Previous Session Recap

Trading volume at PSX floor increased by 42.6 million shares or 38.82% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43431.31, posted a day high of 43707.13 and a day low of 43354.13 during last trading session. The session suspended at 43618.07 with net change of 207.14 and net trading volume of 60.04 million shares. Daily trading volume of KSE100 listed companies increased by 28.83 million shares or 92.35% on DoD basis.

Foreign Investors remained in net buying position of 2.73 million shares and net value of Foreign Inflow increased by 1.4 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net selling positions of 0.02 and 0.27 million shares but Foreign Corporate Investors remained in net buying position of 3.01 million shares. While on the other side Local Individuals, Banks and Insurance Companies remained in net selling positions of 2.29, 3.66 and 8.34 million shares respectively but Local Companies, NBFCs, Mutual Funds and Brokers remained in net buying positions of 2.36, 5.47, 0.51 and 2.59 million shares respectively.

Analytical Review

Asian shares slip on U.S. protectionism fears

The combination left investors scurrying for safety as global equities took a knock, the dollar fell and bonds rose. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.3 percent, retreating from a 1-1/2 month high hit on Tuesday. Australian shares stumbled 0.8 percent in early trade, while Japan's Nikkei .N225 dropped 0.8 percent. South Korea's Kospi index .KS11 declined 0.7 percent. The weakness followed losses on Wall Street, with the Dow .DJI off 0.7 percent, the S&P 500 .SPX down 0.6 percent and the Nasdaq Composite .IXIC down 1.0 percent.

Rs 107b surcharges on power consumers rejected

The stakeholders have rejected the continuation of imposition of three different surcharges of Rs107 billion per month on the electricity consumers and said that they are unjustified. While hearing on the petition of Ministry of Energy, NEPRA chairman Tariq Sadozai reserved the judgment on the continuation of Rs 107 billion monthly surcharges on electricity consumers . The federal government has submitted a petition, re-determinations of tariff for Discos for the 2015-16, pleading to continue surcharges on electricity consumers . An average of Rs2.35 per unit surcharges on electricity were imposed in 2014 on all the electricity consumers . The three surcharges include tariff rationalisation surcharge, financing cost surcharge and Neelum-Jhelum surcharge. The Neelum Jhelum and financing cost surcharges would remain flat at 10 paisas and 43 paisas per unit, respectively, for all consumers while the tariff rationalisation surcharge, with an average of Rs1.82 per unit, would vary for each consumer category and distribution company based on system losses. The government is currently collecting Rs 7 billion as Neelum Jhelum surcharge, Rs 70 billion as financial cost while Rs 30 billion for tariff rationalisation surcharge.

Rs 558b released for development projects

The government has released over Rs 558 billion under its PSDP 2017-18 for various ongoing and new schemes against the total allocations of Rs1,001 billion. The Planning Commission has been following a proper mechanism for the release of funds and accordingly funds are released as per given mechanism. The commission releases 20% of funds in first quarter (July-Sept), 20% in second quarter (Oct-Dec), 25% in third quarter (Jan-March) and 35% in fourth quarter (April-June).

Foreign investors call for tax cuts, consistency in policies

Pakistan is on the radar of foreign investors who rate the country positively for investment but there is a dire need for consistent and transparent policies along with affordable taxes, Overseas Investors Chamber of Commerce and Industry (OICCI) President Bruno Olierhoek said on Tuesday. Talking to journalists at the Overseas Investors Chamber, Mr Olierhoek said that Pakistan – with a consumers market of 220 million people and a GDP growth rate of over 5 per cent – offered great attractions for potential foreign investors. He stressed that there is a need to explore and attract new investments, adding that many American and European companies are keen to invest. Pakistan is operating at 25-30pc of its potential, noted Mr Olierhoek.

Line losses slightly reduced in last 3 years

The line losses of power sector have shown a slight reduction during the last three years, reveals the data submitted to the National Assembly on Tuesday. The overall line losses of ten Discos stood at 17.9 per cent by the end of the fiscal year 2016-17. In 2014-15, the losses were calculated at 18.7 per cent. The Sukkur Electric Power Company (Sepco) suffered 37.9 per cent transmission and line losses during the year 2016-17. Its losses during 2014-15 were 38.3 per cent. Insiders believe the improvement was occurred due to the Rangers’ role in bill recovery and electricity theft prevention operations. The line losses of Pesco were reduced to 32.6 per cent while in 2014-15 the losses were 34.8. The losses in Qesco were 23.1 during 2016-17 while in 2014-15 they were 23.9 per cent. Line losses in Hesco increased from 27.1 in 2014-15 to 30.6 in 2016-17. The Mepco losses remained at 16.8 per cent in 2016-17. During the previous years, the losses were 16.7 per cent. In 2016-17, the Lesco is showing 13.8 per cent transmission and line losses , Gepco 10.2 per cent, Fesco 10.6 per cent, Iesco 9.0 per cent and Tesco 15.4 per cent.

