Previous Session Recap

Trading volume at PSX floor increased by 15.83 million shares or 11.47%,DoD basis, whereas, the benchmark KSE100 Index opened at 40236.92, posted a day high of 40236.92 and a day low of 39478.05 during the last trading session. The session suspended at 39846.78 with a net change of -390.75 points and net trading volume of 78.94 million shares. Daily trading volume of KSE100 listed companies increased by 16.24 million shares or 25.9%,DoD basis.

Foreign Investors remained in a net buying position of 11.6 million shares and net value of Foreign Inflow increased by 18.24 million shares. Categorically, Foreign Corporate Investors remained in a net buying position of 12.42 million shares but Overseas Pakistanis remained in a net selling position of 0.82 million shares.On the otherside Local Individuals, Companies and Mutual Funds remained in net selling positions of 2.39, 10.67 and 9.21 million shares but Banks, Brokers and Insurance Companies remained in net buying positions of 2.14, 2.25 and 4.68 million shares respectively.

Analytical Review

Asian shares advanced to a decade high on Monday, while U.S. oil futures jumped to hover near a six-month top as escalating tensions between the Iraqi government and Kurdish forces threatened supply. Iraqi forces began moving at midnight on Sunday towards oil fields held by Kurdish Peshmerga fighters near the oil-rich city of Kirkuk. In response, U.S. crude climbed 0.9 percent to $51.92 a barrel, not far from $52.85 touched late last month - a level not seen since April. Brent crude climbed 1.2 percent to $57.88 per barrel. MSCI’s broadest index of Asia-Pacific shares outside Japan gained for a fifth day running to its highest level since late 2007. Japan’s Nikkei rallied for a sixth day to a level not seen since November 1996. Australian shares extended their winning streak to a fourth straight session to rise 0.6 percent, while the Shanghai Composite Index edged 0.1 percent higher.

The federal government has decided to apply uniform costing criteria for natural gas consumers living within a five-kilometre radius of gas fields in the four provinces without putting additional burden on provincial governments. The federal government is likely to meet the additional cost most probably from funds allocated for commitments made regarding the Sustainable Development Goals, Energy for All and Gas Infrastructure Development Cess initiatives under the Public Sector Development Programme. A government official told Dawn that the federal government initially wanted the provinces to subsidise each other, with three of the provinces mainly bearing the additional burden of Balochistan through a uniform rate in order to compensate for the decades when the province supplied gas to the national system.

Insisting that its external repayment obligations stand at $18 billion for the current year, Pakistan has asked the World Bank (WB) to rectify its ‘error’ that put external obligations at $31bn. “The matter has been taken up with the World Bank to rectify the error,” said the finance ministry on Sunday after a meeting presided over by Finance Minister Ishaq Dar. The meeting reviewed first quarter performance of the national economy — including revenue collection, imports, exports, remittances etc — and noted that “external inflows are expected to be sufficient to meet repayment obligations”.

The growing split between the United States and the rest of the world spilled into the annual meetings of the International Monetary Fund and World Bank in Washington this week. The US administration showed a diminished view of the Bretton Woods institutions that shaped a US-led order after World War II, rejecting efforts to expand their activities, and defending its attack on free trade pacts as part of President Donald Trump’s “America First” agenda. And at the same time, the US continued to stymie China’s ambitions to elevate its global role via an expanded stake in both the IMF and World Bank.

Politics is not their business but the risk-averse private sector of Pakistan, aware of the country’s power dynamics, lets its instincts guide it’s positioning in turbulent times. Blaming the civilian leadership for the hostile business environment, in a seminar, it stopped short of calling the supreme commander to assume charge. Chief of the Army Staff Qamar Javed Bajwa speech was insightful. Did it reflect a fresh security doctrine? It is hard to say in the absence of credible information. However, the concluding remarks of Gen Bajwa contrasted both in content and formulation from the thrust of a daylong seminar. Was it meant to appear this way? Again, it is hard to be certain.

Today ATRL, ENGRO, ISL and PPL may lead the market in the positive direction.

