Previous Session Recap

Trading volume at PSX floor increased by 12.01 million shares or 8.77% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,498.05, posted a day high of 41,150.41 and a day low of 40,339.04 during last trading session. The session suspended at 41,049.91 with net change of 527.87 and net trading volume of 93.50 million shares. Daily trading volume of KSE100 listed companies increased by 23.86 million shares or 34.26% on DoD basis.

Foreign Investors remain in net selling positions of 66.48 million shares and net value of Foreign Inflow dropped by 8.25 million US Dollars. Categorically Foreign Individuals remained in net buying positions of 0.12 million shares but Foreign Corporate investors remained in net selling positions of 66.59 million shares. While on the other side Local Individuals, Local Companies, Banks, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 53.98, 1.65, 2.11, 2.50, 3.29 and 2.72 million shares respectively but NBFCs remained in net selling positions of 0.03 million shares.

Analytical Review

Oil prices claw back some ground, but demand worries drag

Oil on Friday clawed back some of its losses from the previous session when prices fell the most in a month, although worries that emerging market crises and trade disputes could dent demand continued to drag. Brent crude was up 23 cents, or 0.3 percent, at $78.41 a barrel by 0122 GMT, after falling 2 percent on Thursday. The global benchmark the day before rose to its highest since May 22 at $80.13 a barrel.U.S. light crude was up 27 cents, or 0.4 percent, at 68.86, after dropping 2.5 percent on Thursday. The International Energy Agency on Thursday warned that although the oil market was tightening at the moment and world oil demand would reach 100 million barrels per day (bpd) in the next three months, global economic risks were mounting.

Foreign firms continue to evade tax worth Rs300b

Hundreds of so-called foreign companies, which had entered into joint ventures with Pakistani firms and their owners became ‘resident persons’, have been continuing to evade tax for the last seven years, inflicting more than Rs300 billion annual loss to national exchequer. Official sources in the FBR told The Nation that there was no need to approach the International Monetary Fund for financial assistance, as the tax evasion of non-resident firms (AOPs), which have now turned to thousands in number due to CPEC projects and their tax evaded money mounts to trillions of rupees, are capable of generating amount equal to federal budget alone.

PR to expand network: Minister

Minister for Railways Sheikh Rashid Ahmed on Thursday said that Pakistan Railways (PR) with the help of China Railways would expand its existing network hence reaching to the remote parts of the country. “We are all set to bring about a revolution in Railway sector with the help of China”, he said while talking to media persons after inspecting a newly furbished rake for the upcoming train to run between Rawalpindi and Minawali.

Foreign reserves decline to $16.07b

Total liquid foreign reserves of the country stood at 16.07 billion dollars on September 7, said the State Bank of Pakistan (SBP) on Thursday. According to the SBP's weekly statement issued here, the foreign reserves held by the State Bank on September 7 amounted to 9,624.4 million. The net foreign reserves held by the commercial banks were dollars 6,445.5 million. During the week ending September 7, SBP's reserves decreased by 261 million to 9,624 million, due to external debt servicing and other official payments.

Developmental REIT Scheme: 50 percent tax cut in dividend to be available for three years: FBR

The Federal Board of Revenue (FBR) has clarified that 50 percent tax reduction on dividend received from such Developmental Real Estate Investment Trust (REIT) Scheme would be available for three years from the date of setting up of such Developmental REIT Scheme. The FBR has issued budget explanatory circular 3 of 2018 here on Wednesday.”

Oil on Friday clawed back some of its losses from the previous session when prices fell the most in a month, although worries that emerging market crises and trade disputes could dent demand continued to drag. Brent crude was up 23 cents, or 0.3 percent, at $78.41 a barrel by 0122 GMT, after falling 2 percent on Thursday. The global benchmark the day before rose to its highest since May 22 at $80.13 a barrel.U.S. light crude was up 27 cents, or 0.4 percent, at 68.86, after dropping 2.5 percent on Thursday. The International Energy Agency on Thursday warned that although the oil market was tightening at the moment and world oil demand would reach 100 million barrels per day (bpd) in the next three months, global economic risks were mounting.

Hundreds of so-called foreign companies, which had entered into joint ventures with Pakistani firms and their owners became ‘resident persons’, have been continuing to evade tax for the last seven years, inflicting more than Rs300 billion annual loss to national exchequer. Official sources in the FBR told The Nation that there was no need to approach the International Monetary Fund for financial assistance, as the tax evasion of non-resident firms (AOPs), which have now turned to thousands in number due to CPEC projects and their tax evaded money mounts to trillions of rupees, are capable of generating amount equal to federal budget alone.

Minister for Railways Sheikh Rashid Ahmed on Thursday said that Pakistan Railways (PR) with the help of China Railways would expand its existing network hence reaching to the remote parts of the country. “We are all set to bring about a revolution in Railway sector with the help of China”, he said while talking to media persons after inspecting a newly furbished rake for the upcoming train to run between Rawalpindi and Minawali.

