Previous Session Recap

Trading volume at PSX floor dropped by 108.19 million shares or 45.33% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43891.16, posted a day high of 43897.82 and a day low of 42270.38 during last trading session. The session suspended at 42347.49 with net change of -586.23 and net trading volume of 55.75 million shares. Daily trading volume of KSE100 listed companies dropped by 53.21 million shares or 48.83% on DoD basis.

Foreign Investors remained in net buying of 4.9 million shares and net value of Foreign Inflow increased by 7.45 million shares. Categorically, Foreign Individuals Corporate and Overseas Pakistani investors remained in net buying of 0.09, 0.94 and 3.87 million shares respectively. While on the other side Local Individuals, Banks, Mutual Funds and Insurance Companies remained in net buying of 0.45, 0.91, 1.75 and 4.83 million shares respectively but Local Companies, NBFCs and Brokers remained in net selling of 1.06, 2.88 and 7.08 million shares respectively.

Analytical Review

Asian shares slumped on Tuesday, as miners were pressured by weaker Chinese iron ore prices, while the euro stood near a 3-year peak on rising expectations that the European Central Bank could pare its monetary stimulus. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.2 percent in early trade. U.S. markets were closed for a public holiday on Monday. Australian shares slipped 0.5 percent. Chinese iron ore futures tumbled 2 percent on Monday, as stockpiles of the steelmaking commodity at China’s ports surged to the highest since at least 2004, with weaker steel prices also adding pressure. Japan's Nikkei stock index .N225 was slightly higher in early trading, but momentum was heavy with exporters struggling to shake off the effect of a stronger yen.

The government is committed to finalising the process of privatisation of loss-making Pakistan International Airlines' (PIA) core business before April 15, Minister for Privatisation Daniyal Aziz said on Monday. Addressing a press conference in Islamabad, the minister emphasised that the government plans to sell only the core business relating to management and flight operations of the national flag carrier, whereas the rest of the business would remain in the government's custody. The government is also planning to establish another company under which all the fixed assets of PIA would be managed, he said. Aziz claimed that during the privatisation process, all legal rights and monetary benefits of PIA employees will be "fully protected".

Prime Minister Shahid Khaqan Abbasi Monday said that Mari Petroleum Company (MPCL) has played an active role in alleviating the energy deficiency in the country. Prime Minister Shahid Khaqan made these remarks during the annual function of MPCL here. Prime Minister commended Mari Petroleum for undertaking production enhancement initiatives in Mari Field and other blocks to help country in bridging the ever-increasing gap between demand and supply of energy. He further said that the company’s effort to provide uninterrupted gas supply to downstream customers for the last five decades is an unmatched achievement that has made Mari Field a model for all other operators in the country to follow.

A meeting with representatives of Wapda Hydro Electric Workers Union (CBA) was held to discuss resolution of various issues faced by staff Wapda House Lahore. The discussions lasted for well over seven hours and almost 64 demands of the CBA were deliberated upon threadbare. For the first time, all CEOs of the Discos also participated in this session so that the issues could be resolved in a comprehensive manner with collective wisdom of all stakeholders. During the meeting it was noted that mostly the demands of the CBA are genuine and need serious consideration for effective resolution. It was also observed that in case all of these demands are affirmatively resolved, it will massively increase financial burden on the Discos . Hence, it was expressed that due to poor financial health of the Discos , it is not an opportune time to place these demands before the PEPCO board for approval despite a strong desire of the management to resolve all these issues.

The Securities Exchange Commission of Pakistan, with an objective to reduce regulatory burden and to promote ease of doing business, has approved rationalization of existing licensing regime for securities brokers. In order to provide ease of doing business, without compromising on regulatory objectives, the Commission has approved that a single licence would be issued to a securities broker. A licensed securities broker would not require all other mandatory licenses including futures broker, securities advisor, futures advisor and accredited representative. As per new simplified procedure for annual renewal, a security broker will only required to provide recommendation from the Pakistan Stock Exchange (PSX) along with an undertaking from the securities broker and deposit of regulatory fee.

Market is expected to remain volatile.

