Previous Session Recap

Trading volume at PSX floor dropped by 8.25 million shares or 6.68% on DoD basis, whereas the benchmark KSE100 index opened at 39,205.40, posted a day high of 39,504.49 and a day low of 39,049.08 points during last trading session while session suspended at 39,412.55 with net change of 363.47 points and net trading volume of 83.82 million shares. Daily trading volume of KSE100 listed companies dropped by 7.78 million shares or 8.49% on DoD basis.

Foreign Investors remained in net buying positions of 0.69 million shares and net value of Foreign Inflow increased by 0.87 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net buying positions of 0.19 and 0.68 million shares. While other side Local individuals, Companies and Mutual Funds remained in net buying positions of 2.39, 0.65 and 1.45 million shares but Local Banks, Brokers and Insurance Companies remained in net selling positions of 2.1, 2.16 and 1.78 million shares respectively.

Analytical Review

Global auto leaders urge Trump administration to end trade turmoil

Auto executives gathered in Detroit on Monday called on the Trump administration and Congress to resolve trade disputes, and end the government shutdown, saying political uncertainty is costing the industry. U.S. trade officials are negotiating a new deal with China in hopes of avoiding new tariffs, while a new regional trade agreement with Canada and Mexico still needs congressional approval. Automakers producing vehicles in the United States are contending with U.S. steel and aluminum prices driven higher by Trump administration tariffs.

Country all set to finalise $10b agreement with Saudi Arabia

Pakistan is all set to finalise $10 billion investment agreement with Saudi Arabia and will also seek the downward revision in LNG prices from Qatar, said Federal Minister for Petroleum Ghulam Sarwar Khan. Saudi Arabia Crown Prince, Muhammad bin Salman would visit Pakistan next month to sign memorandum of understanding (MoU) on setting up refinery and Petro Chemical complex in Gwadar, said the Federal minister for Petroleum while talking to a selected group of journalists here Monday. Saudi Arabia has initially committed to provide $10 billion to set up oil refinery with 200,000 to 300,000 tons per day capacity and petro chemical complex in Gwadar. The minister further informed that Prime Minister Imran Khan may also request to provide credit facility for LNG imports and revision in LNG prices during upcoming visit to Qatar. He said that Pakistan’s annual LNG import bill is around $ 4 billion and Qatar is likely to extend LNG credit facility for one year.

FBR reshuffles another 17 officers

The Federal Board of Revenue (FBR), in the second phase, has reshuffled 17 officers on Monday. Earlier, the government had reshuffled 95 senior officers of the FBR on January 2 after facing massive shortfall of Rs170 billion in tax collection during six months (July to December) of the ongoing financial year. This is consecutive second month when the government is changing officials of FBR as it had already reshuffled its senior officers last month (December). Last month, the government had removed top five members of the FBR.

Hike in FED on cement, vehicles on cards in mini budget

The government is planning to standardize sales tax on petroleum products likely at 17 percent. Among other measures, hike in Federal Excise Duties (FED) on cements, beverages, cigarettes, and vehicles (1600cc and above) are also on cards. Experts think these revenue measures would dent profitability of cement and consumer sectors mainly due to inability to pass on this burden to customers in the short run and owing to tough competition in consumer industry. However, rumors related to increase in General Sales Tax (GST) are also doing rounds. Experts said that with a view to overcome revenue shortfall and bolster exports, the govt is mulling to announce a mini budget on January 23, 2018 with additional revenue measures of up to Rs150b.

Govt borrows Rs113bn in just one week

The government has borrowed Rs113 billion for budgetary support within just one week, according to latest data released by the State Bank of Pakistan (SBP). Borrowing for budgetary support has seen manifold increase during the first half of fiscal year as almost all other revenue streams have fallen short of targets. During July 31 to Jan 4, the government’s budgetary borrowing increased to Rs835.7bn compared to Rs353.4bn during the same period last year; translating into a 136 per cent jump. According to data released by central bank, during the week ending Dec 28, 2018 total borrowing for the fiscal year stood at Rs722bn, however, as of Jan 4, the total amount rose to Rs835.7bn — Rs113bn increase in just one week.

Auto executives gathered in Detroit on Monday called on the Trump administration and Congress to resolve trade disputes, and end the government shutdown, saying political uncertainty is costing the industry. U.S. trade officials are negotiating a new deal with China in hopes of avoiding new tariffs, while a new regional trade agreement with Canada and Mexico still needs congressional approval. Automakers producing vehicles in the United States are contending with U.S. steel and aluminum prices driven higher by Trump administration tariffs.

Pakistan is all set to finalise $10 billion investment agreement with Saudi Arabia and will also seek the downward revision in LNG prices from Qatar, said Federal Minister for Petroleum Ghulam Sarwar Khan. Saudi Arabia Crown Prince, Muhammad bin Salman would visit Pakistan next month to sign memorandum of understanding (MoU) on setting up refinery and Petro Chemical complex in Gwadar, said the Federal minister for Petroleum while talking to a selected group of journalists here Monday. Saudi Arabia has initially committed to provide $10 billion to set up oil refinery with 200,000 to 300,000 tons per day capacity and petro chemical complex in Gwadar. The minister further informed that Prime Minister Imran Khan may also request to provide credit facility for LNG imports and revision in LNG prices during upcoming visit to Qatar. He said that Pakistan’s annual LNG import bill is around $ 4 billion and Qatar is likely to extend LNG credit facility for one year.