Total liquid foreign reserves of the country stood at 16.07 billion dollars on September 7, said the State Bank of Pakistan (SBP) on Thursday. According to the SBP's weekly statement issued here, the foreign reserves held by the State Bank on September 7 amounted to 9,624.4 million. The net foreign reserves held by the commercial banks were dollars 6,445.5 million. During the week ending September 7, SBP's reserves decreased by 261 million to 9,624 million, due to external debt servicing and other official payments.

The Federal Board of Revenue (FBR) has clarified that 50 percent tax reduction on dividend received from such Developmental Real Estate Investment Trust (REIT) Scheme would be available for three years from the date of setting up of such Developmental REIT Scheme. The FBR has issued budget explanatory circular 3 of 2018 here on Wednesday.”

ATRL, DGKC, ISL and SNGP would try to lead positive sentiment during current trading session.

Technical Analysis

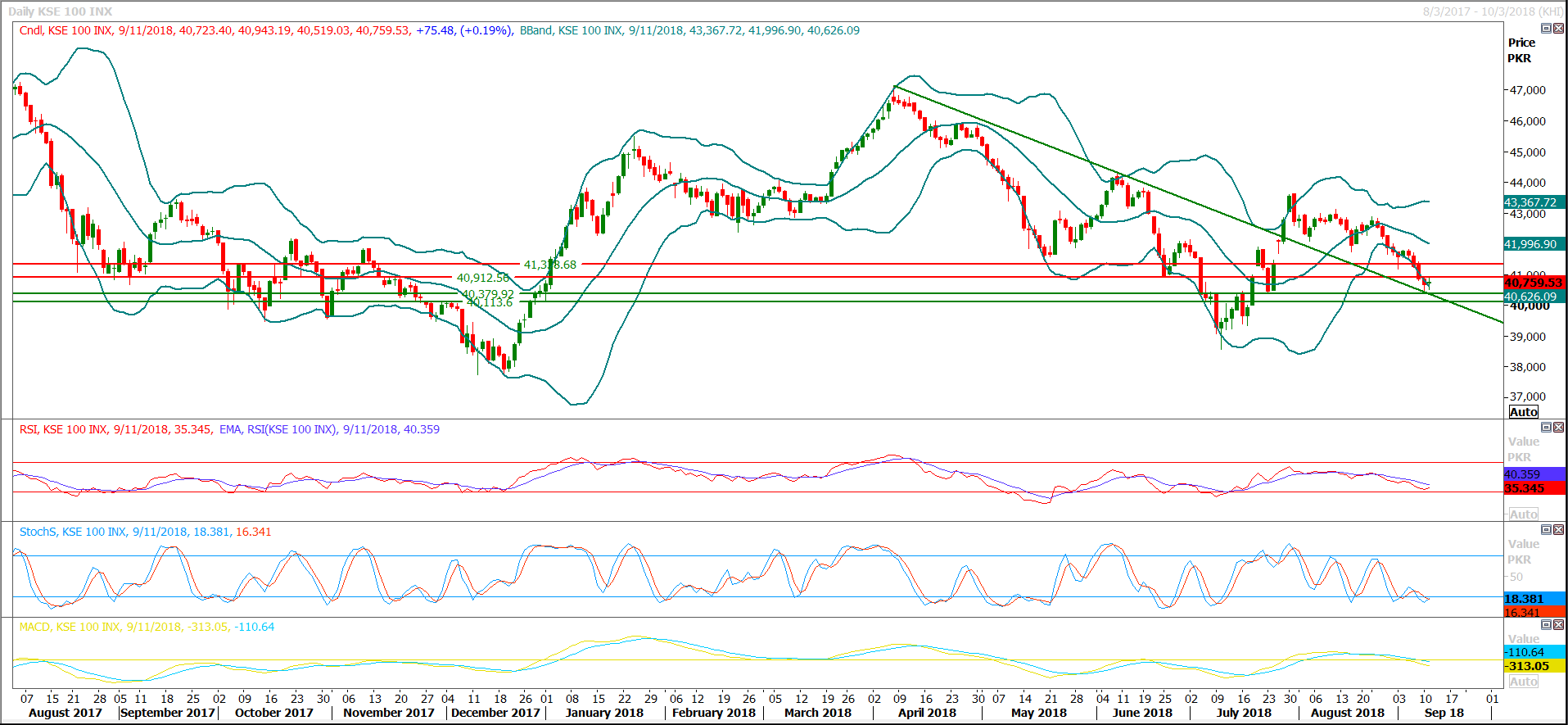

The Benchmark KSE100 Index is getting support from a descending trend line along with a strong horizontal supportive region at its 61.8% correction of its last bullish rally since last two consecutive trading sessions. Now chances of reversal are increasing because momentum indicators on hourly chart have generated bullish crossovers and if index would succeed in closing above 40,930 points during current trading session then daily momentum indicators would also change their direction towards bullish sentiment. If index would succeed in penetrating above 40,930 points then chances of a morning star would become evident on daily chart which would lead index towards 41,200 and 41,340 points. For current trading session index have supportive regions ahead at 40,380 and 40,110 points while resistant regions are standing at 40,930 and 41,340 points. It’s recommended to start buying on dip with strict stop loss of 40,110 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.