Previous Session Recap

Trading volume at PSX floor increased by 74.14 million shares or 74.38%,DoD basis, whereas, the benchmark KSE100 Index opened at 41407.04 with a positive gap of 127.74 points, posted a day high of 42346.23 and a day low of 41387.30 during the last trading session. The session suspended at 42310.12 with a net change of 1030.82(2.44%) points and a net trading volume of 84.25 million shares. Daily trading volume of KSE100 listed companies increased by 27.03 million shares or 47.23%, DoD basis.

Foreign Investors remained in a net selling position of 1.68 million shares and a net value of Foreign Inflow dropped by 2.1 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 0.26 and 1.42 million shares. While on the other side Local Individuals, Banks remained in a net selling position of 11.39 and 6.49 million shares, but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying position of 4.08, 1.84, 13.84 and 1.75 million shares respectively.

Analytical Review

Asian stocks held steady on Thursday, consolidating after touching their highest in a decade and appeared to take in stride a burst of Chinese data which undershot market expectations. China’s factory output grew 6.0 percent in August from a year earlier, while fixed-asset investment expanded 7.8 percent in the first eight months, both well below economists’ forecasts, data released on Thursday showed. Retail sales for August also undershot expectations. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was effectively flat after rising to its highest since 2007 the day before. Japan's Nikkei .N225 nudged up 0.1 percent and the broader TOPIX .TOPX brushed a two-year high as the yen weakened. Australian shares lost 0.2 percent while South Korea's KOSPI .KS11 edged up 0.1 percent. Shanghai .SSEC added 0.1 percent.

The independent consultants have finally suggested allowing up to 7.1 per cent unaccounted-for gas (UFG losses) allowance to gas utilities in the consumer tariff for the next five years with tight targets for their gradual decline. The consultants — KPMG Taseer Hadi and Company, appointed by the Oil and Gas Regulatory Authority (Ogra) — have conceded that even the 5pc UFG benchmark recoverable from consumers was the highest in comparable gas markets. As if that was not sufficient, the consultants said the two gas utilities — Sui Northern Gas Pipelines (SNGP) and Sui Southern Gas Company (SSGC) — should be given an additional UFG allowance of 2.6pc for local conditions like theft, leakages, measurement errors, expansion of network on political grounds and law and order problems.

The government has restructured the board of directors of Pakistan Petroleum Limited (PPL) by adding four choice members of Prime Minister Shahid Khaqan Abbasi. In a notification issued by the Ministry of Energy on Wednesday, the number of public sector members on the PPL board has been increased, those from the private sector reduced and for the first time Director General Petroleum Concessions (DGPC) has been excluded from the board. The new members to the board include Hasan Nasir Jamy, Sabino Sikandar Jalal (both senior officers of the Petroleum Division in addition to continuation of Secretary Petroleum Sikandar Sultan Raja.

The local industry despatched 7.15 million tonnes of cement in July-August, up 21 per cent from the corresponding period of the last fiscal year. The domestic consumption increased 28pc during this period, although cement exports fell 14pc. Cement consumed in the north region was up 28.5pc year-on-year while the increase recorded in the south region was 25.4pc. In contrast, exports from the north region declined 2.47pc compared to a fall of 25.4pc from the south region. A spokesperson for the All Pakistan Cement Manufacturers Association (APCMA) said this should be a matter of concern for the authorities because south-based factories would lead exports in the past because of their proximity to the sea.

Pakistan and the United States need to focus on improving bilateral relation particularly in areas of economy and trade as there exists a lot of scope and opportunities in both countries. This was stated by the head of political and economic affairs of the US consulate, John Robinson, in a meeting with members of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Wednesday. He was emphatic that both the countries needed to ‘significantly’ improve bilateral relations in certain areas. The acting president FPCCI Irfan Ahmed Sarwana, speaking on the occasion, urged upon the six-member US team from the Karachi consulate to provide assistance in including textile and leather products in the US’s GSP scheme.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and selling on strength is recommended.

