Previous Session Recap

The Bench Mark KSE100 Index Opened at 49391.91 with a positive gap of 181 points, posted day high of 49392.49 and day low of 49821.75 during last trading session. The session suspended at 49888.54 with net change of -321.96 points and net trading volume of 157.17 million shares. Daily trading volume of KSE100 listed companies dropped by 10.66 million shares or 6.35% on DOD bases.

Foreign Investors remained in net selling position of 39.12 million shares and net value of Foreign Inflow dropped by 12.15 million US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.04 and 1.67 million shares respectively but Foreign Corporate investors remained in net selling position of 40.83 million shares. While on the other side, Local Individuals, Companies and NBFCs remained in net buying position of 12.70, 33.1 and 0.27 million shares respectively but Local Banks, Mutual Funds and Brokers remained in net selling position of 2.21, 7.22 and 3.94 million shares respectively.

Analytical Review

Asian stocks and the pound sagged on Tuesday as investors waited for British Prime Minister Theresa May to lay out plans to exit the European Union, which traders fear will see Britain lose access to the bloc single market. Britain will not seek a Brexit deal that leaves it half in, half out of the EU, May will say later in the day, according to her office, in a speech setting out her 12 priorities for upcoming divorce talks with the bloc. Those priorities will include leaving the EU single market and regaining full control of Britain borders, media reported, reinforcing fears of a Hard Brexit which has pushed the pound to some of the lowest levels against the U.S. dollar in more than three decades and weighed on other riskier assets such as stocks.

Oil and Gas Regulatory Authority (OGRA) determined an estimated revenue of Rs 415 billion against the demand of Rs 486 billion by two gas utilities (SNGPL and SSGC) during the financial year 2015-16, stated an annual report titled Conduct of OGRA Affairs, 2015-16 released here on Monday.

The accumulated amount under claw back mechanism, which K-Electric has to pass on to its consumers, has gone up to over Rs 17 billion. It emerged on Monday. National Electric Power Regulatory Authority (Nepra) and consumer representatives said the loss-bearing power utility at the time of amendment agreement with Ministry of Power Government of Pakistan in 2009 made a commitment to share a certain percentage of profit with its consumers from the year it started making profit.

As Pakistan Steel Mills (PSM) continues to pile up liabilities, the government is considering leasing the country largest industrial complex to a private concern for 45 years under a revenue sharing arrangement, and laying off almost 5,000 employees. On Monday, a transaction committee discussed various options in this regard, based on which the Privatisation Commission’s board will meet on Tuesday (today) to decide the duration of the lease. Sources privy to the development said a meeting of the cabinet committee on privatisation has been called over the weekend to approve the transaction structure.

Federal Minister for Planning, Development and Reforms Ahsan Iqbal Monday said that Diamer-Bhasha Dam would also be part of the China-Pakistan Economic Corridor (CPEC). He said that 11,000MW of electricity would be added to the national grid by 2018, 5,000MW under the CPEC and 6,000MW under non-CPEC projects. The minister said this while briefing the Parliamentary Committee on CPEC which met under the chairmanship of Senator Mushahid Hussain Sayed here at the Parliament House.

ENGRO, TREET, CHCC and SMBL can lead market in positive direction.

Technical Analysis

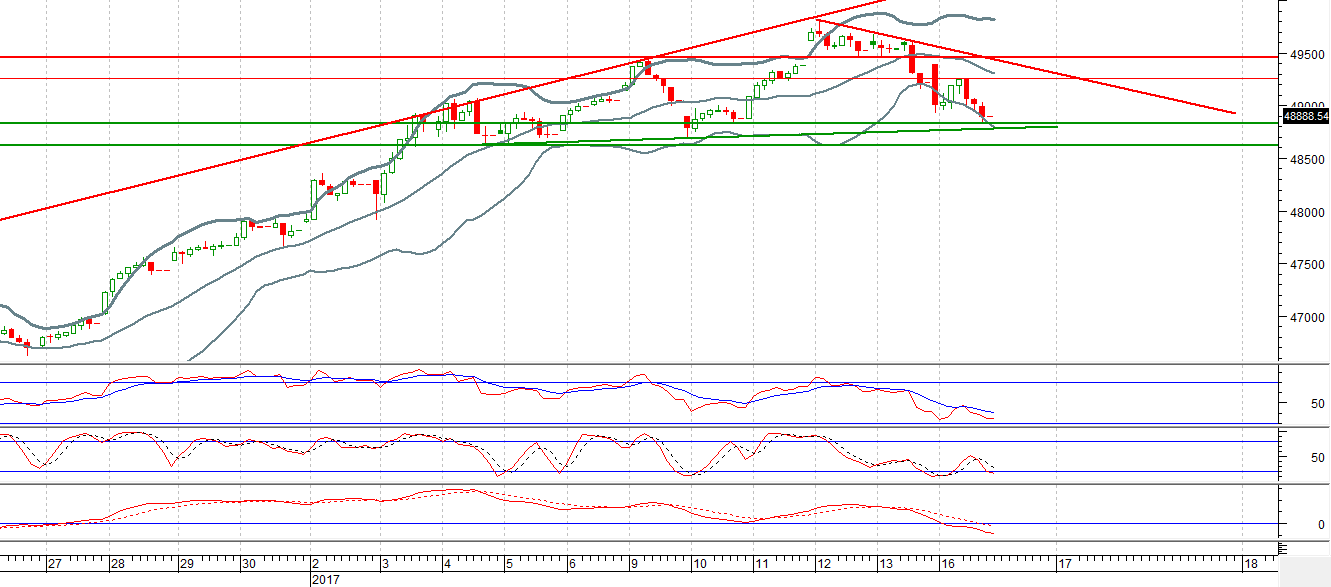

The Bench Mark KSE100 Index is caged in a triangle on hourly chart and right now it is getting support from a rising trend line along with a horizontal supportive region. For current trading session a rebound is expected in Index as supportive regions are ahead at 48830 and 48622 while resistant regioins are standing at 49256. Downward penetration of 48830 will call for 48622 where index will have a strong support so buying between these two supportive regions is recommended with strict stop loss of 48622.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.