Previous Session Recap

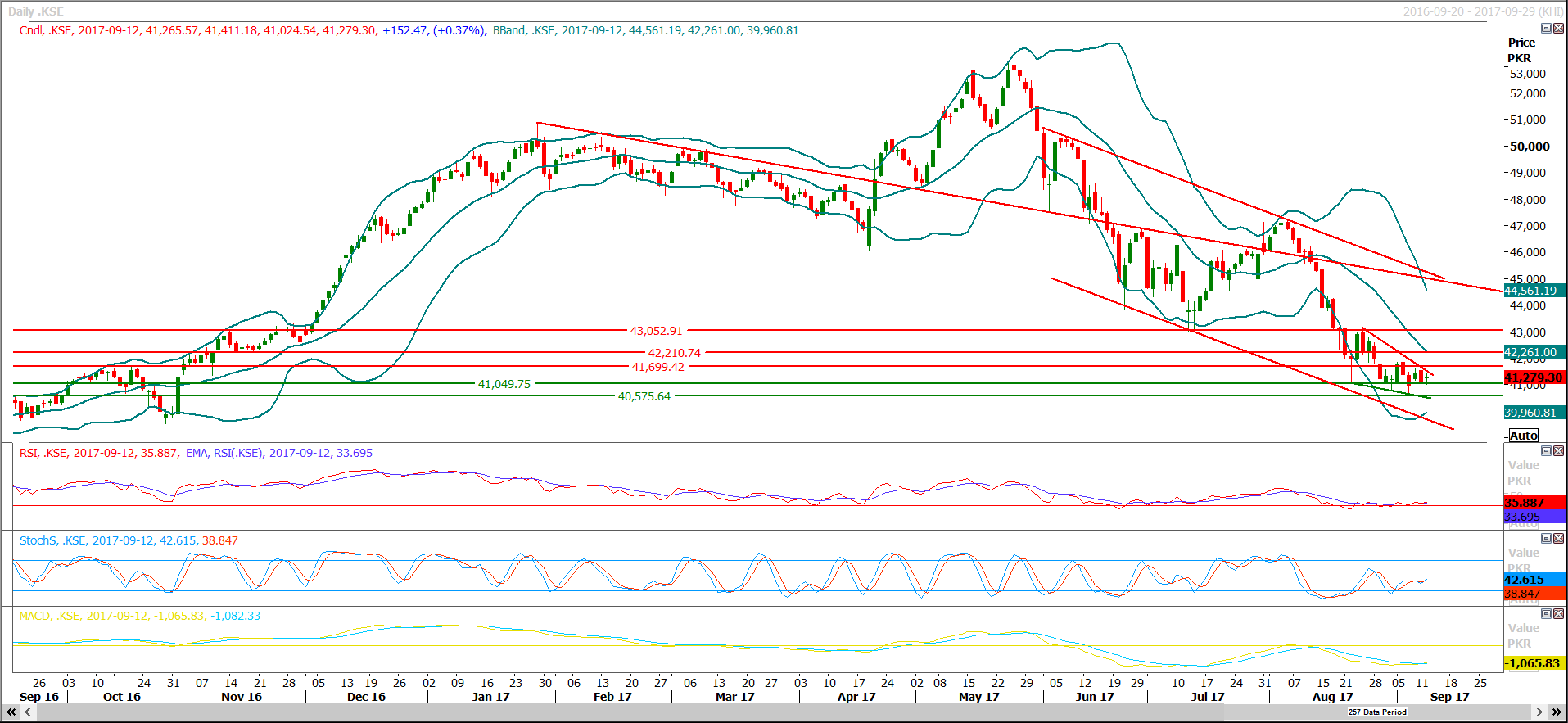

Trading volume at PSX floor increased by 4.73 million shares or 4.98%,DoD basis, whereas, the benchmark KSE100 Index opened at 41265.57, posted a day high of 41411.18 and a day low of 41024.54 during the last trading session. The session suspended at 41279.30 with a net change of 152.47(0.37%) points and a net trading volume of 57.22 million shares. Daily trading volume of KSE100 listed companies increased by 6.84 million shares or 13.58%, DoD basis.

Foreign Investors remained in net buying position of 2.75 million shares and a net value of Foreign Inflow increased by 3.82 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net buying positions of 1.82 and 0.96 million shares. While on the other side Local Individuals, Companies, Banks and Mutual Funds remained in net selling position of 3.14, 3.92, 0.42 and 5.71 million shares respectively but Brokers and Insurance Companies remained in net buying positions of 9.34 and 1.05 million shares. Foreign Investors have added 1.73 million shares to their portfolio on Month till date basis but they have offloaded 856.32 million shares from their portfolio on Year till date basis.

