Previous Session Recap

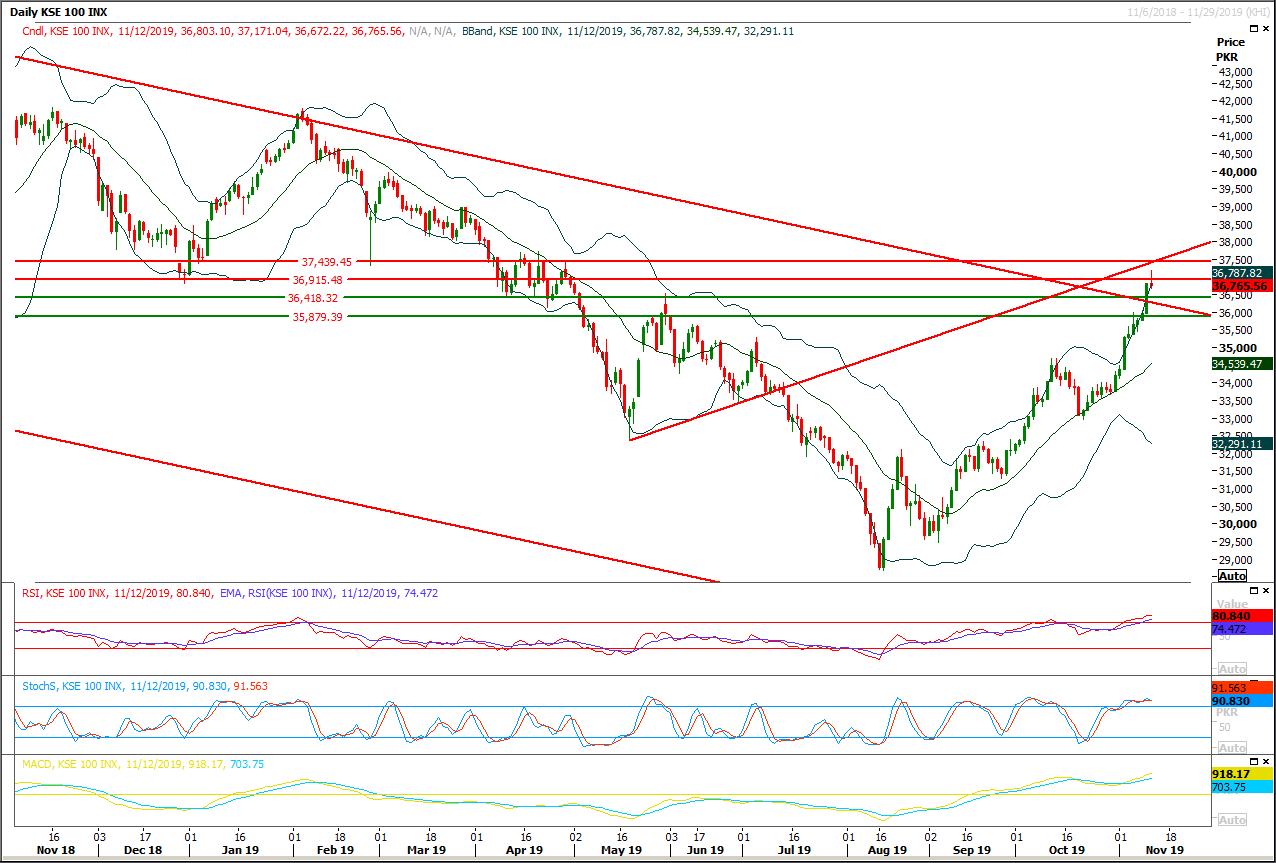

Trading volume at PSX floor increased by 9.12 million shares or 3.22% on DoD basis, whereas the benchmark KSE100 index opened at 36,803.10, posted a day high of 37,171.04 and a day low of 36,672.22 points during last trading session while session suspended at 36,765.56 points with net change of -34.54 points and net trading volume of 189.21 million shares. Daily trading volume of KSE100 listed companies increased by 7.25 million shares or 3.98% on DoD basis.

Foreign Investors remained in net selling positions of 4.81 million shares but net value of Foreign Inflow increased by 1.22 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.14 and 6.57 million shares but Overseas Pakistanis remained in net long positions of 1.9 million shares. While on the other side Local Individuals and Companies remained in net long positions of 18.16 and 5.66 million shares but Local Banks, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 5.69, 5.59, 6.03 and 0.57 million shares respectively.

Analytical Review

Asian shares slide on trade disappointment, HK unrest

Asian stocks and Wall Street futures fell on Wednesday, as growing worries that U.S.-China trade talks are stalling and concern about intensifying unrest in Hong Kong hurt demand for risky assets. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.01% to the lowest in more than a week. Hong Kong shares .HSI slumped 1.8% to a two-week low, battered by fears that anti-government protests appear to be spiraling out of control. The dollar drifted in Asia after U.S. President Donald Trump said a trade deal was “close” but gave no new details on when or where an agreement would be signed, disappointing investors in what was billed as a major speech on his administration’s economic policies.

SBP allows $10,000 advance payment for raw material imports

The State Bank of Pakistan (SBP) on Tuesday allowed advance payments of up to $10,000 or equivalent per invoice on behalf of manufacturing concerns for import of raw material and spare parts for their own use only. Speaking at a press briefing on Tuesday, SBP Governor Dr Reza Baqir said important decisions have been taken to improve economy particularly following the exchange rate stability and ease of doing business improvements.

