Previous Session Recap

Trading volume at PSX floor increased by 8.43 million shares or 6.51%,DoD basis, whereas, the benchmark KSE100 Index opened at 40558.74, posted a day high of 40791.91 and a day low of 39834.10 during the last trading session. The session suspended at 40237.53 with a net change of -266.15 points and a net trading volume of 62.7 million shares. Daily trading volume of KSE100 listed companies increased by 9.95 million shares or 18.86%,DoD basis.

Foreign Investors remained in a net buying position of 10.64 million shares and net value of Foreign Inflow increased by 4.98 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net selling positions of 0.1 and 1.67 million shares but Foreign Corporate investors remained in a net selling position of 12.41 million shares. While on the other side Local Individuals, NBFCs and Mutual Funds remained in net selling positions of 7.57, 0.35 and 11.65 million shares respectively but Local Companies, Banks, Borkers and Insurance companies remained in net buying positions of 0.92, 2.23, 1.8 and 3.23 million shares respectively.

Analytical Review

Asian stocks held firm near a 10-year high on Friday thanks to expectations of brisk global growth, although investors held off chasing the shares higher ahead of U.S. and Chinese economic data as well as the Chinese Communist Party congress next week. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.1 percent, having gained 3.4 percent so far this month. Japan's Nikkei .N225 was little changed. Wall Street shares dipped slightly on Thursday, pulled down by a fall in AT&T (T.N) after the telecoms company reported subscriber losses in its cable TV business. But MSCI’s .MIWD00000PUS broadest gauge of the world stocks exchanges covering 47 markets hit another record high, extending its gains so far this year to 17 percent.

During a meeting presided over by Prime Minister Shahid Khaqan Abbasi, the Cabinet Committee on Energy decided on Thursday to import additional electricity from Iran, and directed the power ministry to take up the matter on a priority basis. The meeting was told by the Ministry of Power that the government of Iran was interested in increasing the export of electricity to Pakistan by 100 megawatts (MW). The neighbouring country is currently providing 100MW of electricity for which the supply contract is renewed annually.

All Pakistan Textiles Mills Association (Aptma) on Thursday called for implementing the “Prime Minister Export Enhancement Package” in its true letter and spirit besides making steps for ensuring ease of doing business in order to make Pakistan’s exports competitive in the international markets. While addressing a press conference, APTMA Chairman Aamir Fayyaz Sheikh flanked by APTMA Punjab Chairman Ali Pervaiz also called upon the government for ensuring uninterrupted energy supply to the textile sector in order to attain competitiveness besides enhancing exports for the socio-economic development of the country.

MOL Group and Mari Petroleum Company Ltd (MPCL) on Thursday announced a strategic cooperation initiative for evaluating future potential business opportunities in the local, international upstream exploration and production sector. An MoU was inked between MOL Group and MPCL in this regard. The MoU was signed by MOL Group Executive Vice President Upstream Dr Berislav Gaso and MPCL MD/CEO Lt Gen (R) Ishfaq Nadeem Ahmad here at MOL Group HQ. Other dignitaries including Graham Balchin, MD/CEO MOL Pakistan; Ali Murtaza Abbas, MOL Group Regional Advisor Middle East, Africa & Pakistan; Aqib Anwer, GM Business Development & Commercial MPCL and TufailA. Khoso, GM Exploration MPCL witnessed the signing ceremony.

The Pakistan International Airlines (PIA) Board of Director (BOD) has expressed dissatisfaction over the business plan presented by the current management in the meeting held on Thursday. The meeting was chaired by PIA Chairman Irfan Elahi and PIA CEO Musharraf Rasool Cyan presented business plan before the board meeting. Sources privy to development said that the PIA CEO presented business plan in board meeting wherein airline was supposed to purchase five new B-787 planes. But the BOD members termed the plan sketchy and narrative and directed the management to put more efforts to make the plan comprehensive. In the business plan a growth rate of 7-8 percent has been shown. At the same time it was proposed that PIA should get rid of 777’s and replace them by 787 and A350s as 777s are too big. The CEO was not able to explain that on one hand you are showing growth rate of 8 percent and on the other hand you are proposing smaller aircrafts. This is contradictory.

