Previous Session Recap

Trading volume at PSX floor increased by 11.53 million shares or 10.29% on DoD basis, whereas the benchmark KSE100 index opened at 39,116.30, posted a day high of 39,278.20 and a day low of 38,780.18 points during last trading session while session suspended at 39,049.08 with net change of -41.20 points and net trading volume of 91.60 million shares. Daily trading volume of KSE100 listed companies increased by 25.15 million shares or 37.85% on DoD basis.

Foreign Investors remained in net buying positions of 1.13 million shares and net value of Foreign Inflow increased by 1.31 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net selling positions of 0.11 and 0.29 million shares but Foreign Corporate investors remained in net buying positions of 1.54 million shares. While on the other side Local individuals, Banks, Mutual Funds and Insurance Companies remained in net selling positions of 0.09, 1.94, 1.27 and 3.33 million shares but Local Companies, NBFCs and Brokers remained in net buying positions of 1.9, 0.15 and 3.69 million shares respectively.

Analytical Review

Asian shares falter from 1-1/2-month highs, markets wary about China data

Asian shares turned down on Monday as China trade data started trickling in and as investors looked to key corporate earnings later in the week to take the pulse of a cooling global economy. Partial data on trade from China showed dollar-denominated exports growth was the highest since 2011. Markets are still awaiting numbers for December due shortly.

Govt puts major CPEC power project on hold

The Pakistan Tehreek-i-Insaf (PTI) government has decided to shelve a major power project pushed by the Pakistan Muslim League-Nawaz regime under the China-Pakistan Economic Corridor (CPEC) and will axe hundreds of other schemes under the Public Sector Development Programme (PSDP) later this month. Background discussions with government officials suggest that Islamabad has officially conveyed to Beijing that it is no more interested in the 1,320MW Rahim Yar Khan power project in view of sufficient generation capacity already lined up for the next few years. It has requested the Chinese friends to formally delete the project from the CPEC list.

KP govt planning to raise fruit, veg on 18,000 acres

The Khyber Pakthunkhwa Government has embarked on an inclusive plan to raise fruits and vegetables on 18000 acres land in different districts besides establishing central markets to provide these commodities to people at affordable rates. “The plan to raise fruits and vegetables on 18000 acres besides setting up of nine state-of-the art central markets in all seven divisions of KP was developed in PTI Govt’S first 100 days plans and these targets would be achieved during next five years, Murad Ali, Deputy Director, Planning Agriculture Department told APP on Sunday.

Govt terms 10pc hike in remittances positive

Ministry of Finance Spokesperson Dr Khaqan Najeeb has said during the first six month of Pakistan Tehreek-e-Insaf government, there is 10 percent increase in remittances that bring a positive impact to manage the country's pending balance of payments. In a tweet on Finance Ministry's social media account, the spokesperson said, "Govt. continues to strengthen Pakistan's remittance initiative. Double digit growth of 10 percent witnessed during July-Dec18; US$ 10.72 bn vis US$ 9.74 bn remitted July-Dec17. Growth in remittances to continue to stabilize BoP".

Foreigners keen to invest in Pakistan: Economists

Economists on Sunday said foreign investors have shown growing interest to invest in Pakistan due to immense market potential of the country and improved governance. Talking in a Radio Current Affairs programme, Senior Economist Dr. Ashfaq Hassan Khan said Pakistani businessmen could exploit many opportunities globally to increase their exports. China, Qatar and Saudi Arabia have also expressed willingness to invest in Pakistan, he added. He said Pakistan has come out of the critical situation because of the untiring efforts of the Prime Minister Imran Khan.

Asian shares turned down on Monday as China trade data started trickling in and as investors looked to key corporate earnings later in the week to take the pulse of a cooling global economy. Partial data on trade from China showed dollar-denominated exports growth was the highest since 2011. Markets are still awaiting numbers for December due shortly.

The Pakistan Tehreek-i-Insaf (PTI) government has decided to shelve a major power project pushed by the Pakistan Muslim League-Nawaz regime under the China-Pakistan Economic Corridor (CPEC) and will axe hundreds of other schemes under the Public Sector Development Programme (PSDP) later this month. Background discussions with government officials suggest that Islamabad has officially conveyed to Beijing that it is no more interested in the 1,320MW Rahim Yar Khan power project in view of sufficient generation capacity already lined up for the next few years. It has requested the Chinese friends to formally delete the project from the CPEC list.

The Khyber Pakthunkhwa Government has embarked on an inclusive plan to raise fruits and vegetables on 18000 acres land in different districts besides establishing central markets to provide these commodities to people at affordable rates. “The plan to raise fruits and vegetables on 18000 acres besides setting up of nine state-of-the art central markets in all seven divisions of KP was developed in PTI Govt’S first 100 days plans and these targets would be achieved during next five years, Murad Ali, Deputy Director, Planning Agriculture Department told APP on Sunday.