The Federal Board of Revenue (FBR), in the second phase, has reshuffled 17 officers on Monday. Earlier, the government had reshuffled 95 senior officers of the FBR on January 2 after facing massive shortfall of Rs170 billion in tax collection during six months (July to December) of the ongoing financial year. This is consecutive second month when the government is changing officials of FBR as it had already reshuffled its senior officers last month (December). Last month, the government had removed top five members of the FBR.

The government is planning to standardize sales tax on petroleum products likely at 17 percent. Among other measures, hike in Federal Excise Duties (FED) on cements, beverages, cigarettes, and vehicles (1600cc and above) are also on cards. Experts think these revenue measures would dent profitability of cement and consumer sectors mainly due to inability to pass on this burden to customers in the short run and owing to tough competition in consumer industry. However, rumors related to increase in General Sales Tax (GST) are also doing rounds. Experts said that with a view to overcome revenue shortfall and bolster exports, the govt is mulling to announce a mini budget on January 23, 2018 with additional revenue measures of up to Rs150b.

The government has borrowed Rs113 billion for budgetary support within just one week, according to latest data released by the State Bank of Pakistan (SBP). Borrowing for budgetary support has seen manifold increase during the first half of fiscal year as almost all other revenue streams have fallen short of targets. During July 31 to Jan 4, the government’s budgetary borrowing increased to Rs835.7bn compared to Rs353.4bn during the same period last year; translating into a 136 per cent jump. According to data released by central bank, during the week ending Dec 28, 2018 total borrowing for the fiscal year stood at Rs722bn, however, as of Jan 4, the total amount rose to Rs835.7bn — Rs113bn increase in just one week.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

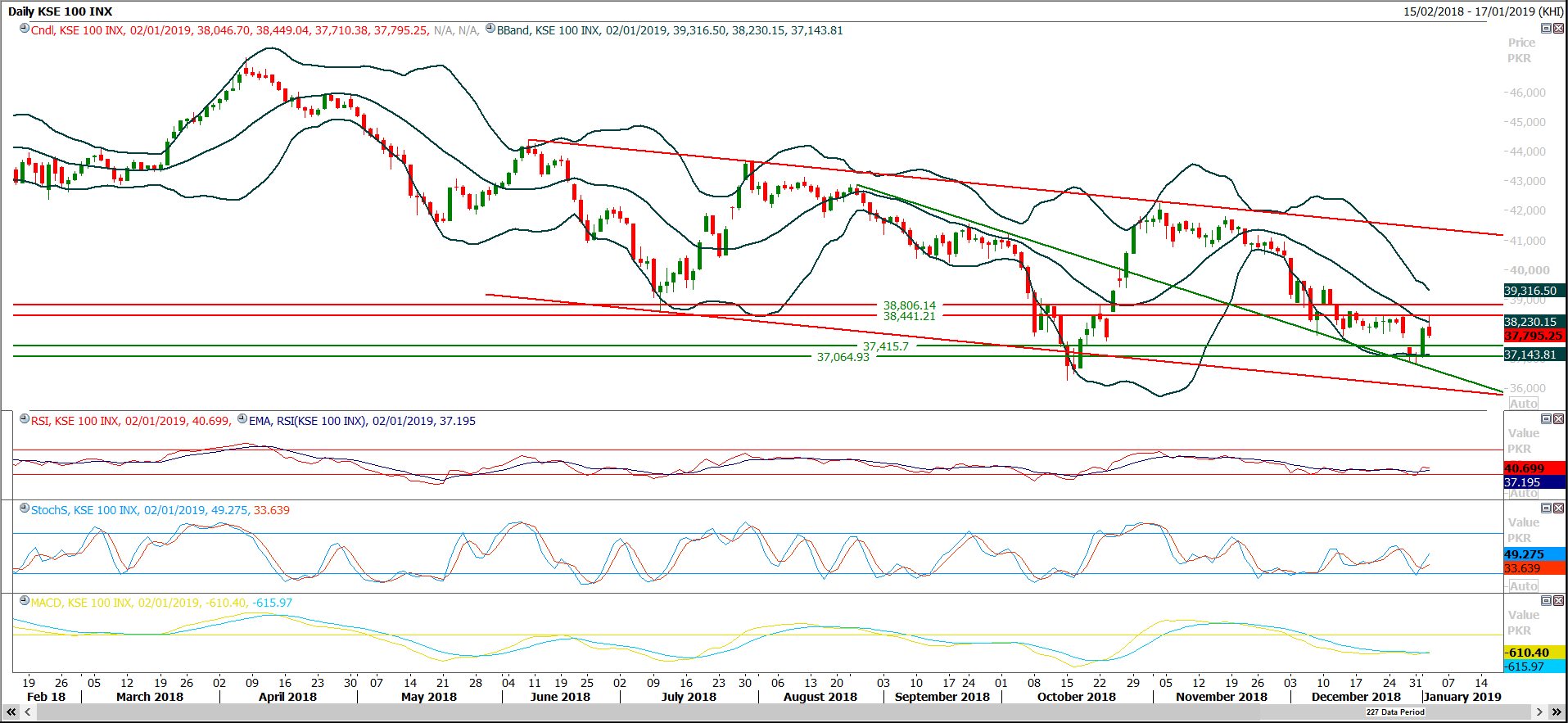

Technical Analysis

The Benchmark KSE100 Index is still not being able to close above its correction levels of its previous bearish rally even though weekly momentum have change to bullish side but still attraction is not being generated from buying side. Weekly chart have created a morning star which would try to push index in bullish direction if its impact would not be vanished during first two or three days of this week by penetration by below 38,500 points. Index is standing at 50% correction of its last bearish rally and it would remain volatile and range bound until it would succeed in closing above 39,960 points therefore its recommended to stay cautious and trade with strict stop loss until index close below 38,470 or above 39,960 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.