Previous Session Recap

Trading volume at PSX floor dropped by 0.26 million shares or 0.10% on DoD basis, whereas the Benchmark KSE100 index opened at 41,018.60, posted a day high of 41,477.90 and day low of 40,942.26 points during last trading session while session suspended at 41,428.63 with net change of 434.58 points and net trading volume of 145.16 million shares. Daily trading volume of KSE100 listed companies dropped by 1.40 million shares or 0.96% on DoD basis.

Foreign Investors remained in net selling position of 0.88 million shares and net value of Foreign Inflow dropped by 2.75 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 0.74 and 0.15 million shares respectively. While on the other side Local Companies, Banks, NBFCs and Mutual Fund remained in net selling positions of 2.03, 0.15, 0.53 and 7.00 million shares respectively but Local Individuals, Brokers and Insurance Companies remained in net buying positions of 4.21, 2.97 and 1.98 million shares respectively.

Analytical Review

Sterling scarred by Brexit turmoil; Asia shares cling to trade hopes

The British pound lay battered and bruised in Asia on Friday after a bout of political turmoil fanned fears the country could crash out of the European Union without a divorce deal. Asian share markets fared better as hopes for a thaw in Sino-U.S. trade relations gave Wall Street a fillip, though there were dueling reports on the prospects for an actual agreement. MSCI’s broadest index of Asia-Pacific shares outside Japan was ahead 0.26 percent in early trade, while Japan’s Nikkei added 0.2 percent.

C/A deficit down 4.5pc in July-Oct

The current account deficit shrank by 4.5 per cent during the first four months of this fiscal year, however it is still much higher than desired level as the government struggles to reduce deficits and avoid large foreign borrowings. The latest report by the State Bank of Pakistan shows the country has a current account deficit of $4.840 billion during July-October period of 2018-19, albeit declining by $232 million, from $5.072bn in the same period last year.

AIIB keen to invest $1b in Pakistan

The Asian Infrastructure Investment Bank (AIIB) has expressed willingness to invest $1 billion for the development of various projects in Pakistan, Laurel Ostfield, Head of Communications and Development at AIIB, told media delegation. While speaking to journalists of South Asian and South East Asian countries attending Asian media workshop organized by People’s Daily, Tsinghua University and international department of CPC, Laurel said that AIIB, the multilateral development bank desired to bring countries together to address Asia’s daunting infrastructure funding gap estimated at $ 26 trillion through 2030.

IMF for controlling trade deficit, increasing tax collection

Talks between Pakistan and International Monetary Fund (IMF) for new loan programme continued on Thursday as the visiting delegation met with the officials of ministry of finance, NEPRA and BISP. The delegation of IMF has met with chairman of the National Electric Power Regulatory Authority (Nepra) Tariq Sadozai. The NEPRA has briefed the Fund about performance of the Authority and power situation of the country. Sources informed that NEPRA has told the Fund about power generation, line losses, and power tariff. The aim of the NEPRA visit was to have an independent view of the regulator on power sector issues and challenges.

ACCA discusses importance of ‘ethics for economic prosperity’

ACCA held an event at the Governor House Lahore to discuss the importance of ethics and its impact on economic prosperity. The congregation in Lahore was the third in a series of events to commemorate the Global Ethics Day. Previously events had been held in Islamabad and Karachi.

The British pound lay battered and bruised in Asia on Friday after a bout of political turmoil fanned fears the country could crash out of the European Union without a divorce deal. Asian share markets fared better as hopes for a thaw in Sino-U.S. trade relations gave Wall Street a fillip, though there were dueling reports on the prospects for an actual agreement. MSCI’s broadest index of Asia-Pacific shares outside Japan was ahead 0.26 percent in early trade, while Japan’s Nikkei added 0.2 percent.

The current account deficit shrank by 4.5 per cent during the first four months of this fiscal year, however it is still much higher than desired level as the government struggles to reduce deficits and avoid large foreign borrowings. The latest report by the State Bank of Pakistan shows the country has a current account deficit of $4.840 billion during July-October period of 2018-19, albeit declining by $232 million, from $5.072bn in the same period last year.

The Asian Infrastructure Investment Bank (AIIB) has expressed willingness to invest $1 billion for the development of various projects in Pakistan, Laurel Ostfield, Head of Communications and Development at AIIB, told media delegation. While speaking to journalists of South Asian and South East Asian countries attending Asian media workshop organized by People’s Daily, Tsinghua University and international department of CPC, Laurel said that AIIB, the multilateral development bank desired to bring countries together to address Asia’s daunting infrastructure funding gap estimated at $ 26 trillion through 2030.

