Previous Session Recap

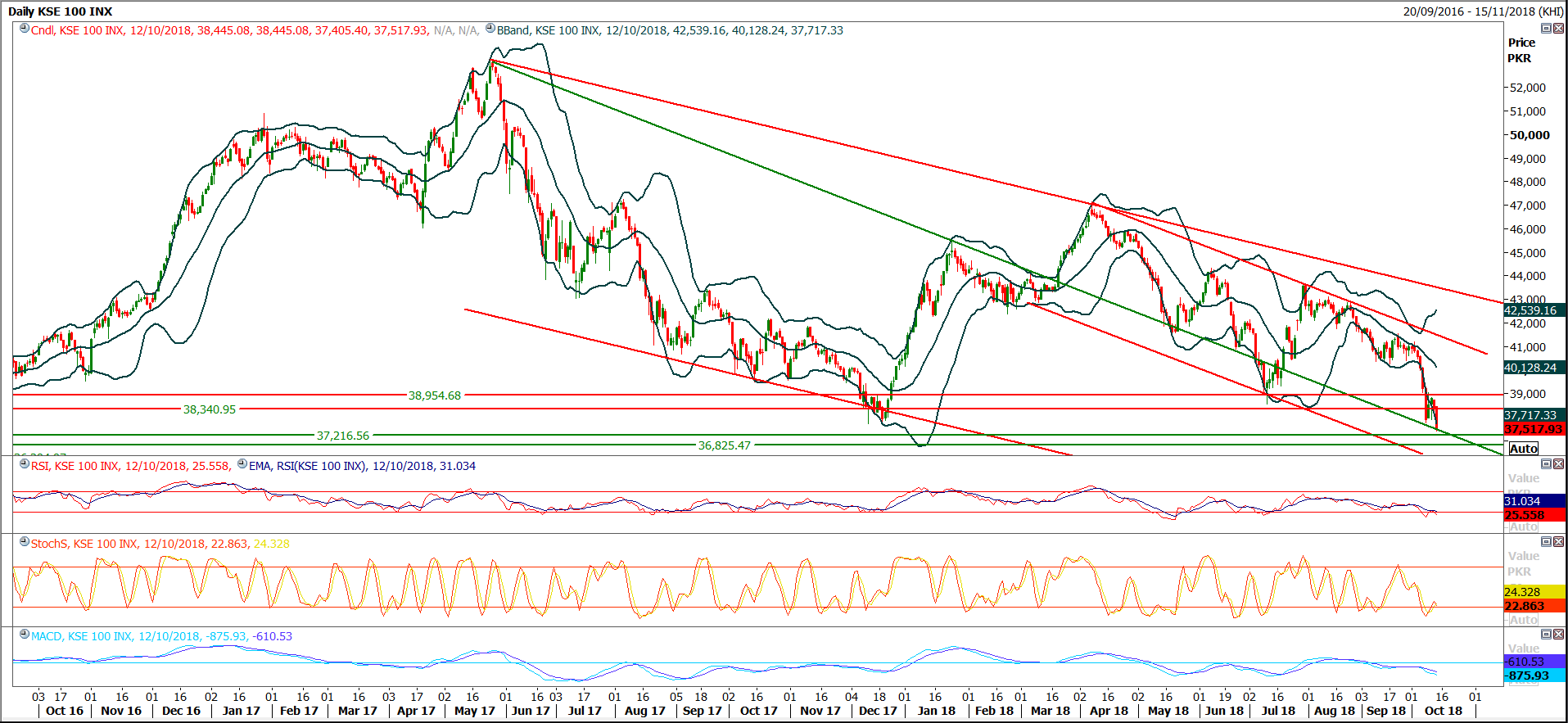

Trading volume at PSX floor increased by 0.81 million shares or 0.61% on DoD basis, whereas the Benchmark KSE100 index opened at 38,445.08, posted a day high of 38,445.08 and day low of 37,405.40 points while the session suspended at 37,517.93 with net change of -880.37 points and net trading volume of 92.22 million shares. Daily trading volume of KSE100 listed companies increased by 7.50 million shares or 8.86% on DoD basis.

Foreign Investors remained in net selling position of 3.09 million shares and net value of Foreign Inflow dropped by 0.61 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.01 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 1.85 and 3.09 million shares. While on the other side Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 4.30, 3.64, 5.47 and 2.58 million shares but Local Individuals, NBFCs and Brokers remained in net selling positions of 9.99, 1.14 and 2.60 million shares respectively.

Analytical Review

Asian shares resume descent, oil prices up on Saudi tensions

Asian shares slipped on Monday as worries over Sino-U.S. trade disputes, a possible slowdown in the Chinese economy and higher U.S. borrowing costs tempered optimism despite a rebound in global equities late last week. Not helping the mood, oil prices jumped and Saudi Arabian shares tumbled on rising diplomatic tensions between Riyadh and the West after the monarchy warned against threats to punish it over disappearance of a journalist critical of its policies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.8 percent while Shanghai shares .SSEC were down 0.4 percent in early trade. Japan's Nikkei .N225 dropped 1.4 percent, with carmaker shares .ITEQP.T hitting 13-month lows after Washington said it would seek a provision about currency manipulation in future trade deals with Japan.

