement of wheat at a minimum support price of Rs1,400 per 40kg. The ECC meeting was presided over by Finance Adviser Dr Abdul Hafeez Shaikh. The ECC discussed falling prices of oil in international market and its impact on the national economy and “announced the benefit of the reduced oil prices in the global market would be passed on the consumers in Pakistan in due course.”

Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh has directed the Federal Board of Revenue (FBR) to release approximately Rs15 billion refunds to exporters in the next two days to resolve their liquidity issues. “We have received a directive from the adviser to release the refunds,” FBR Official Spokesperson Dr Hamid Ateeq confirmed to Dawn, adding the amount will be released in the next couple of days. The directive came from top when exporters met with top officials and Prime Minister Imran Khan and complained about their stuck refunds with the FBR. Normally, FBR blocks release of refunds to show higher revenue growth.

Market is expected to remain volatile during current trading session.

Technical Analysis

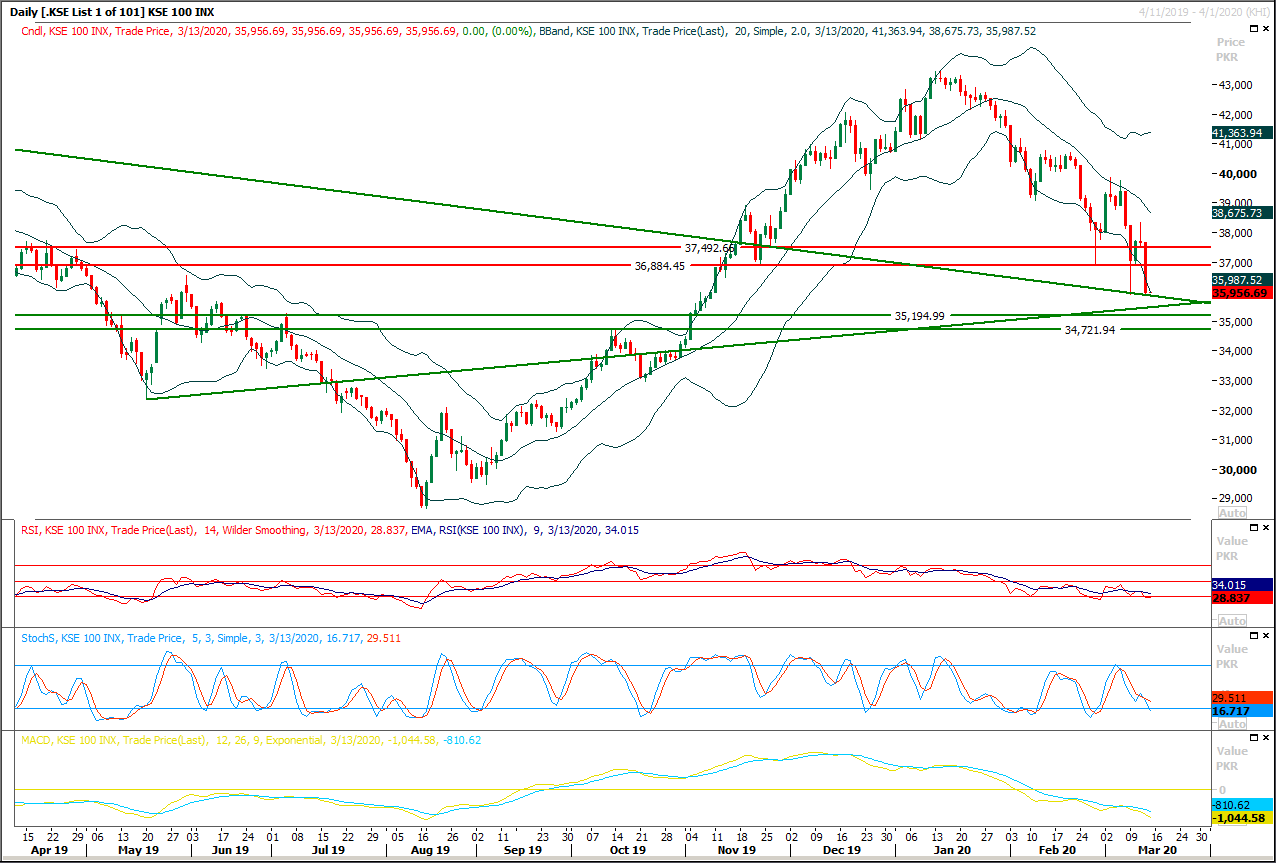

The Benchmark KSE100 index had posted a double bottom on daily chart during last trading session but it's expected that it would open with a negative gap during current trading session and index would try to slide downward and its initial supportive region where index would try find some ground is standing at 35,000 points while breakout of that region in downward direction would call for 37,400 and 34,500 points. It' s recommended to stay on selling side in first half and then take an intraday entry in buying around 34,700 points with strict stop loss of 34,000 points. While on flip side index would face strong resistances at 36,880 points and 37,500 points in coming days. While on intraday basis index would face its initial resistances at 35,500 points and 35,860 points after breakout below these regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.