Previous Session Recap

Trading volume at PSX floor increased by 59.77 million shares or 25.91% on DoD basis, whereas the benchmark KSE100 index opened at 34,273.73, posted a day high of 36,212.38 and a day low of 34,273.73 points during last trading session while session suspended at 36,060.88 points with net change of 104.19 points and net trading volume of 237.69 million shares. Daily trading volume of KSE100 listed companies also increased by 49.37 million shares or 26.22% on DoD basis.

Foreign Investors remained in net selling positions of 15.63 million shares but value of Foreign Inflow dropped by -12.36 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.11 million shares but Foreign Corporate and Overseas Pakistani remained in net selling positions of 10.77 and 4.97 million shares respectively. While on the other side Banks, Mutual Fund, Brokers and Insurance Companies remained in net long positions of 6.36, 1.85, 12.33 and 5.78 million shares but Local Individuals, Companies and NBFCs remained in net selling positions of 8.75, 1.33 and 0.001 million shares respectively.

Analytical Review

Stocks reel as Fed leads global rescue effort for markets

Stock markets and the dollar were roiled on Monday after the Federal Reserve slashed interest rates in an emergency move and its major peers offered cheap U.S. dollars to break a logjam in global lending markets. The aggressive policy steps were aimed at cushioning the economic impact as the breakneck spread of the coronavirus all but shut down more countries, but had only limited success in calming panicky investors. Data out of China also underscored just how much economic damage the disease had already done with industrial output plunging 13.5% and retail sales 20.5%.

Special economic zones to increase exports to $1.5bn

Special economic zones (SEZs) could help Pakistan enhance its exports to around $1-1.5 billion annually in the short run by ensuring effective planning, said an industry official on Sunday. “Investors from China, Turkey, Korea and Britain have pumped $1.10 billion into SEZs and they are bringing in more investors from their countries to invest in Pakistan,” stated Mian Kashif Ashfaq, chairman of the Faisalabad Industrial Estate Development and Management Company (FIEDMC). He said these investors expressed their eagerness to explore the possibility of investment in diverse sectors of Pakistan, especially ceramics, chemicals, steel, food processing and automobiles.

Gas companies told to cut tariff, lower revenue targets

In a major policy shift, the government has formally directed the board of directors and managing directors of the two gas utilities to give up major revenue streams to provide relief to consumers through lower tariff. In a letter, the petroleum division has asked the chairpersons and managing directors of the Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) to seek approval of their boards for lower revenue requirements in the consumer tariff. In the letter, seen by Dawn, the companies have been asked to reduce their benchmarks of unaccounted for gas (UFG) from 6.3 per cent allowed by the Oil & Gas Regulatory Authority (Ogra) to 4pc. This will cut gas companies’ revenue by Rs10bn a year.

Aramco's 2019 profit falls 21 per cent, plans to adjust capital spending

Oil giant Saudi Aramco on Sunday posted a 21 per cent decline in 2019 net profit due to a drop in oil prices and production, and said it plans to “rationalise” capital spending in the wake of the coronavirus outbreak. This was Aramco’s first earnings announcement after it listed in December in a record $29.4 billion initial public offering (IPO) that valued the company at $1.7 trillion. Its shares fell below the IPO price last week for the first time, as oil prices crashed after the collapse of an output deal between Opec and non-Opec members which led to an oil price war between Riyadh and Moscow.

Finance Division releases Rs5b for Temporarily Displaced Persons

Finance Division has released Rs5 billion to Special Federal Development Programme for Temporarily Displaced Persons (TDPs) against the total allocations of Rs32.5 billion in the PSDP 2019-20, while for security enhancement around Rs6 billion over and above the allocations have been released. Of the total Rs32.5 billion allocations in the Federal PSDP block allocations managed by the Finance Division Rs5 billion have been released till March 2020, while for Security enhancement against the allocation of Rs32.5 billion, Rs38.456 billion have been released, official data shared by the Federal Ministry for Planning, Development and Special Initiative reveals.

Stock markets and the dollar were roiled on Monday after the Federal Reserve slashed interest rates in an emergency move and its major peers offered cheap U.S. dollars to break a logjam in global lending markets. The aggressive policy steps were aimed at cushioning the economic impact as the breakneck spread of the coronavirus all but shut down more countries, but had only limited success in calming panicky investors. Data out of China also underscored just how much economic damage the disease had already done with industrial output plunging 13.5% and retail sales 20.5%.

Special economic zones (SEZs) could help Pakistan enhance its exports to around $1-1.5 billion annually in the short run by ensuring effective planning, said an industry official on Sunday. “Investors from China, Turkey, Korea and Britain have pumped $1.10 billion into SEZs and they are bringing in more investors from their countries to invest in Pakistan,” stated Mian Kashif Ashfaq, chairman of the Faisalabad Industrial Estate Development and Management Company (FIEDMC). He said these investors expressed their eagerness to explore the possibility of investment in diverse sectors of Pakistan, especially ceramics, chemicals, steel, food processing and automobiles.

In a major policy shift, the government has formally directed the board of directors and managing directors of the two gas utilities to give up major revenue streams to provide relief to consumers through lower tariff. In a letter, the petroleum division has asked the chairpersons and managing directors of the Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) to seek approval of their boards for lower revenue requirements in the consumer tariff. In the letter, seen by Dawn, the companies have been asked to reduce their benchmarks of unaccounted for gas (UFG) from 6.3 per cent allowed by the Oil & Gas Regulatory Authority (Ogra) to 4pc. This will cut gas companies’ revenue by Rs10bn a year.