Technical Analysis

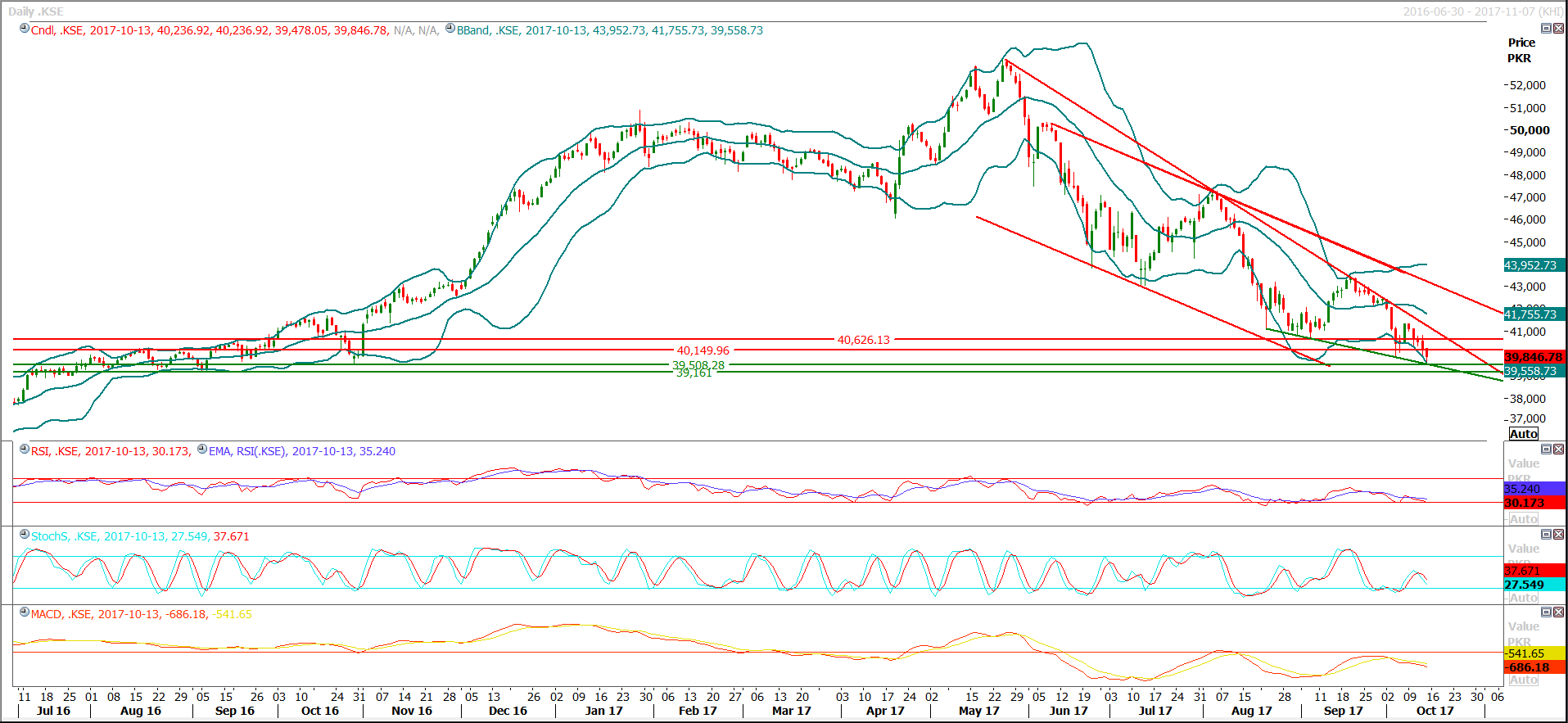

The Benchmark KSE100 Index is getting support from crossover of a supportive trend line with a horizontal line on the daily chart, hourly stochastic has generated a bullish crossover which indicates that index is ready for an intraday pullback. In coming trading sessions it is expected that index might start a reversal towards 40036 and 40200 therefore buying below 40000 might be initiated. Index has supportive regions around 39500 and 39100 for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.