Previous Session Recap

Trading volume at PSX floor increased by 52.64 million shares or 60.2%, DoD basis, whereas, the benchmark KSE100 Index opened at 41239.89, posted a day high of 41316.74 and a day low of 40899.50 during the last trading session. The session suspended at 40943.78 with a net change of -296.11 and net trading volume of 57.49 million shares. Daily trading volume of KSE100 listed companies increased by 23.32 million shares or 68.26%,DoD basis.

Foreign Investors remained in a net selling position of 2.13 million shares but net net value of Foreign Inflow increased by 4.2 million US Dollars. Categorically, Foreign individuals and Overseas Pakistanis remained in net buying positions of 0.41 and 0.45 million shares but Foreign Corporate Investors remained in a net selling position of 2.99 million shares. While on the other side Local Individuals and Brokers remained in net buying positions of 11.12 and 0.1 million shares but Local Companies, Banks, Mutual Funds and Insurance Companies remain in net buying positions of 5.54, 0.26, 3.15 and 0.15 million shares.

Analytical Review

Asian stocks slipped on Wednesday after weaker crude oil prices took a toll on Wall Street, while the euro kept big gains after enjoying a boost from robust German economic growth. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.45 percent. China’s Shanghai index was down 0.7 percent, Australian stocks dropped 0.3 percent and South Korea’s KOSPI shed 0.3 percent. Japan’s Nikkei lost 0.9 percent. “The decline by U.S. equities led by energy shares is having a knock-on effect, dampening sentiment in sectors related to energy and industry,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management in Tokyo.

The receivables of Pakistan State Oil (PSO) have swelled to whooping over Rs307 billion resulting in the massive liquidity crisis for the state-owned entity mainly cropped up on account of huge default of worth over Rs276 billion by power sector and Rs15.7 billion by the PIA. According to the daily financial sheet unfolding the receivables and payables position of PSO as of today (November 13, 2017), also available with The News, the receivables of the state-owned entity has surged up to Rs307.1 billion owing to which its capacity to maintain the operations of importing the furnace oil for powerhouses and jet fuel for PIA has eroded manifold.

Fauji Fertilizer Bin Qasim Limited (FFBL) has increased DAP prices by Rs 50.00 per bag to Rs 2,670.00 per bag. The price increase will be effective from today (November 15, 2017). Other players in the industry have also increased DAP prices and revised average prices now stand at Rs 2,630.00 per bag. FFC DAP will also be available at the same rate. "Annualized earning per share (EPS) impact of the said development on both Fauji Fertilizer Company (FFC) and Engro Fertilizers Limited (EFERT) is Rs 0.02 and on FFBL is Rs 0.52", an analyst at JS Global Capital said.

The Federal government is likely to withdraw restrictions on import of cotton from December 1, 2017 aimed at allowing textile industry to import raw material at a competitive price, well-informed sources told Business Recorder. The sources said the country's cotton requirement is around 1.5 million bales but Cotton Crop Assessment Committee (CCAC) estimates cotton production would be around 12.6 million bales against the initial estimate of 14.04 million bales for the current season (2017-18). "Since Pakistan is deficient in cotton, we have recommended to the Economic Co-ordination Committee (ECC) of the Cabinet to allow cotton imports to meet industry's requirement," the sources added.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

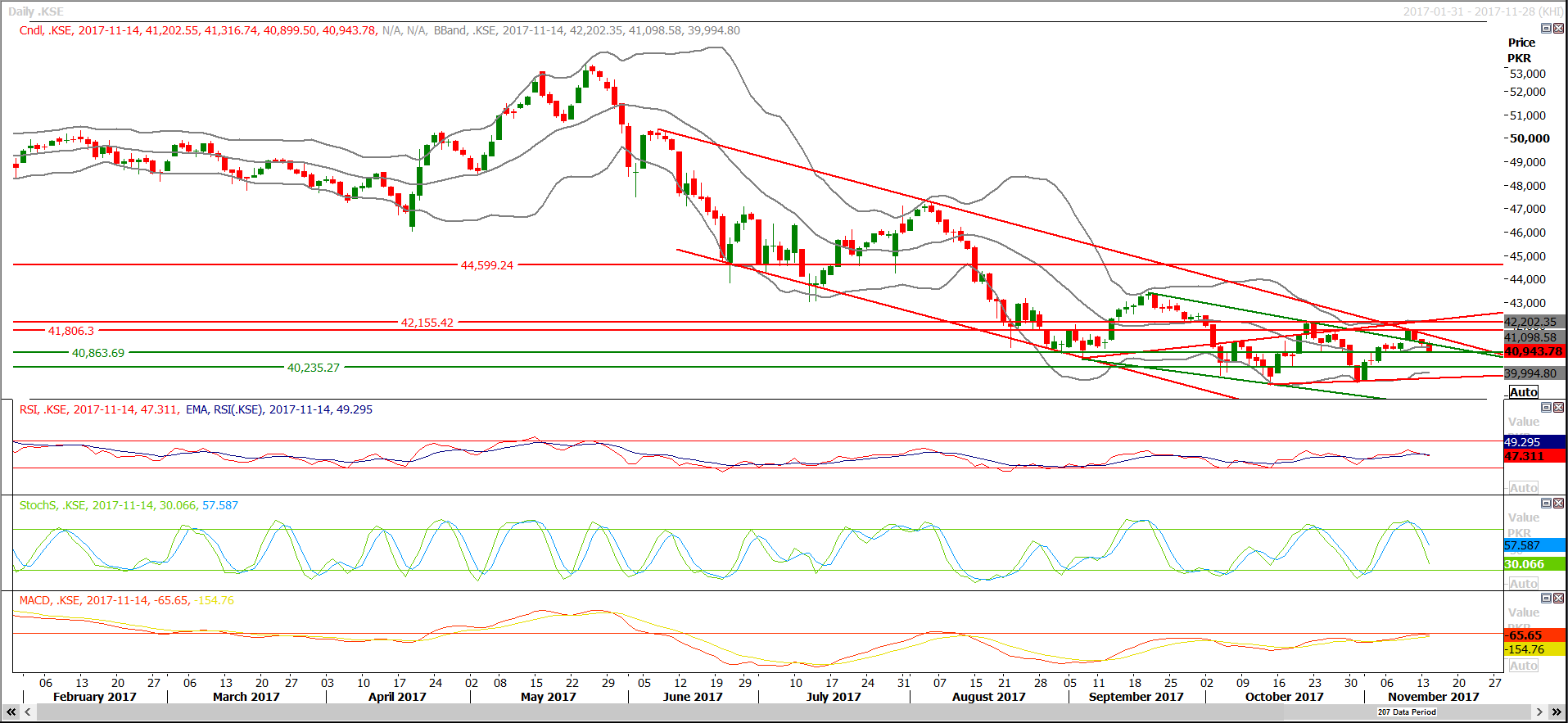

The Benchmark KSE100 Index is capped by a resistant trend line on the daily chart and it closed at a critical level during the last trading session which falls on a horizontal supportive line. For the current trading session Index has supportive regions at 40860 and 40500 while resistant regions are standing at 41800 and 42200. It is recommended to remain careful if index closes above 42200 or below 40860 as breakout of these levels in either direction might push index for a further 1000 points in respective direction. It is recommended to avoid new buying until a clear indication of trend from index on the daily chart. On Intraday basis a false breakout of 40860 might be witnessed in bearish direction but for initiating trades it’s recommended to wait for minimum hourly closing below or above this level.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.