Previous Session Recap

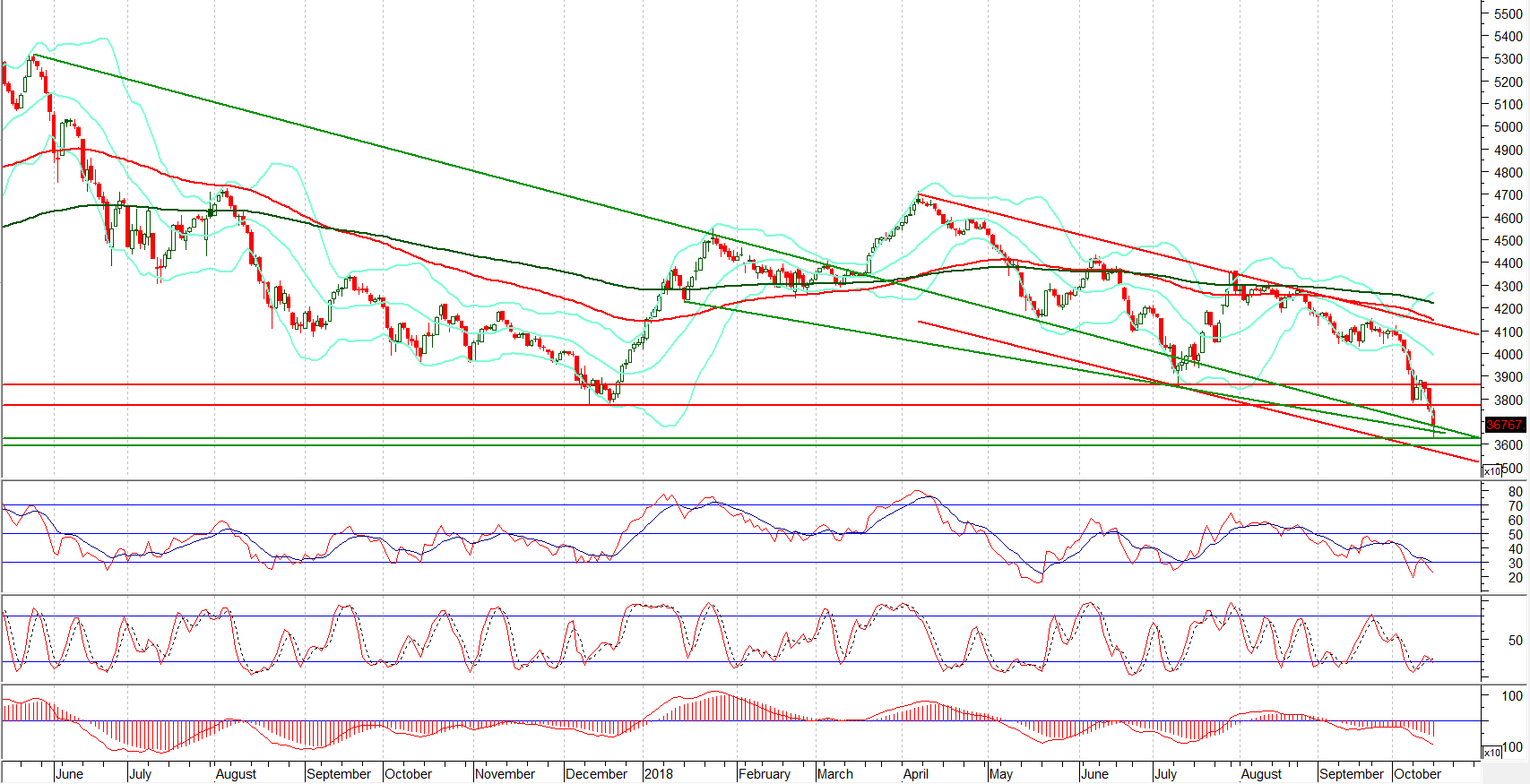

Trading volume at PSX floor increased by 30.10 million shares or 22.23% on DoD basis, whereas the Benchmark KSE100 index opened at 37,453.24, posted a day high of 37,573.33 and day low of 36,274.94 points while the session suspended at 36,767.57 with net change of -750.36 points and net trading volume of 105.52 million shares. Daily trading volume of KSE100 listed companies increased by 13.31 million shares or 14.43% on DoD basis.

