Previous Session Recap

Trading volume at PSX floor dropped by 0.85 million shares or 0.48% on DoD basis, whereas the Benchmark KSE100 index opened at 41,112.26, posted a day high of 41,202.42 and day low of 40,760.59 points during last trading session while session suspended at 41,152.28 with net change of 55.95 points and net trading volume of 91.31 million shares. Daily trading volume of KSE100 listed companies dropped by 5.66 million shares or 5.84% on DoD basis.

Foreign Investors remained in net buying position of 0.99 million shares but net value of Foreign Inflow dropped by 0.17 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net buying positions of 0.28 and 0.73 million shares and Foreign Individuals investors remained in net selling positions of 0.01 million shares respectively. While on the other side Local Individuals, Local Companies, Banks and NBFCs remained in net selling positions of 10.43, 1.62, 0.44 and 0.20 million shares respectively but Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 3.94, 2.77 and 4.91 million shares respectively.

Analytical Review

State of economy: IMF”s Finger shares initial assessment with Umar

Finance Minister Asad Umar held a meeting with the visiting International Monetary Fund (IMF) mission led by Harald Finger here on Tuesday. The mission leader shared his initial assessment with the finance minister on various sectors of the economy, following the delegation''s interaction with officials of relevant ministries and entities, says a press release issued here.

New petroleum policy by month-end: Minister

Minister for Petroleum Ghulam Sarwar Khan has said that the new petroleum policy will be announced in the last week of the current month after completing necessary consultations with the provinces. “As per vision of Prime Minister Imran Khan, the government is working on drafting of petroleum policy. It will be a uniformed policy, which will bring a major changes in the areas of oil, gas, liquefied petroleum gas (LPG) and liquefied natural gas (LNG).

Govt starts homework for privatisation oftwo RLNG-fired power plants

The Privatization Commission (PC) board has asked National Power Parks Management Company Limited (NPPMCL) to come up with a detailed working paper on proposed privatisation of two regasified liquid natural gas- RLNG-based power plants, a statement said on Tuesday. The 1233MW Balloki and 1230MW Haveli Bahadur Shah power plants have already been cleared by Cabinet Committee on Privatization (CCoP) for their 100pc privatisation in the next two years.

New FTA with China expected by June next year

Pakistan is hopeful to complete the negotiation on existing and new tariff lines under the second phase of free trade agreement with China by mid of the next year, a top government official said on Tuesday.

TAPI pipeline to move forward

The TAPI pipeline project to supply Turkmenistan’s gas to India and Pakistan via Afghanistan is moving closer to securing funding and a final investment decision could be made next year, its chief executive said on Tuesday.

Finance Minister Asad Umar held a meeting with the visiting International Monetary Fund (IMF) mission led by Harald Finger here on Tuesday. The mission leader shared his initial assessment with the finance minister on various sectors of the economy, following the delegation''s interaction with officials of relevant ministries and entities, says a press release issued here.

Minister for Petroleum Ghulam Sarwar Khan has said that the new petroleum policy will be announced in the last week of the current month after completing necessary consultations with the provinces. “As per vision of Prime Minister Imran Khan, the government is working on drafting of petroleum policy. It will be a uniformed policy, which will bring a major changes in the areas of oil, gas, liquefied petroleum gas (LPG) and liquefied natural gas (LNG).

The Privatization Commission (PC) board has asked National Power Parks Management Company Limited (NPPMCL) to come up with a detailed working paper on proposed privatisation of two regasified liquid natural gas- RLNG-based power plants, a statement said on Tuesday. The 1233MW Balloki and 1230MW Haveli Bahadur Shah power plants have already been cleared by Cabinet Committee on Privatization (CCoP) for their 100pc privatisation in the next two years.

Pakistan is hopeful to complete the negotiation on existing and new tariff lines under the second phase of free trade agreement with China by mid of the next year, a top government official said on Tuesday.

