Previous Session Recap

Trading volume at PSX floor dropped by 25.89 million shares or 18.79% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43,217.20, posted a day high of 43,589.72 and a day low of 43,217.20 during last trading session. The session suspended at 43,507.50 with net change of 278.60 and net trading volume of 72.36 million shares. Daily trading volume of KSE100 listed companies dropped by 14.55 million shares or 16.74% on DoD basis.

Foreign Investors remained in net selling position of 1.05 million shares and net value of Foreign Inflow dropped by 2.81 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.01 and 2.90 million shares but Foreign Corporate investors remained in net selling positions of 3.96 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs and Mutual Fund remained in net buying positions of 4.13, 1.89, 2.19, 0.12 and 0.71 million shares but Brokers and Insurance Companies remained in net selling positions of 3.24, and 4.24 million shares respectively.

Analytical Review

Asian shares down on Fed hike, Sino-U.S. trade anxiety

Asian shares edged down on Thursday after the Federal Reserve raised interest rates and took a more hawkish tone in forecasting a slightly faster pace of tightening for the rest of the year, while concerns about U.S.-China trade frictions kept investors on edge. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.25 percent in early trade. South Korea's KOSPI .KS11 was off 0.9 percent, while Australia's market slipped 0.2 percent. Japan's Nikkei .N225 shed 0.7 percent. The Fed raised its benchmark overnight lending rate a quarter of a percentage point to a range of 1.75 percent to 2 percent, as expected, on the back of strong U.S. economic growth. The markets, however, latched on to a change in Fed policymakers’ rates projections, which pointed to two additional hikes by the end of this year compared to one previously, based on board members’ median forecast.

NTC imposes anti-dumping duty on steel coils import

The National Tariff Commission (NTC) has imposed anti-dumping duty on Chinese and South African origin colour coated steel coils and sheets imports on Wednesday. NTC initiated an anti-dumping investigation last year in June at the behest of an application lodged by International Steels Limited (ISL). The Commission established that the domestic industry producing colour coated steel coils/sheets suffered material injury due to the increase in volume of dumped imports and price undercutting of the domestic like product in the local market leading to low levels of production, capacity utilisation, declining market share, and damaging effects on inventories and growth for domestic manufacturers of the product.

Mills fail to clear dues of sugarcane growers despite SC order

The sugar mills in the country have failed to make full payments to sugarcane growers on the orders of Supreme Court of Pakistan as more than 30 percent payments are still pending for the recently closed crushing year of 2017-18. On April 25, the Supreme Court of Pakistan had ordered owners of sugar mills in Punjab and Sindh to clear dues of sugarcane farmers for the ongoing season within 5 weeks. Though the Pakistan Sugar Mills Association did not respond officially regarding the payment of outstanding dues to the growers on the order of the court but industry sources said that mills are not in position to make the full payments in time, as they are facing severe liquidity crunch due to over production and declining prices of the sugar in global market.

LSM posts 5.76pc growth in 10 months

Large-scale manufacturing (LSM) posted growth of 4.14 percent in April on annual basis. The LSM, which constitutes 80 percent share within manufacturing and 10.7pc in overall GDP, recorded growth of 5.76 percent during ten months (July to April) of the current fiscal year over a year ago. The LSM growth rebounded to 4.14 percent in April after slowing down to 1.81 per cent year-on-year in March, according to the data of Pakistan Bureau of Statistics (PBS). The LSM data, provided by the Ministry of Industries and Production for 36 items, showed growth of 3.81 percent during July-July period of the year 2017-18 over a year ago. Similarly, the data provided by the provincial Bureaus of Statistics for 65 items showed growth of 1.2 percent over the same period. The output of 11 items, whose data is provided by the Oil Companies Advisory Committee, increased by 0.76 percent during the period under review

WB to provide $565m for water, energy projects

Pakistan on Wednesday signed two loan agreements worth $565 million with World Bank to support the projects in energy and water sectors. The World Bank would give loan worth $425 million for the National Transmission Modernisation (Phase-I) Project and $140 million for Sindh Barrages Improvement Project. Syed Ghazanfar Abbas Jilani, secretary Economic Affairs Division (EAD), signed the loan agreements on behalf of Pakistan while representatives of government of Sindh and National Transmission Despatch Company signed the project agreements of their respective projects. Patchamuthu Illangovan, country director WB, signed the agreements on behalf of the World Bank.

