Previous Session Recap

The Bench Mark KSE100 Index Opened with a gap of 111.79 points at 45969.68, posted day high of 46268.44 points and day low of 45602.64 points during last trading session while session suspended at 46185.27 points with net change of 327.38 points and net trading volume of 201.04 million shares. Daily trading volume of KSE100 listed companies increased by 7.16 million shares or 3.7% on DOD bases.

Foreign Investors remain in net selling of 3.88 million shares and net value of Foreign Inflow dropped by 10.9 million shares. Categorically Foreign Individuals, Corporates and Overseas Pakistanis remain in net selling of 0.14, 2.0 and 1.74 million shares respectively.

Analytical Review

Asian shares and currencies struggled on Thursday after the Federal Reserve raised rates for the first time in a year and hinted at the risk of a faster pace of tightening than investors were positioned for. Yields on short-term U.S. debt surged to the highest since 2009, sending the dollar to peaks not seen in almost 14 years, which in turn prompted China to set the yuan at its weakest level against the greenback since 2008. The Fed anticipated policy path, and expectations U.S. President-elect Donald Trump will set growth on a higher gear, are keeping Asian policymakers on edge as capital gets sucked out from the fragile export-dependent regional economies toward dollar-based assets. The Fed rate rise of 25 basis points to 0.5-0.75 percent was well flagged but investors were spooked when the dot plots of members projections showed a median of three hikes next year, up from two previously.

Pakistani exports of services witnessed growth of nearly 19 per cent year-on-year to $468.42 million in October, the Pakistan Bureau of Statistics (PBS) said on Wednesday. The increase will help the government control the widening current account deficit in 2016-17. In the first three months of the current fiscal year, the exports of services recorded negative growth. Similarly, they fell 24.61pc to $1.61 billion in July-Oct. The annual drop was 7.14pc to $5.46bn in 2015-16. The services sector has emerged as the main driver of economic growth. Its share increased from 56pc of the gross domestic product (GDP) in 2005-06 to 57.7pc in 2014-15. Its major sub-sectors are finance and insurance, transport and storage, wholesale and retail trade, public administration and defence.

The Council of Common Interests (CCI) is all set to approve amendments in the Nepra Act 1997 aimed at establishing electricity market trading, de-licensing power generation, removing provincial quota restrictions on appointment of members, and authority to impose surcharges, well-informed sources in Cabinet Division told Business Recorder Wednesday. Prime Minister Nawaz Sharif has already cleared the summary for onward submission to the CCI to solicit approval of proposed amendments in terms of article 154 of the Constitution of Pakistan, 1973 read with entries numbers 4 and 6 of part-II of the Fourth Schedule of the Constitution.

Slow trading activity was witnessed on the cotton market on Wednesday as the ginners started raising asking prices, dealers said. The official spot rate was unchanged at Rs 6250, dealers said. In Sindh, seed cotton prices were at Rs 2600-3250, they said that in Punjab, phutti rates were at Rs 2800 and Rs 3500, as per 40 kg, they added. In the ready session, around 15,000 bales of cotton changed hands between Rs 5600-6550, they said.

Electricity subsidies continue to benefit the richest households disproportionately, as the correlation between measured power consumption and household welfare is relatively weak, a new World Bank study says. Research contained in the study says that despite cuts in tariffs on heavy users, electricity subsidies continue to be poorly targeted. Residential consumers are charged tariffs based on monthly electricity consumption, with the most generous subsidies provided to households with low and moderate usage.

INDU, PIAA, FATIMA and CHCC, along with Fertilizer Sector, and Cement Sector can lead market in positive direction. But BYCO may face a pressure today

Technical Analysis

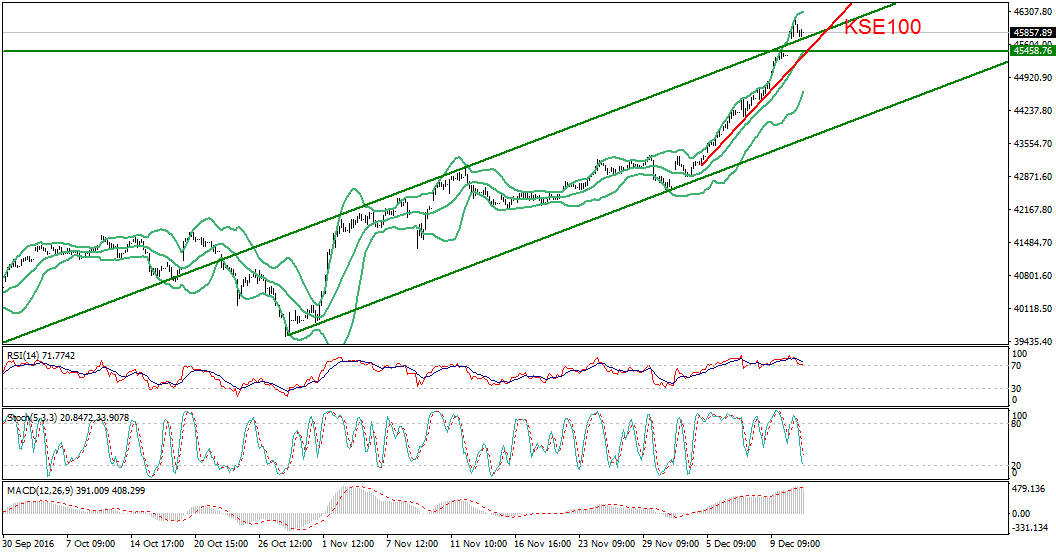

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction with a gap of around 408 points on Tuesday but have tried to cover that gap during last trading session. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 45460 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as it can try to fulfil its Gap and a slight pressure can be witnessed on oil sector from internation curde oil prices.Market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.