Previous Session Recap

Trading volume at PSX floor dropped by 3.07 million shares or 2.12% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,422.98, posted a day high of 42,481.95 and a day low of 41,753.64 during last trading session. The session suspended at 41,960.80 with net change of -485.76 and net trading volume of 83.62 million shares. Daily trading volume of KSE100 listed companies dropped by 8.75 million shares or 11.68% on DoD basis.

Foreign Investors remained in net selling position of 0.81 million shares and net value of Foreign Inflow dropped by 1.26 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.03 and 1.56 million shares but Overseas Pakistanis investors remained in net buying positions of 0.78 million shares. While on the other side Local Individuals, Companies, Banks and Brokers remained in net selling positions of 4.93, 0.53, 0.29 and 4.49 million shares but NBFCs, Mutual Fund and Insurance Companies remained in net buying positions of 1.0, 5.38 and 2.50 million shares respectively.

Analytical Review

Asian shares gain on U.S.-China trade talks, lira recovers

Asian shares won a modest reprieve on Friday after China and the United States agreed to hold their first trade talks since June next week and as the Turkish lira extended gains from its record low earlier this week. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.4 percent, a day after it hit its lowest level in a year. Japan’s Nikkei advanced 0.5 percent. In U.S. markets on Thursday, the Dow Jones Industrial Average rose 1.58 percent and the S&P 500 gained 0.79 percent. MSCI’s index of world stocks rose 0.63 percent on Thursday, the biggest gain in a month. News that a Chinese delegation led by Vice Minister of Commerce Wang Shouwen will meet U.S. representatives helped to improve the mood. But the impact could be short-lived as such lower-level talks alone are unlikely to resolve the trade dispute. White House Economic adviser Larry Kudlow warned Beijing not to underestimate President Donald Trump’s resolve in pushing for changes in China’s economic policies.

CPEC projects help industries grow by 58pc

The business community of Khyber Pakhtunkhwa has demanded of the federal government and Ministry of Planning and Reforms to increase Special Economic Zones (SEZs) and hydel power generation projects along with schemes relating to trade and industries for the province under the CPEC. "The CPEC is a game changer, which will make the country a hub of business and economic activities, said Zahidullah Shinwari, president of Sarhad Chamber of Commerce and Industry (SCCI) while speaking at the CPEC conference held here at Chamber House. He said the CPEC is a joint venture of Pakistan and China, which will not only bring economic prosperity and development in the country, rather it would also become catalyst for regional development.

Automobile sale rises 16 percent

Sale of cars in the country during July 2018 increased by 15.5 percent to 18,875 units against the sale of 16,337 units in same month of previous year. According to latest data released by Pakistan Automobile Manufacturers Association (PAMA), as many as 4,609 units of Honda (Civic & City) were sold in the country during July 2018 as compared to the sale of 3,820 units during same month of previous year. Toyota Corolla cars' sale also witnessed growth of 17.8 per cent as it rose to 4,566 units in July 2018 from 3,875 units in same period of previous year. Suzuki Swift witnessed a growth of 68 per cent as its sale rose to 484 units in fist month of the fiscal year 2018-19 from 288 units in July 2017.

PSEs' debt, liabilities reach Rs1.3tr

The previous PML-N government had failed to address the issue of mounting debt and liabilities of the Public Sector Entities (PSEs) that touched Rs1.3 trillion during last fiscal year (FY2018). The PML-N government had not brought reforms in the PSEs including Pakistan International Airlines (PIA) and Pakistan Steel Mills (PSM) that loaded with huge loans. The collective debt and liabilities of PSEs had swelled to Rs1.3 trillion at the end of previous fiscal year amid government's failure to bring reforms or privatizing these PSEs.

Govt assessing future impact of renewed sanctions on Iran

The Ministry of Energy (MoE) has been asked to finalise its evaluation of the impact of US sanctions on Pakistan’s options for growth of economic relations with Iran, particularly in the energy sector. The task for coming come up with firm recommendations for future course of action was assigned to the MoE by the inter-ministerial meeting arranged by the Ministry of Foreign Affairs. The MoE’s recommendation would form part of the incoming government’s economic and trade relations abroad amid realignment of regional and international relationships among major global powers, particularly in the aftermath of US pulling out of nuclear deal with Iran, a senior official told Dawn.

