Previous Session Recap

Trading volume at PSX floor increased by 43.97 million shares or 19.39% on DoD basis, whereas the benchmark KSE100 index opened at 40,514.17, posted a day high of 41,077.82 and a day low of 40,514.17 points during last trading session while session suspended at 40,916.59 points with net change of 402.42 points and net trading volume of 180.34 million shares. Daily trading volume of KSE100 listed companies increased by 26.26 million shares or 17.05% on DoD basis.

Foreign Investors remained in net selling positions of 4.40 million shares but value of Foreign Inflow dropped by 3.25 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.05 million shares but Foreign Corporate and Overseas Pakistanis remained in net selling positions of 3.57 and 0.89 million shares. While on the other side Local Individuals, Banks and Mutual Fund remained in net buying positions of 11.68, 0.42 and 0.78 million shares but Local Companies, NBFCs, Brokers and Insurance Companies remained in net selling positions of 3.46, 0.06, 4.97 and 0.80 million shares respectively.

Analytical Review

Asian shares up as 'phase one' trade deal boosts confidence

Asian shares moved higher on Monday as investors welcomed a trade agreement between Beijing and Washington over the weekend, but enthusiasm was capped by lingering scepticism about the deal and ongoing relations between China and the United States. U.S. Trade Representative Robert Lighthizer on Sunday said a deal was “totally done”, notwithstanding some needed revisions, and would nearly double U.S. exports to China over the next two years. That helped push the MSCI’s broadest index of Asia-Pacific shares outside Japan, which had touched its highest level since April 24 on Friday, up 0.27%. Australia’s S&P/ASX 200 led the way as it jumped 1.24%, while shares in Taiwan and South Korea added about 0.1%. But Chinese investors had a more tepid reaction, pulling the benchmark Shanghai Composite index down 0.16% as investors took profits following a 1.8% gain on Friday.

Govt may issue Ijara Sukuk next month to raise Rs700bn

The government is expecting to raise up to Rs700 billion next month through domestic Ijara Sukuk to support its budgetary position and deepen the Islamic banking industry. A senior government official told Dawn that the Ministry of Finance would give a detailed presentation to the coming meeting of the federal cabinet about the country’s debt profile and an attractive opportunity to raise funds from the domestic market. He said the cabinet was requested last week to grant the go-ahead for “issuance of Islamic Ijara Sukuk against unencumbered land of Jinnah International Airport, Karachi” in the domestic market for which three banks had already been selected as transaction advisers through a transparent process.

PM steps in to save power firm from default

On the intervention by the Prime Minister Office, the power division has resolved a dispute over the signing of a formal power purchase agreement (PPA) to save Neelum-Jhelum Hydropower Company (NJHPC) from default. The Rs510 billion power project attained 969MW generation capacity in August last year and has since been providing electricity to the national grid without any payment. The non-signing of the PPA between the Central Power Purchasing Agency (CPPA) and NJHPC had resulted in a circular debt build-up of about Rs75bn. In recent meetings with various top functionaries, NJHPC chief executive officer Brig Mohammad Zareen had warned that non-payment of dues would have serious political, financial and reputation risks to the government. This was because the delayed payments would require the government to increase consumer tariff to clear its backlog of over Rs75bn and avoid exposing the guarantees of the government and Water and Power Development Authority (Wapda) to default.

Israel eyes Dubai expo as ‘portal’ to Arab world

With the world’s largest trade fair opening in an Arab country for the first time next year, Israel is stepping up preparations, hoping to boost nascent ties with regional neighbours. The Dubai Expo 2020 trade fair will gather nearly 200 countries vying for the attention of a projected 25 million visitors over nearly six months from October. Like most Arab countries, the United Arab Emirates has no diplomatic relations with Israel. But the Jewish state has been quietly moving closer to Gulf Arab countries on the basis of shared security interests and a common enemy — Iran.

President reconstitutes National Economic Council

President Dr Arif Alvi has reconstituted the National Economic Council (NEC), the highest advisory body for economic development in the country. According to details, the President on the advice of the Prime Minister has reconstituted the National Economic Council under Article 156(1) of the Constitution. The NEC will now comprise of 13 members under the chairmanship of Prime Minister Imran Khan, and four provincial chief ministers, Advisor to the PM on Finance, Revenue and Economic Affairs Abdul Hafeez Shaikh, Advisor to the PM on Commerce, Textile, Industry and Production, and Investment Abdul Razak Dawood, Advisor to the PM on Institutional Reforms and Austerity Ishrat Hussain, Provincial Minister of Punjab for Finance Hashim Jawan Bakht, Provincial Minister of Khyber Pakhtunkhwa for Finance Taimur Saleem Khan Jhagra.