Asian shares edged down on Thursday after the Federal Reserve raised interest rates and took a more hawkish tone in forecasting a slightly faster pace of tightening for the rest of the year, while concerns about U.S.-China trade frictions kept investors on edge. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.25 percent in early trade. South Korea's KOSPI .KS11 was off 0.9 percent, while Australia's market slipped 0.2 percent. Japan's Nikkei .N225 shed 0.7 percent. The Fed raised its benchmark overnight lending rate a quarter of a percentage point to a range of 1.75 percent to 2 percent, as expected, on the back of strong U.S. economic growth. The markets, however, latched on to a change in Fed policymakers’ rates projections, which pointed to two additional hikes by the end of this year compared to one previously, based on board members’ median forecast.

The National Tariff Commission (NTC) has imposed anti-dumping duty on Chinese and South African origin colour coated steel coils and sheets imports on Wednesday. NTC initiated an anti-dumping investigation last year in June at the behest of an application lodged by International Steels Limited (ISL). The Commission established that the domestic industry producing colour coated steel coils/sheets suffered material injury due to the increase in volume of dumped imports and price undercutting of the domestic like product in the local market leading to low levels of production, capacity utilisation, declining market share, and damaging effects on inventories and growth for domestic manufacturers of the product.

The sugar mills in the country have failed to make full payments to sugarcane growers on the orders of Supreme Court of Pakistan as more than 30 percent payments are still pending for the recently closed crushing year of 2017-18. On April 25, the Supreme Court of Pakistan had ordered owners of sugar mills in Punjab and Sindh to clear dues of sugarcane farmers for the ongoing season within 5 weeks. Though the Pakistan Sugar Mills Association did not respond officially regarding the payment of outstanding dues to the growers on the order of the court but industry sources said that mills are not in position to make the full payments in time, as they are facing severe liquidity crunch due to over production and declining prices of the sugar in global market.

Large-scale manufacturing (LSM) posted growth of 4.14 percent in April on annual basis. The LSM, which constitutes 80 percent share within manufacturing and 10.7pc in overall GDP, recorded growth of 5.76 percent during ten months (July to April) of the current fiscal year over a year ago. The LSM growth rebounded to 4.14 percent in April after slowing down to 1.81 per cent year-on-year in March, according to the data of Pakistan Bureau of Statistics (PBS). The LSM data, provided by the Ministry of Industries and Production for 36 items, showed growth of 3.81 percent during July-July period of the year 2017-18 over a year ago. Similarly, the data provided by the provincial Bureaus of Statistics for 65 items showed growth of 1.2 percent over the same period. The output of 11 items, whose data is provided by the Oil Companies Advisory Committee, increased by 0.76 percent during the period under review

Pakistan on Wednesday signed two loan agreements worth $565 million with World Bank to support the projects in energy and water sectors. The World Bank would give loan worth $425 million for the National Transmission Modernisation (Phase-I) Project and $140 million for Sindh Barrages Improvement Project. Syed Ghazanfar Abbas Jilani, secretary Economic Affairs Division (EAD), signed the loan agreements on behalf of Pakistan while representatives of government of Sindh and National Transmission Despatch Company signed the project agreements of their respective projects. Patchamuthu Illangovan, country director WB, signed the agreements on behalf of the World Bank.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

