Previous Session Recap

Trading volume at PSX floor dropped by 61.38 million shares or 42.15% on DOD basis whereas the Benchmark KSE100 index opened at 38,323.80, posted a day high of 38,464.80 and day low of 37.767.00 during last trading session while session suspended at 38,011.60 points with net change of -295.81 points and net trading volume of 57.73 million shares. Daily trading volume of KSE100 listed companies dropped by 49.31 million shares or 46.07% on DOD basis.

Foreign Investors remained in net selling positions of 3.31 million shares and net value of Foreign Inflow dropped by 0.66 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.04 and 0.24 million shares but Foreign Corporate investors remained in net selling positions of 3.59 million shares. While on the other side Local Individuals, Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 3.63, 0.06, 0.34, 0.65 and 2.27 million shares respectively but Banks and Mutual Fund remained in net selling positions of 0.66 and 4.95 million shares.

Analytical Review

Asian shares jolted by weak Chinese data, growth risks

Asian shares tumbled on Friday after China reported a set of weak data, fanning fresh worries of a sharp slowdown in the world’s second-biggest economy and leaving investors fretting over the wider impact of a yet unresolved Sino-U.S. trade dispute. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.4 percent, while Japan’s Nikkei dropped 2.1 percent. Mainland China’s benchmark Shanghai Composite and the blue-chip CSI 300 declined 0.6 percent and 0.9 percent, respectively, and Hong Kong’s Hang Seng tumbled 1.6 percent.

Pakistan, ADB sign $284m loan, grant deals

The Pakistani government and the Asian Development Bank (ADB) on Thursday signed loan and grant agreements worth $284 million to improve Pakistan’s power transmission network. The agreement was signed by ADB Country Director for Pakistan Ms Xiaohong Yang and Secretary of the Economic Affairs Division Mr Noor Ahmed at a ceremony in Islamabad.

Ministry proposes removal of 10pc ST

Ministry of National Food Security and Research has proposed to remove existing 10 per cent Sales Tax (ST) on locally manufactured powdered milk to promote its production. The other proposal is to increase duty on import of dry milk powder to discourage its import. Official sources on Thursday said Pakistan has imported on an average 55,000 tons of powdered milk (skimmed milk powder, whey powder, growing up milk powders/infant formulas) each year. The main reasons of import of powdered milk (skimmed milk powder, whey powder, growing up milk powders/ infant formulas etc.) in Pakistan are low productivity of indigenous dairy animals and rising demand of milk and milk products during lean period (May to September), usage of recipe dairy/ milk formulas/products etc. and high input cost of local milk production encourages import of dry milk powder. The sources said current estimated production of powdered milk is around 67,000 tons annually in the country.

Cheetay.pk raises $3.675m

Cheetay.pk being on the trajectory of growth and expansion has raised a whopping $3.675 million in funding from investors based in the US. The funding has enabled them to establish a logistics base of an entire fleet of riders and dedicated vehicles, over 450 restaurant sand more than 200 employees. Starting with food delivery as the initial business vertical, they have expanded into delivering Books, Health & Beauty products and are on the cusp of launching Cheetay Grocery.

New smartphone brand enters Pakistan

Realme, an emerging smartphone brand of China, has decided to enter real and diversified market of Pakistan, as its launch is expected in next few weeks. The Realme launching in Pakistan is set to target over 60% of Pakistan’s young population with attractive and affordable smartphone range, following exceptional launch success experienced in Indonesia, Malaysia, Philippines, Vietnam and India; besides, capturing a strong market presence in Thailand.

Asian shares tumbled on Friday after China reported a set of weak data, fanning fresh worries of a sharp slowdown in the world’s second-biggest economy and leaving investors fretting over the wider impact of a yet unresolved Sino-U.S. trade dispute. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.4 percent, while Japan’s Nikkei dropped 2.1 percent. Mainland China’s benchmark Shanghai Composite and the blue-chip CSI 300 declined 0.6 percent and 0.9 percent, respectively, and Hong Kong’s Hang Seng tumbled 1.6 percent.

The Pakistani government and the Asian Development Bank (ADB) on Thursday signed loan and grant agreements worth $284 million to improve Pakistan’s power transmission network. The agreement was signed by ADB Country Director for Pakistan Ms Xiaohong Yang and Secretary of the Economic Affairs Division Mr Noor Ahmed at a ceremony in Islamabad.

Ministry of National Food Security and Research has proposed to remove existing 10 per cent Sales Tax (ST) on locally manufactured powdered milk to promote its production. The other proposal is to increase duty on import of dry milk powder to discourage its import. Official sources on Thursday said Pakistan has imported on an average 55,000 tons of powdered milk (skimmed milk powder, whey powder, growing up milk powders/infant formulas) each year. The main reasons of import of powdered milk (skimmed milk powder, whey powder, growing up milk powders/ infant formulas etc.) in Pakistan are low productivity of indigenous dairy animals and rising demand of milk and milk products during lean period (May to September), usage of recipe dairy/ milk formulas/products etc. and high input cost of local milk production encourages import of dry milk powder. The sources said current estimated production of powdered milk is around 67,000 tons annually in the country.

Cheetay.pk being on the trajectory of growth and expansion has raised a whopping $3.675 million in funding from investors based in the US. The funding has enabled them to establish a logistics base of an entire fleet of riders and dedicated vehicles, over 450 restaurant sand more than 200 employees. Starting with food delivery as the initial business vertical, they have expanded into delivering Books, Health & Beauty products and are on the cusp of launching Cheetay Grocery.