Foreign Investors remained in net selling position of 8.09 million shares and net value of Foreign Inflow dropped by 3.26 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 6.23 and 1.86 million shares. While on the other side Local Individuals, Local Companies, Banks and Insurance Companies remained in net buying positions of 1.20, 2.39, 1.38 and 5.05 million shares but NBFCs, Mutual Fund and Brokers remained in net selling positions of 0.09, 1.76 and 1.11 million shares respectively.

Analytical Review

Asia stocks bounce modestly but Saudi tensions limit gains

Asian stocks bounced modestly on Tuesday, gaining a toe-hold after a week of heavy losses, although increasing tensions between Saudi Arabia and the West fanned geopolitical concerns and capped gains. The disappearance earlier this month of a Saudi journalist critical of Riyadh has provoked an international outcry against the oil-rich kingdom. U.S. President Donald Trump has sent Secretary of State Mike Pompeo to Saudi Arabia over the case, potentially straining the relationship between the strategic allies. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.25 percent, crawling away from a 19-month trough touched on Thursday. Japan’s Nikkei bounced 0.3 percent following a decline of nearly 2 percent the previous day.

Govt agrees to cut tax rates on stock trading

In a bid to revive investor confidence in the bourse, the government has decided to reduce the advance income tax and capital gains tax on the sale and purchase of shares. The Pakistan Stock Exchange benchmark index has fallen to its two-year lows losing 4,200 points, or 10 per cent, during first two weeks of this month. The government accepted stockbrokers’ demands after a delegation of PSX Stockbrokers Association on Monday held meetings with Finance Minister Asad Umar, Minister for State on Finance Hammad Azhar and the Securities and Exchange Pakistan (SECP) Chairman Shaukat Hussain. The delegation is scheduled to hold another meeting with the SECP chairman and representatives of the Federal Board of Revenue (FBR) on Tuesday. It will discuss their long-standing demand to reduce tax rate under section 233A of Income Tax Ordinance 2001 and rationalisation of Capital Gains Tax (CGT).

‘Rising cost of materials to hurt govt’s housing plan’

Cement and steel prices have surged throughout the country following the prime minister’s announcement to build five million houses under the Naya Pakistan Housing Programme (NPHP), said builders on Monday. “We see soaring steel bar and cement bag prices as a threat to NPHP initiated by Prime Minister Imran Khan,” said Association of Builders and Developers (Abad) chairman Mohammad Hassan Bakhshi. Cement prices in southern region have risen by Rs20 and Rs80 per 50 kg bag in northern region within few days. Besides, the price of steel bar for high-rise building has also jumped to Rs107,000 from Rs100,000, builders claimed on Tuesday. The Abad chairman claimed that the price of steel bar and cement has risen after announcement of NPHP, adding that the market is abuzz with reports that powerful cement makers may come out with another price shock of Rs20 per bag.

APWC for freezing prices of essential items

All Pakistan Workers Confederation has said that the federal and provincial governments should freeze the prices of the items of daily use in order to save the public from exploitation of hoarders and profiteers since the devaluation of rupee had raised the prices, particularly imported goods. These demands were raised in a meeting of large number of workers and trade union representatives held under the aegis of All Pakistan Workers Confederation at Bakhtiar Labour Hall Lahore.

Dollar rises by Rs1.43 in interbank market

Fluctuations in the US dollar against the rupee continued as the market opened on Monday. The greenback increased by Rs1.43 after initially rising by Rs1.57 and was being traded at Rs133.40 after closing at Rs131.97. However, in the open market the dollar remained stable at Rs132. Following a steep increase in the greenback's price last week, the rupee made a recovery against the dollar in the interbank market on Friday as it was trading at Rs132.40 in the interbank, down Rs1.40 and closed at Rs131.93, down by Rs1.87.