The TAPI pipeline project to supply Turkmenistan’s gas to India and Pakistan via Afghanistan is moving closer to securing funding and a final investment decision could be made next year, its chief executive said on Tuesday.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

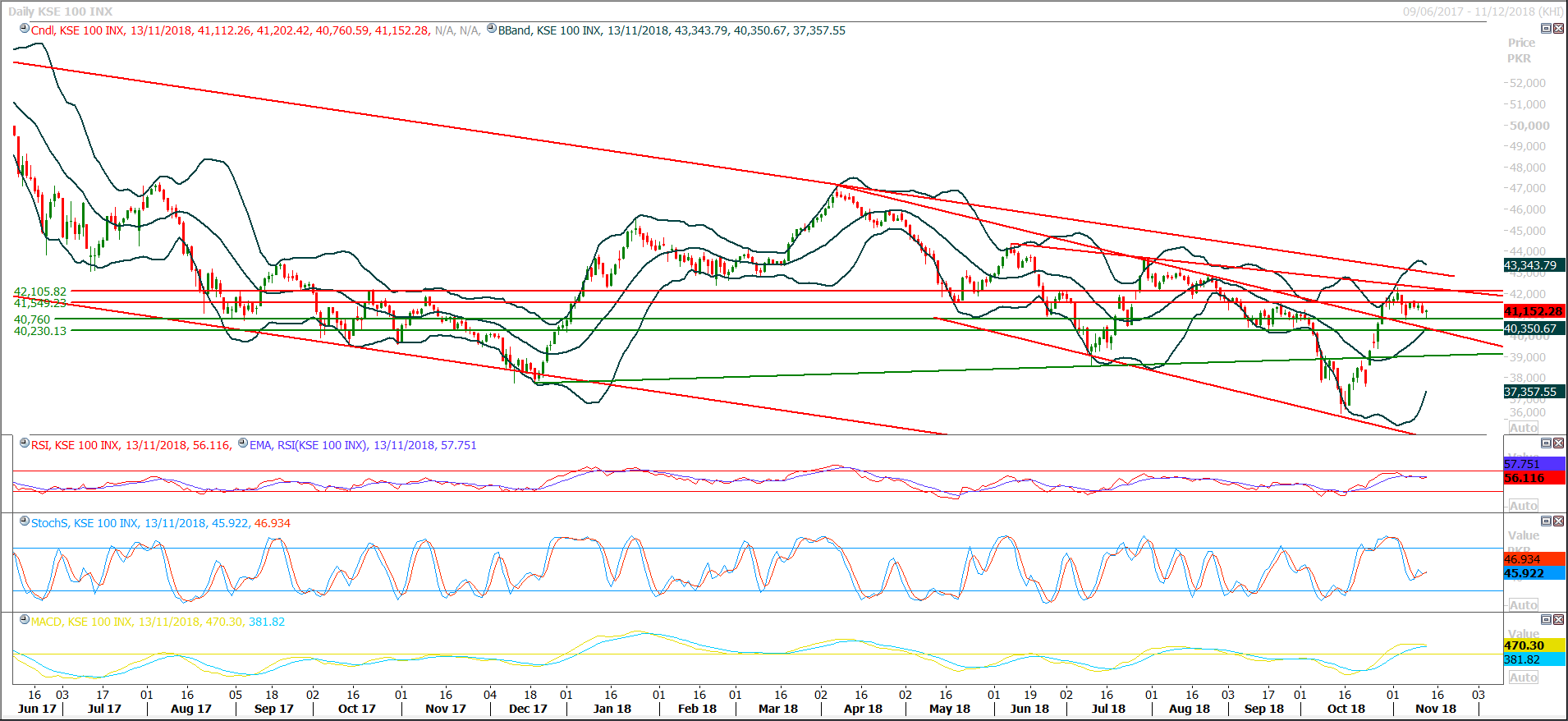

The Benchmark KSE100 Index have tried to bounce back after getting support from a horizontal supportive region and formatted a hammer on daily chart which have opened chances for creation of a morning star on daily chart if index would succeed in closing above 41,400 points during current trading session. But still index is capped by major resistances at 41,550 and 42,100 points and trend would remain bearish on short term basis until index would succeed in closing above 42,300 points on weekly chart therefore its recommended to start profit taking around 42,100 points and wait for a breakout of 42,300 points before initiating long positions. Hourly momentum indicators are ready for a bearish crossover and daily sentiment is still bearish therefore its recommended to stay cautious before initiating new positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.