Previous Session Recap

Trading volume at PSX floor dropped by 61.63 million shares or 19.43% on DoD basis. Whereas KSE100 index opened at 48071.04, posted a day high of 48601.75 and a day low of 47484.85 during the last trading session, the session suspended at 47608.64 with a net change of -462.40 points and a net trading volume of 74.8 million shares. Daily trading volume of KSE100 listed companies dropped by 28.43 million shares or 27.54% on DoD basis.

Foreign Investors remained in a net buying position of 8.13 million shares and net value of Foreign Inflow dropped by 3.43 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net buying positions of 1.45 and 6.74 million shares but Foreign Individuals remained in a net selling position of 0.065 million shares. On the other side Local Individuals, Banks, NBFCs and Brokers remained in net buying positions of 2.84, 5.4, 0.8 and 2.9 million respectively but Local Companies and Mutual Funds remained in net selling positions of 11.74 and 8.77 million shares.

Analytical Review

U.S. stock futures dipped and Asian shares were on the defensive on Thursday after a media report that U.S. President Donald Trump is being investigated by a special counsel for possible obstruction of justice. Investors appetite for riskier assets was also dampened by soft U.S. data and after the Federal Reserve raised interest rates as expected and gave its first clear outline on its plan to reduce its $4.2-trillion bond portfolio. MSCI broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent while Japanese Nikkei fell 0.4 percent. Asian markets were also waiting to see if Chinese central bank would follow the Fed with another round of money market rate increases, as it did in March. But traders were divided over the possibility, with some analysts noting the yuan is in better than a few months ago while liquidity in China has already been tightening.

The government would revise the Strategic Trade Policy Framework (STPF), which has failed to enhance the country’s tumbling exports that resulted in massive trade deficit. Previously, the government had announced three years STPF with aim to enhance the country’s exports to $35 billion by the end of June 2018. However, the government had failed to enhance tumbling exports, which are likely to remain at around $21 billion by the end of current fiscal year. The country’s trade deficit has already touched historic level of $30 billion during 11 months (July-May) of the ongoing financial year due to massive increase in imports and continuous decline in exports.

The construction work on Gwadar International Airport is likely to start by the end of September this year, it is learnt reliably here. After the approval of grant by Chinese government work has been accelerated for the development of the airport and now the construction will start in next three months, official sources told The Nation here no Wednesday. The project will be completed in two to three year and will cost $230 million or around Rs23 billion, the official said. The Chinese government has agreed to provide funds for the construction of the airport. China has approved a grant in this regard during Prime Minister Nawaz Sharif recent visit to China.

The government departments, blamed by the joint investigation team (JIT) for allegedly obstructing their probe into allegations against the Sharif family, are expected to submit their replies to the Supreme Court on Thursday (today). A number of replies have been submitted to the attorney general (AG) office by different organisations, such as the Securities and Exchange Commission of Pakistan (SECP), Federal Board of Revenue (FBR) and the law ministry, and may be filed formally before the Supreme Court on June 15.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended

Technical Analysis

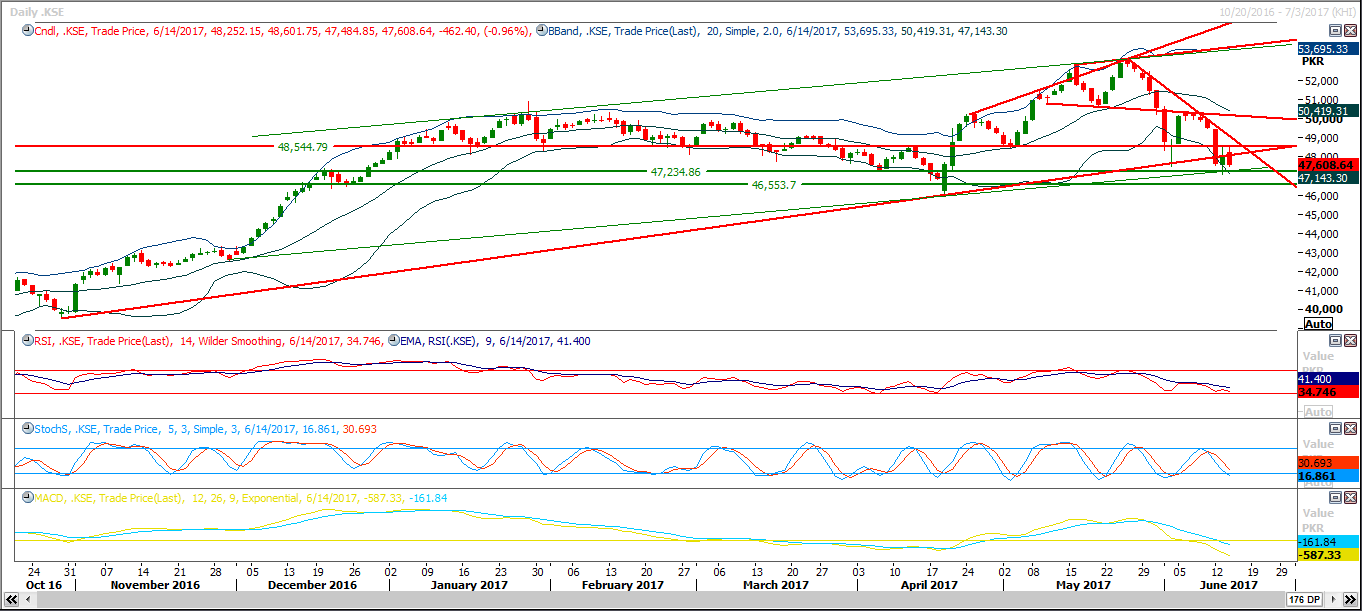

The Benchmark KSE100 index failed to recover from its Intraday bearish corrections and have dropped from its 50% correction once again, during the last trading session. Along with this negative aspect, it has also failed to penetrate its supportive region created by the supportive trend line of its bullish daily channel and a horizontal support. Index is under pressure towards 46550 and if breaches below this region, then a sharp decline towards 44500 would be witnessed. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.