Previous Session Recap

The Bench Mark KSE100 Index Opened at 46185.27, posted day high of 46635.31 and day low of 46141.79 during last trading session while session suspended at 46358.35 points with net change of 173.08 points and net trading volume of 171.81 million shares. Daily trading volume of KSE100 listed companies dropped by 29.22 million share or 14.54% on DOD bases.

Foreign Investors remained in net buying position of 1.11 million shares but net value of Foreign inflow dropped by 4.79 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani Investors remained in net buying position of 0.048 and 1.18 million shares but Foreign Corporate Investors remained in net selling position of 0.12 million shares. While on the other hand, Local Individuals, Banks and Brokers remained in net selling position of 3.86, 0.61 and 15.1 million shares respectively but Local Companies and Mutual Funds remained in net buying position of 22.84 and 9.9 million shares respectively.

Analytical Review

The dollar stood near a 14-year peak, bond yields were highly elevated and Asian stocks struggled for traction on Friday as global markets continued adjusting to the idea of higher U.S. interest rates. In a move that reverberated across the financial markets, the Fed on Wednesday raised rates for the first time in a year and projected three more increases in 2017, up from the two projected in September. The dollar index against other major currencies last stood at 103.10 after storming to 103.56 overnight, its highest since December 2002. The euro was steady at $1.0427 after hitting $1.0366 overnight, its lowest since January 2003. The dollar was little changed at 118.250 yen after surging to a 10-month high of 118.660 the previous day. The prospect of the Fed tightening monetary policy next year faster than earlier expected drove the benchmark U.S. Treasury 10-year yield to highs unseen in two years.

The Private Power Infrastructure Board (PPIB) has urged the authorities to amend Request for Proposals (RfPs) Implementation Agreement (IA) and Power Purchase Agreement (PPA) for the proposed 1,200MW RLNG-fired power plant in Muzaffargarh in the light of Nepra directives.

The government on Thursday reversed its decision of November 25 to reduce gas prices for the industrial sector by 33 per cent following a strong protest from the Punjab government and Punjab-based textile industry. Instead, the reduction in gas rates has now been diverted to the power generation sector — including public-sector power plants and independent power producers (IPPs) — to give some relief to the textile industry in Punjab. On Nov 25, the Economic Coordination Committee (ECC) of the Cabinet led by Finance Minister Ishaq Dar approved the reduction in the gas price for all industries from Rs600 per million British thermal units (mmBtu) to Rs400 per mmBtu to pass on the benefit of the drop in the Brent crude price in the international market.

Pakistan Sugar Mills Association (PSMA) has sought permission to export 0.5 million tons of sugar by March 31, 2017, with a slight hope of subsidy due to a declining trend in prices of sugar in international market.

The Senate blocked Companies Ordinance 2016 with a majority vote on Thursday on the grounds that it should be promulgated through parliament. It was the third setback for the PML-N government in three years as the upper house has earlier rejected two presidential ordinances citing the same reason. The Companies Ordinance 2016, which was to replace the Companies Ordinance of 1984, was rejected by the Senate within minutes of the start of the session. It was promulgated on Nov 12 by the president of Pakistan, possibly as a shorter route by the government to fulfil certain international obligations for the country to upgrade its corporate laws.

ISL, ASL, SEARL, SMBL, and PSMC can lead market in positive direction.

Technical Analysis

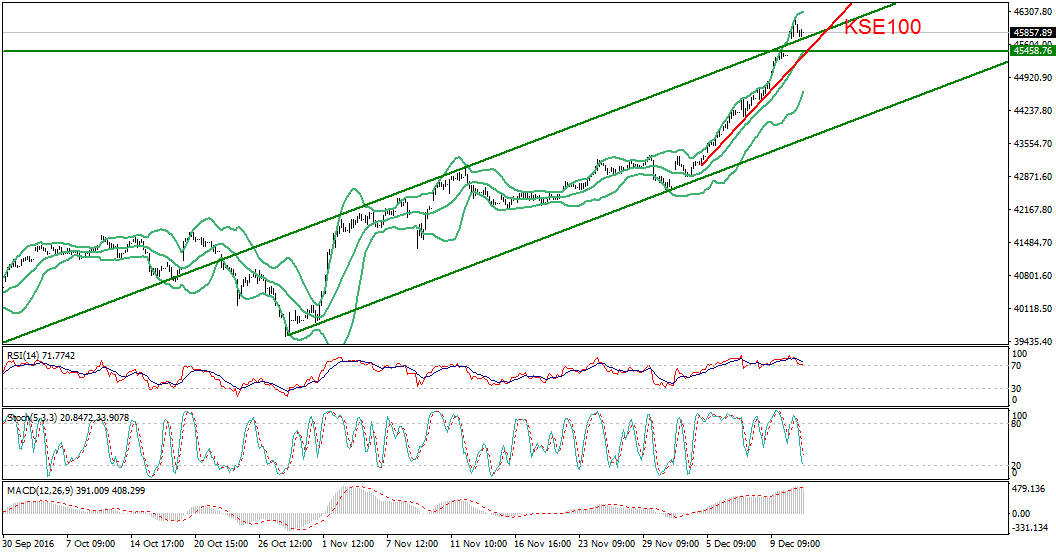

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction with a gap of around 408 points on Tuesday but has tried to cover that gap during last trading session. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 45700 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as it can try to fulfill its Gap and a slight pressure can be witnessed on oil sector from international crude oil prices. Market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.