Previous Session Recap

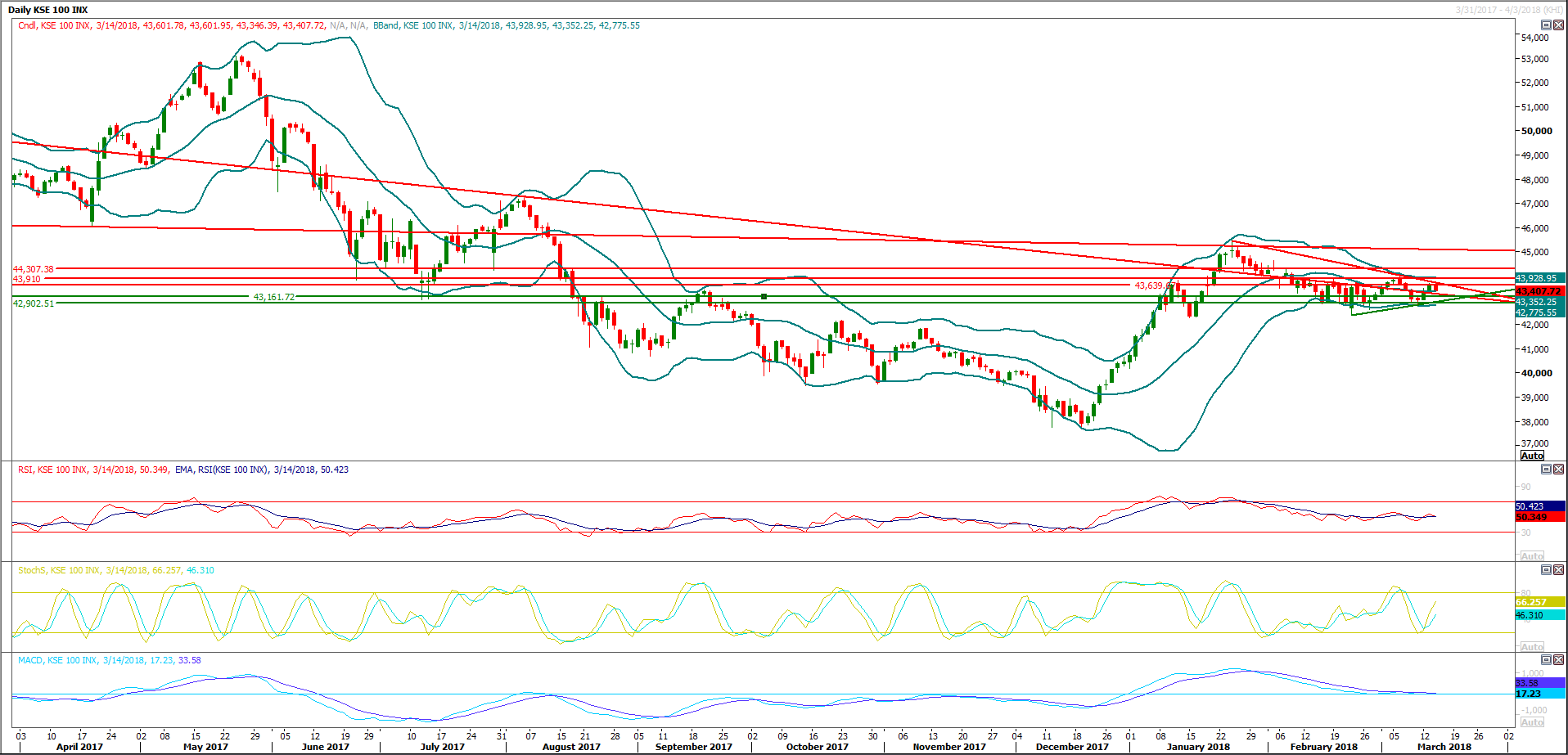

Trading volume at PSX floor increased by 46.11 million shares or 30.27% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43601.78, posted a day high of 43601.95 and a day low of 43346.39 during last trading session. The session suspended at 43407.72 with net change of -210.36 and net trading volume of 47.24 million shares. Daily trading volume of KSE100 listed companies dropped by 12.81 million shares or 21.33% on DoD basis.

Foreign Investors remained in net selling position of 5.54 million shares and net value of Foreign Inflow dropped by 3.34 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 0.53 and 5.0 million shares. While on the other side Local Individuals, Banks and Insurance Companies remained in net selling positions of 4.0, 3.72 and 2.95 million shares but Local Companies, NBFCs, Mutual Funds and Brokers remained in net buying positions of 1.06, 0.12, 9.47 and 4.96 million shares respectively.

