Previous Session Recap

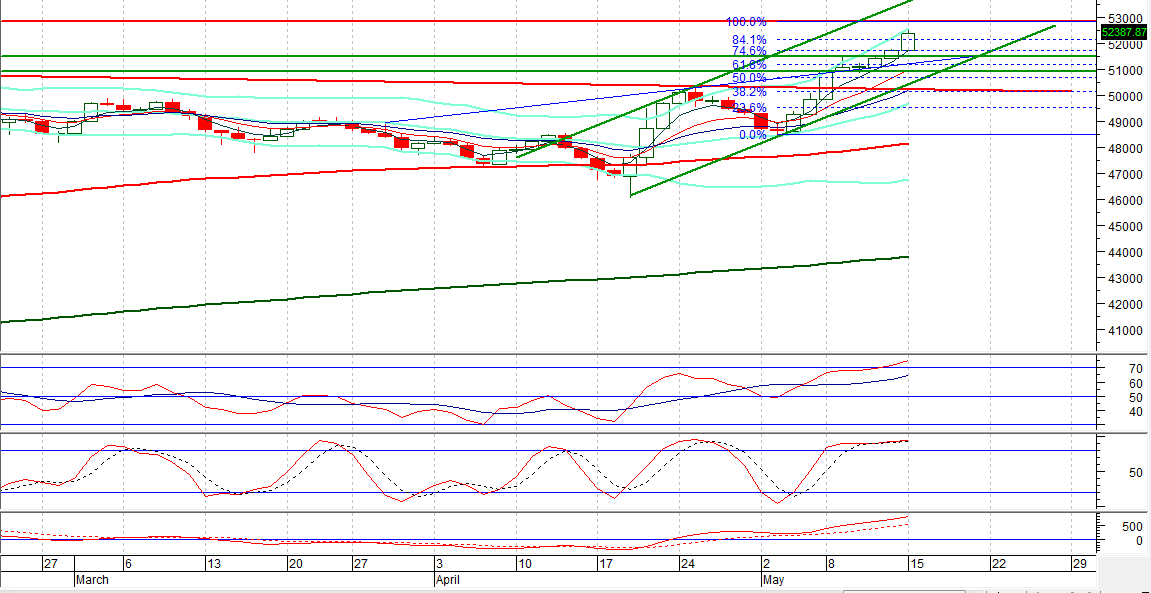

The Benchmark KSE100 Index Opened at 51750.91, posted a day high of 52599.07 and a day low of 51750.91 during last trading session, while session suspended at 52387.87 with a net change of 636.96 and a net trading volume of 147.88 million shares.

Analytical Review

Asian stocks briefly climbed to a fresh-two year high on Tuesday on the back of an overnight rise in Wall Street, while oil extended gains after major producers Saudi Arabia and Russia said supply cuts needed to continue into 2018. But investors are growing increasingly wary of the broader market as valuations look stretched and with the latest rally taking place in thin volumes and led by just a few sectors. "We are approaching a short-term resistance as the breadth of this rise is very unhealthy and the market momentum looks tired," said Alex Wong, a fund manager at Ample Capital Ltd in Hong Kong, with about $130 million under management. In Hong Kong, the broader market .HSI rose to its highest level since June 2015 on the back of extended buying into Chinese lenders and market heavyweight Tencent (0700.HK) before declining 0.6 percent.

A strike by goods carriers entered into its eighth day on Monday, hindering the movement of goods to and from ports and depriving factories of much-needed raw material. The wholesale commodity market has managed so far reflected in price stability, but traders believe the situation could not be sustained for long with expected customers’ influx close to Ramazan. Goods’ carriers went on strike last Monday against a ban imposed by the Sindh High Court (SHC) on the movement of heavy vehicles in Karachi during the day. The strike was later joined by 14 other transport bodies.

For the second consecutive year, the Khyber Pakhtunkhwa finance department has released less development funds for local governments than the amount it is legally bound to give under the Local Government Act 2013. The LGA 2013 dictates transfer of 30pc of the provincial development budget to the 25 districts. “They are rolling back fiscal decentralisation,” an official of the KP finance department said, mentioning the amendments to LGA 2013 which allow cuts from resource allocation for local governments. The move has sparked criticism from donors and opposition parties.

Apropos a story titled “CPEC master plan revealed” appearing in Dawn on May 15, Minister for Planning, Development and Reform Ahsan Iqbal has said that CPEC Long Term Plan is not a project document, rather it “delineates the aspirations of both sides”. Read: What is CPEC master plan? “It is a live document and both sides [China and Pakistan] have an understanding to modify it as per the need besides reviewing it periodically,” Mr Iqbal claimed on Monday. While describing the news item as “one-sided and factually incorrect”, he said it was based on a “redundant document”

The government is making expedited full payments to the power projects to deliver about 6,020 megawatts of additional power generation capacity to the national grid by December to announce zero loadshedding before it goes to polls next year. The prime minister himself was keeping track of progress on about 25 small-to-large power units that authorities concerned have presented to him with timelines for completion latest by December 2017, a senior official at the PM Office told Dawn. Mainly because of this reason, the government has released almost full amounts allocated for the power sector in the current year budget and the prime minister had made it clear to all agencies and ministries concerned to deliver on the promise, the official added.

As a reminder, MSCI will reclassify the MSCI Pakistan Indexes from Frontier Markets to Emerging Markets at the May 2017 Semi-Annual Index Review. The MSCI Pakistan Indexes will fully converge with the MSCI Provisional Pakistan Indexes, effective June 1, 2017. There will be no additions to and ten deletions from the MSCI Pakistan Index. There will be eleven additions to and six deletions from the MSCI Pakistan Small Cap Index.

Today EFERT, ENGRO, HBL ,MCB and PSO may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index is moving in an upward price channel but it has resistance ahead from its 100% expansion of its last bullish correction at 52915 which can push index in a negative zone. Daily stochastic is trying to generate a bearish crossover which can generate negative momentum on board during current trading session. Selling on strength is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.