Previous Session Recap

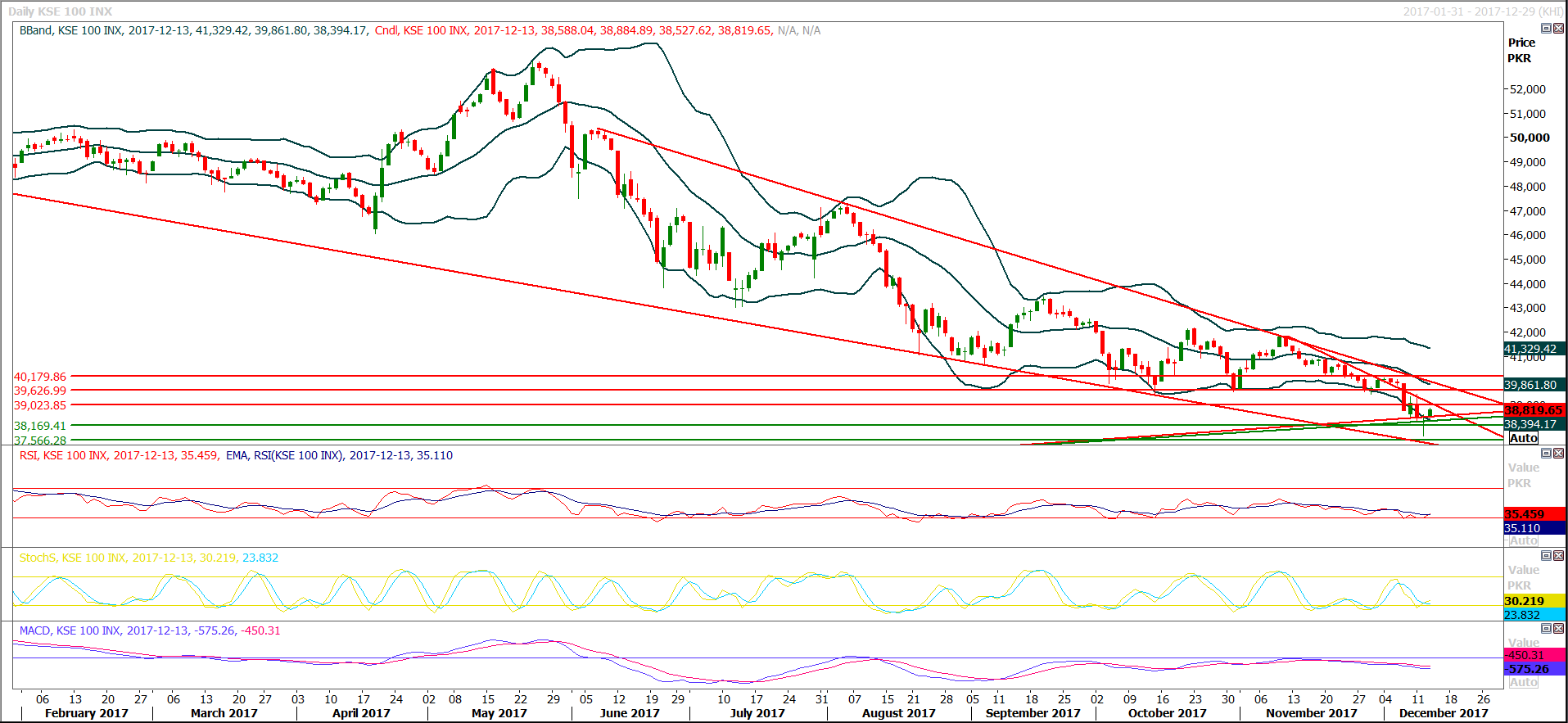

Trading volume at PSX floor dropped by 77.78 million shares or 39.79% on DoD basis, whereas, the benchmark KSE100 Index opened at 38588.04, posted a day high of 38884.89 and a day low of 38527.62 during last trading session. The session suspended at 38819.65 with net change of 294.54 and net trading volume of 70.08 million shares. Daily trading volume of KSE100 listed companies dropped by 37.66 million shares or 34.95% on DoD basis.