Ministry of Finance Spokesperson Dr Khaqan Najeeb has said during the first six month of Pakistan Tehreek-e-Insaf government, there is 10 percent increase in remittances that bring a positive impact to manage the country's pending balance of payments. In a tweet on Finance Ministry's social media account, the spokesperson said, "Govt. continues to strengthen Pakistan's remittance initiative. Double digit growth of 10 percent witnessed during July-Dec18; US$ 10.72 bn vis US$ 9.74 bn remitted July-Dec17. Growth in remittances to continue to stabilize BoP".

Economists on Sunday said foreign investors have shown growing interest to invest in Pakistan due to immense market potential of the country and improved governance. Talking in a Radio Current Affairs programme, Senior Economist Dr. Ashfaq Hassan Khan said Pakistani businessmen could exploit many opportunities globally to increase their exports. China, Qatar and Saudi Arabia have also expressed willingness to invest in Pakistan, he added. He said Pakistan has come out of the critical situation because of the untiring efforts of the Prime Minister Imran Khan.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

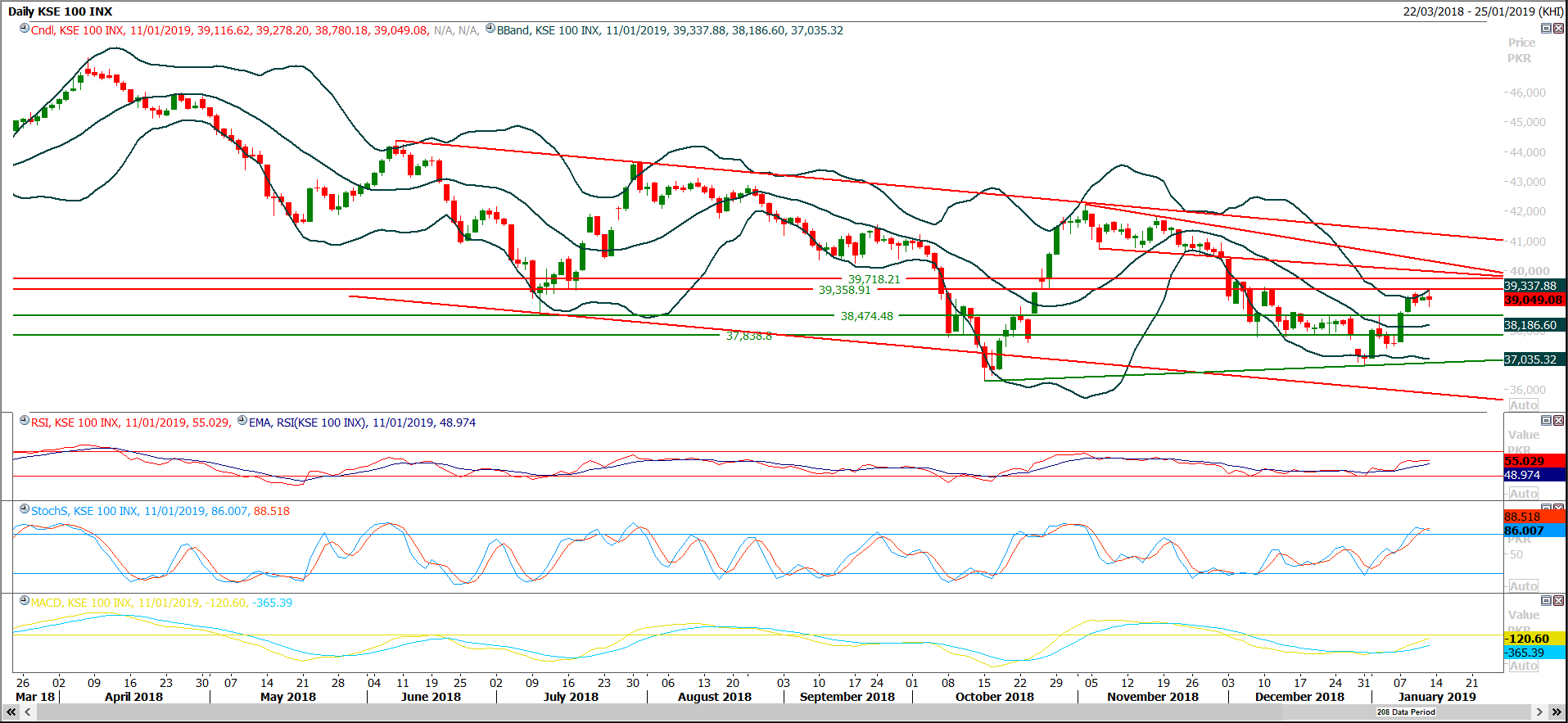

Technical Analysis

The Benchmark KSE100 index have not succeeded in penetration above its major resistant region of 39,360 points during last week but weekly chart have created a morning star which would try to push index in bullish direction if its impact would not be vanished during first two or three days of this week by penetration by below 38,500 points. Index is standing at 50% correction of its last bearish rally and it would remain volatile and range bound until it would succeed in closing above 39,500 points therefore its recommended to stay cautious and trade with strict stop loss until index close below 38,470 or above 39,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.