Car sales dip by 44pc

Overall car sales plunged 44 per cent to 40,586 units in July-October 2019, from 72,563 units in the same period last year. Meanwhile, Honda Atlas Cars Pakistan Ltd (HACPL) has planned to work only seven days in November due to depressed demand and unsold stocks. After witnessing a 70 per cent fall in Honda Civic and City sales during 4MFY20 to 4,961 units, sources in HACPL said the company still has unsold stocks of 2,400 units, thus signalling another struggling month for the Japanese assembler.

CDNS achieves net target of Rs20 billion

The Central Directorate of National Savings (CDNS) has collected a net target of Rs20 billion by November 8, of fiscal year 2019-20. The CDNS has set Rs350 billion annual net target for the year 2019-20 as compared to Rs324 billion for the previous year’s 2018-19 to enhance savings and promoting saving culture in the country, senior official of CDNS told APP here on Tuesday. The Directorate has also revised and increased the gross target of Rs1570 billion for fiscal year 2019-20, he said. Replying to a question, he said that CDNS had collected Rs410 billion by June 30, 2019 exceeding the target of Rs324 billion set for the year while during the preceding year of 2017-18, CDNS collected Rs155 billion. The total savings held by the CDNS stood at Rs1,150 billion by June 30, while the directorate had Rs774 billion savings by the same date, a year ago, he said.

No plan to revise budget deficit target upwards

The federal government has no plan to upward revise the budget deficit target for the current fiscal year despite projecting massive shortfall in tax collection as it would depend on non-tax revenue including telecom licenses renewal fee and privatisation of LNG based power plants. The Federal Board of Revenue (FBR) is facing massive shortfall of Rs165 billion in tax collection during four months (July to October) of the ongoing fiscal year. The FBR had collected Rs1.28 trillion in four months of the year 2019-20 against the target of Rs1.447 trillion. The ministry of finance and FBR had projected the tax collection shortfall to reach Rs300 billion by the end of current fiscal year. The government had set challenging tax collection target of Rs5550 billion for the year 2019-20.

Asian stocks and Wall Street futures fell on Wednesday, as growing worries that U.S.-China trade talks are stalling and concern about intensifying unrest in Hong Kong hurt demand for risky assets. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.01% to the lowest in more than a week. Hong Kong shares .HSI slumped 1.8% to a two-week low, battered by fears that anti-government protests appear to be spiraling out of control. The dollar drifted in Asia after U.S. President Donald Trump said a trade deal was “close” but gave no new details on when or where an agreement would be signed, disappointing investors in what was billed as a major speech on his administration’s economic policies.

The State Bank of Pakistan (SBP) on Tuesday allowed advance payments of up to $10,000 or equivalent per invoice on behalf of manufacturing concerns for import of raw material and spare parts for their own use only. Speaking at a press briefing on Tuesday, SBP Governor Dr Reza Baqir said important decisions have been taken to improve economy particularly following the exchange rate stability and ease of doing business improvements.

Overall car sales plunged 44 per cent to 40,586 units in July-October 2019, from 72,563 units in the same period last year. Meanwhile, Honda Atlas Cars Pakistan Ltd (HACPL) has planned to work only seven days in November due to depressed demand and unsold stocks. After witnessing a 70 per cent fall in Honda Civic and City sales during 4MFY20 to 4,961 units, sources in HACPL said the company still has unsold stocks of 2,400 units, thus signalling another struggling month for the Japanese assembler.

The Central Directorate of National Savings (CDNS) has collected a net target of Rs20 billion by November 8, of fiscal year 2019-20. The CDNS has set Rs350 billion annual net target for the year 2019-20 as compared to Rs324 billion for the previous year’s 2018-19 to enhance savings and promoting saving culture in the country, senior official of CDNS told APP here on Tuesday. The Directorate has also revised and increased the gross target of Rs1570 billion for fiscal year 2019-20, he said. Replying to a question, he said that CDNS had collected Rs410 billion by June 30, 2019 exceeding the target of Rs324 billion set for the year while during the preceding year of 2017-18, CDNS collected Rs155 billion. The total savings held by the CDNS stood at Rs1,150 billion by June 30, while the directorate had Rs774 billion savings by the same date, a year ago, he said.

The federal government has no plan to upward revise the budget deficit target for the current fiscal year despite projecting massive shortfall in tax collection as it would depend on non-tax revenue including telecom licenses renewal fee and privatisation of LNG based power plants. The Federal Board of Revenue (FBR) is facing massive shortfall of Rs165 billion in tax collection during four months (July to October) of the ongoing fiscal year. The FBR had collected Rs1.28 trillion in four months of the year 2019-20 against the target of Rs1.447 trillion. The ministry of finance and FBR had projected the tax collection shortfall to reach Rs300 billion by the end of current fiscal year. The government had set challenging tax collection target of Rs5550 billion for the year 2019-20.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index had formatted a hammer on daily chart during last trading session after getting resistance from a horizontal resistant region and now it's now expected that index would face some pressure from 36,915 points and 37,200 points. While on flip side supportive regions are standing at 36,500 and 36,200 points. It's expected that index would close on a negative note and if it would succeed in sliding below 36,500 points on day end then a daily evening shooting star would take place on daily chart which would push index in bearish zone for short term. It's recommended to start selling on strength and short positions with strict stop loss of 37,800 points could be beneficial because on this region index would face strong resistances on monthly chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.