Oil giant Saudi Aramco on Sunday posted a 21 per cent decline in 2019 net profit due to a drop in oil prices and production, and said it plans to “rationalise” capital spending in the wake of the coronavirus outbreak. This was Aramco’s first earnings announcement after it listed in December in a record $29.4 billion initial public offering (IPO) that valued the company at $1.7 trillion. Its shares fell below the IPO price last week for the first time, as oil prices crashed after the collapse of an output deal between Opec and non-Opec members which led to an oil price war between Riyadh and Moscow.

Finance Division has released Rs5 billion to Special Federal Development Programme for Temporarily Displaced Persons (TDPs) against the total allocations of Rs32.5 billion in the PSDP 2019-20, while for security enhancement around Rs6 billion over and above the allocations have been released. Of the total Rs32.5 billion allocations in the Federal PSDP block allocations managed by the Finance Division Rs5 billion have been released till March 2020, while for Security enhancement against the allocation of Rs32.5 billion, Rs38.456 billion have been released, official data shared by the Federal Ministry for Planning, Development and Special Initiative reveals.

Market is expected to remain volatile during current trading session.

Technical Analysis

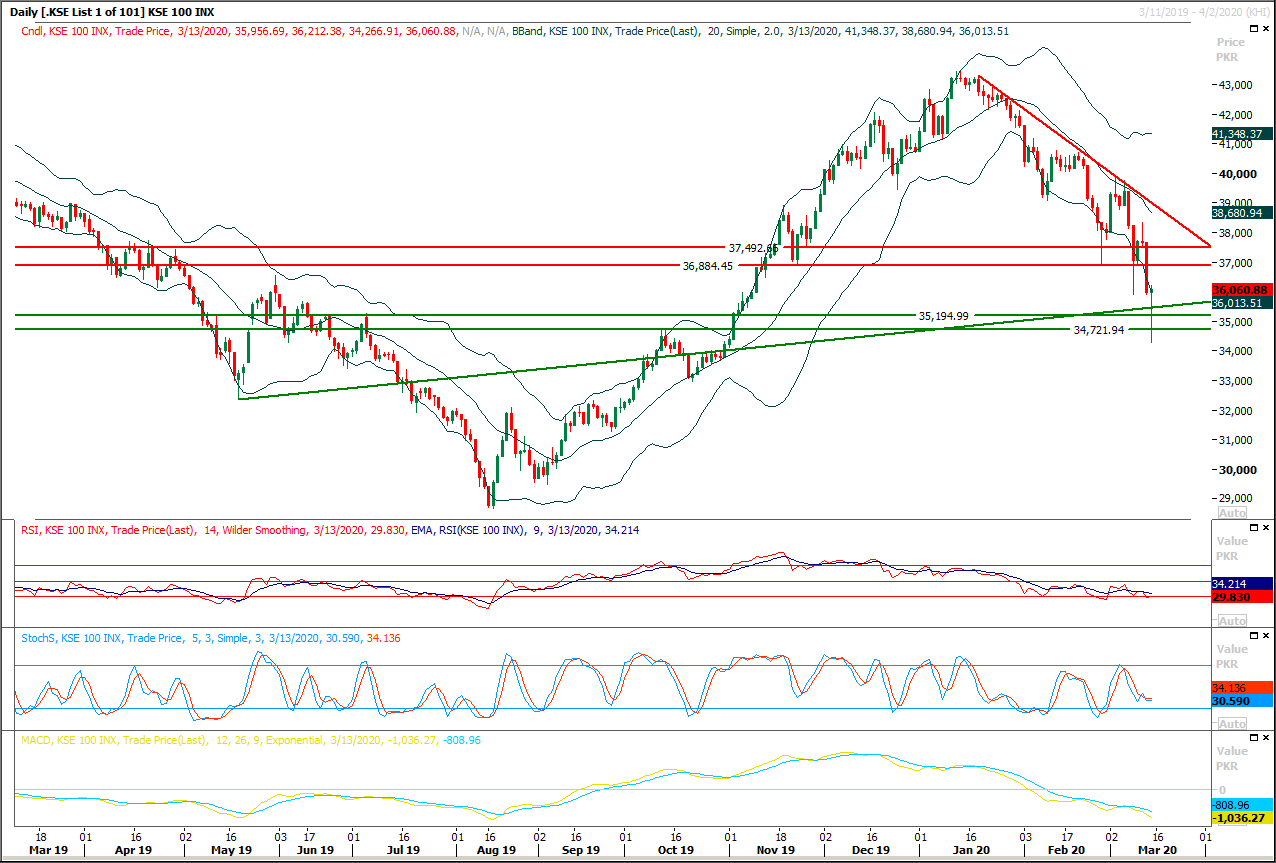

The Benchmark KSE100 index have bounced back after completing 100% expansion of its last correction and getting support from a horizontal supportive region and now it's expected that index would face strong resistances at 36,880 and 37,500 points. As of now it's expected that index would start a new bearish journey after an intraday spike and during this intraday pull back index would face resistances at 36,500 and 36,880 points. It's recommended to start profit taking from existing long positions and start selling on strength with strict stop loss of 37,500 points. Meanwhile if index would succeed in sliding below 35,700 points on hourly closing basis then some serious pressure could be witnessed during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.