Market is expected to remain volatile there its advised to remain cautious while trading today.

The combination left investors scurrying for safety as global equities took a knock, the dollar fell and bonds rose. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.3 percent, retreating from a 1-1/2 month high hit on Tuesday. Australian shares stumbled 0.8 percent in early trade, while Japan's Nikkei .N225 dropped 0.8 percent. South Korea's Kospi index .KS11 declined 0.7 percent. The weakness followed losses on Wall Street, with the Dow .DJI off 0.7 percent, the S&P 500 .SPX down 0.6 percent and the Nasdaq Composite .IXIC down 1.0 percent.

The stakeholders have rejected the continuation of imposition of three different surcharges of Rs107 billion per month on the electricity consumers and said that they are unjustified. While hearing on the petition of Ministry of Energy, NEPRA chairman Tariq Sadozai reserved the judgment on the continuation of Rs 107 billion monthly surcharges on electricity consumers . The federal government has submitted a petition, re-determinations of tariff for Discos for the 2015-16, pleading to continue surcharges on electricity consumers . An average of Rs2.35 per unit surcharges on electricity were imposed in 2014 on all the electricity consumers . The three surcharges include tariff rationalisation surcharge, financing cost surcharge and Neelum-Jhelum surcharge. The Neelum Jhelum and financing cost surcharges would remain flat at 10 paisas and 43 paisas per unit, respectively, for all consumers while the tariff rationalisation surcharge, with an average of Rs1.82 per unit, would vary for each consumer category and distribution company based on system losses. The government is currently collecting Rs 7 billion as Neelum Jhelum surcharge, Rs 70 billion as financial cost while Rs 30 billion for tariff rationalisation surcharge.

The government has released over Rs 558 billion under its PSDP 2017-18 for various ongoing and new schemes against the total allocations of Rs1,001 billion. The Planning Commission has been following a proper mechanism for the release of funds and accordingly funds are released as per given mechanism. The commission releases 20% of funds in first quarter (July-Sept), 20% in second quarter (Oct-Dec), 25% in third quarter (Jan-March) and 35% in fourth quarter (April-June).

Pakistan is on the radar of foreign investors who rate the country positively for investment but there is a dire need for consistent and transparent policies along with affordable taxes, Overseas Investors Chamber of Commerce and Industry (OICCI) President Bruno Olierhoek said on Tuesday. Talking to journalists at the Overseas Investors Chamber, Mr Olierhoek said that Pakistan – with a consumers market of 220 million people and a GDP growth rate of over 5 per cent – offered great attractions for potential foreign investors. He stressed that there is a need to explore and attract new investments, adding that many American and European companies are keen to invest. Pakistan is operating at 25-30pc of its potential, noted Mr Olierhoek.

The line losses of power sector have shown a slight reduction during the last three years, reveals the data submitted to the National Assembly on Tuesday. The overall line losses of ten Discos stood at 17.9 per cent by the end of the fiscal year 2016-17. In 2014-15, the losses were calculated at 18.7 per cent. The Sukkur Electric Power Company (Sepco) suffered 37.9 per cent transmission and line losses during the year 2016-17. Its losses during 2014-15 were 38.3 per cent. Insiders believe the improvement was occurred due to the Rangers’ role in bill recovery and electricity theft prevention operations. The line losses of Pesco were reduced to 32.6 per cent while in 2014-15 the losses were 34.8. The losses in Qesco were 23.1 during 2016-17 while in 2014-15 they were 23.9 per cent. Line losses in Hesco increased from 27.1 in 2014-15 to 30.6 in 2016-17. The Mepco losses remained at 16.8 per cent in 2016-17. During the previous years, the losses were 16.7 per cent. In 2016-17, the Lesco is showing 13.8 per cent transmission and line losses , Gepco 10.2 per cent, Fesco 10.6 per cent, Iesco 9.0 per cent and Tesco 15.4 per cent.

