Previous Session Recap

The Bench Mark KSE100 Index Opened at 42292.67, posted day high of 42481.07 and day low of 42213.50. The session suspended at 42404.47 points with net change of 111.80 points and net change of 111.80 points with net trading volume of 114.06 million shares. Daily trading volume of KSE100 listed companies dropped by 11.75 million shares or 9.34% on DOD bases.

Foreign Investors remained in net selling position of 2.54 million shares and net value of Foreign Inflow dropped by 8.12 million shares. Categorically, Foreign Individuals, Corporates and Overseas Pakistanis remained in net selling position of 0.045, 8.03 and 0.04 million shares respectively. While on the other hand, Local Individuals and Banks remained in net buying position of 10.47 and 2.49 million shares respectively but Local Companies, Mutual Funds and Brokers remained in net selling position of 7.44, 0.97 and 2.15 million shares respectively.

Analytical Review

Opec officials are working to nail down details of their plan to limit oil supply and gaps over some sticking points are narrowing, Opec sources said, a sign of progress in finalising the exporter group’s first such deal since 2008.

The dollar hit a 14-year high against a basket of currencies on Wednesday as a post-US election sell-off resumed across global bond markets, lifting Treasury yields and attracting investors to the US currency.

Pakistani exporters will be participating in FoodEx Saudi 2016 exhibition, being held from November 21 to 24 in Jeddah. Several Pakistani companies, through the Trade Development Authority of Pakistan (TDAP), will be participating in the exhibition, being arranged by Saudi Exhibition Company, said a message received here Wednesday from Jeddah.

Lahore Chamber of Commerce & Industry (LCCI) Wednesday urged Directorate General of Valuation to withdraw increase in valuation of decoration lights (rice lights). Talking to a delegation of Shahalam Market led by Talha Tayyab Butt and Shahrukh Jamal, the LCCI President Abdul Basit said here that increase in valuation would hit traders. He said that Federal Board of Revenue and Directorate General of Valuation should take immediate notice of the matter. The LCCI Vice President Muhammad Nasir Hameed Khan was also present.

Crude oil futures dropped on Thursday after official inventory reports indicated a larger-than-expected build in U.S. oil stocks. Crude inventories in the United States rose by 5.3 million barrels in the week to Nov. 11, compared with expectations for an increase of 1.5 million barrels.

TRG, SMBL,SHEL, PIBTLand HASCOL are looking attractive on Intra-day and short term bases, they can lead the market in positive direction. On the other side, MUREB, JPGL and HUBC,will remain under pressure.

Technical Analysis

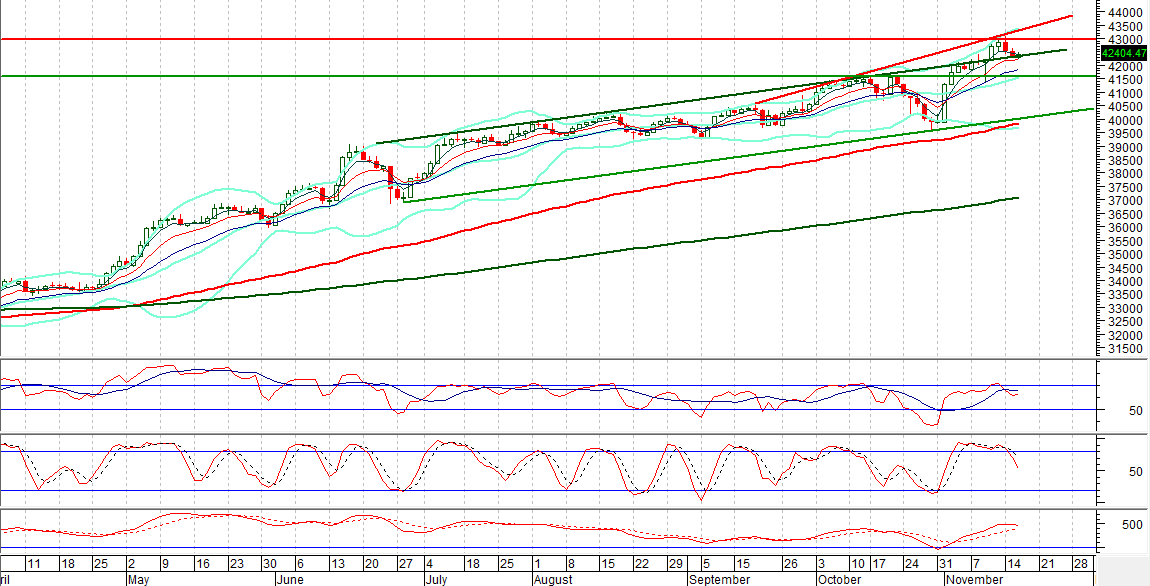

KSE100 Index is capped by a resistant trend line at 43249 on Daily Chart and it has penetrated its supportive regions of 42479 and 42460 in bearish direction and right now supportive region stands at 42260 points from a horizontal support or double bottom. Daily Stochastic and Moving Average over RSI(MAORSI) have generated bearish crossovers which is a positive sign for a healthy correction, which for the current trading sessions stands at 42490 and 42527 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.