Asian shares moved higher on Monday as investors welcomed a trade agreement between Beijing and Washington over the weekend, but enthusiasm was capped by lingering scepticism about the deal and ongoing relations between China and the United States. U.S. Trade Representative Robert Lighthizer on Sunday said a deal was “totally done”, notwithstanding some needed revisions, and would nearly double U.S. exports to China over the next two years. That helped push the MSCI’s broadest index of Asia-Pacific shares outside Japan, which had touched its highest level since April 24 on Friday, up 0.27%. Australia’s S&P/ASX 200 led the way as it jumped 1.24%, while shares in Taiwan and South Korea added about 0.1%. But Chinese investors had a more tepid reaction, pulling the benchmark Shanghai Composite index down 0.16% as investors took profits following a 1.8% gain on Friday.

The government is expecting to raise up to Rs700 billion next month through domestic Ijara Sukuk to support its budgetary position and deepen the Islamic banking industry. A senior government official told Dawn that the Ministry of Finance would give a detailed presentation to the coming meeting of the federal cabinet about the country’s debt profile and an attractive opportunity to raise funds from the domestic market. He said the cabinet was requested last week to grant the go-ahead for “issuance of Islamic Ijara Sukuk against unencumbered land of Jinnah International Airport, Karachi” in the domestic market for which three banks had already been selected as transaction advisers through a transparent process.

On the intervention by the Prime Minister Office, the power division has resolved a dispute over the signing of a formal power purchase agreement (PPA) to save Neelum-Jhelum Hydropower Company (NJHPC) from default. The Rs510 billion power project attained 969MW generation capacity in August last year and has since been providing electricity to the national grid without any payment. The non-signing of the PPA between the Central Power Purchasing Agency (CPPA) and NJHPC had resulted in a circular debt build-up of about Rs75bn. In recent meetings with various top functionaries, NJHPC chief executive officer Brig Mohammad Zareen had warned that non-payment of dues would have serious political, financial and reputation risks to the government. This was because the delayed payments would require the government to increase consumer tariff to clear its backlog of over Rs75bn and avoid exposing the guarantees of the government and Water and Power Development Authority (Wapda) to default.

With the world’s largest trade fair opening in an Arab country for the first time next year, Israel is stepping up preparations, hoping to boost nascent ties with regional neighbours. The Dubai Expo 2020 trade fair will gather nearly 200 countries vying for the attention of a projected 25 million visitors over nearly six months from October. Like most Arab countries, the United Arab Emirates has no diplomatic relations with Israel. But the Jewish state has been quietly moving closer to Gulf Arab countries on the basis of shared security interests and a common enemy — Iran.

President Dr Arif Alvi has reconstituted the National Economic Council (NEC), the highest advisory body for economic development in the country. According to details, the President on the advice of the Prime Minister has reconstituted the National Economic Council under Article 156(1) of the Constitution. The NEC will now comprise of 13 members under the chairmanship of Prime Minister Imran Khan, and four provincial chief ministers, Advisor to the PM on Finance, Revenue and Economic Affairs Abdul Hafeez Shaikh, Advisor to the PM on Commerce, Textile, Industry and Production, and Investment Abdul Razak Dawood, Advisor to the PM on Institutional Reforms and Austerity Ishrat Hussain, Provincial Minister of Punjab for Finance Hashim Jawan Bakht, Provincial Minister of Khyber Pakhtunkhwa for Finance Taimur Saleem Khan Jhagra.

Market is expected to remain volatile during current trading session.