Technical Analysis

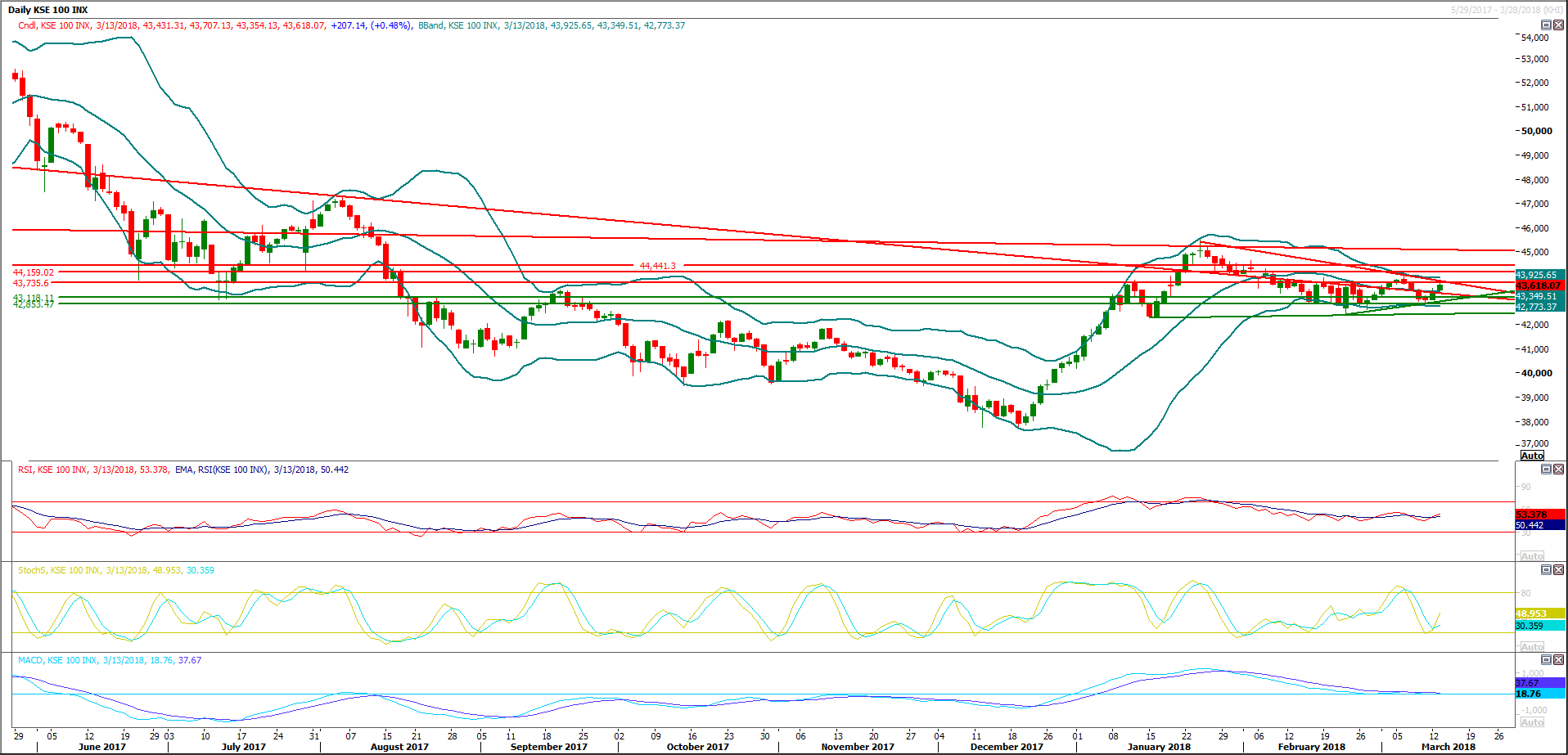

The Benchmark KSE100 Index is capped by a horizontal resistant region along with a descending trend line and these both indicators would try to cap mark move on intraday basis. Daily and Weekly momentum is in bullish mode but Hourly Stochastic and MAORSI have generated bearish crossover and these would try to push index downward on intraday basis along with help of Fibonacci correction, because on hourly chart index have completed its 61.8% correction and 74.6% falls at its horizontal resistant region of 43735 points. As of right now index would face resistance at 43735 and 43960 points while supportive regions falls at 43118 and 42860 points. Hourly chart also have generated a bearish engulfing during last trading session which is indication of a reversal pattern therefore its expected that index would remain under pressure during current trading session. Its recommended to book profits or sell on strength.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.