Previous Session Recap

Trading volume at PSX floor increased by 43.31 million shares or 24..92% on DoD basis, whereas, the benchmark KSE100 Index opened at 42392.65, posted a day high of 42732.51 and day low of 42171.26 points during last trading session while session suspended at 42683.57 points with net change of 373.45(0.87%) points and net trading volume of 80.41 million shares. Daily trading volume of KSE100 listed companies dropped by 3.84 million shares or 4.56% on DoD basis.

Foreign Investors remain in net buying of 2.64 million shares and net value of Foreign Inflow increased by 7.77 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remain in net selling of 0.26 and 3.58 millionn shares but Foreign Corporate Investors remain in net buying of 6.48 million shares. While on the other side Local Individuals, Companies, Banks and Mutual Funds remain in net selling of 6.69, 11.10, 2.35 and 0.73 million shares respectively but Brokers and Insurance Companies remain in net buying of 16.26 and 1.98 million shares respectively.

Analytical Review

U.S. stock futures and Asian shares dipped after North Korea fired another missile over Japan into the Pacific Ocean on Friday, demonstrating Pyongyang’s defiance in the face of intensifying sanctions. U.S. stock futures ESc1 fell 0.2 percent while MSCI’s Asia-Pacific share index excluding Japan .MIAPJ0000PUS shed 0.4 percent, though it was still up 0.4 percent on the week. Japan's Nikkei .N225 ticked up 0.1 percent. Japan said the North Korean missile fell into sea about 2,000 km (1,240 miles) east of Hokkaido. The launch came just days after the U.N. Security Council approved new sanctions against Pyongyang for its Sept. 3 nuclear test, but markets are growing accustomed to North Korea’s sabre-rattling.

The government drastically reduced borrowing from the central bank in the first two months of 2017-18, causing a slowdown in the contraction of broad money. The government borrowed Rs115 billion from the State Bank of Pakistan (SBP) in July-August, which was just 15 per cent of its borrowing during the same period of 2016-17. In the last fiscal year, the government relied heavily on the central bank by borrowing Rs776bn in July-August and kept retiring the debt of commercial banks. The economy witnessed a monetary expansion of 13.69pc or Rs1,756bn in 2016-17, which helped it achieve over 5pc growth rate.

The State Bank of Pakistan has introduced new penalty structure to align the existing regime for cash processing functions. In a circular issued on Thursday, the central bank stated that in order to align the existing penalty regime for cash processing functions (CPC) with the Currency Management Strategy, a new penalty structure has been developed. This new penalty structure will supersede all previous penalty instructions regarding cash management operations of the banks, said the circular. All banks were advised to ensure strict compliance with the currency management instructions issued from time to time.

The government on Thursday decided in principle to expand incentive package for exporters and allowed subsidised export of half a million tonnes of sugar at the rate of Rs10.70 per kg. The decisions were taken at meeting of the Economic Coordination Committee (ECC) of the Cabinet presided over by Prime Minister Shahid Khaqan Abbasi. The meeting also extended the date for wheat export. The meeting reviewed the impact of Prime Minister’s Export Package towards boosting the country’s exports. The Export Package worth Rs180 billion announced in January this year offered incentives to the exporters of textile and non-textile sectors for enhancing their export potential.

Buoyancy in the domestic cement market continued unabated in August as well as local sales increased by 10.85 percent compared with sales during corresponding month of last year but exports nosedived by 26.47 percent reducing overall sales growth to 5.05 percent only. According to the data for August 2017, cement despatches in the month were 3.766 million tons as compared to 3.585 million tons in August 2016. In August 2017 the domestic cement despatches in the northern region were 2.731 million tons against despatches of 2.495 in August 2016 whereas the despatches in the southern region were 0.625 million tons in August 2017 against despatches of 0.532 million tons in same month last year. Exports from north were 0.307 million tons last month against 0.355 million tons in August 2016. The exports from the south stood at 0.103 million tons in August 2017 against exports of 0.203 million tons in August last year.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and selling on strength is recommended.

