Previous Session Recap

The Bench Mark KSE100 Index Opened at 49833.70 points with a positive gap of 65 points, posted day high of 49920.28 and day low of 49097.02 points during last trading session while session suspended at 49214.15 points with net change of -553.76 points and net trading volume of 156.6 million shares. Daily trading volume of KSE100 Index increased by 20.22 million shares or 14.82% on DOD bases.

Foreign Investors remained in net buying position of 4.73 million shares and net value of Foreign Inflow increased by 3.24 million US Dollars. Categorically Foreign Individuals remained in net selling position of 33297 shares but Foreign Corporate and Overseas Pakistani investors remained in net buying position of 0.77 and 3.99 million shares. While on the other side Local Individuals, NBFCs, Mutual Funds and Brokers remained in net selling position of 7.22, 0.69, 8.63 and 4.41 million shares respectively but Local Companies and Banks remained in net buying position of 3 and 8.64 million shares respectively.

Analytical Review

Asia Stock Rally Fizzles as Bonds Gain, whereas Yen Jumps. Stocks in Tokyo fell as the yen jumped and U.S. Treasuries climbed after five straight days of declines. The moves came after the MSCI All-Country World Index closed at an all-time high on Wednesday. Evidence of firming U.S. inflation had spurred bets that the economy can withstand higher interest rates as it waits for stimulus from the Trump administration. The dollar slipped against most major currencies.

SC seeks details of Qatari investment in Pakistan. The top court has asked the Sharif family to provide details of the Qatar royal family’s investment in Pakistan and also submit conclusive documentary evidence to establish that Prime Minister Nawaz Sharif’s son Hussain Nawaz is the beneficial owner of Park Lane flats in London. Justice Ijazul Ahsan remarked that no document had been produced regarding the generation of money by Qatar’s investment, as well as ownership of the flats. He also observed that there was no document, which could substantiate the money trail.

The government on Wednesday while revising the prices of petroleum products for the next fortnight has increased the prices of petrol and high speed diesel (HSD) by Rs 1 per litre each, effective from February 16. Addressing a press conference Federal Minister for Finance and Revenue, Ishaq Dar said the prices of petrol and HSD have been increased by one rupee per litre each. He maintained that the prices of light diesel oil (LDO) and kerosene oil (KO) will remain unchanged. The finance minister said the government will have to bear a financial burden of Rs 3 billion as subsidy for not increasing the prices as proposed by OGRA. The Oil and Gas Regulatory Authority (OGRA) has proposed to hike prices of petrol and high-speed diesel by Rs 1.91 per litre and Rs 2.03 per litre respectively.

Market is expected to remain volatile. Traders are advised to exercise caution, take profit on higher levels and buy on dips.

Technical Analysis

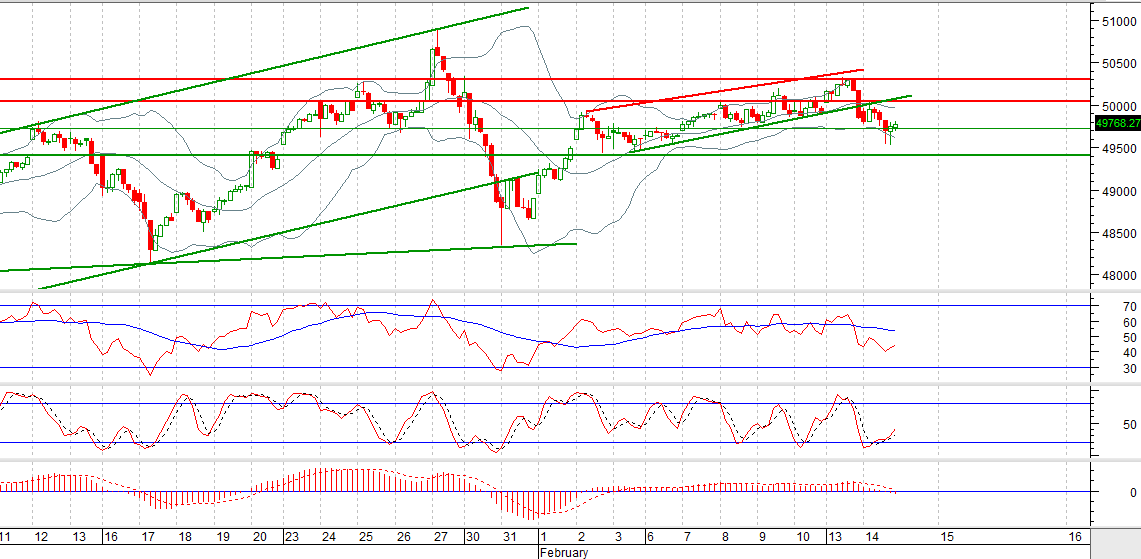

The Bench Mark KSE100 Index is not being able to break its channel and right now bearish momentum is becoming strong on hourly chart KSE100 Index have completed its 100% expansion of last hourly bearish correction. During current trading session a bounce back of 250-300 points can be witnessed in Index as it will try to take a correction of its bearish move after getting support from a supportive trend line and horizontal supportive region of 49021 points, but still its capped by a resistant trend line along with a horizontal line. Hourly Stochastic and RSI are also ready for an intraday pull back. Clear breakout of 49021 and 48952 points will call for 48620 points so trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.