Analytical Review

Stocks retreat, bonds advance as simmering trade woes curb risk appetite

Stock markets slipped broadly on Thursday while government bonds attracted safe-haven demand amid mounting investor concerns that growing trade tensions would hurt the global economy. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.45 percent. The Asian markets took their cues from Wall Street shares, which fell for the third straight session overnight after U.S. President Donald Trump sought to impose fresh tariffs on China, intensifying fears of a trade war. Boeing Co (BA.N), seen as particularly vulnerable to retaliation from U.S. trade partners, fell 2.5 percent, leading the losers on the Dow .DJI. Equity market losses were widespread, with the pan-European FTSEurofirst 300 index .FTEU3 shedding 0.14 percent overnight and MSCI's global stock index .MIWD00000PUS losing 0.46 percent. Hong Kong's Hang Seng .HSI dropped 0.75 percent, Australian stocks fell 0.4 percent and South Korea's KOSPI .KS11 lost 0.45 percent. Japan's Nikkei .N225 was down 0.85 percent but still up roughly 0.6 percent on the week.

Financial close deadlines extended for CPEC power projects

Private Power and Infrastructure Board (PPIB) Wednesday allowed extension in Financial Close deadlines of two 660 MW Thar coal based power projects and 660 kV HVDC Matiari-Lahore Transmission Line being processed under China Pakistan Economic Corridor (CPEC). The approval for the extension was given by the 115th meeting of the PPIB held here. Chairing the meeting, Minister for Power Awais Ahmed Khan Leghari said that the government realizes the importance of transmission lines in complimenting the upcoming power generation projects. "Current transmission network needs to be strengthened and made reliable to support government's aim of achieving sustainability in the system," he said. He emphasized that the government was working on upgrading the existing transmission network to make it more reliable and efficient and NTDC has been asked to take the necessary measures. "At the same time private sector is being encouraged to contribute in network expansion," he said.

ADB, KP sign $140m loan pact to improve roads

The Asian Development Bank (ADB) and Pakistan on Wednesday signed a $140million loan agreement to improve the provincial roads in Khyber Pakhtunkhwa (KP). The loan agreement was signed by ADB Country Director for Pakistan Xiaohong Yang and Economic Affairs Division (EAD) Secretary Syed Ghazanfar Abbas Jilani in Islamabad. Communication and Works Department Secretary Shahab Khattak and Pakhtunkhwa Highway Authority Managing Director Ahmed Nabi Sultan signed the project agreement on behalf of the government of KP. "The project signed here is a continuation of ADB support for upgrading Pakistan's vital infrastructure to stimulate economic growth and job creation." said Ms Yang. "ADB continues to look forward to work very closely with federal and provincial governments to accelerate economic development by -among others- developing road for improving mobility and connectivity." The overall cost of the project is around $164million, which the government of Pakistan would contribute only $24million and rest would be obtained as loan from the ADB .

SECP, FBR launch one-window facility for company, NTN registration

As part of Doing Business Reforms agenda, the Securities and Exchange Commission of Pakistan (SECP) and the Federal Board of Revenue (FBR) have launched a one-window facility for company and national tax number (NTN) registration. Zafar Abdullah, the SECP chairman, and Khawaja Adnan Zahir, member (IT) FBR , jointly inaugurated the system during the launch ceremony held on Wednesday at the SECP’s head office, which was attended by senior officials of SECP , FBR , BoI and PRAL. Zafar Abdullah congratulated the teams of SECP , FBR and PRAL on putting in exhaustive efforts to develop the system. The SECP has undertaken a host of reform measures, which have resulted in a robust corporate growth in the country, leading to formalisation of the business sector and documentation of economy, he added.

Assemblers selling cars at higher rates: Minister

The government on Wednesday admitted that some car assemblers were selling vehicles at higher rates and were not delivering some variants within the prescribed time of two months which was resulting in black marketing. Minister for Industries and Production Ghulam Murtaza Khan Jatoi in his written reply said "It is partially true, that the prices of automobiles are high as compared to the global prices." He said prices of Suzuki's Wagon-R and Swift are higher in Pakistan than India and Indonesia due to low volumes. Whereas the price of Toyota Altis produced in Pakistan is less than those prevailing in the regional countries. The minister said prices of Honda City and Civic are also less in Pakistan as compared to prices of these vehicles in Thailand, Indonesia and Malaysia. As per provided data, the price of Suzuki Wagon-R VXR is Rs10,74000 in Pakistan, where as it is being sold at Pak Rs85,1801 in India. Likewise Suzuki Swift 1.3 Deluxe is being sold at a price of Rs1375000 in Pakistan where the same car is being sold at a price of Rs900,000 in neighbouring country, India.

Market is expected to remain volatile there its advised to remain cautious while trading today.