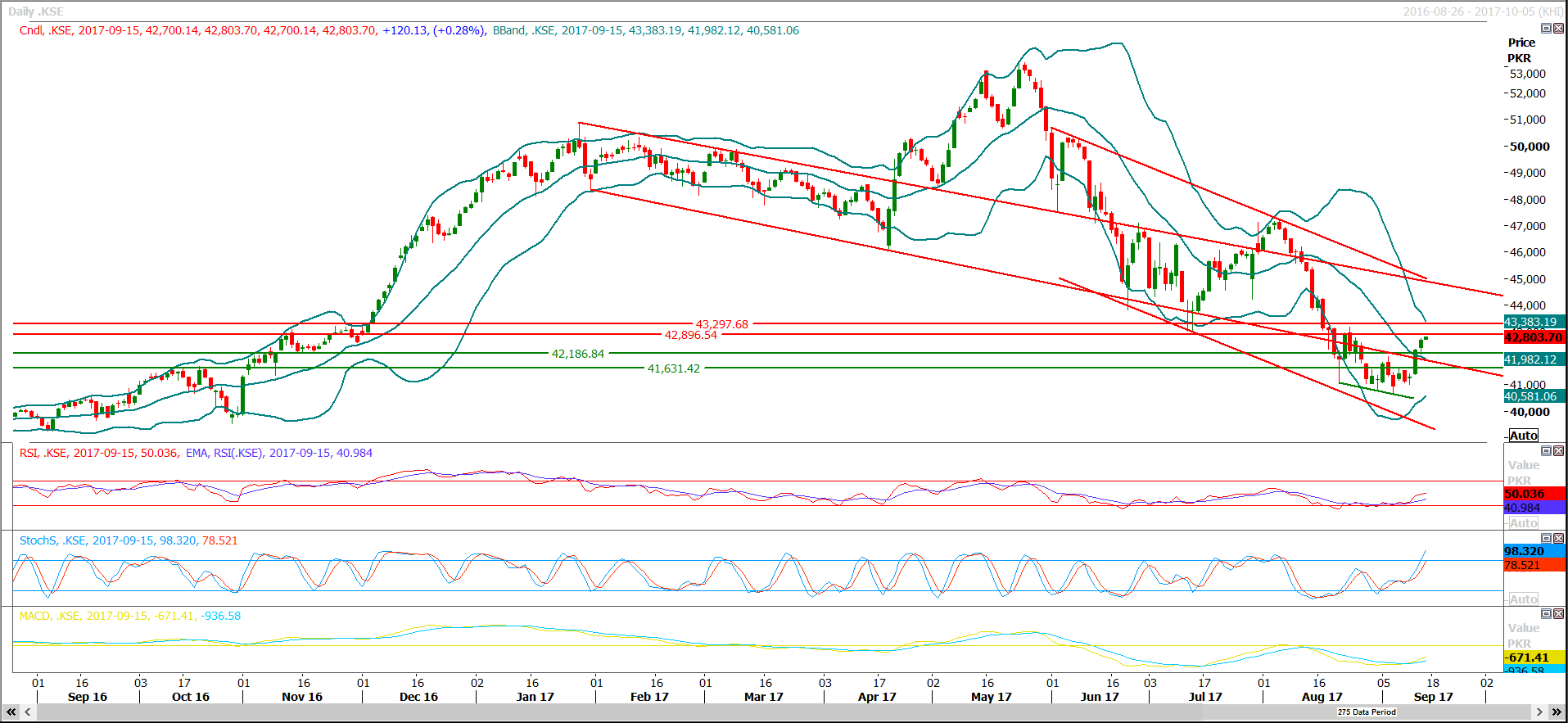

Technical Analysis

The Bench Mark KSE100 Index is capped by a resistant trend line on hourly chart along with a horizontal resistance at 42896 points. Breakout of this level will call for 43053 and 43200 points, from these regions a correction is expected therefore selling on strength is recommended. Index will try to close around 42580 points for a further bearish move in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.