Previous Session Recap

Trading volume at PSX floor dropped by 49.71 million shares or 35.49%, DoD basis, whereas, the benchmark KSE100 Index opened at 40814.42, posted a day high of 40904.35 and a day low of 40585.54 during the last trading session. The session suspended at 40662.79 with a net change of -280.99 and net trading volume of 47.87 million shares. Daily trading volume of KSE100 listed companies dropped by 9.62 million shares or 16.73%, DoD basis.

Foreign Investors remained in a net selling position of 5.57 million shares and net value of Foreign Inflow dropped by 5.06 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.016 and 0.85 million shares but Foreign Corporate Investors remained in a net selling position of 6.43 million shares. While on the other side Local Individuals, Companies, Brokers and Insurance Companies remained in net buying positions of 4.0, 2.33, 2.52 and 3.42 million shares respectively but Local Banks and Mutual Funds remained in net selling positions of 4.46 and 3 million shares.

Analytical Review

Asian shares got off to a cautious start on Thursday after Wall Street stumbled despite upbeat U.S. economic news and the Treasury yield curve hit its flattest in a decade as investors priced in more U.S. rate hikes. Concerns over the prospects for a massive U.S. tax cut also showed no sign of abating as two Republican lawmakers on Wednesday criticized the Senate’s latest proposal. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched up 0.1 percent in early trade, while Australian stocks were a fraction weaker. Japan's Nikkei .N225 dithered either side of flat, while EMini futures for the S&P 500 ESc1 eased 0.03 percent. Wall Street had been weighed by a retreat in the S&P 500 energy sector .SPNY which suffered a four-day decline of 4 percent, its weakest such period in 14 months.

Pakistan Chemical Manufacturers Association (PCMA) on Tuesday urged the government to form a one-window facilitation commission for establishment of country's first Petrochemical Complex .PCMA Secretary General Iqbal Kidwai stated here that the PCMA, since its inception two years back, had been highlighting significance of a Petrochemical Complex for Pakistan and efforts had ultimately attracted the attention of local and foreign investors to invest in this momentous project, which needed strong patronage and support from government authorities to turn the dream into reality.

A rift among car assemblers has emerged as Pakistan Automotive Manufa¬cturers Association (PAMA) has claimed that “all the OEMs are facing serious technical issues due to low quality of fuel.”So far only Honda Atlas Cars Ltd (HACL) has formally lodged a complaint with the Oil and Gas Regulatory Authority (OGRA) about the low quality petrol. In a letter on Nov 13, PAMA has asked the regulator to check the metal contents (including manganese) in the petrol being marketed against the international standards as assemblers are facing serious technical issues due to low quality of the fuel.

Foreign Direct Investment (FDI) maintained an upward momentum, moving up by 74 percent during the first four months of this fiscal year (FY18), supported by rising Chinese and Malaysian investment. Economists said China is massively investing in several projects under China Pakistan Economic Corridor (CEPC) and the majority of the foreign investments were focused towards the power sector followed by construction. In addition, in power sector, the major chunk of FDI has been invested in coal-based power projects this fiscal year, they added. "We expect the improvement in FDI to play a pivotal role in providing support to balance of payments, which is heavily under pressure due to growing trade deficit," they said. They said although Chinese investment is arriving in Pakistan; however other investors are still reluctant to invest in the country due to ongoing political uncertainty, which needs to be ended to attract more foreign investment.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

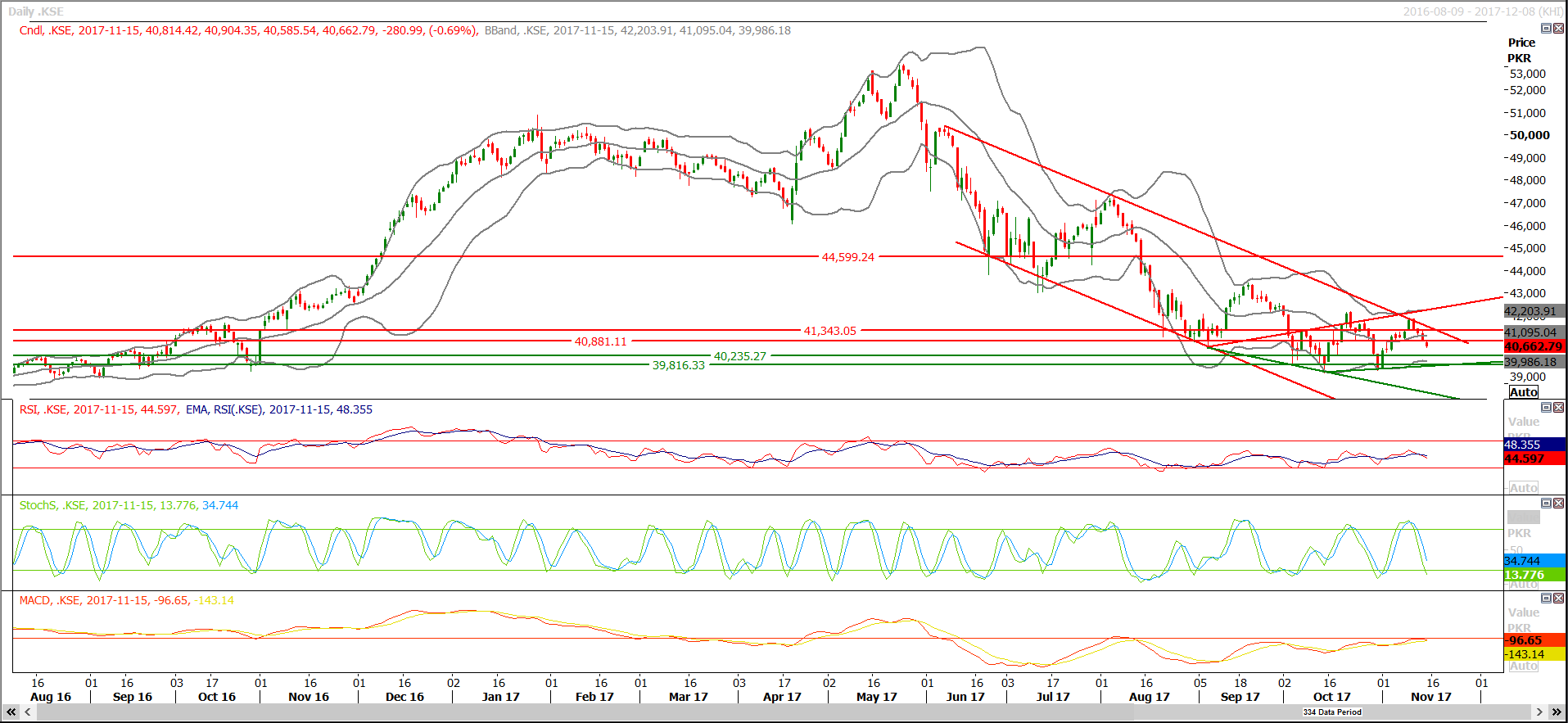

The Benchmark KSE100 Index is about to complete 61.8% correction of its last bullish rally at 40400 where it may find support but major supportive regions are standing at 40200 and 39800 if index penetrates its correction in bearish direction. For the current trading session buying on dips with strict stop loss could be initiated as reversal started from its correction levels or supportive regions might try to push index towards 40860 which was supportive region while index was moving downward and now it may try to react as a resistance. Crossover of a supportive trend line and horizontal support is taking place at 39800 which might be a strong support for index in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.