Today ATRL, NML, POL and SNGP may lead the market in the positive direction.

Technical Analysis

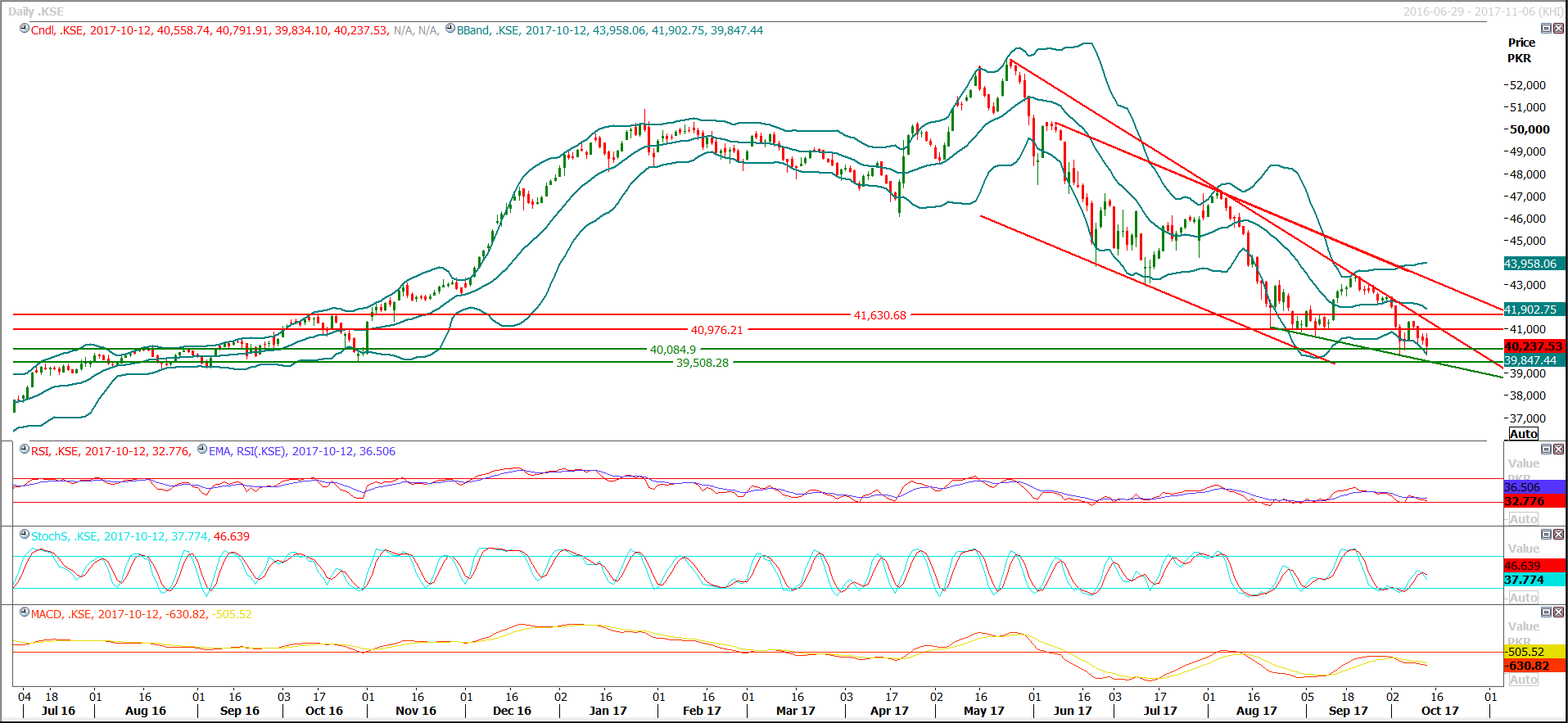

The Benchmark KSE100 Index has tried to format a double bottom on the daily chart but Stochastic and MAORSI are trying to generate a bearish crossover on daily chart while these have converted in to bearish mode on hourly chart, which indicates some sort of uncertainty and would try to add pressure on index. Right now index might move for a serious dip after breakout of 40080 towards 39860 and 39770. For the current trading session index has supports at 40080 and 39772 while resistant regions are standing at 40970 and 41200. For the current trading session a cautious trading strategy is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.