World Bank to finance three hydropower projects in KP

World Bank has agreed to extend its financial support in energy sector of KP by constructing three hydropower projects in districts Upper Dir and Swat. The projects would attract heavy investment in KP as well as creating new job opportunities for the province. These power projects will also add billions of rupees in earnings annually to the provincial exchequer. In this context, a high level meeting was held with World Bank energy specialist leader Dr Rikard Liden and senior energy specialist Mohammad Saqib under the chairmanship of CM KP adviser on energy Himayat ullah Khan. The meeting was also attended by secretary energy Mohammad Salim Khan, PESCO Chief Amjad Ali Khan, CEO PEDO Engr. Zainullah Shah, Secretary SMBR Qaiser Khan, GM Hydel Bahadur Shah and Director PESCO Habib Khan Marwat.

Thar coal project likely to start operation by Dec

The first unit of Thar coal power plant is likely tocontribute 330 MW of electricity to the national grid by December 2018, six months ahead of given schedule as so far 92 percent work on coal mining while 93 percent work of power plant has been completed. Work on coal mining in Thar block II, and power plant near the site of coal mining started in 2016 and was earlier scheduled to be completed by June 2019, but due fast pace of the work, the project is being completed well ahead of given time.

Saudi Arabia’s investment delegation to reach Pakistan on 18th

An investment and business delegation led by senior government functionaries from Kingdom of Saudi Arabia will visit Pakistan by October 18 to negotiate on investment opportunities in different sectors. The investment and business delegation from KSA would negotiate with Pakistan side for increasing trade and investment in areas of petroleum, agriculture, textile and chemicals for enhancing cooperation between the two country, Secretary Commerce and textiles Muhammad Younas Dhaga told APP here on Sunday.

Egypt seeks to weave cotton renaissance

Treading carefully among his sprawling green plants in the Nile Delta, Egyptian farmer Fatuh Khalifa fills his arms with fluffy white cotton picked by his workers. Durable, fine and luxuriously soft, cotton sourced from Egypt has long been seen as the best on the market. But recent years have been far from smooth for the North African country's farmers. "I cultivate 42 hectares (104 acres) and it's expensive ... while the price (of cotton) is very low", said Khalifa, who has been growing the premium long-fibre variety for over 30 years.

Asian shares slipped on Monday as worries over Sino-U.S. trade disputes, a possible slowdown in the Chinese economy and higher U.S. borrowing costs tempered optimism despite a rebound in global equities late last week. Not helping the mood, oil prices jumped and Saudi Arabian shares tumbled on rising diplomatic tensions between Riyadh and the West after the monarchy warned against threats to punish it over disappearance of a journalist critical of its policies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.8 percent while Shanghai shares .SSEC were down 0.4 percent in early trade. Japan's Nikkei .N225 dropped 1.4 percent, with carmaker shares .ITEQP.T hitting 13-month lows after Washington said it would seek a provision about currency manipulation in future trade deals with Japan.

World Bank has agreed to extend its financial support in energy sector of KP by constructing three hydropower projects in districts Upper Dir and Swat. The projects would attract heavy investment in KP as well as creating new job opportunities for the province. These power projects will also add billions of rupees in earnings annually to the provincial exchequer. In this context, a high level meeting was held with World Bank energy specialist leader Dr Rikard Liden and senior energy specialist Mohammad Saqib under the chairmanship of CM KP adviser on energy Himayat ullah Khan. The meeting was also attended by secretary energy Mohammad Salim Khan, PESCO Chief Amjad Ali Khan, CEO PEDO Engr. Zainullah Shah, Secretary SMBR Qaiser Khan, GM Hydel Bahadur Shah and Director PESCO Habib Khan Marwat.

The first unit of Thar coal power plant is likely tocontribute 330 MW of electricity to the national grid by December 2018, six months ahead of given schedule as so far 92 percent work on coal mining while 93 percent work of power plant has been completed. Work on coal mining in Thar block II, and power plant near the site of coal mining started in 2016 and was earlier scheduled to be completed by June 2019, but due fast pace of the work, the project is being completed well ahead of given time.

An investment and business delegation led by senior government functionaries from Kingdom of Saudi Arabia will visit Pakistan by October 18 to negotiate on investment opportunities in different sectors. The investment and business delegation from KSA would negotiate with Pakistan side for increasing trade and investment in areas of petroleum, agriculture, textile and chemicals for enhancing cooperation between the two country, Secretary Commerce and textiles Muhammad Younas Dhaga told APP here on Sunday.

Treading carefully among his sprawling green plants in the Nile Delta, Egyptian farmer Fatuh Khalifa fills his arms with fluffy white cotton picked by his workers. Durable, fine and luxuriously soft, cotton sourced from Egypt has long been seen as the best on the market. But recent years have been far from smooth for the North African country's farmers. "I cultivate 42 hectares (104 acres) and it's expensive ... while the price (of cotton) is very low", said Khalifa, who has been growing the premium long-fibre variety for over 30 years.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index is trying to find support on a descending trend line on daily & weekly chart and this trend line have reacted as a major resistance previously. Index has not succeeded to penetrate said trend line in downward direction on weekly chart since it has closed above that trend line in March 2018. Now its fourth time and index is trying to penetrate said line in downward direction and if it would succeed in sliding below this trend line then index would try to target 36,825 and 36,300 points on immediate basis. For an intraday pull back index need to open above 37,700 points with a positive gap of around 200 points and if it would succeed in doing so then index can start a pull back towards 38,340 and 38,950 points during current trading session. It’s recommended to stay cautious and post strict stop loss on any kind of short or long positions until clear breakout of 37,200 in bearish direction or 38,300 points in bullish direction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.