Technical Analysis

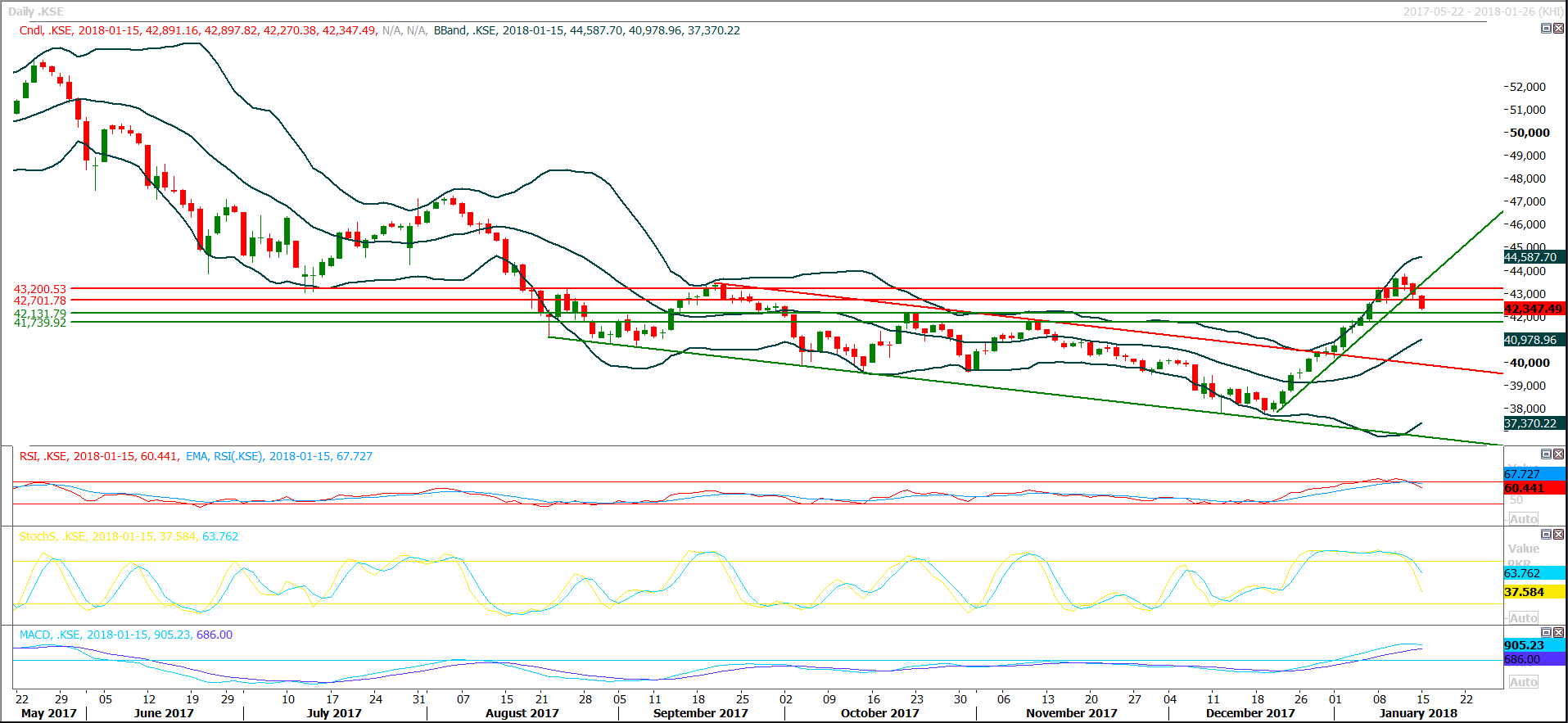

The Benchmark KSE100 Index have slipped below its major supportive region of 42700 after creating a bearish crossovers on daily Stochastic and MAORSI. As of right now index have supportive region around 42131 and penetration of this region in downward direction would call for 41700 points. Its expected that Index would find ground near 40500 in coming days therefore its recommended to sell on strength during current trading session. For new buying its recommended to wait for 42100-42000 region and then initiate buying with strict stop loss of 41700.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.