Realme, an emerging smartphone brand of China, has decided to enter real and diversified market of Pakistan, as its launch is expected in next few weeks. The Realme launching in Pakistan is set to target over 60% of Pakistan’s young population with attractive and affordable smartphone range, following exceptional launch success experienced in Indonesia, Malaysia, Philippines, Vietnam and India; besides, capturing a strong market presence in Thailand.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

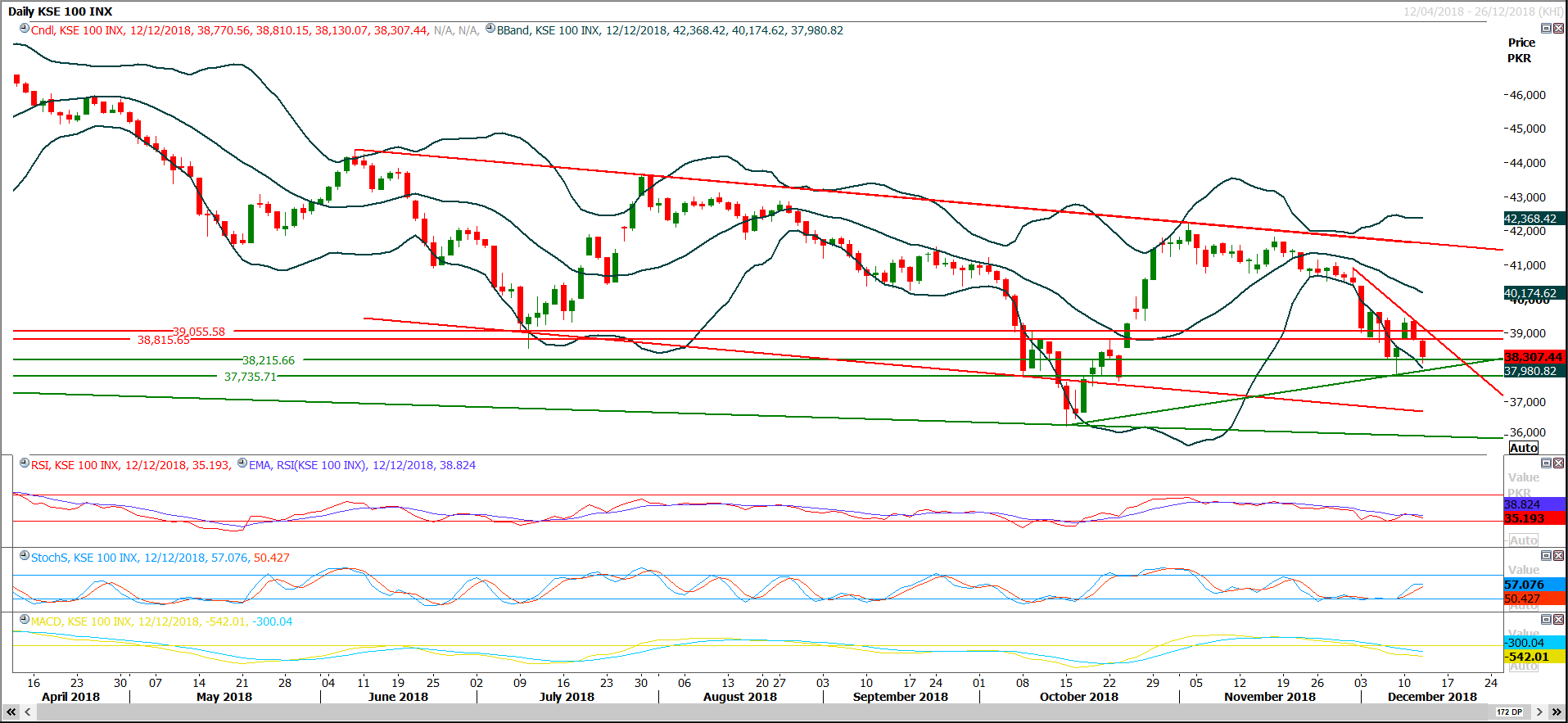

Technical Analysis

The Benchmark KSE100 index has supportive regions ahead at 37,940 and 37,730 points where it’s being supported by a rising trend line along with a horizontal supportive region respectively. Daily momentum indicators are ready to generate bearish crossovers but it’s expected that a pullback may would be witnessed before day end and index would try to recover before breakout of 37,730 points, therefore its recommended to adopt a swing trading strategy during current trading session and start short positions in first half and adopt a cut and reverse strategy in second half of the day. Index seems to remain bearish on short term basis but an intraday pullback would provide some good volumes in market leaders.

PAEL have a strong supportive region at 24.25 and it would try to bounce back towards 26.44 & 26.80 Rs in swing mode. ATRL would try to remain range bounce between 164 & 175 Rs. PSO have strong supportive region ahead at 224-222 Rs region and it would also try to bounce back from that region towards 234 Rs. While TRG would try to find ground between 24.27 till 23.89 Rs region and in case of bounce back it would try to target 25.50 & 26.54.

PAEL have a strong supportive region at 24.25 and it would try to bounce back towards 26.44 & 26.80 Rs in swing mode. ATRL would try to remain range bounce between 164 & 175 Rs. PSO have strong supportive region ahead at 224-222 Rs region and it would also try to bounce back from that region towards 234 Rs. While TRG would try to find ground between 24.27 till 23.89 Rs region and in case of bounce back it would try to target 25.50 & 26.54.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.