Asian stocks bounced modestly on Tuesday, gaining a toe-hold after a week of heavy losses, although increasing tensions between Saudi Arabia and the West fanned geopolitical concerns and capped gains. The disappearance earlier this month of a Saudi journalist critical of Riyadh has provoked an international outcry against the oil-rich kingdom. U.S. President Donald Trump has sent Secretary of State Mike Pompeo to Saudi Arabia over the case, potentially straining the relationship between the strategic allies. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.25 percent, crawling away from a 19-month trough touched on Thursday. Japan’s Nikkei bounced 0.3 percent following a decline of nearly 2 percent the previous day.

In a bid to revive investor confidence in the bourse, the government has decided to reduce the advance income tax and capital gains tax on the sale and purchase of shares. The Pakistan Stock Exchange benchmark index has fallen to its two-year lows losing 4,200 points, or 10 per cent, during first two weeks of this month. The government accepted stockbrokers’ demands after a delegation of PSX Stockbrokers Association on Monday held meetings with Finance Minister Asad Umar, Minister for State on Finance Hammad Azhar and the Securities and Exchange Pakistan (SECP) Chairman Shaukat Hussain. The delegation is scheduled to hold another meeting with the SECP chairman and representatives of the Federal Board of Revenue (FBR) on Tuesday. It will discuss their long-standing demand to reduce tax rate under section 233A of Income Tax Ordinance 2001 and rationalisation of Capital Gains Tax (CGT).

Cement and steel prices have surged throughout the country following the prime minister’s announcement to build five million houses under the Naya Pakistan Housing Programme (NPHP), said builders on Monday. “We see soaring steel bar and cement bag prices as a threat to NPHP initiated by Prime Minister Imran Khan,” said Association of Builders and Developers (Abad) chairman Mohammad Hassan Bakhshi. Cement prices in southern region have risen by Rs20 and Rs80 per 50 kg bag in northern region within few days. Besides, the price of steel bar for high-rise building has also jumped to Rs107,000 from Rs100,000, builders claimed on Tuesday. The Abad chairman claimed that the price of steel bar and cement has risen after announcement of NPHP, adding that the market is abuzz with reports that powerful cement makers may come out with another price shock of Rs20 per bag.

All Pakistan Workers Confederation has said that the federal and provincial governments should freeze the prices of the items of daily use in order to save the public from exploitation of hoarders and profiteers since the devaluation of rupee had raised the prices, particularly imported goods. These demands were raised in a meeting of large number of workers and trade union representatives held under the aegis of All Pakistan Workers Confederation at Bakhtiar Labour Hall Lahore.

Fluctuations in the US dollar against the rupee continued as the market opened on Monday. The greenback increased by Rs1.43 after initially rising by Rs1.57 and was being traded at Rs133.40 after closing at Rs131.97. However, in the open market the dollar remained stable at Rs132. Following a steep increase in the greenback's price last week, the rupee made a recovery against the dollar in the interbank market on Friday as it was trading at Rs132.40 in the interbank, down Rs1.40 and closed at Rs131.93, down by Rs1.87.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 index have tried a false breakout of its major supportive region of 36,500 points but did not closed below that region and an intraday pullback was witnessed before session end. As of now it’s expected that index would continue its pullback during current trading session because it’s bouncing back after testing its second supportive region of 36,300 points and it would try to create a positive sentiment on daily chart which may lead index towards 37,700 and then 38,300 points in coming days. If index would not succeed in closing above 37,700 points then a new bearish rally toward 34,500 points would be witnessed in coming days. It’s recommended to stay cautious until index close above 37,700 points which would now react as a major resistance. For current trading session it’s recommended to initiate buying with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.