Previous Session Recap

Trading volume at PSX floor dropped by 33.69 million shares or 20.83%, DoD basis, whereas the benchmark KSE100 Index opened at 41836.35, posted a day high of 41836.35 and a day low of 41390.81 during the last trading session. The session suspended at 41435.70 with a net change of -354.46 and net trading volume of 54.44 million shares. Daily trading volume of KSE100 listed companies dropped by 24.39 million shares or 30.95%,DoD basis.

Foreign Investors remained in a net selling position of 3.58 million shares and net value of Foreign Inflow dropped by 0.8 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 3.56 and 0.01 million shares. While on the other side Local Individuals, Banks, NBFCs and Mutual Funds remained in net buying positions of 3.17, 0.44, 0.13 and 3.96 million shares respectively but Local Companies, Brokers and Insurance Companies remain in net selling of 0.29, 3.06 and 1.26 million shares respectively.

Analytical Review

Asian shares stepped back in cautious early trade on Monday as investors look to see whether U.S. Republicans can hammer a tax reform deal quickly, while the British pound fell on growing doubts over Prime Minister Theresa May’s leadership. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.15 percent while Tokyo's benchmark Nikkei .N225 dropped 0.7 percent. By Friday’s close on Wall Street, the S&P 500 index had snapped an eight-week winning streak as investors took profits after U.S. Senate Republicans had unveiled a new tax plan that differed from the House of Representatives’ version. There are few signs of a compromise yet, with the head of the House of Representatives’ tax-writing committee opposing a proposal from Senate Republicans that would hike taxes for some middle class Americans.

Oil tankers association put off strike call for Nov he Oil and Gas Regulatory Authority (OGRA) on Friday notified up to 64 per cent increase in freight rates for the movement of oil products by oil tankers. In a notification sent to the Oil Companies Advisory Council (OCAC), the regulator said it had revised uniform freight (road) slab rates with effect from Nov 1 and desired its implementation. The increase will stay in effect for next two years. Although an agreement in this regard was finalized by the Petroleum Division, OGRA and All Pakistan Oil Tanker Owners Association (APOTA) and Oil Tankers Contractor Association (OTCA) on Oct 25, but the regulator took time in notifying revised rates.

Pakistan is set to enhance its import of LNG for power plants established in Punjab from December 28.The country is currently importing 600 million cubic feet per day (mmcfd) from its only LNG terminal located at Port Qasim. However, it would start importing another 600 mmcfd from another LNG terminal expected to be operational by December 28, an official said, adding that the total volume of LNG supply would reach 1.2 bcfd.

A leading Chinese company has drastically slowed down work on the $2 billion 660kV high-voltage direct current (HVDC) transmission line from Lahore to Matiari due to various problems, including differences with the government over size of a revolving fund. For its part, the government has decided not to enter into an agreement over another HVDC transmission line of 660kV (between Port Qasim and Faisalabad) with the company till the completion of the first line (between Lahore and Matiari), according to sources.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

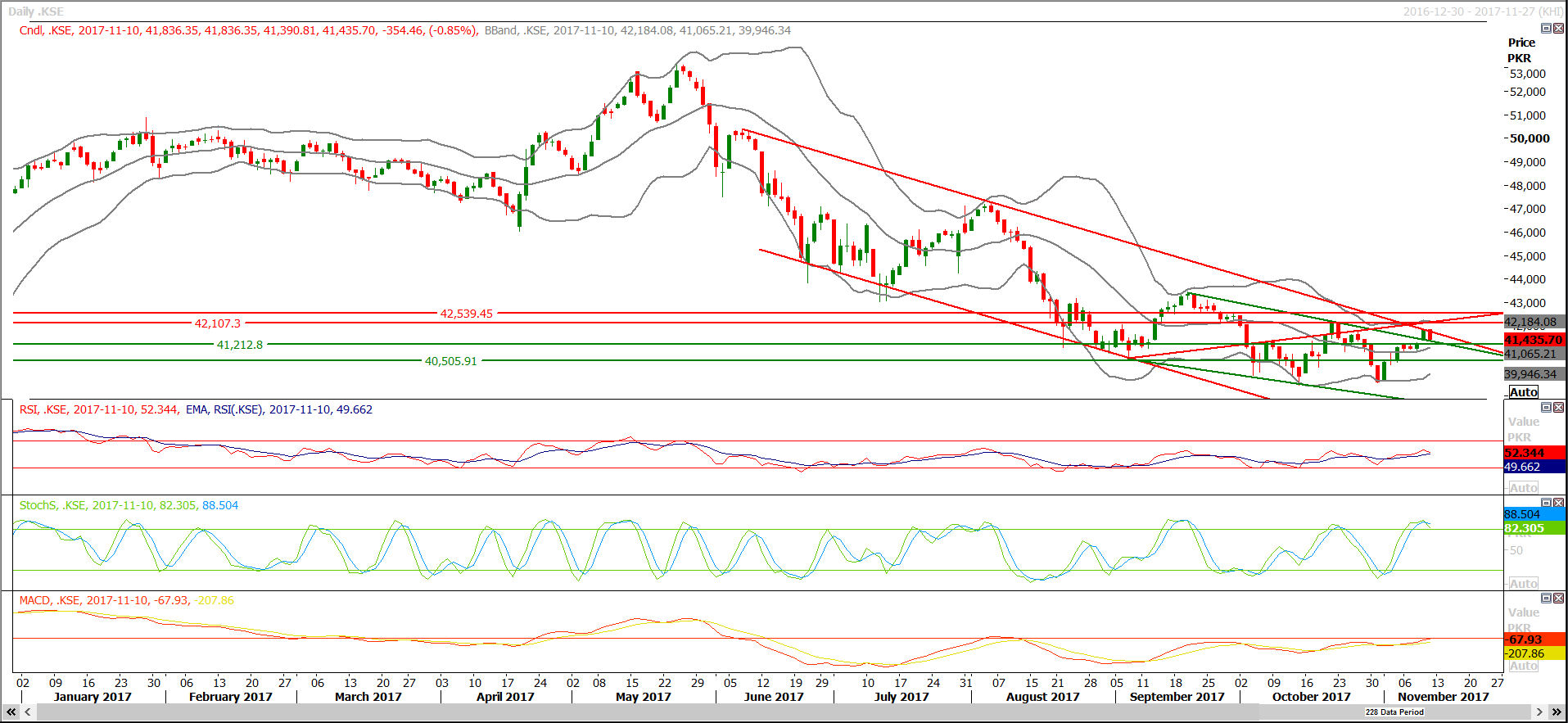

The Benchmark KSE100 Index has formatted a double top on the daily chart after getting resistance from resistant trend line of bearish trend channel, as of right now index has support at 41200 from its previous resistant region along with a major support at 40900 while resistant regions are standing at 41860 and 42200. Daily Stochastic has generated a bearish crossover which may try to ride index in bearish direction if closed below 41200. Breakout of 40900 might change market direction for a short term which leads index towards 40500 and 39600 in coming days therefore a cautious trading strategy is recommended for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.