Stock markets slipped broadly on Thursday while government bonds attracted safe-haven demand amid mounting investor concerns that growing trade tensions would hurt the global economy. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.45 percent. The Asian markets took their cues from Wall Street shares, which fell for the third straight session overnight after U.S. President Donald Trump sought to impose fresh tariffs on China, intensifying fears of a trade war. Boeing Co (BA.N), seen as particularly vulnerable to retaliation from U.S. trade partners, fell 2.5 percent, leading the losers on the Dow .DJI. Equity market losses were widespread, with the pan-European FTSEurofirst 300 index .FTEU3 shedding 0.14 percent overnight and MSCI's global stock index .MIWD00000PUS losing 0.46 percent. Hong Kong's Hang Seng .HSI dropped 0.75 percent, Australian stocks fell 0.4 percent and South Korea's KOSPI .KS11 lost 0.45 percent. Japan's Nikkei .N225 was down 0.85 percent but still up roughly 0.6 percent on the week.

Private Power and Infrastructure Board (PPIB) Wednesday allowed extension in Financial Close deadlines of two 660 MW Thar coal based power projects and 660 kV HVDC Matiari-Lahore Transmission Line being processed under China Pakistan Economic Corridor (CPEC). The approval for the extension was given by the 115th meeting of the PPIB held here. Chairing the meeting, Minister for Power Awais Ahmed Khan Leghari said that the government realizes the importance of transmission lines in complimenting the upcoming power generation projects. "Current transmission network needs to be strengthened and made reliable to support government's aim of achieving sustainability in the system," he said. He emphasized that the government was working on upgrading the existing transmission network to make it more reliable and efficient and NTDC has been asked to take the necessary measures. "At the same time private sector is being encouraged to contribute in network expansion," he said.

The Asian Development Bank (ADB) and Pakistan on Wednesday signed a $140million loan agreement to improve the provincial roads in Khyber Pakhtunkhwa (KP). The loan agreement was signed by ADB Country Director for Pakistan Xiaohong Yang and Economic Affairs Division (EAD) Secretary Syed Ghazanfar Abbas Jilani in Islamabad. Communication and Works Department Secretary Shahab Khattak and Pakhtunkhwa Highway Authority Managing Director Ahmed Nabi Sultan signed the project agreement on behalf of the government of KP. "The project signed here is a continuation of ADB support for upgrading Pakistan's vital infrastructure to stimulate economic growth and job creation." said Ms Yang. "ADB continues to look forward to work very closely with federal and provincial governments to accelerate economic development by -among others- developing road for improving mobility and connectivity." The overall cost of the project is around $164million, which the government of Pakistan would contribute only $24million and rest would be obtained as loan from the ADB .

As part of Doing Business Reforms agenda, the Securities and Exchange Commission of Pakistan (SECP) and the Federal Board of Revenue (FBR) have launched a one-window facility for company and national tax number (NTN) registration. Zafar Abdullah, the SECP chairman, and Khawaja Adnan Zahir, member (IT) FBR , jointly inaugurated the system during the launch ceremony held on Wednesday at the SECP’s head office, which was attended by senior officials of SECP , FBR , BoI and PRAL. Zafar Abdullah congratulated the teams of SECP , FBR and PRAL on putting in exhaustive efforts to develop the system. The SECP has undertaken a host of reform measures, which have resulted in a robust corporate growth in the country, leading to formalisation of the business sector and documentation of economy, he added.

The government on Wednesday admitted that some car assemblers were selling vehicles at higher rates and were not delivering some variants within the prescribed time of two months which was resulting in black marketing. Minister for Industries and Production Ghulam Murtaza Khan Jatoi in his written reply said "It is partially true, that the prices of automobiles are high as compared to the global prices." He said prices of Suzuki's Wagon-R and Swift are higher in Pakistan than India and Indonesia due to low volumes. Whereas the price of Toyota Altis produced in Pakistan is less than those prevailing in the regional countries. The minister said prices of Honda City and Civic are also less in Pakistan as compared to prices of these vehicles in Thailand, Indonesia and Malaysia. As per provided data, the price of Suzuki Wagon-R VXR is Rs10,74000 in Pakistan, where as it is being sold at Pak Rs85,1801 in India. Likewise Suzuki Swift 1.3 Deluxe is being sold at a price of Rs1375000 in Pakistan where the same car is being sold at a price of Rs900,000 in neighbouring country, India.

Technical Analysis

The Benchmark KSE100 Index is capped by a horizontal resistant region along with a descending trend line and these both indicators would try to cap mark move on intraday basis. Daily and Weekly momentum is in bullish mode but Hourly Stochastic and MAORSI have generated bearish crossover and these would try to push index downward on intraday basis along with help of Fibonacci correction, because on hourly chart index have completed its 61.8% correction and 74.6% falls at its horizontal resistant region of 43735 points. As of right now index would face resistance at 43735 and 43960 points while supportive regions falls at 43118 and 42860 points. Hourly chart also have generated a bearish engulfing during last trading session which is indication of a reversal pattern therefore its expected that index would remain under pressure during current trading session. Its recommended to book profits or sell on strength.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.