Technical Analysis

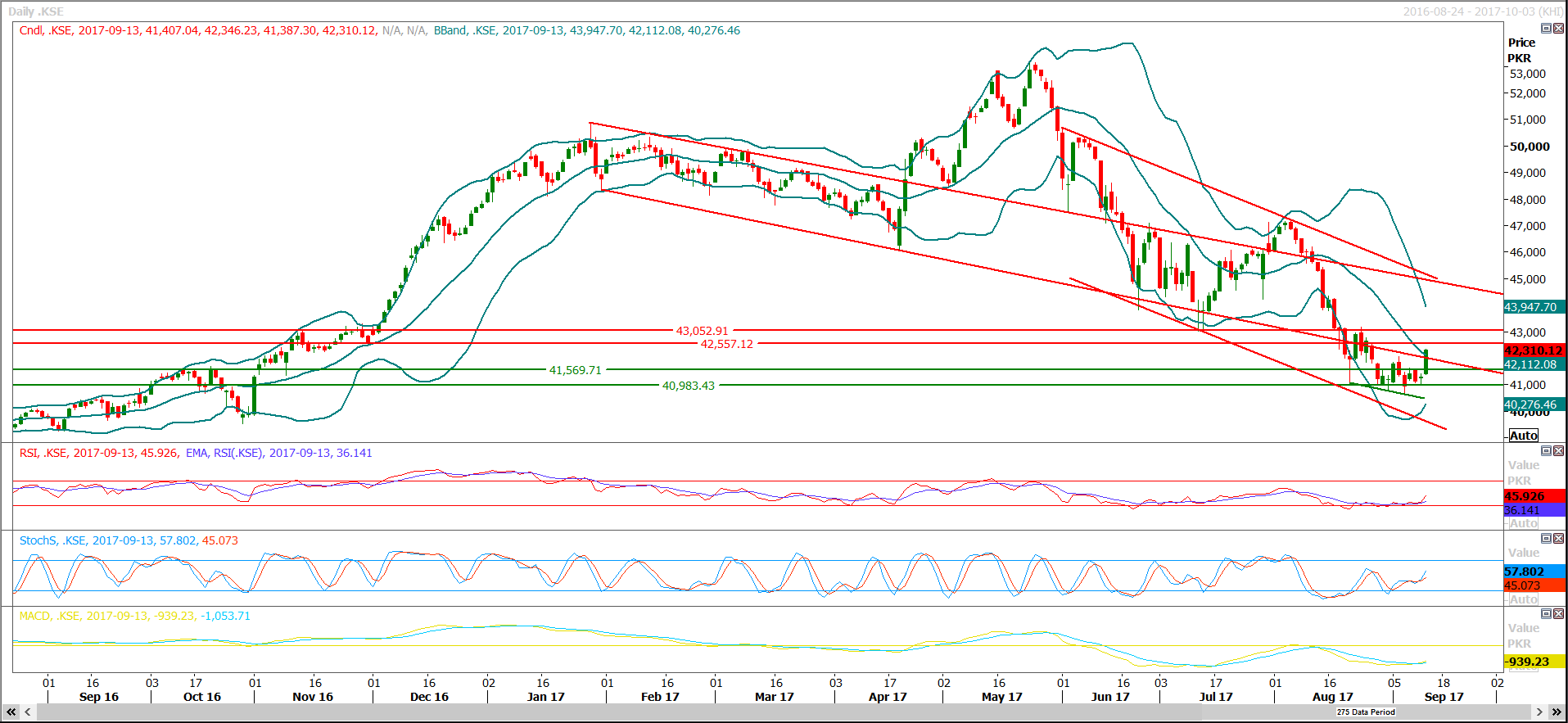

The Benchmark KSE100 Index has penetrated its bearish wedge in bullish direction but it is still capped by a major resistance at 42560 with a horizontal resistance. Hourly Stochastic is ready for a bearish crossover which might push the index back in a negative zone after a positive gap opening. Selling on strength is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.