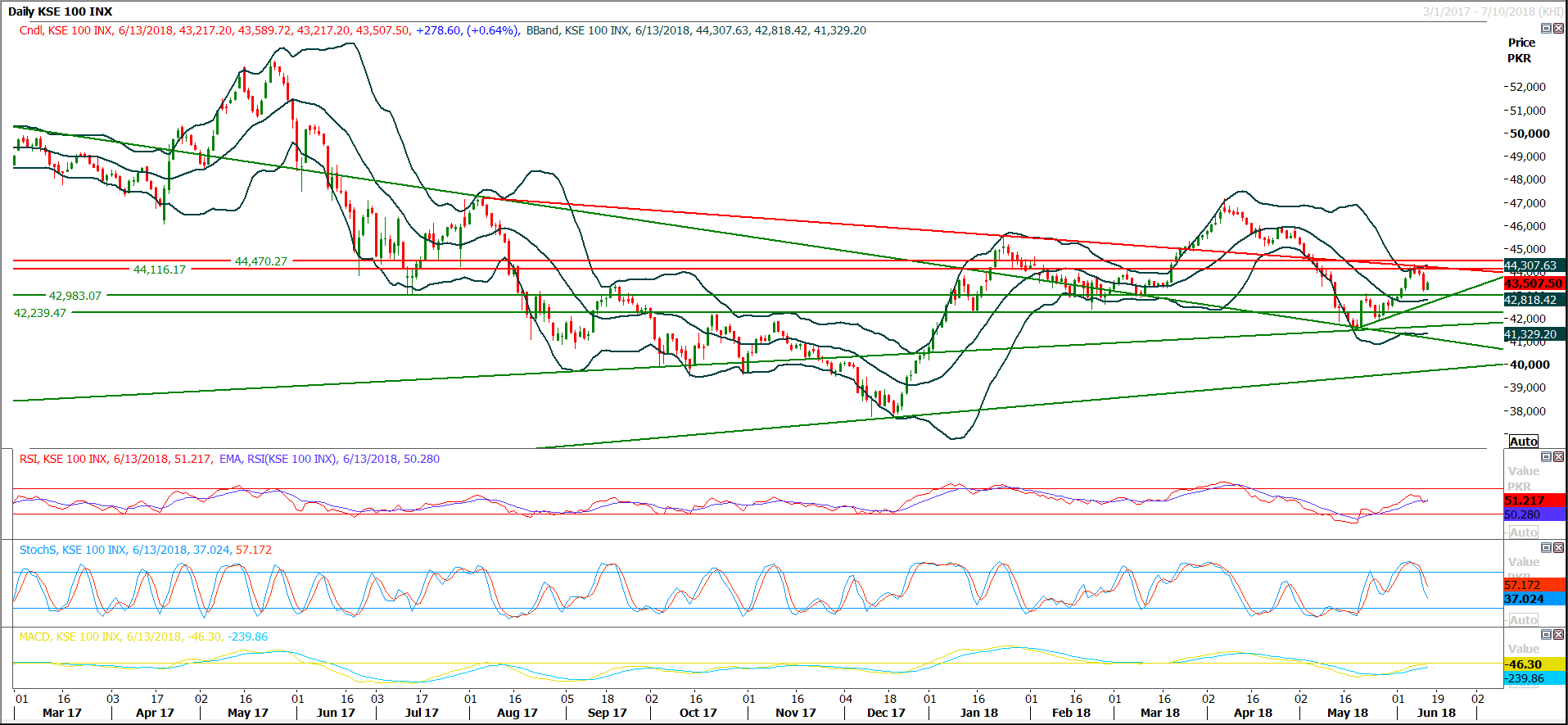

The Benchmark KSE100 Index have bounced back after completing its 50% correction on daily chart and have succeeded in maintaining its major resistant region of 44,330 points which fall on crossover of a horizontal line with a descending trend line, as of now its heading towards its supportive regions of 42,900 and 42,630 points. Daily momentum indicators have confirmed start of a new bearish rally but it would be strengthen if index would succeed in closing below 42,900 points. On intraday basis a spike could be witnessed as hourly momentum indicators would try to normalize themselves but at day end it’s expected that index would remain under pressure. For current trading session it’s recommended to adopt swing trading strategy or selling on strength could be beneficial. If index would succeed in closing below 42,600 points in coming days then index would try to target 39,200 points after Eid holidays.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.