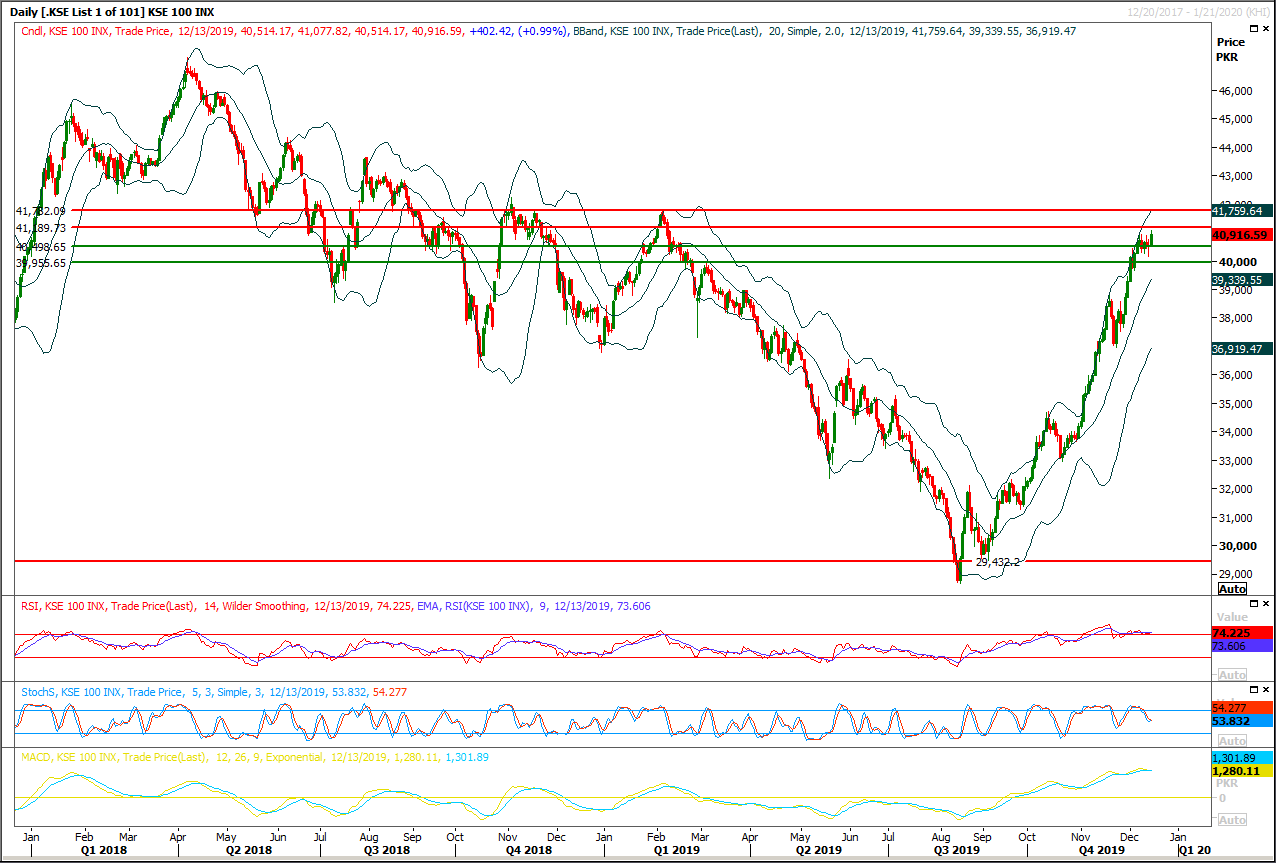

Technical Analysis

The Benchmark KSE100 have penetrated its previous high after two weeks but could not succeed in closing above that region. As of now index have succeed in closing above a strong resistant trend line on hourly chart and this trend line would try to react as a strong support now and would try to push index towards 41,200 and 41,800 points in coming days if it would succeed in maintaining above said trend line. Daily momentum indicator are trying to generate bullish crossovers but all this depends on today's closing. It's recommended to stay cautious in case of any bearish pressure even on intraday basis.

While on flip side incase index would succeed in maintaining above 40,800 points then bullish sentiment would start prevailing but hourly closing below said region would start adding pressure on index and index would start losing strength after posting a double top on daily chart. While in case of breakout below 40,800 points on hourly basis would increase potential for a daily bearish engulfing pattern which may lead index towards 40,000 points in coming days. Index would enter in bearish zone if it would close below 40,000 points on daily chart.

While on flip side incase index would succeed in maintaining above 40,800 points then bullish sentiment would start prevailing but hourly closing below said region would start adding pressure on index and index would start losing strength after posting a double top on daily chart. While in case of breakout below 40,800 points on hourly basis would increase potential for a daily bearish engulfing pattern which may lead index towards 40,000 points in coming days. Index would enter in bearish zone if it would close below 40,000 points on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.