Previous Session Recap

Trading volume at PSX floor increased by 78.00 million shares or 44.03% on DoD basis, whereas the Benchmark KSE100 index opened at 40,874.22, posted a day high of 41,322.77 and day low of 40,763.44 points during last trading session while session suspended at 40,994.05 with net change of -158.23 points and net trading volume of 146.56 million shares. Daily trading volume of KSE100 listed companies increased by 55.25 million shares or 60.61% on DoD basis.

Foreign Investors remained in net selling position of 3.87 million shares and net value of Foreign Inflow dropped by 8.52 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 6.12 million shares and Foreign Individuals and Overseas Pakistani investors remained in net buying positions of 0.19 and 2.05 million shares respectively. While on the other side Local Companies, NBFCs and Insurance Companies remained in net selling positions of 3.45, 0.24 and 2.07 million shares respectively but Local Individuals, Banks, Mutual Fund and Brokers remained in net buying positions of 0.69, 0.86, 4.61 and 2.47 million shares respectively.

Analytical Review

Asia edges up as oil slide slows; pound, euro firm on Brexit optimism

Asian stocks edged up on Thursday as a steep slide in crude oil prices which had chilled investor sentiment slowed, while the pound and euro were supported after British Prime Minister Theresa May gained cabinet support for a Brexit deal. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.15 percent. The index had declined 0.4 percent the previous day as plunging oil prices heightened anxiety about the outlook for broad demand and global growth. Australian stocks rose 0.15 percent while Japan's Nikkei .N225 shed 0.5 percent. All the same, stock market gains in Asia were limited after Wall Street extended their recent decline.

FBR policy, administrative functions to separate in 100 days, IMF assured

The government on Tuesday promised the International Monetary Fund (IMF) to separate policy and administrative functions of the Federal Board of Revenue (FBR) within first 100 days of its tenure and undertake a full-fledged effort for maximum recovery of more than Rs2 trillion tax and power dues. In a change of mind, the government has also planned to seek maximum financial support from the IMF to tide over its external account gap instead of earlier indications that it wanted smaller size of the bailout to keep conditionalities of the programme to a bare minimum.

In Pakistan's interest to seek IMF programme despite help from other countries: Asad Umar

Finance Minister Asad Umar has said it is still in Pakistan's interest to enter into a programme with the International Monetary Fund (IMF) to stabilise its economy, despite the agreements for financial assistance with other countries. Speaking on DawnNewsTV show News Wise on Wednesday, he said the financing arrangements made by the Pakistan Tehreek-i-Insaf (PTI) government have eliminated any foreseeable financing problems until June 30, 2019.

ECNEC approves six uplift projects across country

The Executive Committee of the National Economic Council (ECNEC) on Wednesday approved six development projects including upward revision in cost of Peshawar Sustainable Bus Rapid Transit Corridor Project.

Foreign firms keen on joint ventures in cement sector

The first three-day International Cement Conference concluded on Wednesday on a positive note as the global and local stakeholders entered negotiations over future cooperation and showed keen interest in joint ventures.

Asian stocks edged up on Thursday as a steep slide in crude oil prices which had chilled investor sentiment slowed, while the pound and euro were supported after British Prime Minister Theresa May gained cabinet support for a Brexit deal. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.15 percent. The index had declined 0.4 percent the previous day as plunging oil prices heightened anxiety about the outlook for broad demand and global growth. Australian stocks rose 0.15 percent while Japan's Nikkei .N225 shed 0.5 percent. All the same, stock market gains in Asia were limited after Wall Street extended their recent decline.

The government on Tuesday promised the International Monetary Fund (IMF) to separate policy and administrative functions of the Federal Board of Revenue (FBR) within first 100 days of its tenure and undertake a full-fledged effort for maximum recovery of more than Rs2 trillion tax and power dues. In a change of mind, the government has also planned to seek maximum financial support from the IMF to tide over its external account gap instead of earlier indications that it wanted smaller size of the bailout to keep conditionalities of the programme to a bare minimum.

Finance Minister Asad Umar has said it is still in Pakistan's interest to enter into a programme with the International Monetary Fund (IMF) to stabilise its economy, despite the agreements for financial assistance with other countries. Speaking on DawnNewsTV show News Wise on Wednesday, he said the financing arrangements made by the Pakistan Tehreek-i-Insaf (PTI) government have eliminated any foreseeable financing problems until June 30, 2019.

The Executive Committee of the National Economic Council (ECNEC) on Wednesday approved six development projects including upward revision in cost of Peshawar Sustainable Bus Rapid Transit Corridor Project.