Asian shares won a modest reprieve on Friday after China and the United States agreed to hold their first trade talks since June next week and as the Turkish lira extended gains from its record low earlier this week. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.4 percent, a day after it hit its lowest level in a year. Japan’s Nikkei advanced 0.5 percent. In U.S. markets on Thursday, the Dow Jones Industrial Average rose 1.58 percent and the S&P 500 gained 0.79 percent. MSCI’s index of world stocks rose 0.63 percent on Thursday, the biggest gain in a month. News that a Chinese delegation led by Vice Minister of Commerce Wang Shouwen will meet U.S. representatives helped to improve the mood. But the impact could be short-lived as such lower-level talks alone are unlikely to resolve the trade dispute. White House Economic adviser Larry Kudlow warned Beijing not to underestimate President Donald Trump’s resolve in pushing for changes in China’s economic policies.

The business community of Khyber Pakhtunkhwa has demanded of the federal government and Ministry of Planning and Reforms to increase Special Economic Zones (SEZs) and hydel power generation projects along with schemes relating to trade and industries for the province under the CPEC. "The CPEC is a game changer, which will make the country a hub of business and economic activities, said Zahidullah Shinwari, president of Sarhad Chamber of Commerce and Industry (SCCI) while speaking at the CPEC conference held here at Chamber House. He said the CPEC is a joint venture of Pakistan and China, which will not only bring economic prosperity and development in the country, rather it would also become catalyst for regional development.

Sale of cars in the country during July 2018 increased by 15.5 percent to 18,875 units against the sale of 16,337 units in same month of previous year. According to latest data released by Pakistan Automobile Manufacturers Association (PAMA), as many as 4,609 units of Honda (Civic & City) were sold in the country during July 2018 as compared to the sale of 3,820 units during same month of previous year. Toyota Corolla cars' sale also witnessed growth of 17.8 per cent as it rose to 4,566 units in July 2018 from 3,875 units in same period of previous year. Suzuki Swift witnessed a growth of 68 per cent as its sale rose to 484 units in fist month of the fiscal year 2018-19 from 288 units in July 2017.

The previous PML-N government had failed to address the issue of mounting debt and liabilities of the Public Sector Entities (PSEs) that touched Rs1.3 trillion during last fiscal year (FY2018). The PML-N government had not brought reforms in the PSEs including Pakistan International Airlines (PIA) and Pakistan Steel Mills (PSM) that loaded with huge loans. The collective debt and liabilities of PSEs had swelled to Rs1.3 trillion at the end of previous fiscal year amid government's failure to bring reforms or privatizing these PSEs.

The Ministry of Energy (MoE) has been asked to finalise its evaluation of the impact of US sanctions on Pakistan’s options for growth of economic relations with Iran, particularly in the energy sector. The task for coming come up with firm recommendations for future course of action was assigned to the MoE by the inter-ministerial meeting arranged by the Ministry of Foreign Affairs. The MoE’s recommendation would form part of the incoming government’s economic and trade relations abroad amid realignment of regional and international relationships among major global powers, particularly in the aftermath of US pulling out of nuclear deal with Iran, a senior official told Dawn.

