Previous Session Recap

The Benchmark KSE100 Index opened at 50032.44 with a positive gap of 131 points, posted day high of 50322.55 and day low of 49834.69 during last trading session. The session suspended at 49965.63 with net change of 40.55 points and net trading volume of 143.01 million shares. Daily trading volume of KSE100 listed companies increased by 5.7 million shares or 4.15% on DOD bases.

Foreign Investors remained in net buying position of 0.35 million shares and net value of Foreign Inflow increased by 2.73 million shares. Categorically Foreign Individual and Corporate Investors remained in net buying position of 8093 shares and 1.39 million shares respectively but Overseas Pakistanis remained in net selling position of 1.04 million shares. While on the other side Local Individuals, Banks, NBFCs,Mutual Funds and Brokers remained in net selling position of 0.63, 4.51, 1.2 , 0.62 and 5.18 million shares respectively but Local Companies remained in net buying position of 2.63 million shares.

Analytical Review

Asian shares inched to 19-month highs on Tuesday as the potential for economic stimulus in the United States lifted the dollar, bond yields and Wall Street stocks. The dollar was also bolstered by speculation the head of the Federal Reserve would underline the prospects of more U.S. rate hikes when she testifies to Congress later on Tuesday. Helping sentiment was data showing consumer and producer prices were rising in China and thus reducing the danger of deflation across the globe. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.1 percent, trying for its fifth straight session of gains. Japanese Nikkei .N225 eased 0.1 percent as it struggled with stiff chart resistance that has held since mid-December. Stocks in Shanghai .SSEC were barely changed, but Australia managed a 0.4 percent gain. Wall Street indexes had hit historic peaks on Monday, with the benchmark S&P 500 market value topping $20 trillion as investors bet tax cuts promised by President Donald Trump would boost the economy.

The recent reforms and strengthening of regulatory framework by the SECP have pushed up the modaraba sector asset base to Rs41 billion by end of December 2016. The increase in the assets indicates a growth of 11.41 percent from the June 2016, when the total assets of the modaraba sector were recorded at Rs36.8 billion. Listed Islamic banks have 25,000 shareholders, whereas modaraba sector has around 80,000 investors. The growth in the sector was due to low level of leverage, healthy dividend payouts and other tax incentives available to sector. As a result of recent reforms by the SECP, the sector has managed to shake off its lackluster image and moved to the forefront of the non-banking financial institution (NBFI) segment, experts said at a workshop on the modaraba sector held at the SECP head office.

The Economic Coordination Committee of the Cabinet (ECC) on Monday approved a proposal from the Ministry of Water and Power for issuance of Sovereign Guarantee in respect of syndicated term finance facility for the power sector. Federal Minister for Finance Mohammad Ishaq Dar chaired the meeting of the Economic Coordination Committee of the Cabinet (ECC). The meeting had a detailed discussion on the proposal by the Ministry of Industries and Production for release of Rs1035.202 million to the Utility Stores Corporation (USC) on account of maintaining subsidised prices of 11 essential items. The chair with consensus of the House deferred the matter of release of funds and ordered a special audit of the sale-purchase prices of certain items within 15 days to determine the need for release of the amount of subsidy.

More than 90 percent of the leather industry is unable to avail the Prime Minister incentive package of Rs180 billion announced recently for the export-oriented industries, as the Commerce Ministry has ignored all major finished leather products HS Codes in its notification. Industry sources said that the second biggest export-oriented industry of the country was still deprived of the PM export fund due to sheer negligence of the ministry, which failed to include the export-related HS Codes of finished and tanned leather in the related SRO 62(I)/2017 issued on Feb 2, 2017 despite detailed information provided by the industry.

Iran is ready to increase electricity supply to Pakistan from the existing over 100 megawatts to 3,000 megawatts, said Iranian Consul General Ahmad Mohammadi. According to Radio Tehran, he expressed these words while speaking at the Iranian Consulate General at an event held to mark the 38th anniversary of the Islamic Revolution. The consul general was of the view that Iran-Pakistan (IP) gas pipeline is the least expensive, most secure and profitable source of energy for Pakistan. It is a turning point for ties between the two countries and both are determined to complete it at the earliest, he said.

Market is expected to remain volatile. Traders are advised to take profit on higher levels and buy on dips.

Technical Analysis

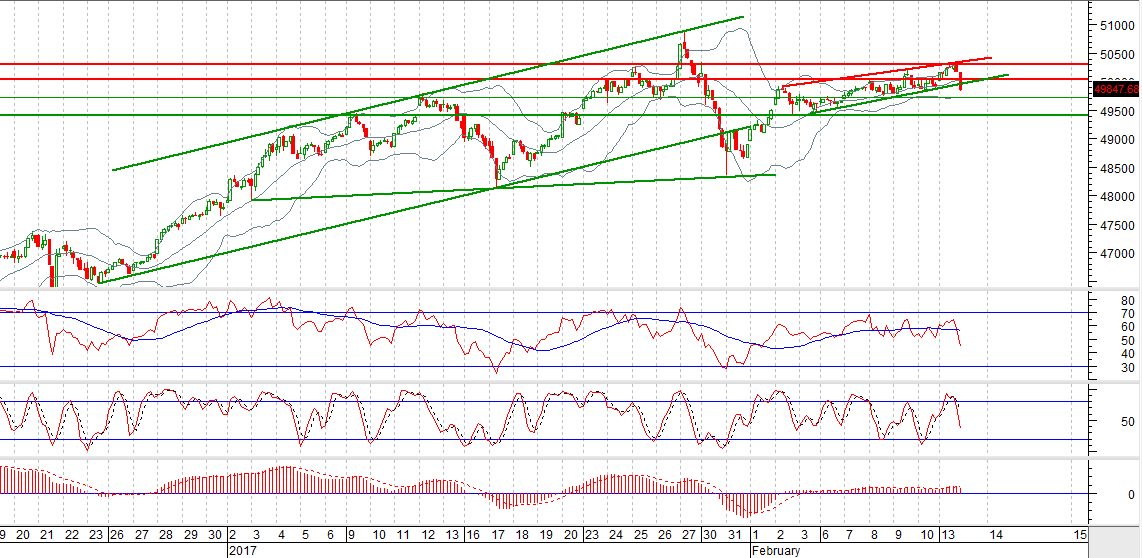

The Benchmark KSE100 Index is caged in an upward price wedge on hourly chart and it is also capped by a resistant horizontal line at 76.4% correction level of its last bearish rally It have tried to penetrate its wedge in downward direction but average closing pull it back in said wedge. Breakout of this wedge could push index for further 1000-1500 points on either side. On hourly and daily chart bullish momentum seems expiring but a gap opening above 49960 could pump some fresh breeze in index to move upward. To start a new bullish rally Index needs to close above 50255 and 50306, if index closes below 49700 then next supportive region would be 49426 and breakout of that region would call for a new bearish trend. A caution call is generated for current trading session so trading with strict stop loss is recommended until Index closes above 50306 or below 49426.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.