Foreign Investors remained in net selling position of 13.72 million shares and net value of Foreign Inflow dropped by 2.77 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.32, 12.33 and 1.07 million shares respectively. While on the other side Local Individuals, Banks, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 1.85, 0.26, 9.64, 2.86 and 0.5 million shares respectively but Local Companies remained in net selling position of 0.69 million shares.

Analytical Review

Asian stocks edged higher on Thursday after the Federal Reserve delivered a much-anticipated interest rate hike but flagged caution about inflation, tempering expectations for future tightening, which weighed on the dollar and Treasury yields. China’s central bank also raised rates, though marginally. While Chinese shares were slightly lower, the wider impact was limited. The Fed’s less hawkish statements supported MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS, which rose 0.45 percent. Shanghai shares .SSEC and the Chinese yuan were marginally lower after the Peoples' Bank of China hiked the reverse repo rate by 5 basis points to 2.50 percent and raised the one-year medium-term lending facility (MLF) rate by 5 basis points to 3.25 percent. Australian stocks added 0.1 percent and South Korea's KOSPI .KS11 climbed 0.8 percent.

Following intervention from the State Bank of Pakistan (SBP), the exchange rate gained stability on Wednesday. The rupee has seen 4.7 per cent devaluation in the last four working days. The dollar was traded as high as Rs111 in the interbank market. But it remained mostly around Rs110.25-50, said currency dealers. However, the SBP reported the bid price as Rs110.41 and offer price as Rs110.60, reflecting a level that was higher than the market rate.

Pakistan GasPort, the country’s second liquefied natural gas (LNG) import terminal, plans to try injecting gas back into the facility’s onshore system on Thursday after a leak forced a shutdown last week, two sources said. The newly inaugurated terminal suspended operations last week following a gas leak in the insulation joint linking the facility to the connecting pipeline infrastructure. Since then, three gas leaks in total had been found, delaying repair work at the facility, an industry source said. Pakistan GasPort initially said the terminal would be back in operation on Dec 8.

The government would be under no obligation for any renewable project lacking firm contract by Dec 10 as era of loadshedding ends with surplus generation capacity, said Federal Minister for Power Awais Ahmad Khan Leghari. Speaking at a news conference on Wednesday, the minister castigated critics challenging continuation of power shortages in many parts of the country saying they were only spreading propaganda. “I humbly stated a few days ago that loadshedding has ended. Today, I am 10 times louder with that statement and tomorrow would repeat 20 times louder that there is no more loadshedding,” he said, adding the government would launch within days a computer application that would help everyone anywhere on phone to check supply situation at any feeder.

Pakistan appeared to have been pushed hard by the Chinese side to give in more than it secured in return during the recently held 7th joint cooperation committee (JCC) meeting of the China-Pakistan Economic Corridor (CPEC). This is evident from the minutes of the 7th meeting on a series of issues including revision in the completion deadlines of the energy projects, the Main Line-1 project and early activation of revolving fund in 30 days for payments to Chinese sponsors. The JCC agreed that Pakistan’s agencies in power sector and Chinese project sponsors should sign the supplemental agreements at the earliest and decided that “Pakistani side will address timely payment of electricity charge in power projects under CPEC as soon as possible”.

ENGRO, ISL, NCL and DGKC may lead the market in positive direction

Technical Analysis

The Benchmark KSE100 Index have closed at 61.8% correction of its last bearish rally which was started from 39437 in response of an expansion of previous correction therefore it needs a positive gap opening for further advance move. Gap opening above 38920 would give a clear bullish sign which would help index to cross first resistant of 39023 points. But it needs to be very cautious while trading today as index is standing at an edge and if it would not become able to give a clear breakout of its resistant regions then a bearish rally could be witnessed towards 38389.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.