ATRL, PSODGKC, ISL and FFL may lead the positive momentum

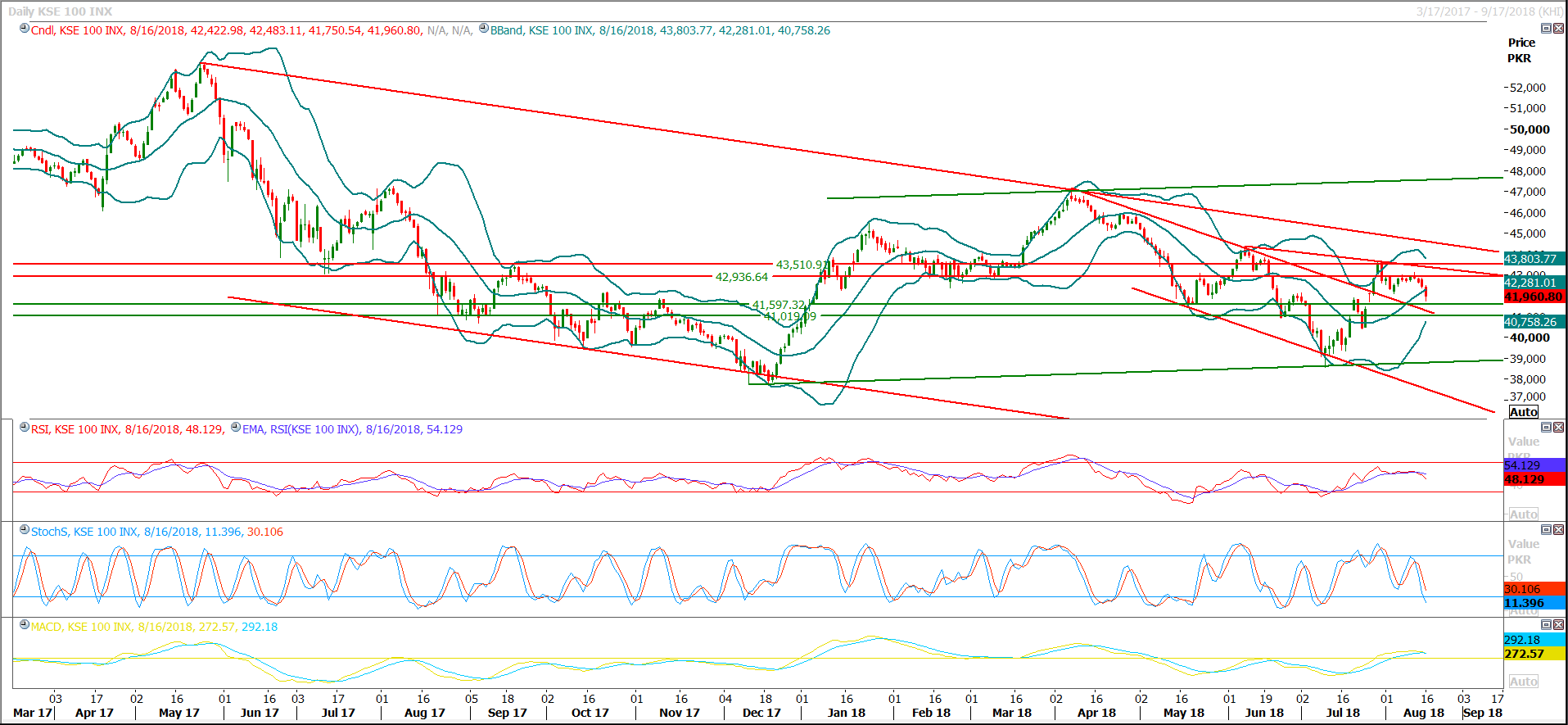

Technical Analysis

The Benchmark KSE100 Index is about to complete its 100% expansion of its last correction at 41,500 from where a bounce back could be witnessed on intraday basis, it’s expected that index would try to recover after a dip and that recovery could be in shape of a very sharp spike which may lead index towards 42,500 and 42,900 points. Hourly momentum indicators generated bullish crossovers and these would play a vital role in recovery from said levels. An intraday pull back is also necessary to avoid any weekly adventure, because if index would close below 41,800 points on weekly chart then an evening star would be formatted on weekly candlestick chart which would result in a very sharp decline in coming week and right now market is not in any kind of adventurous mode of such kind. It’s recommended to start buying on dip with strict stop loss because if all these pullback or reversal indications would turn into a trap then this trap could cost around 1000-1500 points.

Cement sector seems to initiate pull back because DGKC, MLCF and FCCL have closed after retesting their supportive regions and they would try to pull back after a dip. DGKC is about to complete its 50% correction and it can be bought around 109, while MLCF could be bought around 54.30 where it have a strong supportive region and FCCL can be bought 24 where it have a strong support. Cement sector would be joined by steel sector later on as ISL and ASL would start recover from 100-101 and 14.60 Rs respectively. This positive momentum would be strengthen by oil and gas sectors because PSO, SNGP, SSGC would find supports around 335, 94-93 and 29.80 Rs respectively because at these regions PSO have a strong horizontal supportive region while SNGP and SSGC are about to complete 50% and 61.8% corrections respectively.

Cement sector seems to initiate pull back because DGKC, MLCF and FCCL have closed after retesting their supportive regions and they would try to pull back after a dip. DGKC is about to complete its 50% correction and it can be bought around 109, while MLCF could be bought around 54.30 where it have a strong supportive region and FCCL can be bought 24 where it have a strong support. Cement sector would be joined by steel sector later on as ISL and ASL would start recover from 100-101 and 14.60 Rs respectively. This positive momentum would be strengthen by oil and gas sectors because PSO, SNGP, SSGC would find supports around 335, 94-93 and 29.80 Rs respectively because at these regions PSO have a strong horizontal supportive region while SNGP and SSGC are about to complete 50% and 61.8% corrections respectively.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.