Previous Session Recap

The Bench Mark KSE100 Index Opened with a gap of 408.63 points at 45795.86, posted day high of 46126.21 and day low of 45735.80 during last trading session. The session suspended at 45857.89 points with net change of 470.66 points and net trading volume of 193.87 million shares. Daily Trading volume of KSE100 listed companies dropped by 1.39 million shares or 0.71% on DOD bases.

Foreign Investors remained in net selling position of 11.49 milion shares and net value of Foreign Inflow dropped by 22.45 million US Dollars. Categorically Foreign Individuals and Overseas Pakistani Investors remained in net buying position of 0.014 and 0.32 million shares respectively but Foreign Corporate Investors remained in net selling position of 11.82 million shares. While on the other side Local Individuals, Banks, Mutual Funds and Brokers remained in net buying posiiton of 7.7, 1.45, 5.19 and 3.37 million shares respectively but Local Companies remained in net selling position of 3.09 million shares during last trading session.

Analytical Review

Asia shares crept cautiously higher on Wednesday while a hush settled on the U.S. dollar as investors felt certain the Federal Reserve would raise rates for the first time in a year, but were less sure what it might herald for 2017. Australia led the early going with gains of 0.7 percent and MSCI broadest index of Asia-Pacific shares outside Japan nudged up 0.2 percent. Japanese Nikkei went the other way, easing 0.1 percent with moves across the region modest at best. The outcome of the Fed policy meeting will be announced at 1900 GMT, followed by news conference of Chair Janet Yellen half an hour later. A quarter point move is fully priced in, as are two more hikes next year. Any hint the Fed may move faster than that would likely send the dollar higher and hurt emerging markets.

The federal government has decided to enter into a new Gas Pricing Agreement (GPA) with Pakistan Petroleum Limited (PPL) from June 1, 2015 for extension in mining lease on the insistence of the government of Balochistan. Official sources told Business Recorder that both the federal and provincial governments have agreed to indexation of Sui wellhead gas price at 55 percent from existing 50 percent of 2012 policy price with lease extension bonus at 10 percent of the wellhead value.

Packages Limited has announced to incorporate Packages Power as its wholly owned subsidiary for the purpose of setting up a 3.1MW hydropower project as advertised by the Punjab Power Development Board. Accordingly, an initial equity of Rs 25 million divided into 2.5 million shares of Rs 10.00 each has been made by Packages Limited into Packages Power (Private) Limited on Tuesday, the company said in material information sent to Pakistan Stock Exchange.

The trade deficit in merchandise rose nearly 20 per cent year-on-year to $11.775 billion in the first five months of the current fiscal year because of falling exports and increase in imports. The deficit stood at $2.493bn in November, a rise of 14.3pc compared to $2.181bn a year ago, the Pakistan Bureau of Statistics said on Tuesday. The drop, along with fall in remittances, has contributed to the rising current account deficit in the first four months of the current fiscal year.

The Asian Development Bank has downgraded economic growth in developing Asia to 5.6 per cent in 2016, below its previous projection of 5.7pc. However, for 2017, growth remains unchanged at 5.7pc. In a supplement to its Asian Development Outlook, ADB maintained that GDP growth in Pakistan is expected to be on track during the fiscal year ending June 2017, driven mainly by the service sector. In the previous Outlook published in March, the ADB forecast said that GDP growth in Pakistan was expected to accelerate modestly to 4.5pc in fiscal year 2016 and 4.8pc in fiscal year 2017.

ASTL, PKGS, SEARL, PPL and MTL can lead market in positive direction.

Technical Analysis

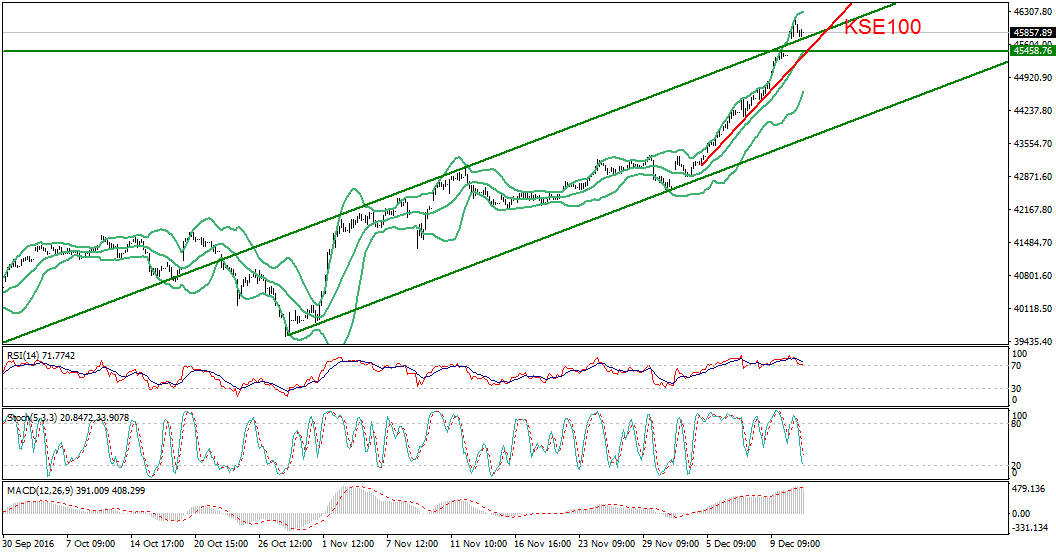

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction with a gap of around 408 points. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 45460 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as it can try to fulfil its Gap but overall intraday sentiment from technical side is positive. Stochastic is trying to generate a bullish crossover which can push index in further upward direction. But market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.