Analytical Review

Asian shares inched up to a 10-year high on Wednesday, cheered by record highs on Wall Street, while the dollar’s rise against the yen helped boost Japanese shares. The S&P 500 .SPX, Dow Jones industrials .DJI and Nasdaq Composite .IXIC all marked record finishes as investors' concerns faded about North Korean tensions as well as the impact of Hurricane Irma.[.N] Gains were kept in check, however, by a decline in shares of Apple Inc (AAPL.O) after it unveiled its newest line of iPhones. Apple fell 0.6 percent but pared some losses in afterhours trade. The new iPhone’s sales will have repercussions beyond Apple for many suppliers as well as its rivals. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was slightly higher in early trade, while Japan's Nikkei stock index .N225 added 0.4 percent to a one-month high, getting a tailwind from a weaker yen. “The Nikkei is not rising on fundamentals at the moment, but rather on supply and demand moves, as the weaker yen prompts investors to cover short positions” that they took during recent bouts of risk aversion, said Yutaka Miura, a senior technical analyst at Mizuho Securities.

Pakistan’s top two bike assemblers in August broke all earlier production and sales records. Atlas Honda Limited (AHL) sold a total of 187,249 bikes in July-Aug 2017-18 as against 136,890 and 136,476 units in 2016-17. Production and sales in Aug 2017 stood at 95,200 and 91,599 units while in May 2017 the figures were 90,800 and 93,060 units. United Auto Motorcycle (UAM) production and sales hit 35,555 and 36,084 units in Aug 2017, compared to its earlier record of 32,773 units each in Nov 2016. UAM overall sales in July-Aug 2017 reached 67,023 units as compared to 49,464 units same period 2016-17.

Five former senior officials of National Bank of Pakistan (NBP) and two corporate chiefs are in the crosshairs of the National Accountability Bureau (NAB) for allegedly engaging in a fraud to the tune of Rs10.4 billion. The accused include Azgard Nine Ltd CEO Abid Humayun Shaikh and CFO Abid Amin. The company is a Lahore-based textile concern. The accused also include NBP’s former president Abid Brohi and former chief operating officer Qamar Hussain. In addition, NBP’s former group chief for corporate and investment banking Nadeem Anwer Ilyas and former SEVPs Nausherwan Adil and Rafiq Bengali are also among the accused. NAB filed a reference before an accountability court in Karachi against these officials alleging that they engaged in a “debt swap and master restructuring of loans” schemes on fraudulent grounds. The reference alleges that when Azgard Nine was “under obligation to repay a sum of around Rs40bn to 63 different financial institutions, including Rs3.41bn to NBP”, the seven accused “in connivance with each other, devised a plan to settle the debt of 22 financial institutions amounting to Rs10.5bn, including Rs3.41bn of NBP, and entered in debt swap and master restructuring of loans.”

Independent consultants have found the proposed unbundling of SSGC and SNGPL to negatively affect equity value, make the gas distribution companies unviable and increase financial pressure on the government and the consumers. “Our findings are in line with World Bank’s presentation shared with us, which highlight the risk that unbundling of the gas distribution business could create companies which are not viable”, a senior official at the Petroleum Division quoted a final report of the KPMG Taseer Hadi & Co. The KPMG was hired by the Sui Northern Gas Company Limited (SNGPL) on the advice of the federal government to analyse four options for unbundling of the two utilities as part of larger gas sector reforms.

As per the corrected figures of PBS, exports recorded growth of 12.89 per cent to $1.87bn in August against $1.65bn a year ago. In the first two months of 2017-18, exports grew 11.8pc to $3.49bn against $3.13bn over the corresponding months of 2016-17. On the other hand, imports recorded growth of 24.85pc to $9.79bn in July-August against $7.84bn a year ago. Imports increased 15.08pc to $4.95bn in August against $4.3bn in the corresponding month of the last fiscal year. The trade deficit in the first two months widened 33.52pc to $6.29bn against $4.72bn a year ago.

Today Automobile Sector, ATRL and EPCL may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index is caged in a bearish wedge on the daily chart and right now it is being caped by the resistant trend line of the said wedge. Daily Stochastic and MAORSI are trying to generate a bullish crossover which might push the index in the positive direction if accomplished. As of now index have resistances ahead at 41400 and 41700 from a resistant trend line along with horizontal resistant region, whereas supportive regions are standing around 40500. Selling on strength is recommended until index closes above 42200.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.