Talks between Pakistan and International Monetary Fund (IMF) for new loan programme continued on Thursday as the visiting delegation met with the officials of ministry of finance, NEPRA and BISP. The delegation of IMF has met with chairman of the National Electric Power Regulatory Authority (Nepra) Tariq Sadozai. The NEPRA has briefed the Fund about performance of the Authority and power situation of the country. Sources informed that NEPRA has told the Fund about power generation, line losses, and power tariff. The aim of the NEPRA visit was to have an independent view of the regulator on power sector issues and challenges.

ACCA held an event at the Governor House Lahore to discuss the importance of ethics and its impact on economic prosperity. The congregation in Lahore was the third in a series of events to commemorate the Global Ethics Day. Previously events had been held in Islamabad and Karachi.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

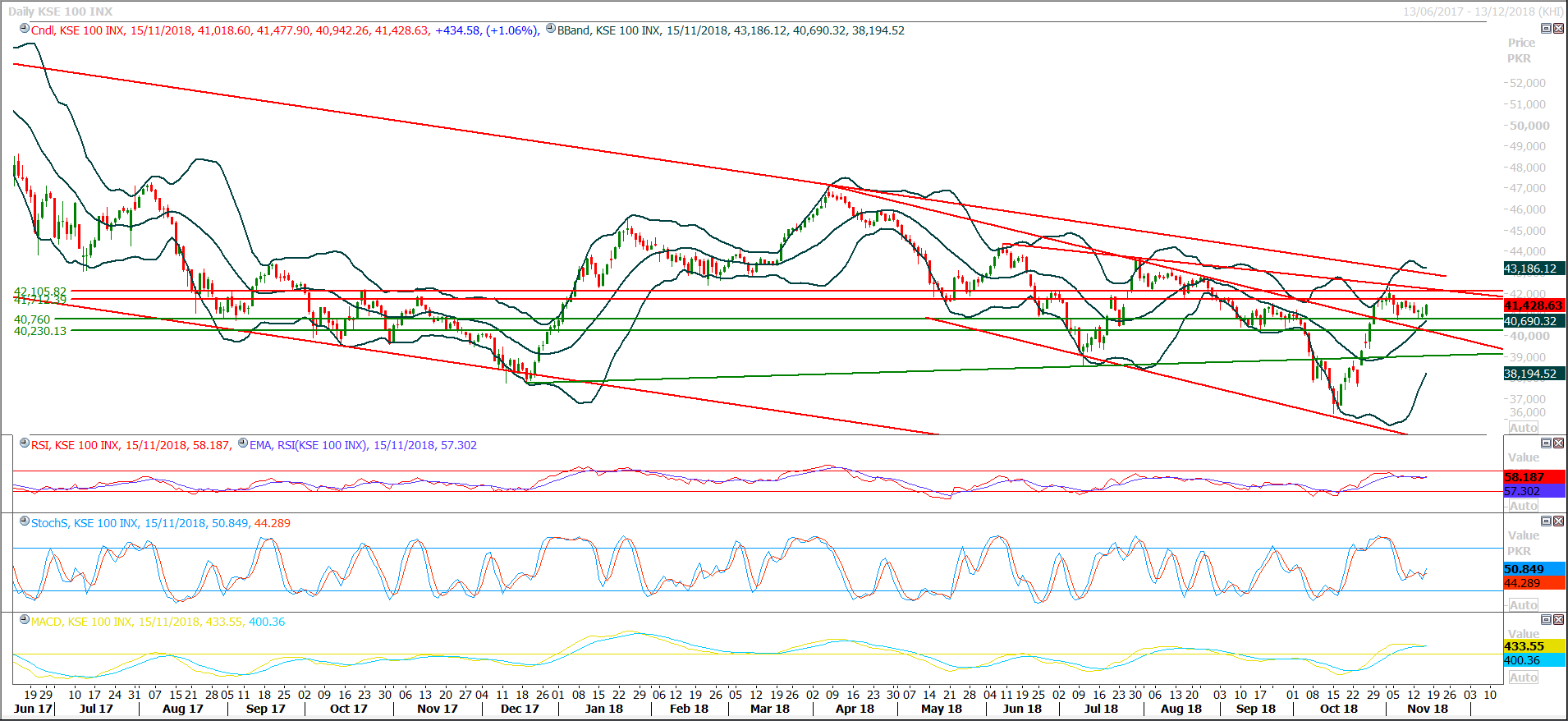

The Benchmark KSE100 Index is heading towards its major resistant region of 41,700 and 42,100 points after bouncing back from its supportive region of 40,760 points and it’s expected that it would face strong resistance which may cap its current bullish momentum before penetration of 42,100 points. Hourly momentum indicators have turned to bearish zone while weekly momentum is trying to exhaust its bullish rally and today’s closing in negative zone will confirm reversal towards bearish sentiment. As of now it’s recommended to start profit taking before 41,700 points and start selling on strength with strict stop loss of 42,100 or 42,300 points. Oil & cement sectors would try to lead any negative sentiment if index would not succeed in penetration of 41,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.