Previous Session Recap

Trading volume at PSX floor dropped by 40.62 million shares or 31.72%, DoD basis, whereas, the benchmark KSE100 Index opened at 41435.70, posted a day high of 41435.70 and a day low of 41141.85 during the last trading session. The session suspended at 41239.89 with a net change of -195.81 and net trading volume of 34.16 million shares. Daily trading volume of KSE100 listed companies dropped by 20.27 million shares or 37.24%,DoD basis.

Foreign Investors remained in a net buying position of 1.41 million shares and net value of Foreign Inflow increased by 1.97 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net buying positions of 0.02 and 2.18 million sahres but Overseas Pakistanis remained in a net buying position of 0.72 million shares. While on the other side Local Individuals and Insurance companies remained in net selling positions of 4.94 and 0.2 million share but Mutual Funds and Brokers remained in net buying positions of 2.18 and 1.53 million shares respectively.

Analytical Review

Asian stocks faltered on Tuesday as Chinese economic data disappointed and investors pondered whether a marked flattening in the U.S. yield curve might ultimately be a harbinger of a slowdown there. China’s retail sales rose 10 percent on the year in October, while industrial output grew 6.2 percent. Both came in under market forecasts and nudged down the Australian dollar, which is often used as a liquid proxy for China wagers. The immediate damage was limited in stocks with the blue-chip CSI300 index .CSI300 off 0.4 percent and EMini futures for the S&P 500 ESc1 down 0.1 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.1 percent after two sessions of declines, while Australia fell 0.8 percent. Japan's Nikkei .N225 managed to recoup 0.5 percent after four sessions of losses.

Engro Corporation from PSX have been deleted from MSCI Gloabl Standard Cap Indexes during its Nov. 2017 review which was published on 13th Nov and same was added to MSCI Global Small Cap Indexes. While Ferozesons, Pak Suzuki and Shell Pakistan are deleted from MSCI Global Small Cap Indexes.

A consortium of state-owned Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL) is being formed to undertake pilot projects to assess the cost of extracting Shale gas and oil. Official told APP that the pilot projects are likely to be executed in selected areas of Balochistan, Sindh and Khyber Pakhtunkhwa. Sources said exploration of Shale gas and oil deposits will prove to be a game-changer for the country.

The domestic oil refineries have warned the government of their imminent closure and resultant disruption in supply chain of petroleum products owing to continuous shut down of oil-based power plants both in the public and private sector. In an SOS to the Power Division of the Ministry of Energy, the Rawalpindi-based Attock Refinery Ltd (ARL) reported serious operational difficulties that would not only widespread shortages of petroleum products in the entire northern region but could also lead to forced closure of oil fields in Khyber Pakhtunkhwa and Pothwar region.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

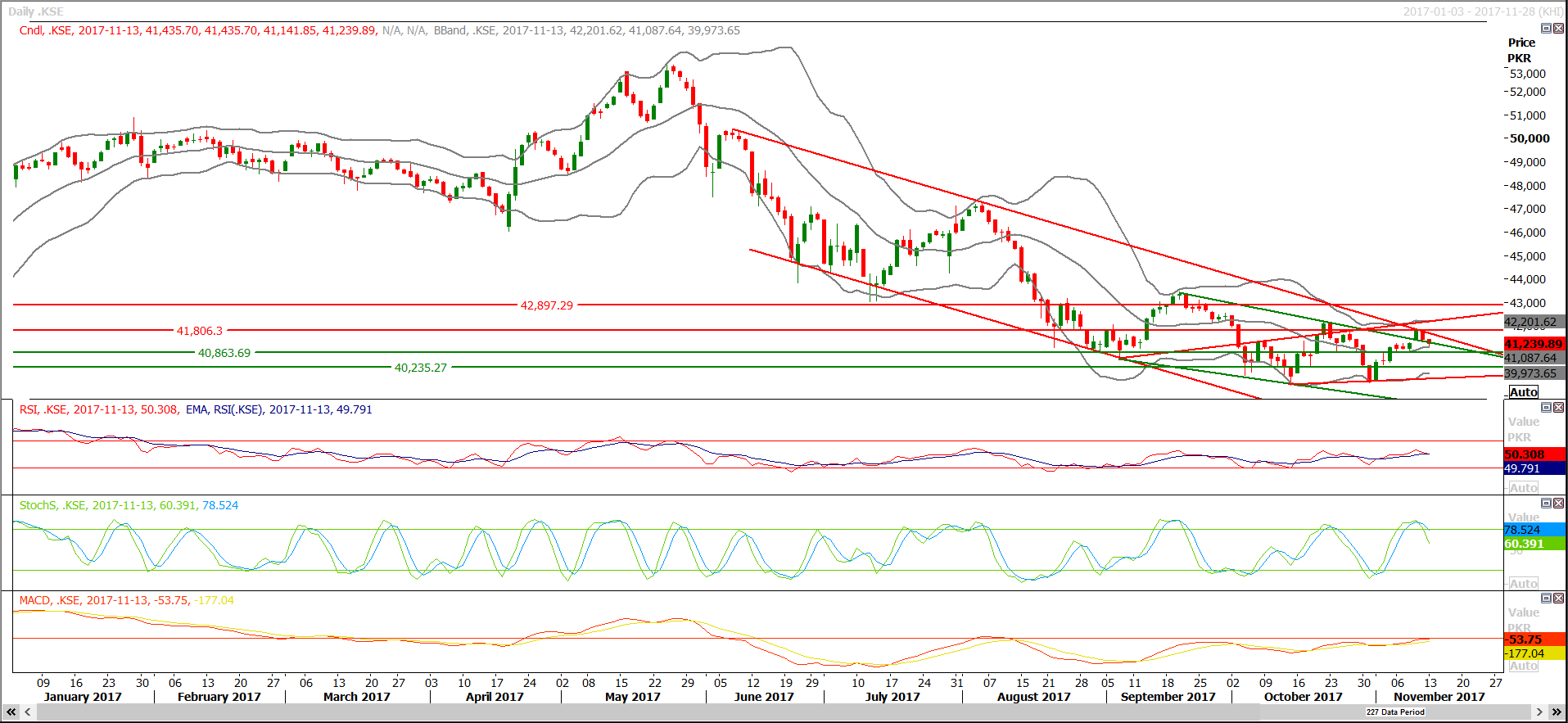

The Benchmark KSE100 Index is capped by a resistant trend line on the daily chart and right now it is being supported by a horizontal line after filling its gap. For the current trading session Index has supportive regions at 41100 and 40860 while resistant regions are standing at 41800 and 42200. It is recommended to remain careful if index closes above 42200 or below 40860 as breakout of these levels in either direction might push index for a further 1000 points in respective direction. It is recommended to avoid new buying until a clear indication of trend from index on the daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.