The first three-day International Cement Conference concluded on Wednesday on a positive note as the global and local stakeholders entered negotiations over future cooperation and showed keen interest in joint ventures.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

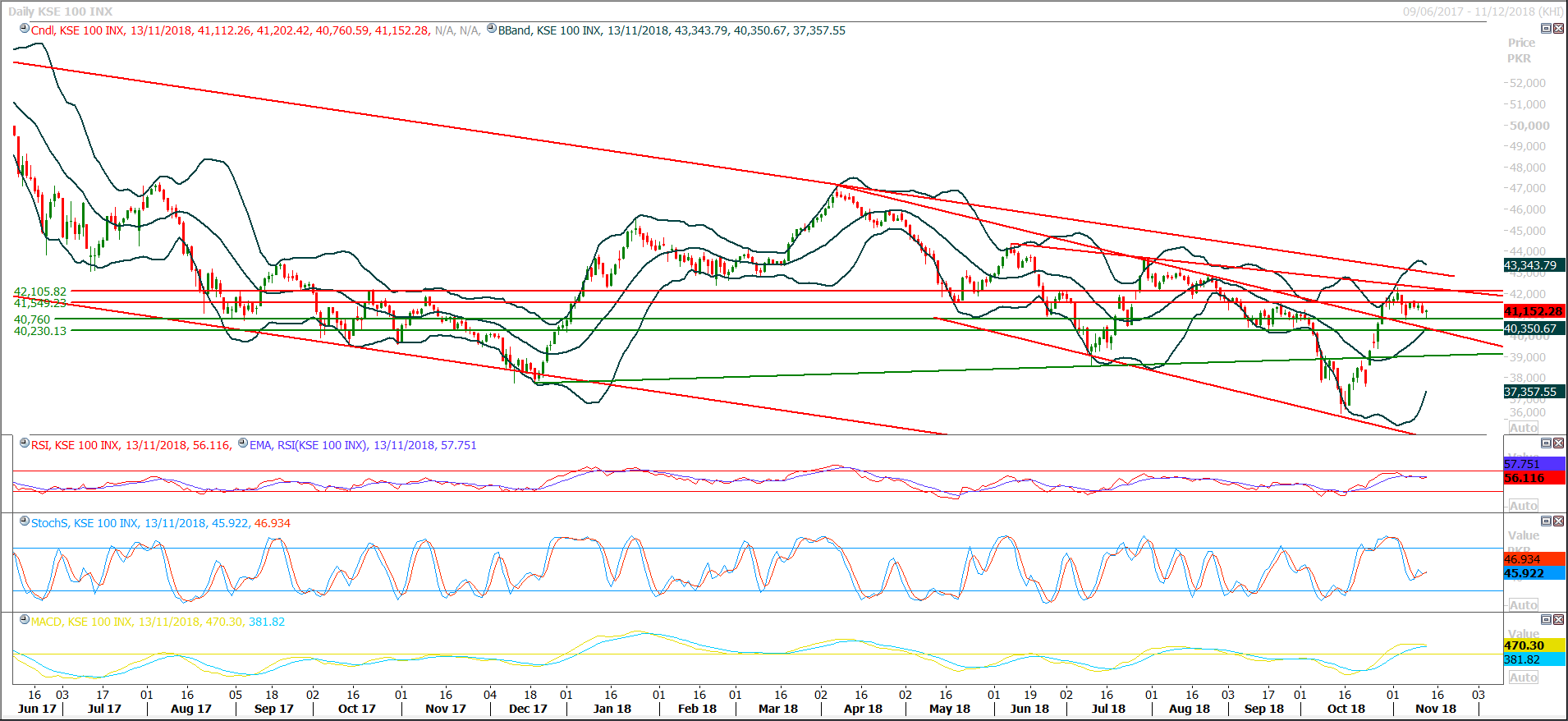

The Benchmark KSE100 Index have tried to bounce back after getting support from a horizontal supportive region and formatted a hammer on daily chart which have opened chances for creation of a morning star on daily chart if index would succeed in closing above 41,400 points during current trading session. But still index is capped by major resistances at 41,550 and 42,100 points and trend would remain bearish on short term basis until index would succeed in closing above 42,300 points on weekly chart therefore its recommended to start profit taking around 42,100 points and wait for a breakout of 42,300 points before initiating long positions. Hourly momentum indicators are ready for a bearish crossover and daily sentiment is still bearish therefore its recommended to stay cautious before initiating new positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.