Previous Session Recap

The Bench Mark KSE100 Index Opened at 48305.38, posted a day high of 48341.17 and a day low of 47774.44 during last trading session whereas session suspended at 48289.66 with net change of -16.17 points and net trading volume of 101.46 million shares. Daily trading volume of KSE100 listed companies dropped by 12.67 million shares or 11.10% on DoD basis.

Analytical Review

Asian stocks advanced on Friday, set for their best week since July, while the dollar continued the slide that began after the Federal Reserve indicated it was unlikely to speed up monetary tightening. The dollar index, which tracks the greenback against a basket of six trade-weighted peers, retreated 0.1 percent to 100.26. It hit a five-week low on Thursday, and is down almost 1 percent for the week. The dollar was steady at 113.32 yen but is on track to post a 1.2 percent loss for the week. While the Fed raised interest rates by 25 basis points on Wednesday, it kept to its original forecast of three rate hikes this year, disappointing investors who were expecting a bump up to four. U.S. Treasury yields, which slid after the decision, staged a recovery on Thursday and continued to rise on Friday. The 10-year yield was at 2.5402 percent, from its last close of 2.524. MSCI broadest index of Asia-Pacific shares outside Japan rose 0.3 percent, set to end the week with a 3.5 percent gain, its biggest increase since the week ended July 15. Japanese Nikkei lost 0.3 percent, and is poised for a 0.4 percent loss for the week. Chinese stocks were steady, set for a 1.6 percent increase for the week. Hong Kong Hang Seng index rode the positive regional trend, staying on track to log a 3.4 percent gain for the week, its biggest since September.

The World Bank has "approved a package of measures worth $450 million to help the poorest and most vulnerable people in Pakistan", a press release issued by the organisation said on Wednesday. The National Social Protection Program for Results, which is worth $100mn, will assist the federal government to strengthen national social safety net initiatives ─ such as the Benazir Income Support Program ─ to improve beneficiary families access to complementary social and productive services", the statement added. "Pakistan has made significant progress in the implementation of economic reforms," said Illango Patchamuthu, World Bank Country Director for Pakistan.

The issue of encashment of sovereign guarantees is far from resolution, as the government has failed to clear the overdue invoices of the Independent Power Producers (IPPs) and the desperate power producers have once again extended the deadline for encashment by 10 days. The deadline given by 13 IPPs was due to expire on March 16. However, the IPP advisory council extended the deadline till March 26 to give the government another chance. As per details, on February 15, 2017, the total verified and audited amounts overdue to the power sector (excluding WAPDA hydel) stood at Rs 414 billion, with the IPPs share of Rs254 billion. According the IPP Advisory Council (IPPAC), on March 10, 2017, the verified, audited and undisputed overdue amount of IPPs was Rs245 billion. As of today, a Government of Pakistan guarantee call of over Rs 35 billion is outstanding.

Both the government of Pakistan and the Asian Development Bank (ADB) have agreed to finalise the award of contract for the Jamshoro Power Generation Project (JPGP) by September, it is learnt reliably. Secretary for Water and Power Yunus Dagha asked the ADB to finalise the process of award of contract by August however it was agreed later to complete the process in September. The decision was made at a meeting between the Ministry of Water and Power and the ADB team. The meeting reviewed the progress on different ongoing ADB-funded power projects and the overall performance of NTDC and DISCOs in improving the energy system.

The deficient tariff determination of the National Electric Power Regulatory Authority (NEPRA) and arrears against the provinces/regions are the main cause of circular debt and it is difficult to control the power sector’s debt unless 100 percent recovery is made, says the Ministry of Water and Power. The Nepra’s determination of tariff is deficient which does not meet the cost of generation and that in turn was contributing to increasing circular debt, said Water and Power Secretary Yunus Dagha while briefing the Senate Subcommittee on Water and Power. The meeting was chaired by Senator Nauman Wazir.

TRG, CSAP,DOL and ISL can lead the market in the positive direction.

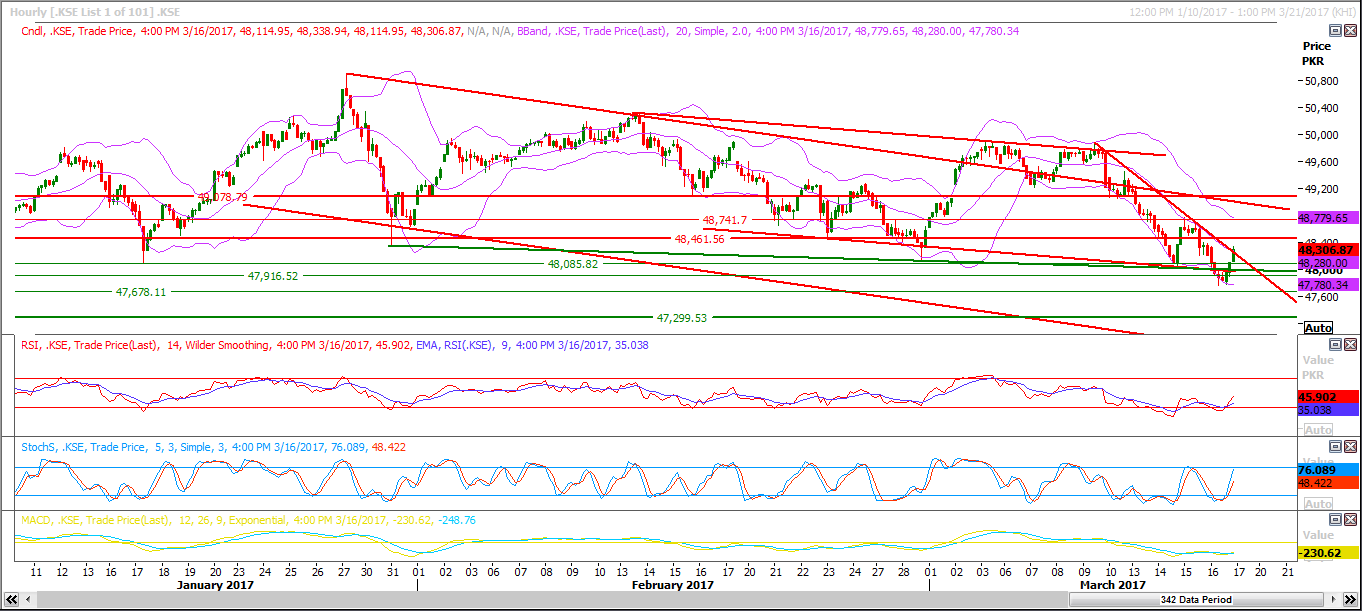

Technical Analysis

The Bench Mark KSE100 Index has bounced back after testing its supportive trend line of bearish trend channel, but right now it has strong resistance ahead from 48735 and 49105 which falls on its correction levels. Market can be pushed back from 48735 if it fails to close above this region on hourly chart. It is recommended either to stay sideline or trade with strict stop losses as it is expected that market will face pressure during current trading session. Index may find support around 48012 and 47900 but it is being pushed downward by resistant trend lines and hourly corrections.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.